Running a successful business requires more than just offering a great product or service. It also involves managing finances effectively to ensure the company’s sustainability and growth. One crucial aspect of financial management is cash flow forecasting, which helps businesses predict their future cash inflows and outflows.

By having a clear view of their liquidity, businesses can make informed financial decisions, avoid debt, growth plan, and ensure there’s enough cash to cover expenses.

What is a Cash Flow Forecast?

Cash flow forecast is a financial tool used by businesses to estimate the amount of cash that will flow in and out of the company over a specific period. It provides a projection of how much money the business expects to receive and spend, helping owners and managers plan and make strategic decisions.

Why is Cash Flow Forecast Essential for Businesses?

There are several reasons why cash flow forecasting is essential for businesses of all sizes:

Ensuring Adequate Cash Reserve

One of the primary reasons businesses need to forecast cash flow is to ensure they have enough cash on hand to cover their expenses. By estimating future cash inflows and outflows, businesses can anticipate periods when they may experience cash shortages and take proactive steps to address them.

Avoiding Debt and Financial Strain

Another key reason for creating a cash flow forecast is to avoid dependency on debt to cover shortfalls. By accurately predicting cash flow, businesses can plan for potential expenses and revenue fluctuations, reducing the need for costly loans or credit lines that can strain their finances.

Strategic Planning and Decision-Making

Cash flow forecasts are invaluable tools for strategic planning and decision-making. By having a clear view of their future cash position, businesses can make informed decisions about investments, expansion opportunities, and operational expenses, ensuring they are aligned with their long-term financial goals.

Securing Financing and Investment Opportunities

Businesses that can demonstrate strong cash flow forecasting capabilities are more likely to secure financing from banks, investors, or other sources. Lenders and investors look for businesses that have a clear understanding of their cash position and can provide reliable forecasts to support their funding needs.

Identifying Potential Shortfalls and Surpluses

Cash flow forecasts help businesses identify potential cash shortfalls or surpluses in advance, allowing them to take appropriate actions to mitigate risks or capitalize on opportunities. By monitoring their cash flow projections regularly, businesses can adjust their strategies to optimize their financial performance.

Key Elements of Cash Flow Forecast

Creating an effective cash flow forecast involves considering several key elements:

Incorporating Historical Data

When preparing a cash flow forecast, it’s essential to analyze historical data to identify trends and patterns that can inform future projections. By examining past cash flow statements and financial records, businesses can gain valuable insights into their cash flow drivers and potential challenges.

Estimating Future Income and Expenses

Forecasting future income and expenses is a crucial aspect of cash flow forecasting. Businesses need to project their expected sales revenue, operating costs, salaries, and other expenses accurately to create a realistic cash flow forecast that reflects their financial reality.

Considering Timing and Seasonality

Timing is a critical factor in cash flow forecasting. Businesses need to estimate when cash will be received and when it will be paid out to create a comprehensive forecast that accounts for the timing of income and expenses. Seasonal fluctuations in revenue and expenses should also be considered to ensure accuracy.

Planning for Contingencies

It’s essential to plan for unexpected events or emergencies when creating a cash flow forecast. Businesses should include contingencies in their projections to account for unforeseen circumstances that could impact their cash flow, such as economic downturns, supply chain disruptions, or regulatory changes.

Utilizing Cash Flow Management Tools

Businesses can leverage cash flow management tools and software to streamline the forecasting process and improve the accuracy of their projections. These tools can help automate data collection, perform complex calculations, and generate detailed reports to support informed decision-making.

How to Create a Cash Flow Forecast

Follow these steps to create an accurate cash flow forecast for your business:

Step 1: Review Historical Data

Start by analyzing your company’s past financial statements, cash flow records, and other relevant data to identify trends, patterns, and factors that may impact your future cash flow.

Step 2: Estimate Future Income

Project your expected sales revenue, investments, loans, and other sources of income based on market trends, customer behavior, and industry analysis. Be realistic in your projections to ensure accuracy.

