Financial planning is a crucial aspect of managing your finances to ensure a secure and prosperous future. It involves creating a roadmap that helps you make the best use of your money and achieve long-term financial goals such as investments, sending your children to college, buying a bigger home, leaving a legacy, or enjoying a comfortable retirement. By taking the time to plan and strategize, you can set yourself up for financial success and peace of mind.

In this article, we will delve into the key elements of financial planning, why it is essential, and how you can create a solid financial plan to achieve your goals.

What is Financial Planning?

Financial planning is the process of setting goals, assessing your current financial situation, and creating a plan to help you achieve those goals. It involves evaluating your income, expenses, assets, and liabilities to develop a comprehensive strategy that aligns with your long-term objectives.

By creating a financial plan, you can establish a clear roadmap for managing your finances, making informed decisions, and working towards a secure financial future.

Why Financial Planning is Essential?

Financial planning is essential for a variety of reasons, including:

Goal Setting

Financial planning helps individuals set clear and achievable financial goals. Whether it’s saving for a down payment on a home, funding a child’s education, or building a retirement nest egg, having a financial plan in place can help individuals stay focused and motivated to reach their goals.

Financial Security

Having a solid financial plan provides individuals with a sense of security, knowing that they have a roadmap in place to meet their financial needs. By creating a plan that accounts for emergencies, unexpected expenses, and future financial goals, individuals can feel confident in their ability to weather financial challenges.

Wealth Building

Financial planning is essential for building wealth over time. By creating a plan that includes strategic savings, investments, and asset management, individuals can grow their wealth and achieve long-term financial success. A well-designed financial plan takes into account individuals’ risk tolerance, investment goals, and time horizon to create a customized strategy for wealth building.

Risk Management

Financial planning helps individuals identify and mitigate potential financial risks that could impact their long-term financial well-being. By analyzing individuals’ insurance needs, emergency savings, and investment strategies, a financial plan can help individuals protect their assets and loved ones from unforeseen events such as illness, job loss, or market downturns.

Retirement Planning

One of the most important aspects of financial planning is retirement planning. By creating a plan that includes saving for retirement, investing in retirement accounts such as a 401(k) or IRA, and determining a retirement income strategy, individuals can ensure they have the financial resources needed to enjoy a comfortable retirement.

Key Elements of Financial Planning

Several key elements make up a comprehensive financial plan:

Setting Financial Goals

One of the first steps in financial planning is setting clear and achievable financial goals. Whether it’s saving for a major purchase, funding your children’s education, or retiring comfortably, defining your goals is essential to creating a roadmap for your financial future.

Assessing Your Current Financial Situation

Before creating a financial plan, it’s important to assess your current financial situation. This includes evaluating your income, expenses, assets, and liabilities to understand where you stand financially and identify areas for improvement.

Creating a Budget

A budget is a foundational element of any financial plan. By creating a budget that outlines your income, expenses, and savings goals, you can track your spending, identify areas where you can save money, and ensure you’re living within your means.

Investment Planning

Investment planning is a crucial component of financial planning. By developing an investment strategy that aligns with your risk tolerance, time horizon, and financial goals, you can grow your wealth over time and work towards achieving your long-term objectives.

Insurance Planning

Insurance planning is essential for protecting your assets and loved ones. By evaluating your insurance needs, including health insurance, life insurance, disability insurance, and long-term care insurance, you can ensure you have the coverage needed to safeguard your financial well-being.

Estate Planning

Estate planning is an important aspect of financial planning that involves creating a plan for the distribution of your assets after your death. By creating a will, establishing trusts, and designating beneficiaries for your assets, you can ensure your assets are distributed according to your wishes and minimize estate taxes.

How to Create a Solid Financial Plan

Creating a solid financial plan involves several steps:

Define Your Financial Goals

Start by defining your short-term and long-term financial goals. Whether it’s saving for a major purchase, funding your children’s education, or retiring comfortably, having clear goals in mind is essential to creating a roadmap for your financial future.

Assess Your Current Financial Situation

Evaluate your income, expenses, assets, and liabilities to understand where you stand financially. This includes reviewing your budget, debt levels, savings accounts, investments, and insurance coverage to identify areas for improvement.

Create a Budget

Developing a budget is a foundational step in creating a solid financial plan. By outlining your income, expenses, and savings goals, you can track your spending, identify areas where you can save money, and ensure you’re living within your means.

