Creating a financial budget is essential for managing your money effectively. It helps you track your expenses, set financial goals, and stay on top of your finances.

While there are many budgeting tools available online, financial budgets offer a convenient and customizable option for those who prefer a more hands-on approach to managing their money.

What is a Financial Budget?

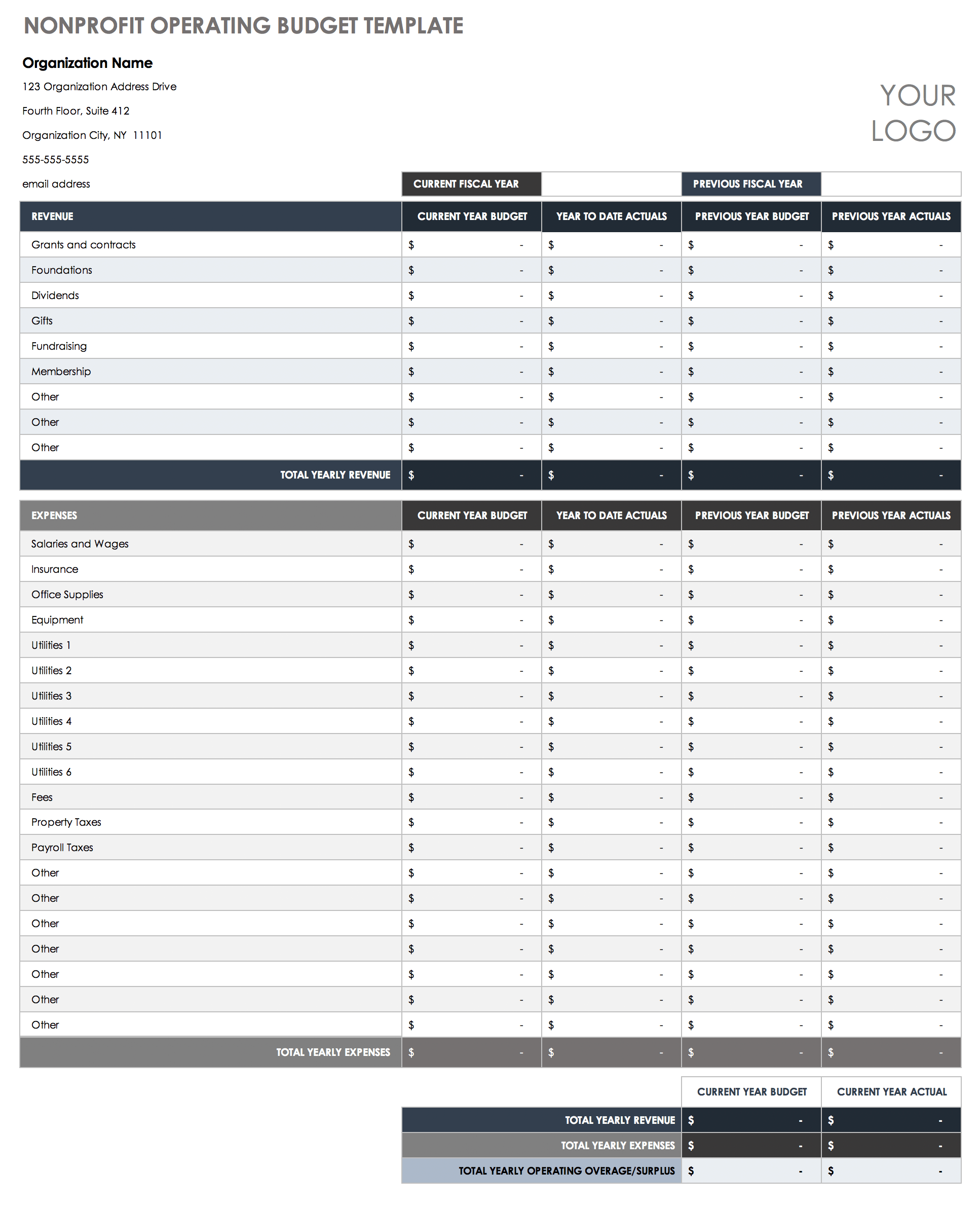

