Regarding insurance, the world can be a complicated place. There are countless types of insurance policies, each with its own set of terms, coverage limits, and exclusions. For businesses and individuals alike, navigating the insurance landscape can be challenging. One key document that can help simplify this process is the Certificate of Insurance.

What is a Certificate of Insurance?

A Certificate of Insurance is a document that serves as proof that an individual or business has a specific insurance policy in effect. It is typically issued by the insurance company and contains essential information about the policyholder’s coverage, including the types of insurance, policy limits, and effective dates.

From a legal perspective, a Certificate of Insurance is a crucial document that can protect both parties involved in a contract or agreement. It verifies the existence of insurance coverage and ensures that the insured party has the financial protection needed to fulfill their obligations.

Why is a Certificate of Insurance Important?

Protection for Third Parties

One of the primary reasons why a Certificate of Insurance is important is that it protects third parties, such as clients, vendors, and landlords. By verifying that the insured party has the necessary insurance coverage, third parties can have peace of mind knowing that they are protected in the event of an accident or loss.

Risk Management

For businesses, having a Certificate of Insurance is essential for risk management. It ensures that the business is adequately covered against potential liabilities and can fulfill its contractual obligations without putting itself at financial risk.

Compliance with Contractual Requirements

Many contracts and agreements require parties to maintain specific insurance coverage. A Certificate of Insurance provides proof of compliance with these requirements, helping to avoid disputes and legal issues that may arise if insurance coverage is not in place.

Peace of Mind

Having a Certificate of Insurance can provide peace of mind for both the insured party and the requesting party. It demonstrates a commitment to responsible business practices and risk management, fostering trust and confidence in business relationships.

What to Include in a Certificate of Insurance?

Insured Party Information

The Certificate of Insurance should include detailed information about the insured party, including the name, address, and contact information. This ensures that the document is easily identifiable and can be used to verify coverage.

Coverage Details

A comprehensive Certificate of Insurance should outline the types of coverage provided by the policy, such as general liability, professional liability, property insurance, and more. Each type of coverage should be clearly defined to avoid confusion.

Policy Limits and Deductibles

Policy limits specify the maximum amount that the insurance company will pay out for a covered claim. Deductibles, on the other hand, are the out-of-pocket expenses that the insured party must pay before the insurance coverage kicks in. Both limits and deductibles should be clearly stated in the Certificate of Insurance.

Effective Dates and Expiration Date

The Certificate of Insurance should include the effective dates of the policy, indicating when the coverage begins and ends. It’s important to note the expiration date to ensure that the policy is renewed or updated before it lapses.

Insurance Company Information

The name of the insurance company, as well as contact information such as phone number and address, should be included in the Certificate of Insurance. This information allows third parties to verify the legitimacy of the insurance coverage and contact the insurance company if needed.

Addition Insured Parties

In some cases, additional insured parties may be included in the insurance policy. The Certificate of Insurance should clearly identify these parties and specify the extent of their coverage under the policy. This information helps ensure that all relevant parties are adequately protected.

How to Obtain a Certificate of Insurance

Requesting from the Insurance Company

To obtain a Certificate of Insurance, the insured party can request a copy from their insurance company. It’s important to provide accurate information and specify the details required in the certificate to ensure that it meets the needs of the requesting party.

Sharing with Third Parties

Once the Certificate of Insurance is received, the insured party can share it with third parties such as clients, vendors, or landlords. It’s essential to provide the document promptly and communicate any relevant details to ensure that all parties are informed about the insurance coverage in place.

Updating and Renewing Certificates

Insurance policies may change or renew over time, requiring updates to the Certificate of Insurance. It’s crucial to review the document regularly and make any necessary changes to ensure that it accurately reflects the current coverage and policy limits.

Staying Organized

Managing Certificates of Insurance can be a complex task, especially for businesses with multiple insurance policies. Creating a system for storing and organizing certificates can help streamline the process and ensure that all documentation is easily accessible when needed.

Compliance with Requirements

Businesses should ensure that they comply with any contractual requirements related to insurance coverage. This includes providing accurate and up-to-date Certificates of Insurance as needed to maintain good business relationships and avoid potential disputes.

Tips for Managing Certificates of Insurance

Keep Detailed Records

Maintaining detailed records of all Certificates of Insurance received and issued can help businesses stay organized and compliant with contractual requirements. Keeping digital copies of certificates can also ensure easy access when needed.

Review Regularly

Regularly reviewing Certificates of Insurance ensures that the coverage is up to date and meets the needs of the business. Any changes to policies or coverage limits should be reflected in the certificates to avoid gaps in insurance protection.