Invest Wisely

Investment planning is a key component of financial planning. By developing an investment strategy that aligns with your risk tolerance, time horizon, and financial goals, you can grow your wealth over time and work towards achieving your long-term objectives.

Protect Your Assets

Evaluate your insurance needs and ensure you have adequate coverage to protect your assets, income, and loved ones from unexpected events. This includes reviewing your health insurance, life insurance, disability insurance, and long-term care insurance to ensure you have the coverage needed to protect your financial well-being.

Plan for Retirement

Retirement planning is a critical aspect of financial planning. By saving for retirement early, opening retirement accounts such as a 401(k) or IRA, and determining a retirement income strategy, you can ensure you have the financial resources needed to enjoy a comfortable retirement.

Review and Adjust Your Plan Regularly

Regularly review your financial plan and make adjustments as needed to ensure you stay on track to meet your goals. This includes monitoring your progress, revisiting your budget, evaluating your investments, and adjusting your plan as your circumstances change.

Tips for Successful Financial Planning

Here are some tips to help you succeed in your financial planning journey:

Start Early

One of the most important tips for successful financial planning is to start early. The sooner you begin planning for your financial future, the more time you have to save, invest, and grow your wealth.

Seek Professional Advice

Consider working with a financial advisor to help you create a comprehensive financial plan tailored to your needs. A professional advisor can provide expert guidance, advice, and support as you work towards achieving your financial goals.

Stay Disciplined

Financial planning requires discipline and commitment. Stick to your budget, investment strategy, and savings goals, and resist the temptation to make impulsive financial decisions that could derail your progress.

Monitor Your Progress

Regularly monitor your progress towards your financial goals. Review your budget, track your savings and investments, and assess whether you’re on track to meet your objectives. Making adjustments as needed will help you stay focused and motivated.

Adapt to Life Changes

Life is full of unexpected twists and turns, so be prepared to adapt your financial plan as your circumstances change. Whether it’s a job loss, a new addition to the family, or a health crisis, staying flexible and adjusting your plan accordingly will help you navigate life’s challenges.

Stay Informed

Stay up-to-date on financial trends, investment options, tax laws, and other financial topics that impact your financial well-being. By staying informed, you can make informed decisions about your finances and take advantage of opportunities to grow your wealth.

Celebrate Milestones

As you reach key milestones in your financial journey, take the time to celebrate your achievements. Whether it’s paying off a debt, reaching a savings goal, or achieving a significant investment milestone, celebrating your successes will help you stay motivated and focused on your long-term financial goals.

Build Emergency Savings

Having an emergency savings fund is essential for financial security. Aim to save enough to cover three to six months’ worth of living expenses in case of unexpected events such as a job loss, medical emergency, or major car repair. Having this buffer will provide peace of mind and financial stability.

Maximize Retirement Savings

Take advantage of retirement savings vehicles such as 401(k)s, IRAs, and employer-sponsored retirement plans. Contribute as much as you can afford to these accounts to take advantage of tax advantages and employer matching contributions, helping you build a nest egg for retirement.

Diversify Your Investments

Diversification is key to managing investment risk. Spread your investments across a mix of asset classes, industries, and geographic regions to reduce the impact of market fluctuations on your portfolio. Diversification can help protect your investments and improve long-term returns.

Revisit Your Insurance Needs

Review your insurance coverage regularly to ensure you have adequate protection for your assets and loved ones. Consider factors such as changes in your income, family situation, and assets to adjust your coverage as needed. Update your policies to reflect your current needs and financial situation.

Set Up Automatic Savings

Automate your savings by setting up automatic transfers from your checking account to your savings or investment accounts. By making saving a priority and automating the process, you can ensure consistent progress towards your financial goals without the need for manual intervention.

Track Your Spending

Monitor your spending habits by tracking your expenses and categorizing them into different budget categories. Use budgeting tools, apps, or spreadsheets to help you visualize where your money is going and identify areas where you can cut back or reallocate funds to meet your financial goals.

Consider Tax Planning

Work with a tax professional to develop a tax-efficient strategy that minimizes your tax liability and maximizes your savings. Take advantage of tax deductions, credits, and retirement account contributions to reduce your tax burden and keep more money in your pocket.