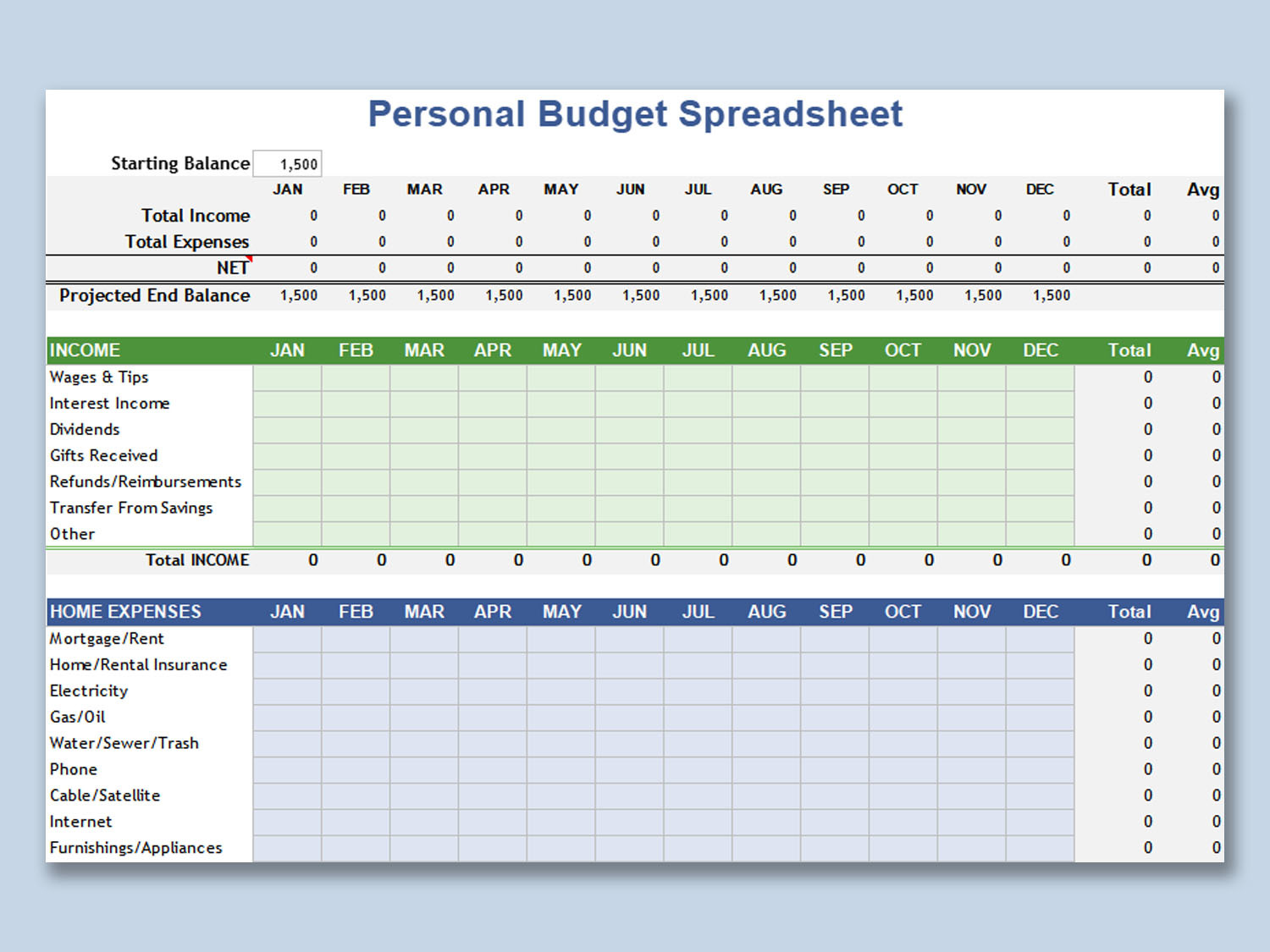

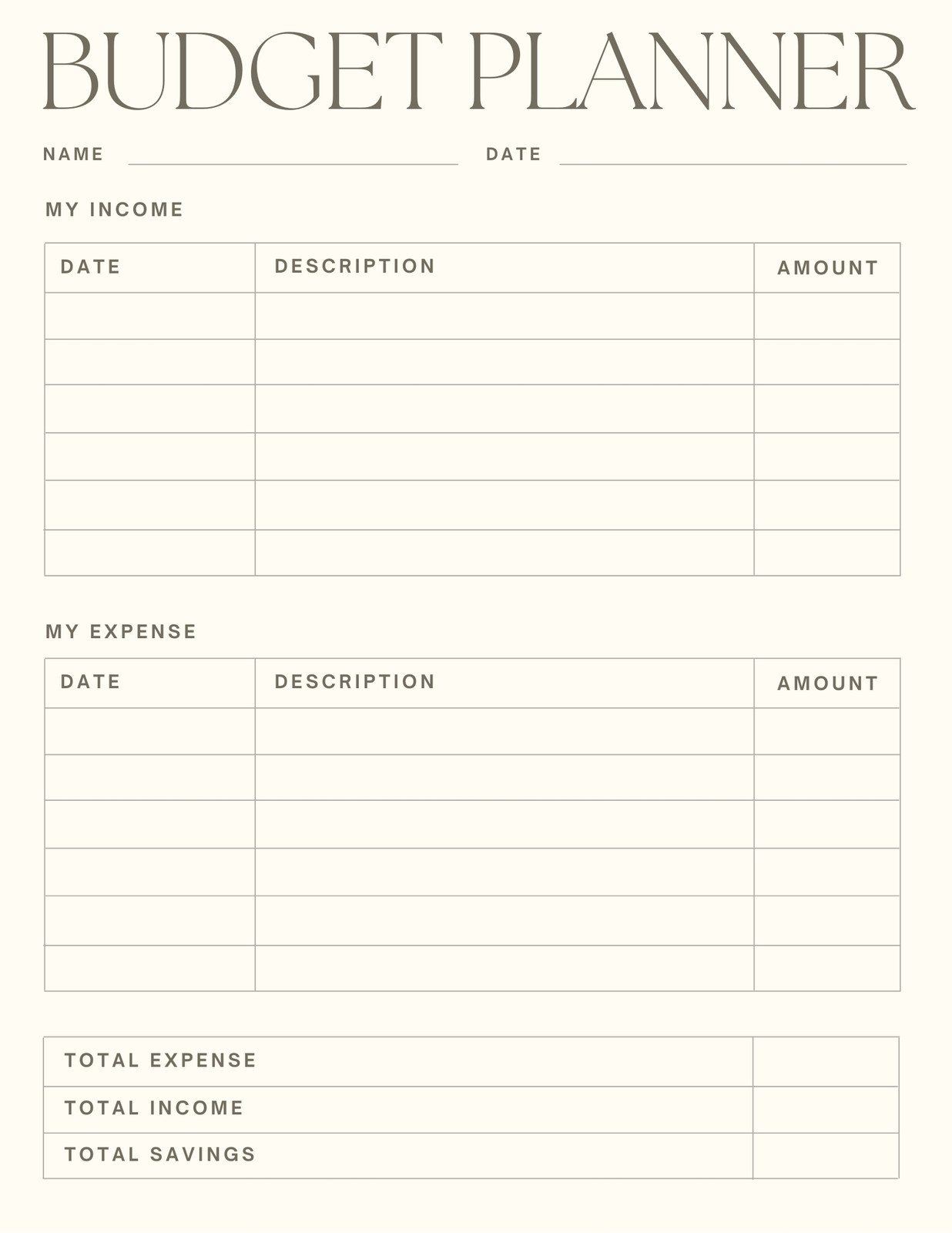

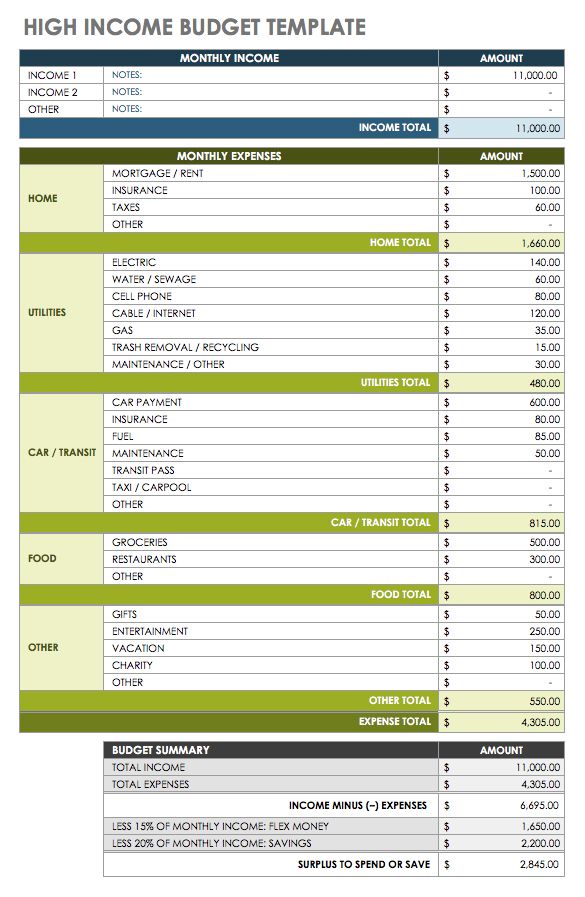

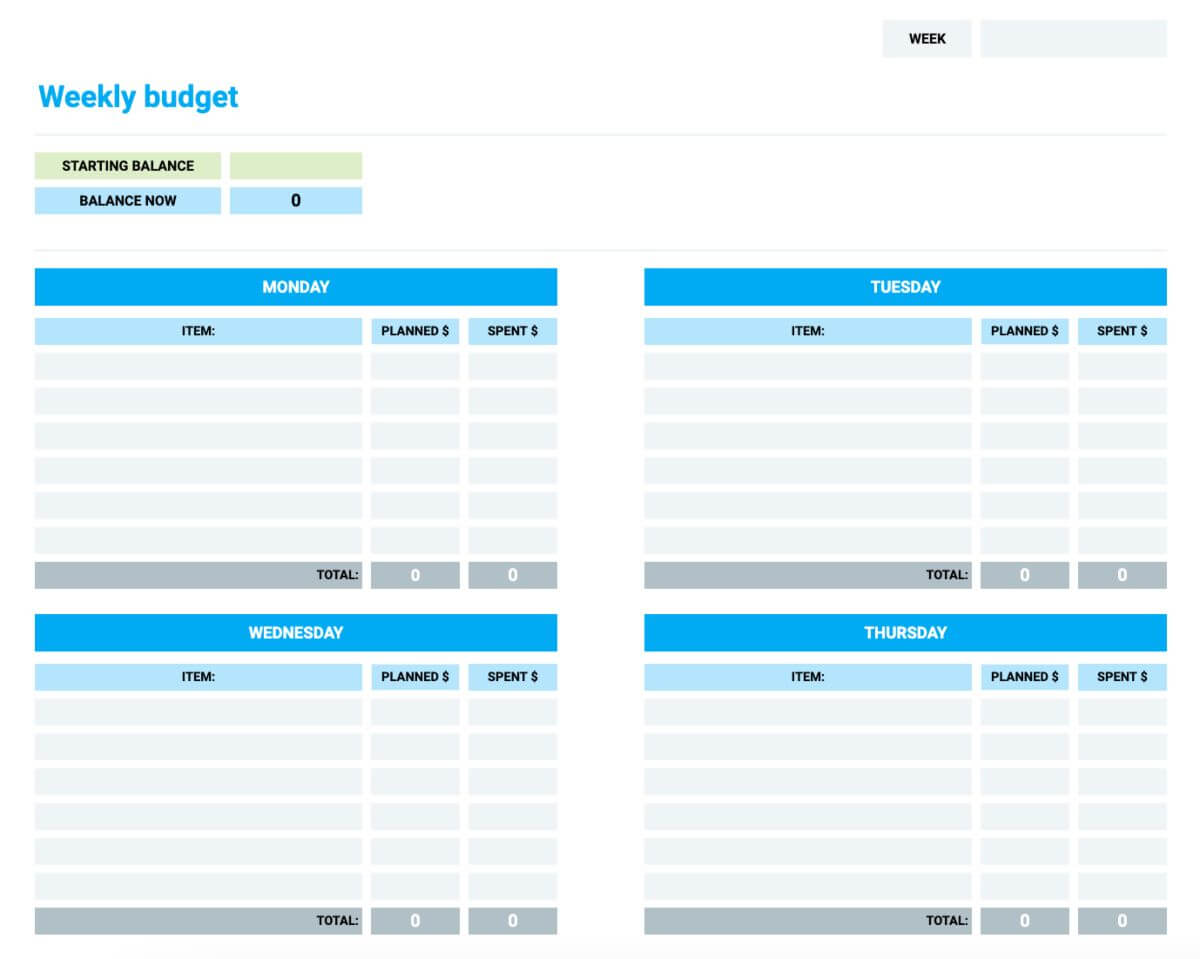

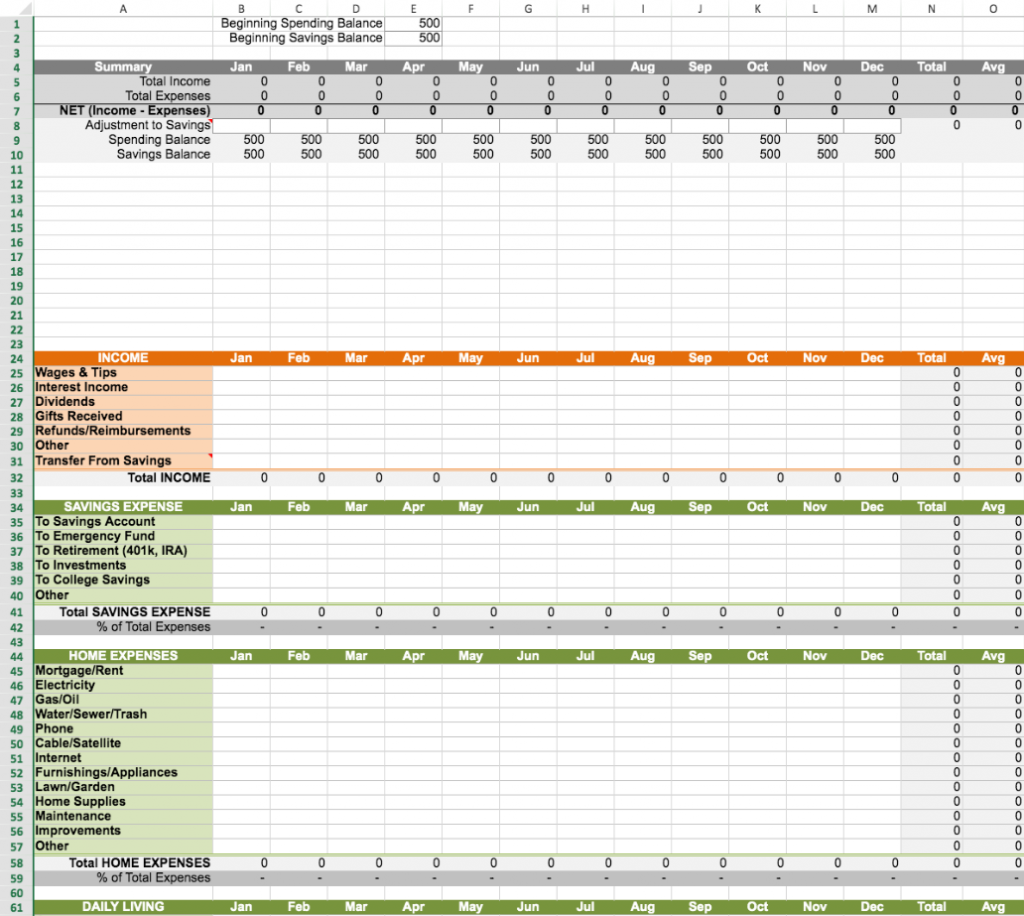

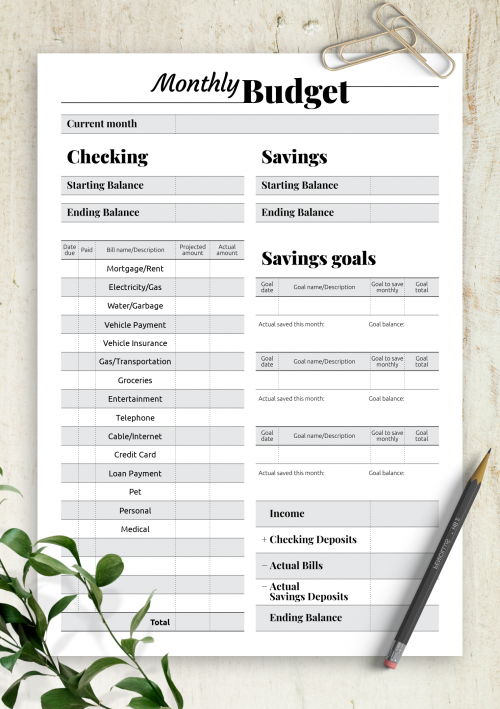

A financial budget is a pre-designed template that you can download and print to help you organize your finances. These templates typically include sections for income, expenses, savings, and financial goals. They are available in various formats, such as PDF, Excel, and Word, making it easy to find one that suits your preferences.

Financial budgets are a great tool for visual learners who prefer to see their finances laid out on paper. They provide a tangible way to track your spending, identify areas where you can cut back, and monitor your progress towards your financial goals.

Why Use a Financial Budget?

There are several benefits to using a financial budget:

- Easy to Use: Financial budgets are user-friendly and require minimal setup. You can start using them right away without the need for any special software.

- Customizable: You can tailor the budget template to suit your individual financial situation and goals. Add or remove categories as needed to create a budget that works for you.

- Visual Representation: Seeing your finances on paper can help you better understand where your money is going and make more informed decisions about your spending.

- Encourages Accountability: By tracking your expenses and income on a regular basis, you can hold yourself accountable for your financial choices and make adjustments as needed.

How to Use a Financial Budget

Using a financial budget is simple and straightforward. Here are some steps to get started:

1. Choose a Budget Template: Find a financial budget template that suits your needs and download it to your computer.

2. Fill in Your Income: Start by listing all sources of income, including wages, freelance work, and any other earnings.

3. List Your Expenses: Record all of your monthly expenses, such as rent, utilities, groceries, and transportation costs.

