What is a Business Expense?

A business expense is any cost incurred in the course of running a business. This can include a wide range of expenditures such as rent, salaries, utilities, office supplies, marketing expenses, travel costs, and more.

Keeping track of these expenses is essential for financial management and tax purposes.

Benefits of a Business Expense Spreadsheet

Organization

One of the key benefits of using a business expense spreadsheet is organization. By consolidating all expenses in one centralized location, businesses can easily track and categorize their expenditures. This organized approach simplifies financial management processes and ensures that no expense goes unnoticed.

Accuracy

Another advantage of a business expense spreadsheet is the accuracy it provides. By entering expenses into a structured spreadsheet format, businesses can reduce the likelihood of errors or discrepancies in their financial records. This accuracy is crucial for maintaining financial integrity and making sound business decisions.

Analysis

A business expense spreadsheet facilitates in-depth analysis of spending patterns and trends. By inputting expenses into specific categories and subcategories, businesses can gain insights into where their money is being allocated. This analysis enables companies to identify areas of overspending, implement cost-saving measures, and optimize their overall financial strategy.

Forecasting

Using a business expense spreadsheet allows businesses to forecast future financial needs with greater accuracy. By tracking expenses over time and monitoring trends, companies can anticipate upcoming expenses, plan for investments, and allocate resources effectively. This forecasting capability helps businesses stay proactive and prepared for financial challenges.

How to Create a Business Expenses Spreadsheet

Selecting the Right Tool

Before creating a business expenses spreadsheet, it’s essential to choose the right tool for the job. Popular options include Microsoft Excel, Google Sheets, and specialized accounting software. Consider factors such as ease of use, customization options, collaboration features, and compatibility with your existing systems.

Designing the Layout

The layout of your business expenses spreadsheet plays a crucial role in its effectiveness. Create columns for date, description, category, amount, payment method, vendor, and any other relevant details. Customize the layout to suit your business needs and make it easy to enter and analyze data.

Categorizing Expenses

Proper categorization of expenses is key to organizing your spreadsheet effectively. Create clear categories and subcategories based on your business’s specific needs. Common expense categories include office supplies, utilities, rent, salaries, marketing, travel, entertainment, and miscellaneous expenses.

Entering Expense Data

Once your spreadsheet is set up, begin entering expense data regularly. Be diligent in recording each expense accurately, including all relevant details such as date, description, category, and amount. Consistent data entry is crucial for maintaining the integrity of your financial records.

Utilizing Formulas

To streamline calculations and analysis, use formulas in your business expenses spreadsheet. Utilize functions such as SUM, AVERAGE, IF, and VLOOKUP to calculate totals, subtotals, averages, and perform other necessary calculations. Formulas save time and ensure accuracy in your financial calculations.

Regular Updates and Reviews

It’s important to update your business expenses spreadsheet regularly to ensure it reflects the most current data. Set a schedule for entering new expenses, reviewing existing entries, and reconciling any discrepancies. Regular reviews help you stay on top of your finances and make informed decisions.

Customizing Reports

Customize your business expenses spreadsheet to generate reports that meet your specific needs. Create summary reports, detailed breakdowns by category or time period, variance analysis reports, and any other reports that provide valuable insights into your expenses. Tailor the reports to suit your reporting requirements and make them easy to interpret.

The Best Way To Keep Track of Business Expenses

Accounting Software Solutions

Investing in accounting software can streamline the process of tracking business expenses. Modern accounting software solutions offer features such as automated expense tracking, receipt scanning, integration with bank accounts, real-time financial reporting, and tax preparation assistance. Choose a software that aligns with your business size, industry, and specific needs.

Digital Receipt Management

Digital receipt management tools can help businesses keep track of expenses more effectively. Use apps or software that allow you to scan and store receipts digitally, categorize expenses, track mileage, and generate expense reports. Digital receipt management reduces paperwork, saves time, and ensures all expenses are accounted for.

Budgeting Tools

Employ budgeting tools to set and monitor your business expenses. Budgeting software or apps can help you establish spending limits, track actual expenses against budgeted amounts, analyze variances, and adjust your spending as needed. Budgeting tools provide a proactive approach to managing expenses and ensure financial discipline.

Expense Tracking Apps

Consider using expense tracking apps to simplify the process of recording expenses on the go. Mobile apps allow you to capture receipts, categorize expenses, track mileage, and sync data across devices. Choose an app that integrates with your accounting software or spreadsheet for seamless expense management.

Employee Training and Policies

Educate your employees on the importance of tracking expenses accurately and following established expense policies. Provide training on how to submit expense reports, document expenses, adhere to spending guidelines, and use expense tracking tools effectively. Clear policies and employee training promote accountability and compliance with expense management practices.

Regular Audits and Reviews

Conduct regular audits of your business expenses to identify any discrepancies, errors, or opportunities for improvement. Review expense reports, receipts, invoices, and financial statements periodically to ensure accuracy and completeness. Audits help you maintain financial integrity and make adjustments to your expense management processes.

