An annual business budget is a financial plan that provides a comprehensive overview of a company’s operations over the next 12 months. It helps track progress towards goals and enables effective resource management.

This budget serves as a roadmap for businesses, outlining anticipated income and expenses, identifying potential growth areas, and providing a clear financial picture for decision-making.

Why is an Annual Business Budget Important?

An annual business budget is crucial for the success and sustainability of any company. Here are some key reasons why it is important:

1. Financial Planning: A budget helps businesses plan their financial activities, including sales targets, marketing expenses, and operational costs. It provides a structured approach to allocate resources and ensures that funds are properly distributed to achieve business objectives.

2. Goal Tracking: By setting specific financial goals in the budget, businesses can monitor their progress throughout the year. This allows them to assess their performance, identify areas of improvement, and make necessary adjustments to stay on track towards achieving their targets.

3. Resource Management: A budget helps businesses manage their resources effectively. By accurately forecasting expenses and revenues, companies can allocate resources optimally, avoid overspending, and make informed decisions regarding investments or cost-cutting measures.

4. Decision Making: With a budget in place, businesses can make informed decisions about resource allocation, expansion plans, hiring, and other financial matters. It provides a framework for evaluating the financial feasibility of different options and helps prioritize initiatives based on their potential impact on the bottom line.

How to Create an Annual Business Budget?

Creating an annual business budget requires careful planning and attention to detail. Here is a step-by-step guide to help you create an effective budget:

1. Define Your Financial Goals

Start by identifying your financial goals for the next 12 months. These goals may include revenue targets, profit margins, market share growth, or cost reduction objectives. Having clear goals will help you align your budget with your business objectives.

2. Gather Historical Financial Data

Collect and review your past financial statements, including income statements, balance sheets, and cash flow statements. Analyze your revenue trends, expenses, and any seasonal variations that may impact your budget. This historical data will serve as a reference point for creating realistic projections.

3. Forecast Your Sales and Revenue

Estimate your sales and revenue for the upcoming year based on market trends, historical performance, and industry analysis. Consider factors such as market demand, competition, economic conditions, and any upcoming product launches or marketing campaigns that may impact your sales.

4. Identify Fixed and Variable Expenses

List all your fixed expenses, such as rent, salaries, utilities, insurance, and loan payments. These expenses remain relatively constant throughout the year. Also, identify variable expenses, such as advertising, inventory, travel, and other costs that may vary based on business needs or seasonal fluctuations.

5. Allocate Resources

Distribute your projected revenue and available funds to different expense categories based on their priority and impact on your business goals. Ensure that you allocate sufficient resources for essential functions while leaving room for potential contingencies or unforeseen expenses.

6. Monitor and Adjust

Regularly monitor your actual financial performance against your budgeted figures. Compare your budgeted revenue and expenses with the actual results to identify any discrepancies or areas that require adjustments. Make necessary revisions to your budget as needed to ensure it remains accurate and aligned with your business goals.