4. Track Your Spending: Keep track of your spending throughout the month and compare it to your budgeted amounts.

5. Review and Adjust: At the end of the month, review your budget and make any necessary adjustments to stay on track.

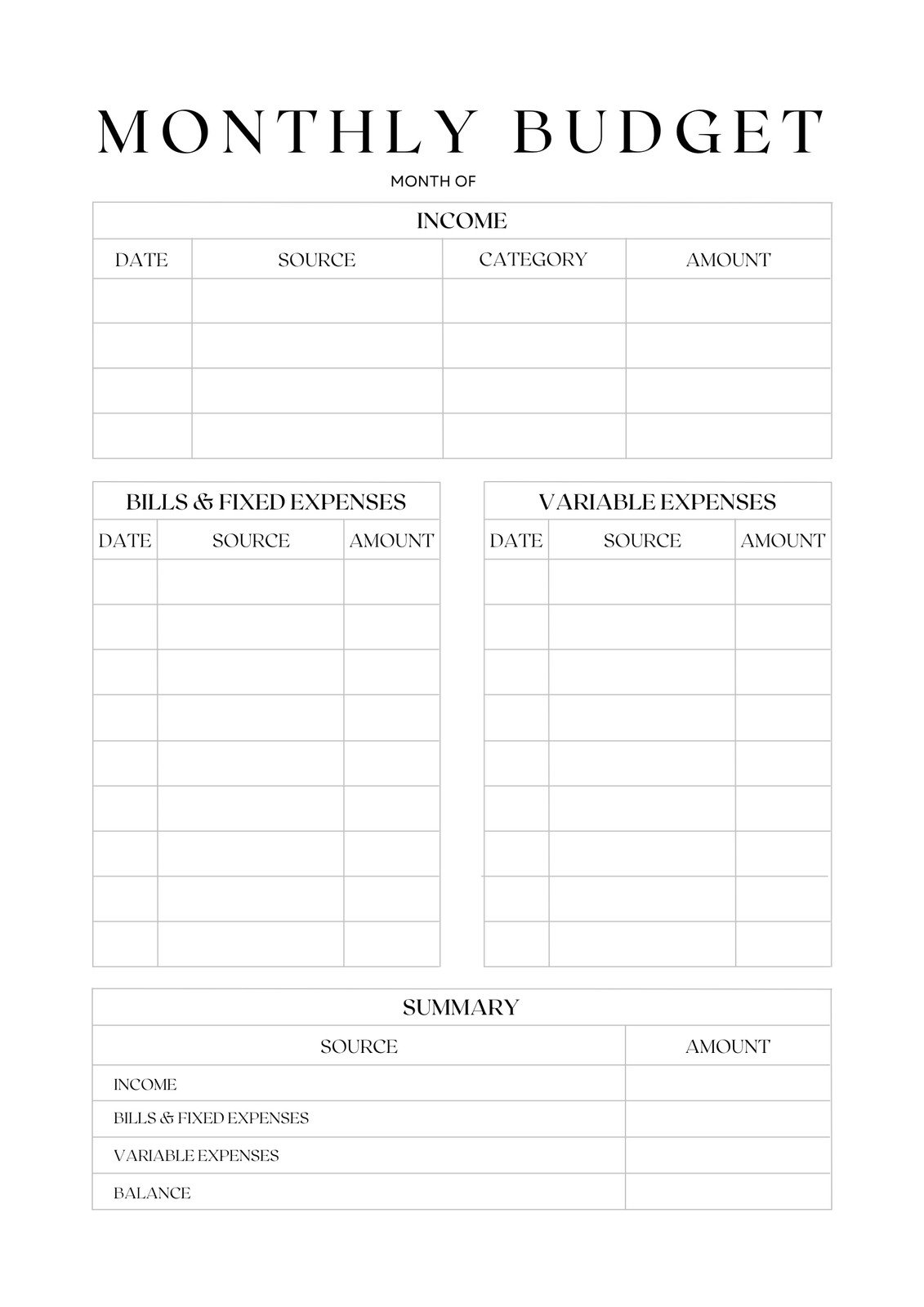

Examples of Financial Budget Templates

There are many free financial budget templates available online. Some popular options include:

1. Monthly Budget Worksheet: A simple template that helps you track your income and expenses on a monthly basis.

2. Debt Payoff Tracker: A budget template specifically designed to help you pay off debt faster by setting realistic goals.

3. Savings Goal Tracker: A template that allows you to set savings goals and track your progress towards achieving them.

Tips for Successful Budgeting

To make the most of your financial budget, consider the following tips:

1. Be Realistic: Set achievable goals and be honest with yourself about your spending habits.

2. Review Regularly: Take time each week to review your budget and make necessary adjustments.

3. Save for Emergencies: Include a category for emergency savings in your budget to prepare for unexpected expenses.

4. Seek Support: Share your budgeting goals with a friend or family member for added accountability.

5. Celebrate Small Wins: Acknowledge your progress and celebrate small victories along the way.

6. Stay Flexible: Your budget may need to evolve over time, so be open to making changes as needed.

In Conclusion

Financial budgets are a valuable tool for anyone looking to take control of their finances. By using a customizable template to track your income, expenses, and savings, you can gain a better understanding of your financial situation and work towards your long-term goals. Whether you’re new to budgeting or looking for a fresh approach, financial budgets offer a practical and accessible solution for managing your money effectively. Start using a financial budget today and take the first step towards financial freedom.

Financial Budget Template – Download