Applying for a credit card can be a daunting task, especially when faced with lengthy online forms or confusing paper applications. However, credit card application forms offer a convenient solution for those who prefer a more traditional approach to applying for credit.

In this comprehensive guide, we will explore everything you need to know about credit card application forms, including what they are, why they are useful, how to fill them out, examples of popular forms, and tips for successful submission.

What is a Credit Card Application Form?

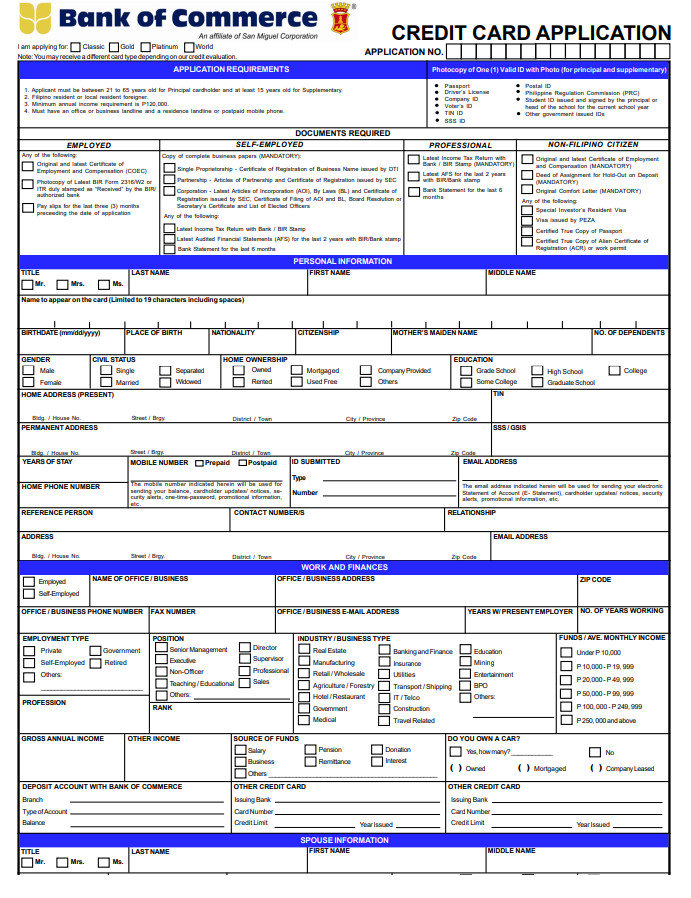

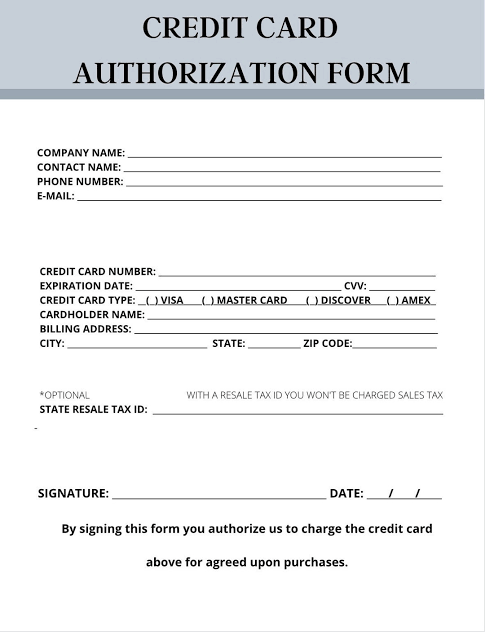

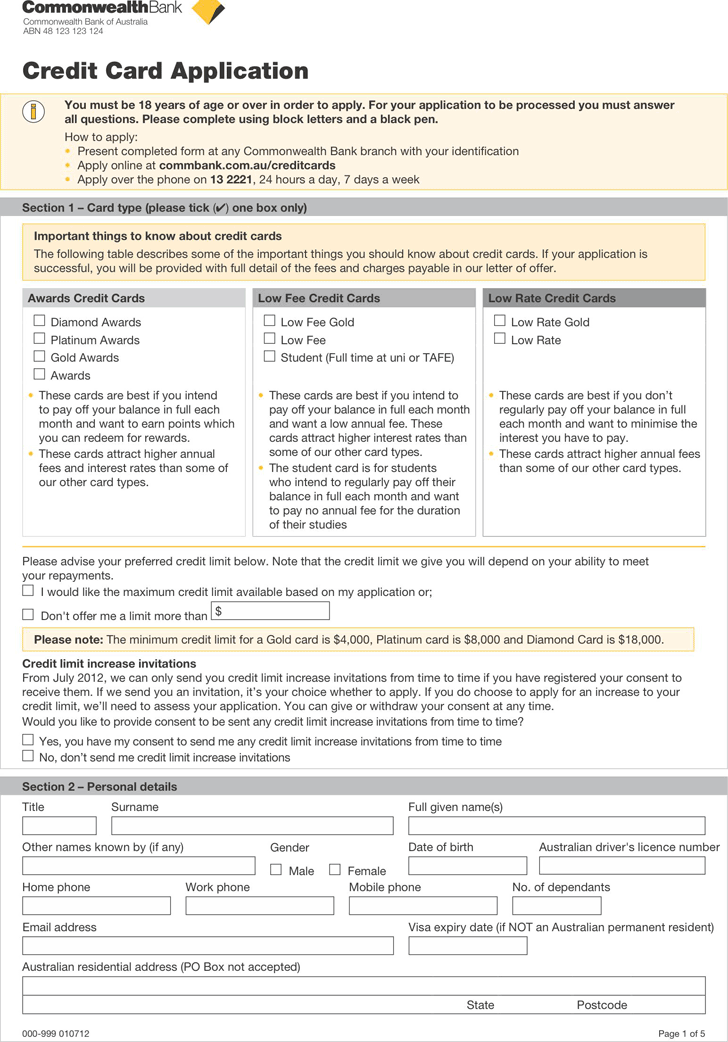

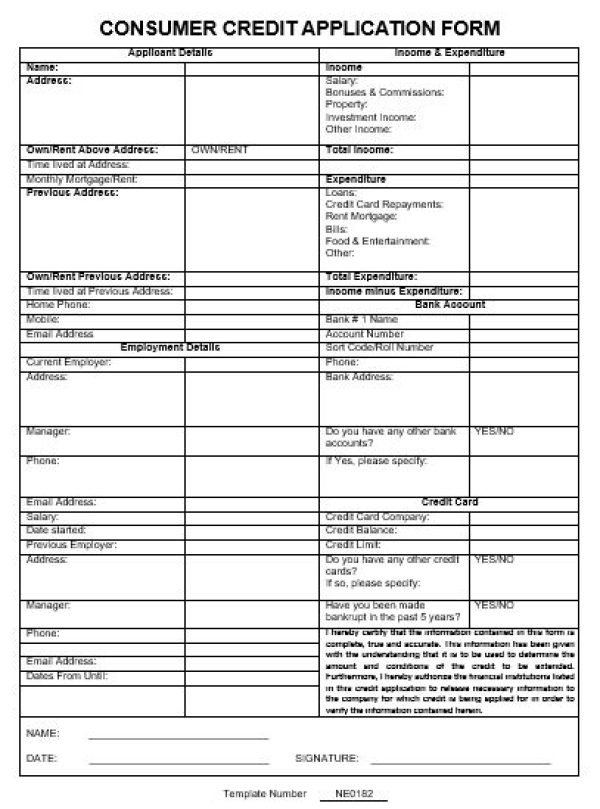

A credit card application form is a document that can be downloaded and printed from a credit card issuer’s website or obtained in person from a bank or financial institution. These forms typically include fields for personal information, income details, employment information, and references, among other required data.

By filling out a credit card application form, individuals can apply for a credit card without the need for an online account or access to a computer.

Why Use a Credit Card Application Form?

There are several reasons why individuals may choose to use a credit card application form instead of an online application. Some of the benefits of forms include:

- Accessibility: Forms can be filled out at any time and from any location, providing flexibility for applicants.

- Privacy: Some individuals may feel more comfortable submitting personal information on a printed form rather than online.

- Tangibility: Holding a physical form may help applicants feel more in control of the application process.

How to Fill Out a Credit Card Application Form

When filling out a credit card application form, it is important to follow the instructions carefully and provide accurate information. Here are some general steps to help you complete the form successfully:

1. Gather Required Documents

Before starting the application, make sure you have all necessary documents on hand, such as identification, proof of income, and contact information for references.

2. Read Instructions Carefully