Step 3: Predict Expenses

Forecast your operating costs, salaries, loan repayments, taxes, and other expenses to determine your total cash outflows. Consider both fixed and variable expenses to create a comprehensive forecast.

Step 4: Adjust for Timing

Consider the timing of cash inflows and outflows to create a monthly or quarterly cash flow forecast that reflects the cyclical nature of your business. Account for any delays or accelerations in payments to ensure accuracy.

Step 5: Monitor and Update Regularly

Review and update your cash flow forecast regularly to reflect changes in the business environment, market conditions, and internal operations. Be proactive in adjusting your projections to align with current realities.

Tips for Successful Cash Flow Forecasting

Here are some tips to help you create an accurate and effective cash flow forecast for your business:

Be Conservative in Your Projections

It’s better to underestimate income and overestimate expenses in your cash flow forecast to avoid potential cash shortages and ensure you have a financial cushion to fall back on.

Include a Buffer for Contingencies

Build a buffer into your forecast to account for unexpected expenses, revenue fluctuations, or external factors that may impact your cash flow. Having a safety net can help you navigate uncertainties more effectively.

Use Reliable and Up-to-Date Data

Base your cash flow forecast on accurate, reliable, and up-to-date financial information to ensure its validity and relevance. Avoid making assumptions or relying on outdated data that may skew your projections.

Seek Professional Guidance if Needed

If you’re unsure about creating a cash flow forecast or need assistance in developing a robust financial plan, consider seeking help from a financial expert, accountant, or business advisor who can provide valuable insights and guidance.

Regularly Compare Actuals to Forecast

Monitor your actual cash flow against your forecasted numbers regularly to identify any discrepancies or deviations. Use this information to adjust your projections, fine-tune your strategies, and optimize your financial performance.

Implement Cash Flow Management Strategies

Develop and implement cash flow management strategies to improve your company’s financial health and stability. These strategies may include negotiating better payment terms with suppliers, incentivizing early customer payments, or reducing unnecessary expenses.

Stay Agile and Flexible

Be prepared to adapt to changing circumstances and adjust your cash flow forecast as needed. Business environments are dynamic and unpredictable, so it’s essential to remain agile and flexible in your financial planning to respond effectively to market fluctuations, regulatory changes, or unexpected events.

Engage Key Stakeholders

Involve key stakeholders, such as senior management, department heads, and financial advisors, in the cash flow forecasting process. Collaboration and communication with relevant parties can help ensure alignment, transparency, and accountability in financial decision-making.

Leverage Technology and Automation

Take advantage of financial management software, tools, and technologies to streamline the cash flow forecasting process. Automation can help reduce manual errors, improve data accuracy, and generate real-time reports to support data-driven insights and decision-making.

Develop Multiple Scenarios

Create multiple scenarios in your cash flow forecast to assess different outcomes and potential risks. By modeling best-case, worst-case, and moderate scenarios, you can prepare for various eventualities and develop contingency plans to mitigate risks and capitalize on opportunities.

Track Key Performance Indicators (KPIs)

Monitor and track key performance indicators related to cash flow, such as liquidity ratios, working capital turnover, and cash conversion cycle. These KPIs can provide valuable insights into your company’s financial health, operational efficiency, and liquidity management.

Seek Continuous Improvement

Strive for continuous improvement in your cash flow forecasting process by soliciting feedback, analyzing performance metrics, and identifying areas for enhancement. Regularly review and refine your forecasting methodologies to optimize accuracy, relevance, and reliability.

