What is a Commercial Invoice?

A commercial invoice is a critical document used in international trade that provides a detailed account of the goods being shipped, their value, and the terms of the sale. It serves as a binding agreement between the buyer and seller, establishing the obligations of both parties in the transaction.

Importance of a Commercial Invoice

1. Facilitating International Trade

Commercial invoices are essential for facilitating international trade. They provide a standardized document that outlines the terms of the sale and the details of the goods being shipped. They also help streamline the customs clearance process and ensure compliance with regulations.

2. Legal Protection

Commercial invoices offer legal protection to buyers and sellers by providing a transaction record. In case of disputes or disagreements, the commercial invoice can be used as evidence to resolve issues and enforce the terms of the sale agreed upon by the parties.

3. Payment Verification

For sellers, commercial invoices serve as a tool to verify that payment has been made for the goods shipped. By including payment terms and instructions on the invoice, sellers can ensure that buyers understand the terms of the transaction and process payments accordingly.

4. Record-Keeping and Compliance

Maintaining accurate commercial invoices is crucial for record-keeping purposes and compliance with tax and import/export regulations. Proper documentation helps businesses track their international transactions and ensure they are following the required procedures.

5. Building Trust and Credibility

By providing detailed and accurate commercial invoices, sellers can build trust and credibility with buyers. Transparent invoicing practices demonstrate professionalism and reliability, enhancing the business relationship between parties.

When is a Commercial Invoice Required?

1. Import Transactions

For import transactions, a commercial invoice is typically required by customs authorities to assess duties and taxes on imported goods. The commercial invoice provides critical information about the shipment that customs officials use to process the goods through customs.

2. Export Transactions

When exporting goods, a commercial invoice is also required to provide details of the shipment to customs authorities in the destination country. The commercial invoice helps ensure that the goods are accurately declared and comply with import regulations in the receiving country.

3. International Regulations

International regulations and trade agreements may stipulate the requirement for commercial invoices in cross-border transactions. It is essential for businesses to familiarize themselves with the specific requirements of the countries they are trading with to ensure compliance.

4. Payment Processing

Commercial invoices are crucial for payment processing in international trade. Banks and financial institutions use the information provided in the commercial invoice to verify the transaction and process payments accordingly. Without a commercial invoice, payment processing can be delayed or hindered.

Risks of No Commercial Invoice

1. Customs Delays and Penalties

Failure to provide a commercial invoice can result in customs delays and potential penalties for non-compliance. Customs authorities require detailed information about the goods being shipped to assess duties and taxes accurately.

2. Payment Disputes

Without a commercial invoice, payment disputes can arise between buyers and sellers. The lack of a formal document outlining the terms of the sale and the details of the goods can lead to disagreements over payment amounts and conditions.

3. Legal Consequences

Non-compliance with regulations regarding commercial invoices can have legal consequences for businesses. Failure to provide accurate and complete commercial invoices can result in fines, penalties, or even the seizure of goods by customs authorities.

4. Financial Losses

Businesses may incur financial losses due to the lack of a commercial invoice. Without a formal document outlining the transaction details, sellers may face challenges in verifying payment, and buyers may encounter difficulties in proving receipt of goods.

How to Create a Commercial Invoice

1. Essential Information

When creating a commercial invoice, it is important to include essential information such as the date of issue, invoice number, buyer and seller details, item description, quantity, unit price, total value, payment terms, currency, and any additional charges.

2. Formatting and Presentation

Commercial invoices should be well-organized and easy to read. Use a clear layout with distinct sections for each piece of information to ensure that all details are included and easily accessible for both parties.

3. Accuracy and Consistency

Double-check all information provided in the commercial invoice to ensure accuracy and consistency. Any discrepancies or errors in the invoice can lead to delays in customs clearance, payment processing, or potential disputes between buyers and sellers.

4. Payment Terms and Instructions

Specify the payment terms and instructions clearly on the commercial invoice. Include details on how payment should be made, the currency accepted, and any deadlines or conditions for payment to avoid confusion or delays in processing.