Take the time to read through the instructions provided on the form to ensure you understand what information is required and how to fill out each section.

3. Provide Accurate Information

Double-check all information entered on the form to avoid errors that could delay or affect the approval process.

4. Sign and Date the Form

Be sure to sign and date the form where required to confirm that all information provided is accurate to the best of your knowledge.

Examples of Popular Credit Card Application Forms

Numerous credit card issuers offer application forms on their websites. Some examples of popular credit card application forms include:

- Chase Sapphire Preferred Application Form: A widely used form for one of the most popular travel rewards credit cards.

- American Express Gold Card Application Form: Known for its premium benefits and rewards, this form is sought after by many consumers.

- Citi Double Cash Card Application Form: A straightforward cash back credit card form that appeals to those looking for simplicity.

Tips for Successful Submission of Credit Card Application Forms

To increase your chances of approval and expedite the application process, consider the following tips when submitting a credit card application form:

- Review Your Information: Before submitting the form, review all information provided to ensure accuracy.

- Include All Required Documents: Make sure to attach any necessary documents requested by the issuer.

- Follow Up if Needed: If you do not hear back within a reasonable time frame, don’t hesitate to follow up with the issuer to inquire about the status of your application.

- Keep a Copy: Always keep a copy of the completed form for your records in case any issues arise during the application process.

Conclusion

Credit card application forms offer a convenient and accessible way for individuals to apply for credit cards without the need for online access. By following the tips provided in this guide and filling out the form accurately, you can increase your chances of approval and enjoy the benefits of your new credit card. Remember to always read the fine print and understand the terms and conditions of the card before submitting your application.

Credit Card Application Form – Download