In business, invoices play a crucial role in maintaining financial records and ensuring timely payments. A business invoice is a document that outlines the details of a transaction between a seller and a buyer. It typically includes information such as the products or services provided, the quantity, the price, and the payment terms.

This comprehensive guide will explore the what, why, and how of business invoices, along with examples and tips for successful invoicing practices.

What is a Business Invoice?

A business invoice is a formal document that serves as a record of a transaction between a business and its customers. It provides a detailed breakdown of the products or services provided, along with the corresponding costs and payment terms.

Business invoices are typically used to request payment from customers and to keep track of outstanding balances. These invoices can be customized to include company logos, contact information, and payment instructions.

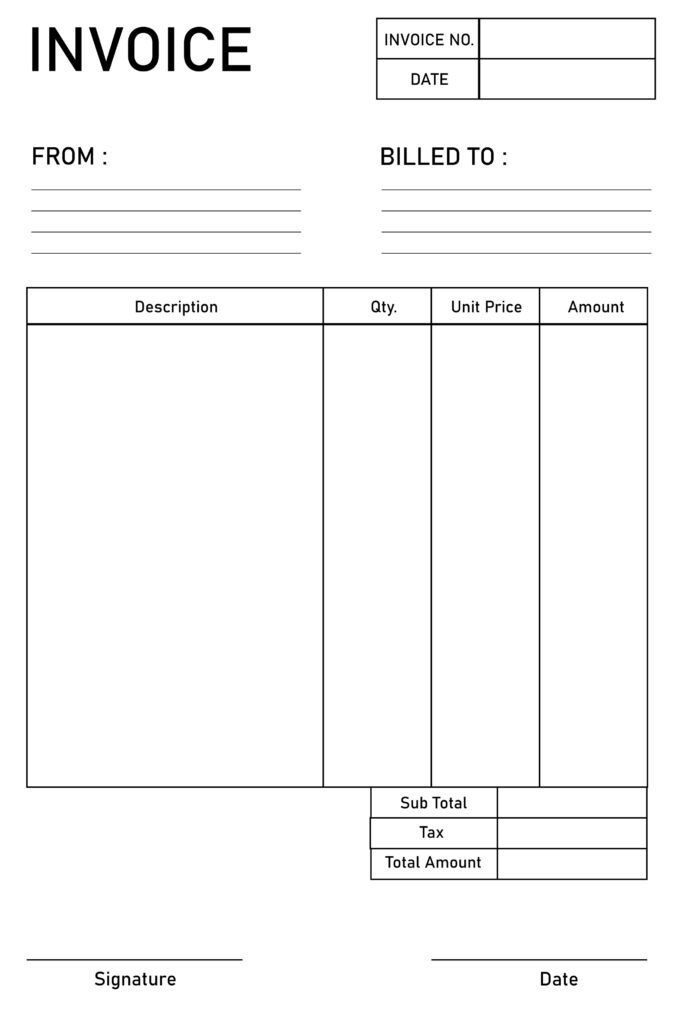

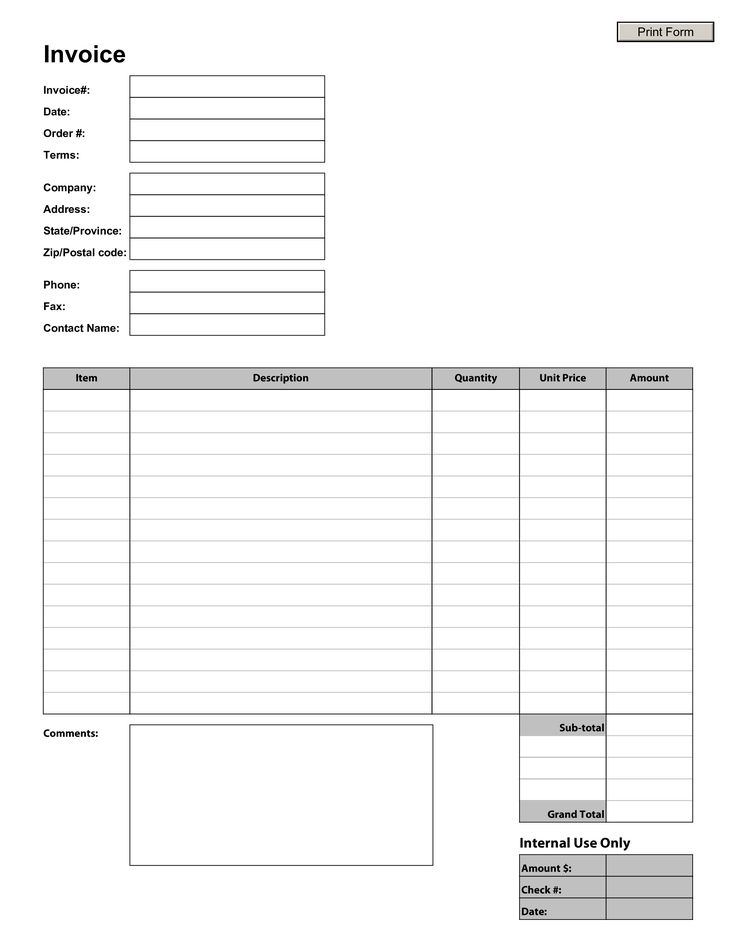

When creating a business invoice, it is important to include the following key elements:

– Business name and contact information

– Customer name and contact information

– Invoice number and date

– Description of products or services provided

– Quantity, price, and total amount due

– Payment terms and due date

Why Use Business Invoices?

Business invoices offer several benefits to both businesses and customers. For businesses, invoices serve as a formal record of transactions, helping to track sales, monitor cash flow, and maintain accurate financial records. Invoices also provide a professional image and help to build trust with customers by clearly outlining the terms of the transaction. For customers, invoices provide a clear breakdown of the products or services received and the amount due, helping to avoid any misunderstandings or disputes.

By using business invoices, businesses can streamline their invoicing process, improve cash flow management, and maintain better relationships with customers. Additionally, invoices serve as legal documents that can be used as evidence in case of disputes or late payments.

How to Create a Business Invoice

Creating a business invoice is a straightforward process that can be done using invoicing software or templates available online. Here are the basic steps to create a professional and effective invoice:

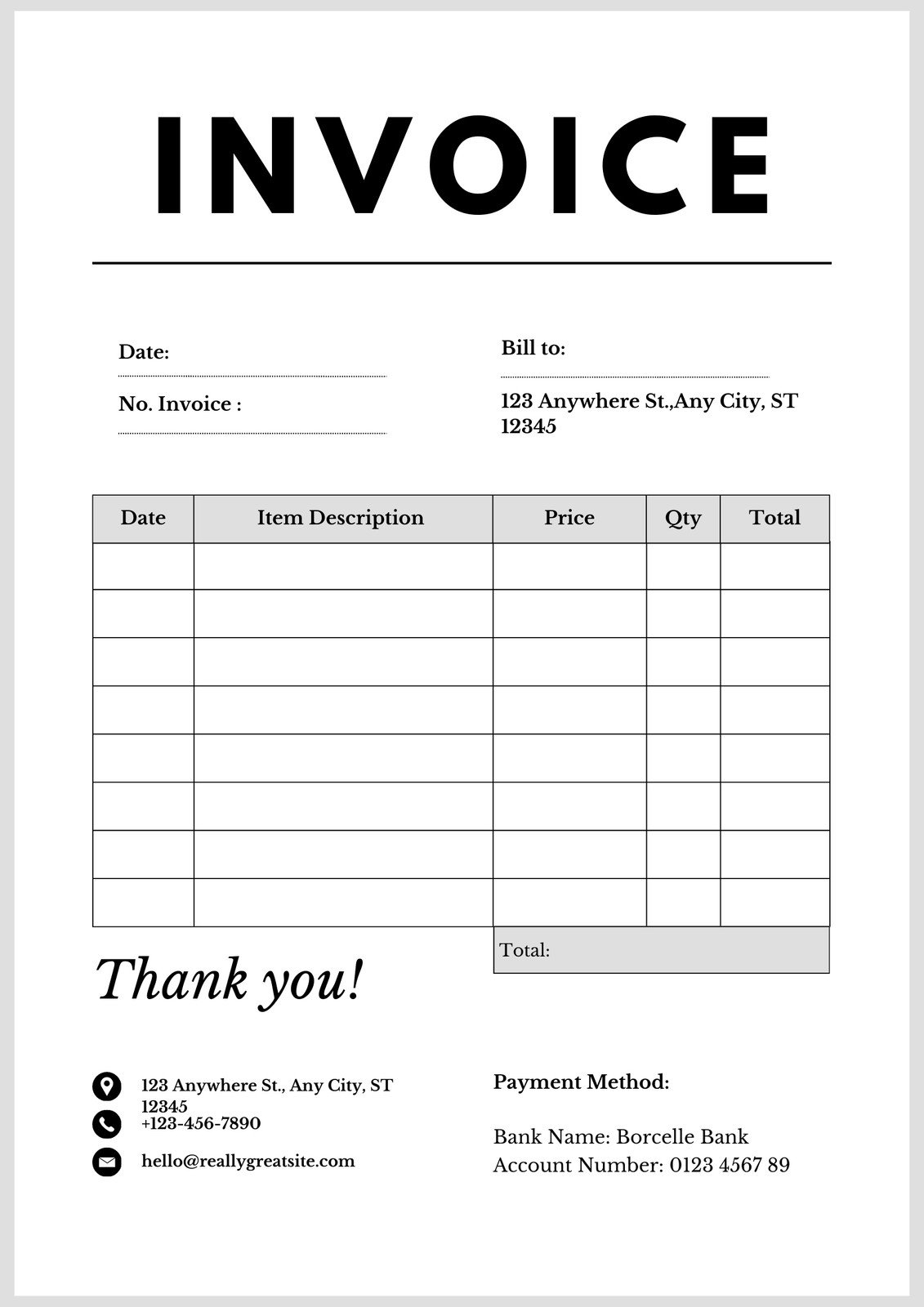

1. Choose a template: Select a business invoice template that suits your business needs and branding.

2. Customize the template: Add your business logo, contact information, and any other relevant details to the template.

3. Fill in the invoice details: Include the customer’s information, invoice number, date, description of products or services, quantity, price, and total amount due.

4. Add payment terms: Clearly outline the payment terms, including the due date, accepted payment methods, and any late payment fees.

5. Review and send: Double-check the invoice for accuracy and completeness before sending it to the customer.

Examples of Business Invoices

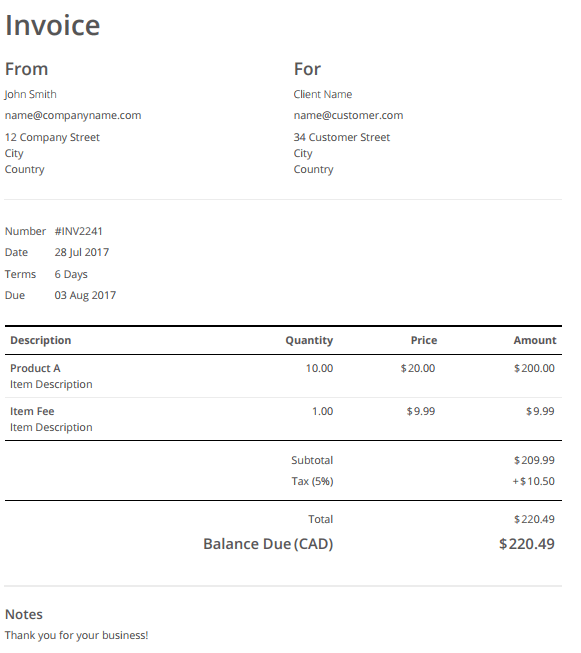

To give you a better idea of what a business invoice looks like, here are a few examples:

– Invoice for a freelance graphic designer: Includes the designer’s logo, contact information, description of services provided, hourly rate, and total amount due.

– Invoice for a small retail store: Includes the store’s name, address, customer information, list of products purchased, unit prices, and payment terms.

– Invoice for a consulting firm: Includes the firm’s logo, contact details, project description, hourly rate, hours worked, and total fee.

By customizing your business invoice to suit your specific business needs, you can create a professional and effective document that helps you get paid on time and maintain good relationships with your customers.

Tips for Successful Invoicing

To ensure smooth and efficient invoicing practices, here are some tips for creating and managing business invoices:

– Use invoicing software: Invest in cloud-based invoicing software to streamline the invoicing process and track payments.

– Set clear payment terms: Clearly outline the payment terms, due date, and accepted payment methods on your invoices.

– Follow up on late payments: Send timely reminders to customers with outstanding balances to avoid cash flow issues.

– Keep accurate records: Maintain detailed records of all invoices sent and payments received for easy reference.

– Review invoices for errors: Double-check each invoice for accuracy and completeness before sending it to customers.

– Offer online payment options: Provide customers with convenient online payment options to speed up the payment process.

– Send invoices promptly: Send invoices as soon as the products or services are delivered to expedite payment collection.

– Provide detailed descriptions: Include detailed descriptions of products or services provided to avoid any confusion or disputes.

– Establish a consistent invoicing schedule: Set a regular schedule for sending invoices to ensure steady cash flow for your business.

– Keep communication open: Maintain open communication with customers regarding payment terms and address any issues promptly.

By following these tips and best practices, you can create professional and effective business invoices that help you get paid on time and maintain strong relationships with your customers.

Business Invoice Template – Download