5. Legal Compliance

Ensure that the commercial invoice complies with the legal requirements of the countries involved in the transaction. Familiarize yourself with the specific regulations and documentation requirements for import and export transactions to avoid any issues with customs authorities.

6. Record-Keeping

Keep a copy of the commercial invoice for your records and provide a copy to the buyer for their records. Proper record-keeping is essential for tracking transactions, resolving disputes, and complying with tax and regulatory requirements.

7. Professional Assistance

If you are unsure about creating a commercial invoice or need guidance on specific requirements for international trade, consider seeking help from customs brokers, trade experts, or legal professionals. Getting assistance from professionals can help ensure that your commercial invoices meet all necessary standards.

8. Stay Informed

Stay updated on changes in regulations and requirements for commercial invoices in the countries you are conducting business with. International trade regulations are subject to change, so it is important to stay informed to avoid any compliance issues or delays in your transactions.

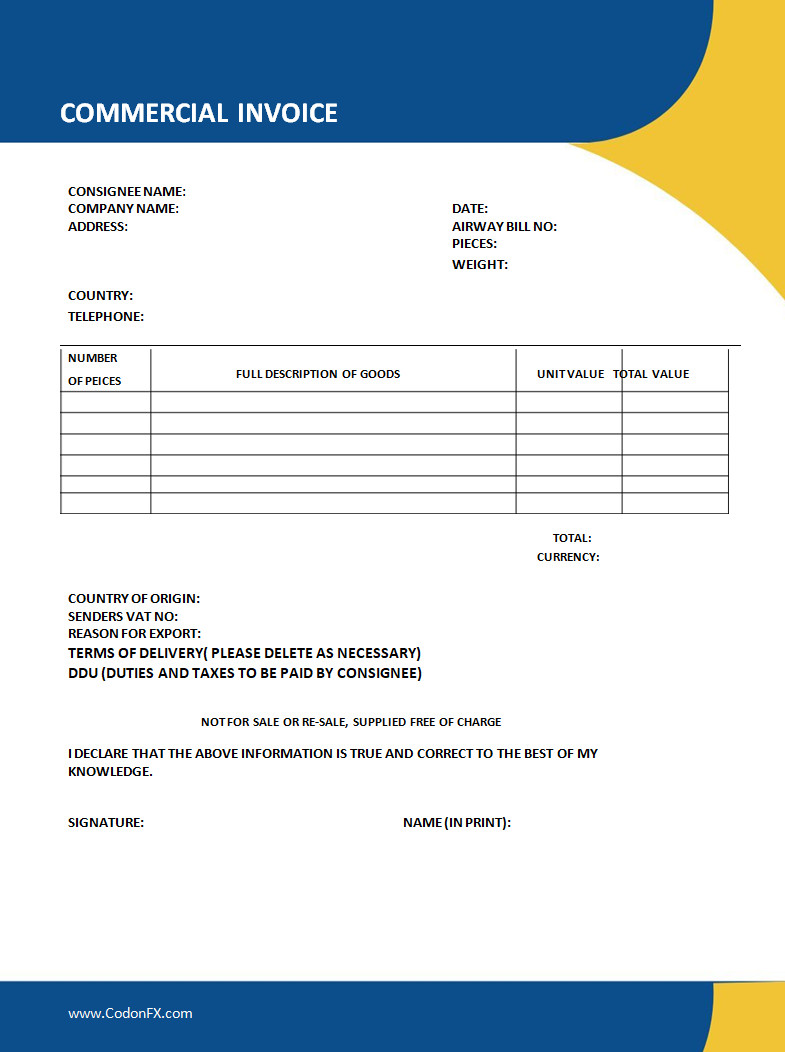

Commercial Invoice Template

Start using our free commercial invoice template today to document transactions accurately, comply with international trade requirements, and ensure smooth customs clearance.

Commercial Invoice Template – Word