Stay on Top of Debt

Manage your debt wisely by paying down high-interest debt and avoiding excessive borrowing. Create a plan to eliminate debt systematically, starting with high-interest debt first, and avoid taking on new debt unless necessary. Staying on top of debt will improve your financial health and reduce financial stress.

Plan for Major Expenses

Anticipate major expenses such as home repairs, car maintenance, or medical bills by setting aside funds in a separate savings account. By planning for these expenses in advance, you can avoid dipping into your emergency fund or going into debt to cover unexpected costs.

Review Your Investments Regularly

Monitor the performance of your investments regularly and make adjustments as needed to stay on track towards your financial goals. Rebalance your portfolio periodically to maintain your desired asset allocation and risk tolerance, ensuring your investments are aligned with your objectives.

Stay Flexible

Financial planning is not a set-it-and-forget-it process. Stay flexible and be willing to adjust your plan as needed to accommodate changing circumstances or new opportunities. By remaining adaptable and open to change, you can stay on course towards your long-term financial goals.

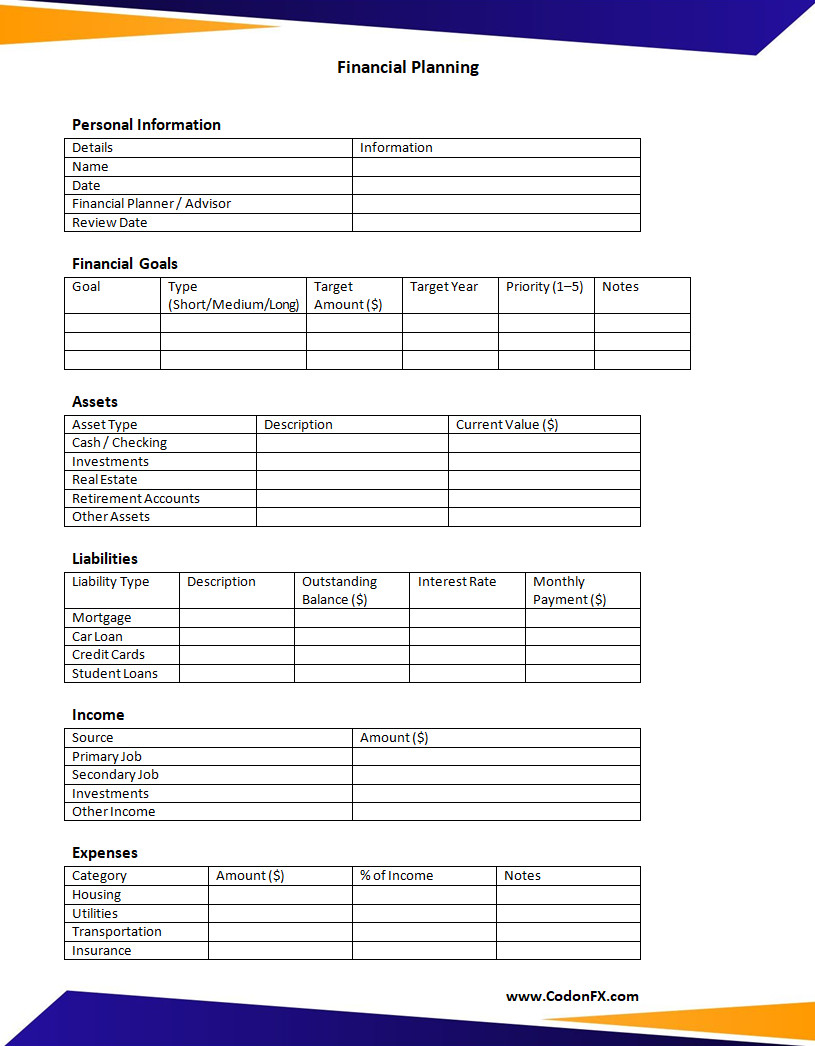

Financial Planning Template

A financial planning is a practical tool for organizing your income, expenses, savings, and investments to achieve your short- and long-term financial goals. It helps you track progress, identify areas for improvement, and make informed financial decisions with confidence. Whether for personal budgeting or business planning, this template brings clarity and structure to your finances.

Download and use our free financial planning template today to take control of your money, plan smarter, and build a secure financial future.

Financial Planning Template – Download