Communicate Clearly

Effective communication is key when managing Certificates of Insurance. All relevant parties should be aware of the insurance coverage in place and how to access the necessary documents. Clear communication can help prevent misunderstandings and ensure that everyone is adequately protected.

Stay Informed

Staying informed about changes in insurance requirements and regulations is essential for managing Certificates of Insurance effectively. Businesses should stay up to date on any changes that may affect their coverage and update their certificates accordingly.

Work with a Trusted Insurance Provider

Choosing a reputable and trusted insurance provider can make a significant difference in managing Certificates of Insurance. Working with an experienced insurer who understands the needs of your business can help ensure that you have the right coverage in place.

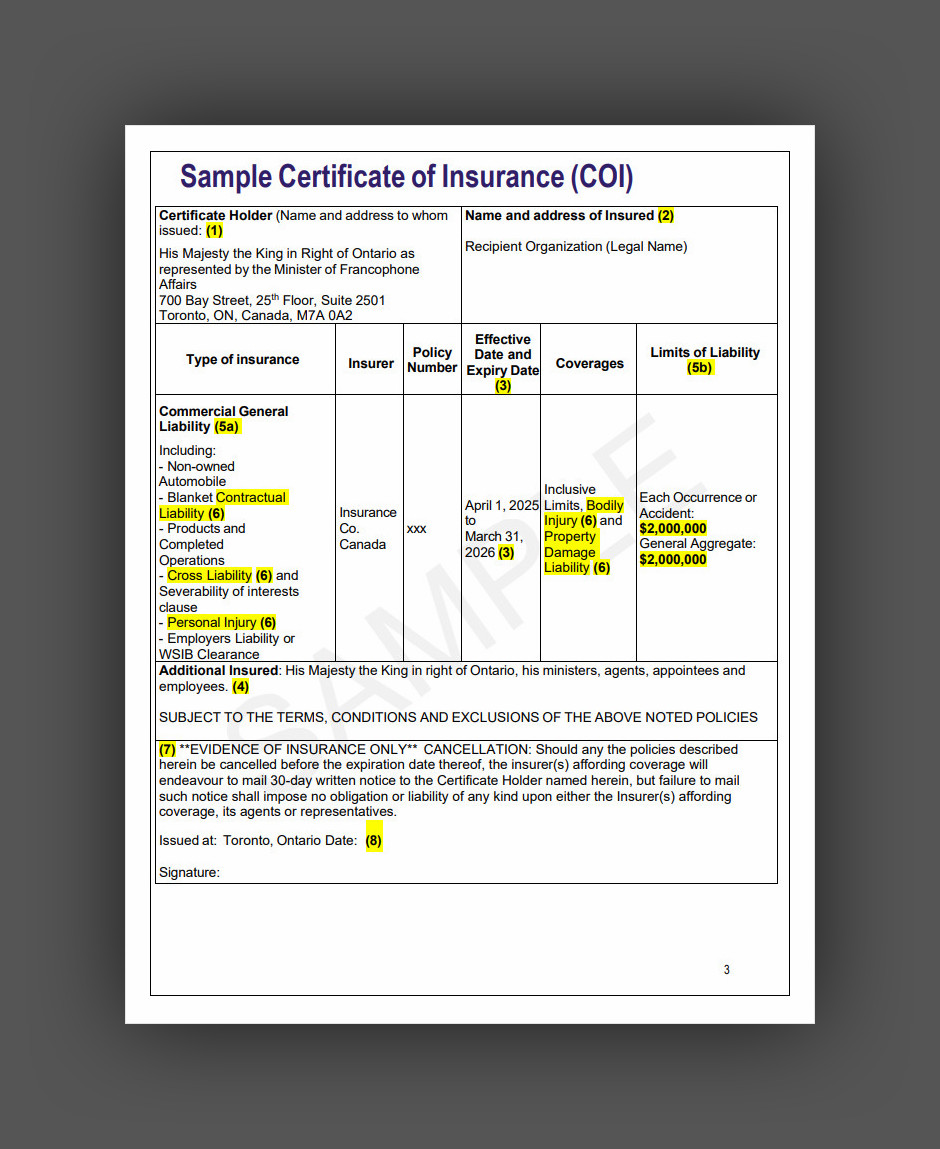

Certificate of Insurance Template

A certificate of insurance verifies coverage, builds trust, and provides proof of protection in business or personal agreements. It ensures transparency and helps avoid potential disputes.

Download our free Certificate of Insurance Template today and create a professional certificate with ease.

Certificate of Insurance Template – Download