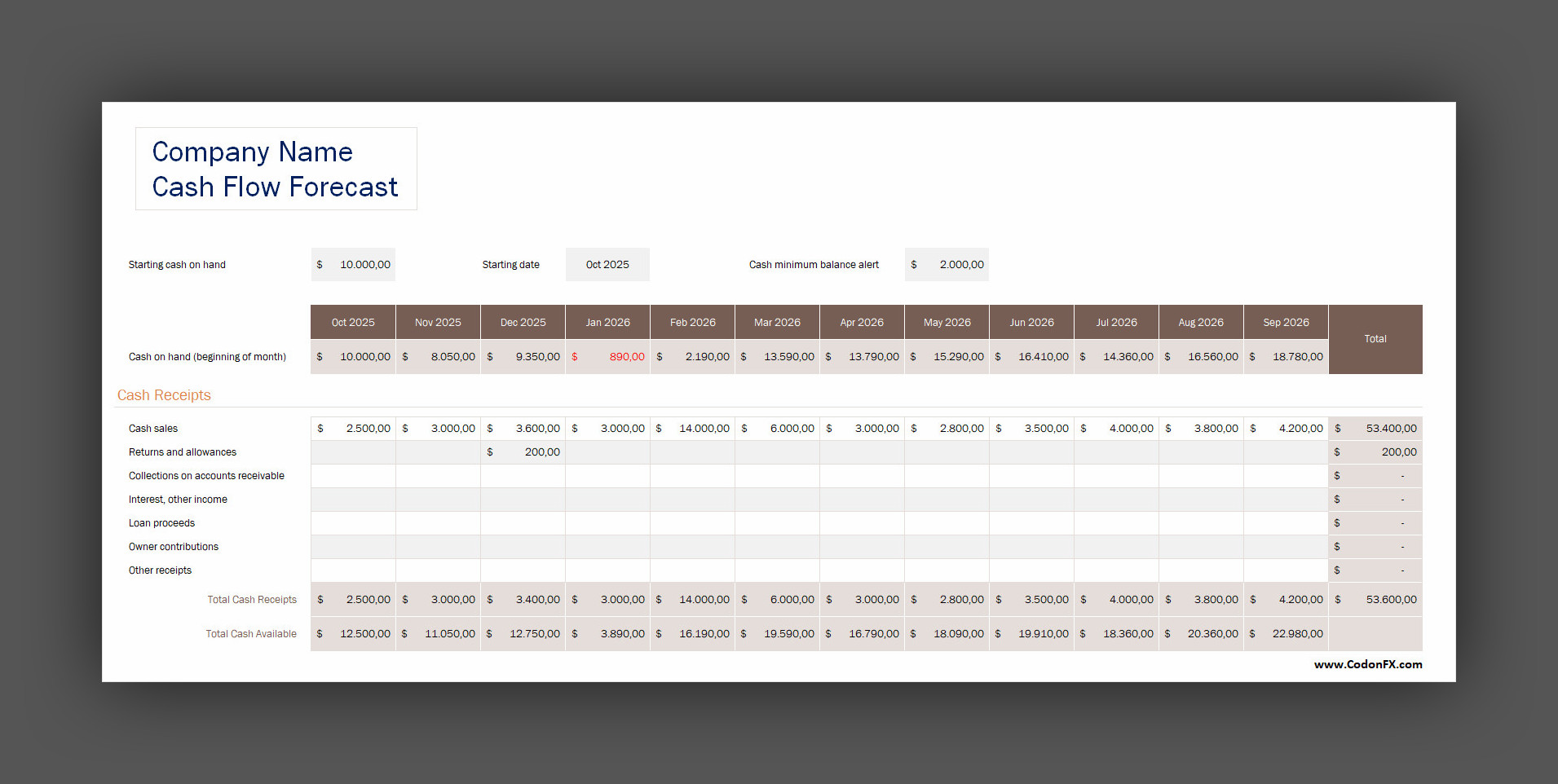

Cash Flow Forecast Template

A cash flow forecast helps you predict income and expenses, manage liquidity, and ensure your business stays financially healthy. It provides clarity for smarter decision-making and long-term planning.

Download our free Cash Flow Forecast Template today and take control of your financial future.

Cash Flow Forecast Template – Excel