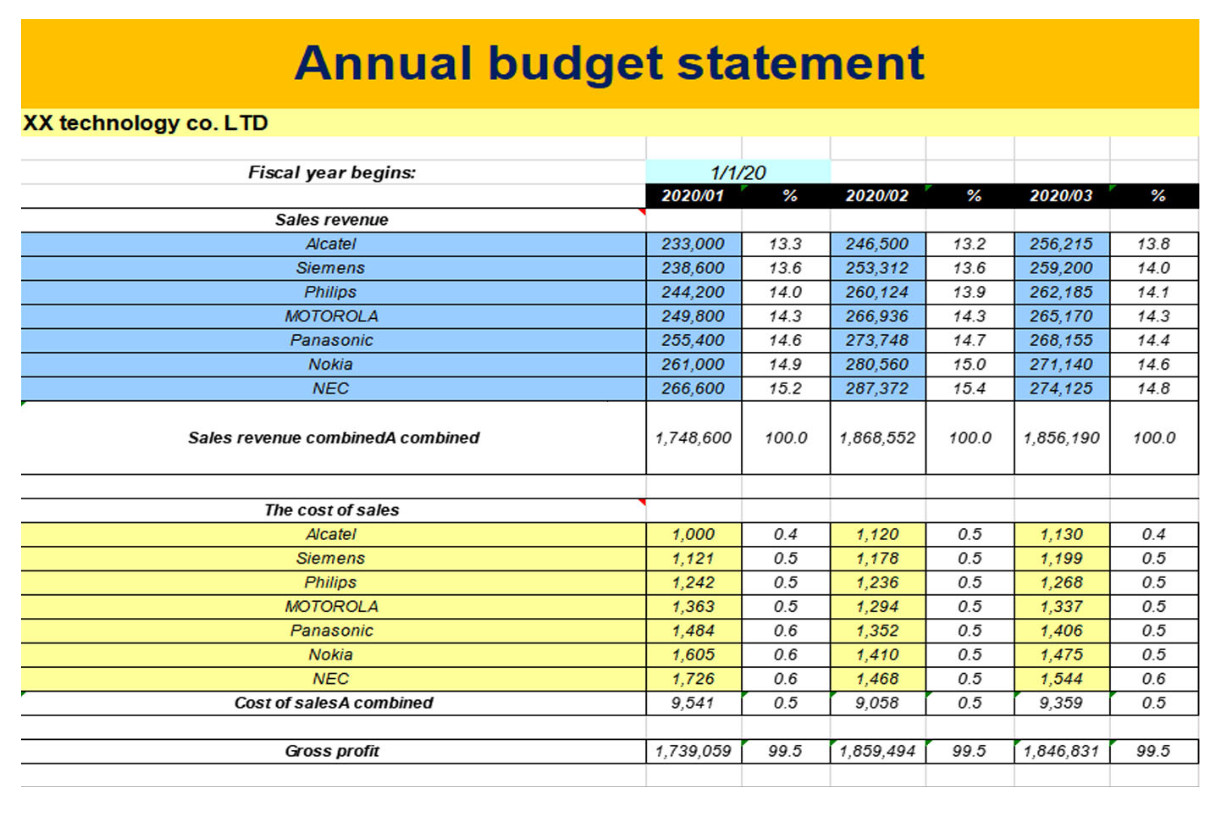

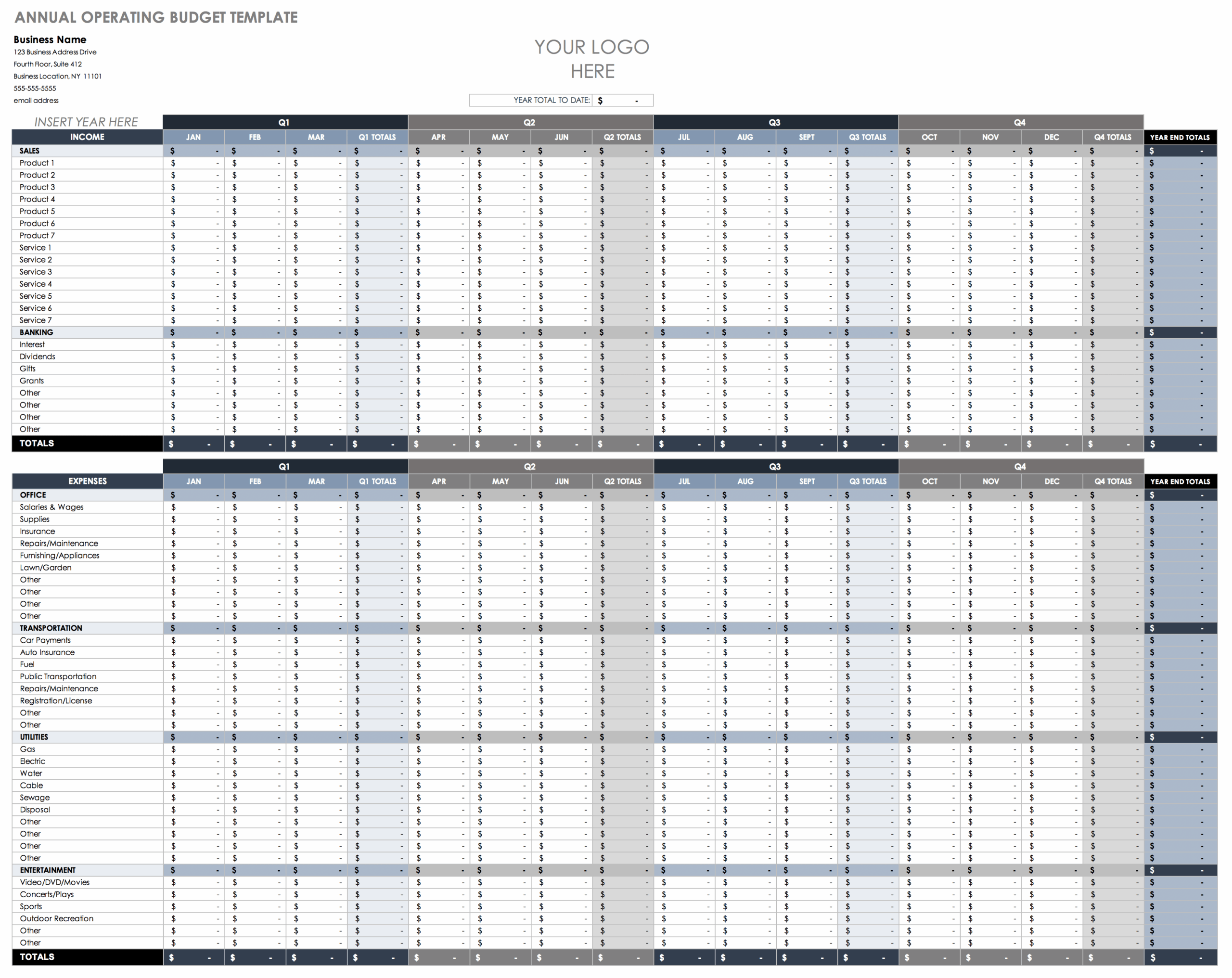

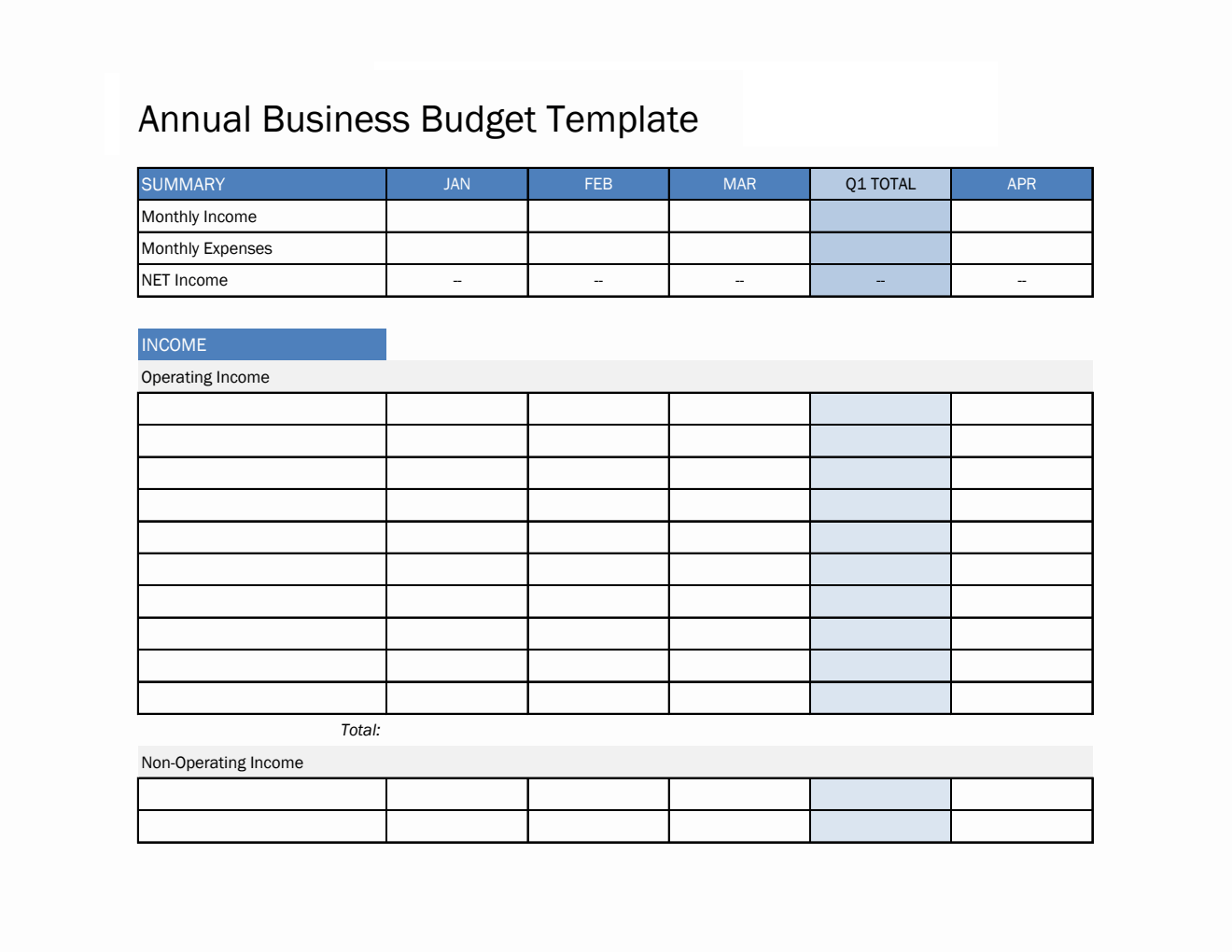

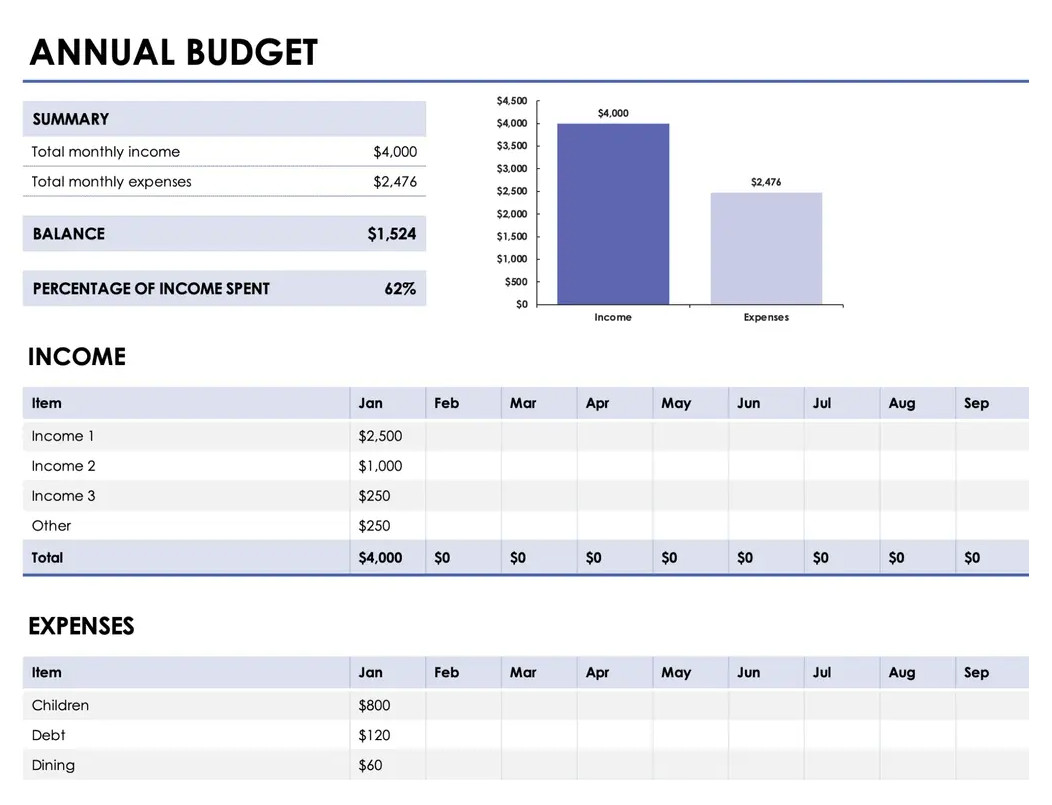

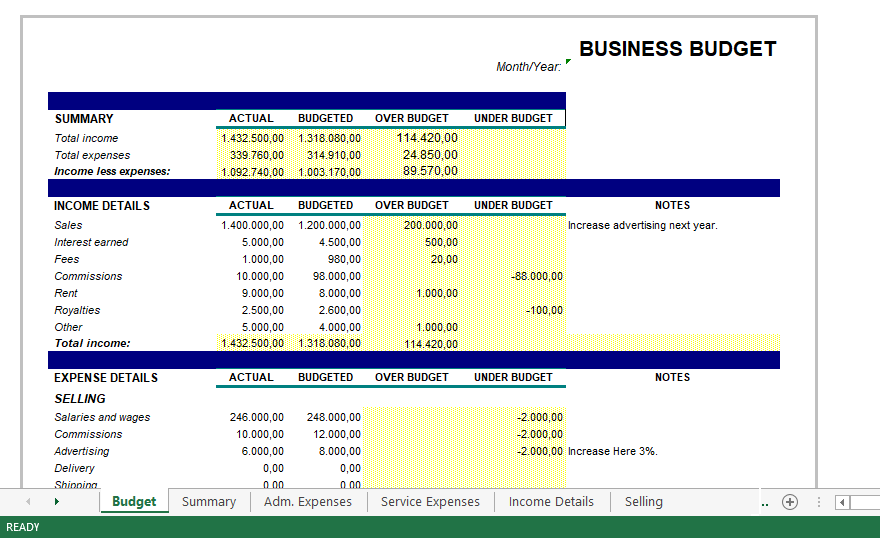

Examples of Annual Business Budget Templates

There are several annual business budget templates available online that can serve as a starting point for creating your budget. Here are a few examples:

Tips for Successful Budgeting

Creating and implementing a successful annual business budget requires attention to detail and a strategic approach. Here are some tips to help you achieve effective budgeting:

- 1. Involve Key Stakeholders: Engage relevant team members and department heads in the budgeting process to gain valuable input and ensure alignment with business objectives.

- 2. Be Realistic: Set realistic revenue and expense projections based on accurate data and market conditions. Avoid overestimating revenue or underestimating expenses to maintain budget integrity.

- 3. Prioritize Essential Expenses: Identify and prioritize essential expenses that are critical to your business operations and goals. Allocate sufficient resources to these areas to ensure their continuity and success.

- 4. Monitor and Review Regularly: Regularly review your budget and compare it with actual financial performance. Make necessary adjustments to your budget to reflect changes in the business environment or internal circumstances.

- 5. Seek Professional Advice: If budgeting is unfamiliar territory for you, consider consulting with a financial advisor or accountant who can provide guidance and ensure the accuracy and effectiveness of your budget.

- 6. Communicate and Educate: Share the budget with relevant stakeholders and educate them about its importance and their role in achieving budgetary goals. Encourage transparency and accountability throughout the organization.

Conclusion

An annual business budget is a vital tool for financial planning, goal tracking, and resource management. By following a structured approach and utilizing the right templates and guidelines, businesses can create effective budgets that support their growth and success.

Remember to regularly review and adjust your budget as needed to ensure it remains aligned with your business objectives and changing market conditions. With a well-designed budget in place, you can make informed decisions, allocate resources effectively, and achieve your financial goals.

Annual Business Budget Template – Download