Consulting Financial Professionals

Seek advice from financial professionals such as accountants, financial advisors, or consultants to optimize your expense tracking processes. Financial experts can offer insights into best practices, recommend tools and strategies, provide tax planning guidance, and help you make informed financial decisions. Consulting professionals adds expertise to your expense management efforts.

Integration with Accounting Systems

Integrate your business expenses tracking tools with your accounting systems for seamless data flow and reporting. Ensure that expense data from spreadsheets, software, apps, and other tools can be imported into your accounting system easily. Integration eliminates manual data entry, reduces errors, and enhances the efficiency of your financial reporting.

Continuous Improvement

Strive for continuous improvement in your business expense tracking practices. Regularly assess your processes, tools, and strategies for tracking expenses and look for opportunities to enhance efficiency, accuracy, and effectiveness. Stay updated on new technologies, trends, and best practices in expense management to stay ahead of the curve.

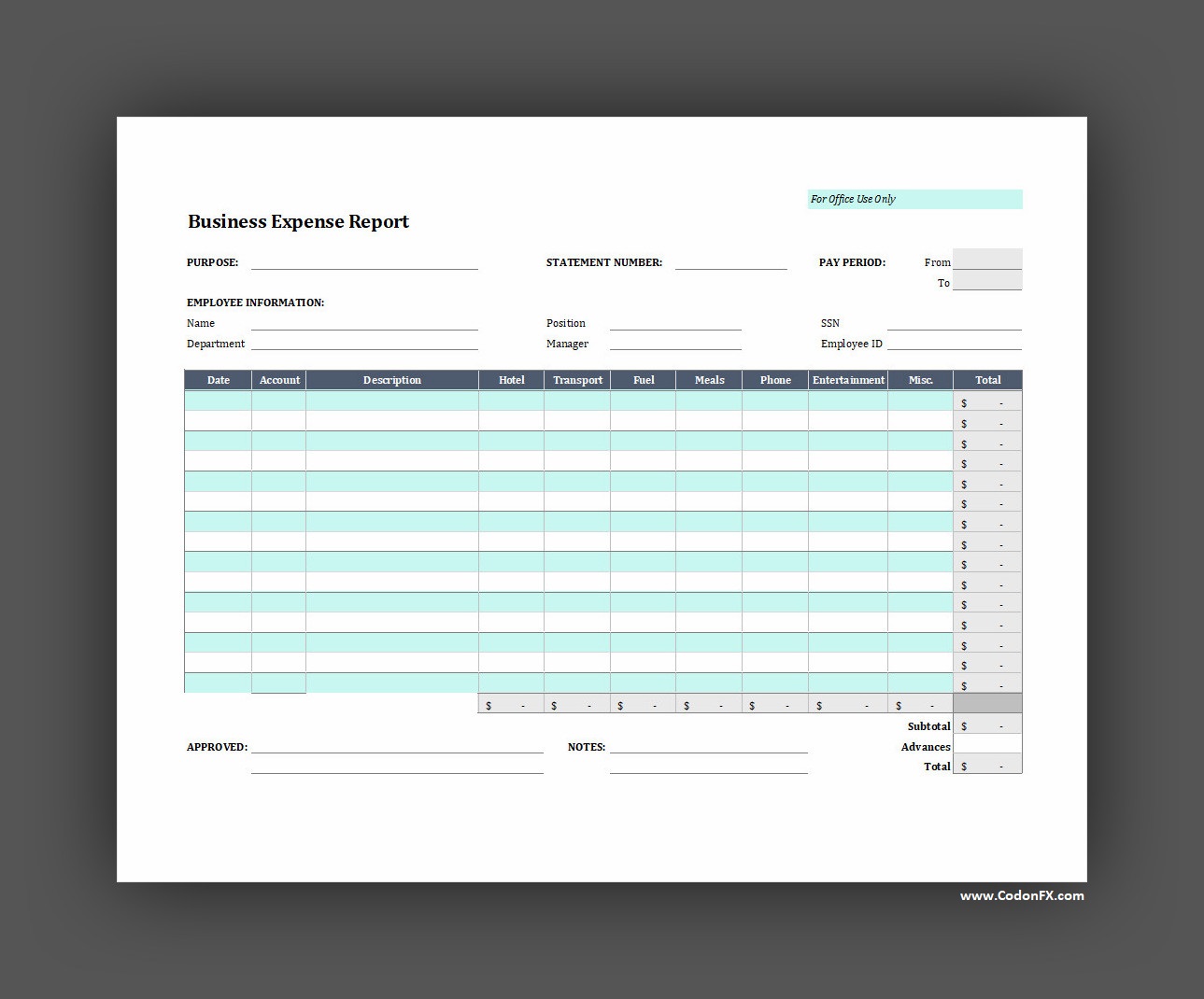

Business Expense Template

A business expense template helps you track costs, manage budgets, and maintain accurate financial records with ease. It simplifies expense reporting and supports smarter financial planning.

Download our free Business Expense Template today and start organizing your expenses more effectively.

Business Expense Template – Excel