In today’s fast-paced world, managing your finances can be a daunting task. From tracking expenses to setting financial goals, staying on top of your financial health requires careful planning and organization. This is where a personal financial planner can come in handy. This tool can help individuals create and implement strategies to achieve their financial goals, assess their current financial situation, set long-term objectives, and develop a plan to reach those goals.

In this comprehensive guide, we will explore the what, why, and how of using a personal financial planner, along with examples and tips for successful financial planning.

What is a Personal Financial Planner?

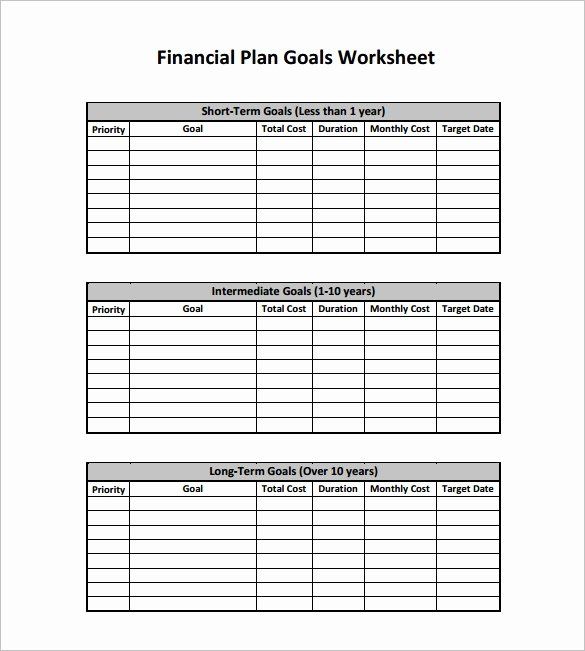

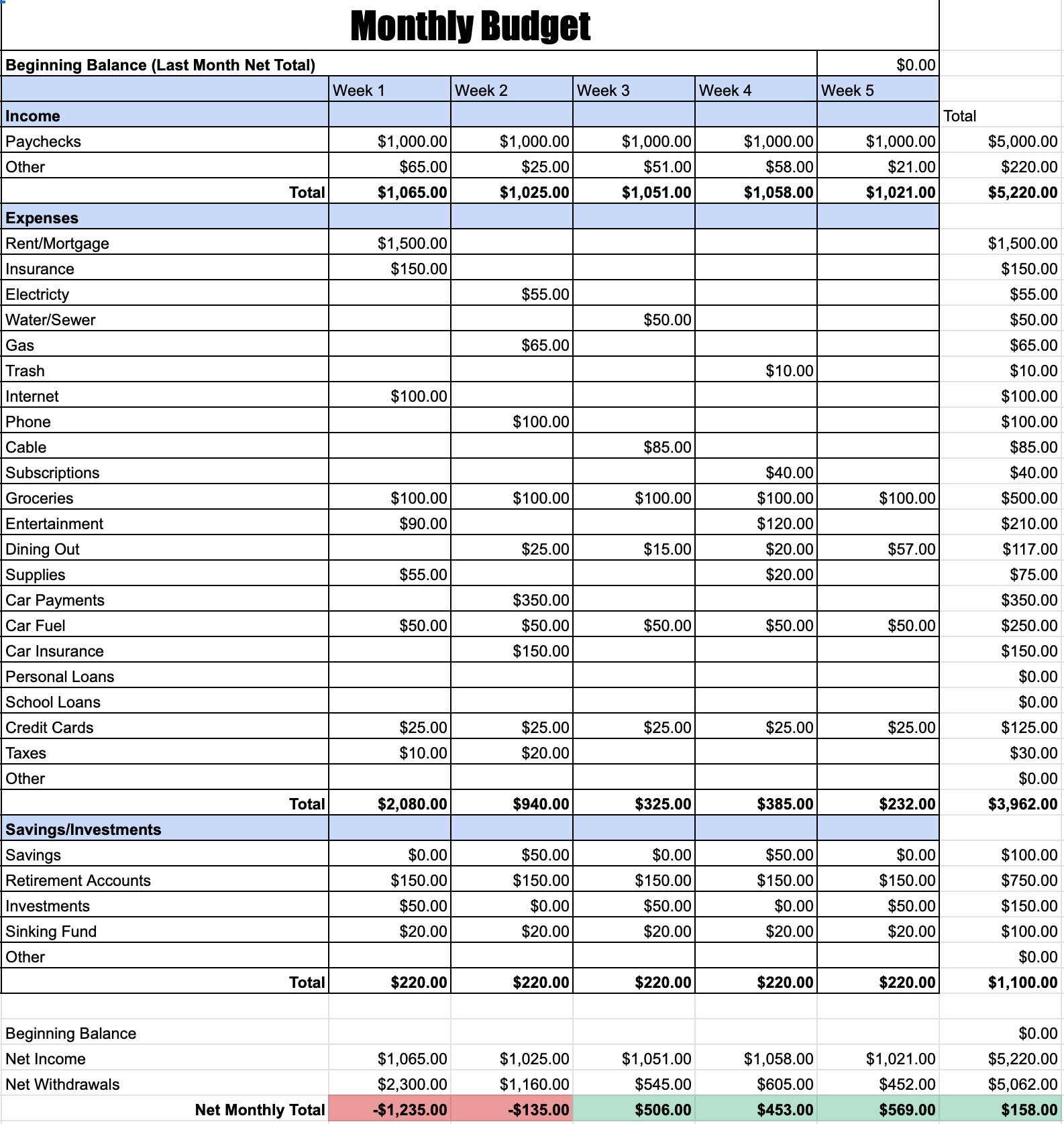

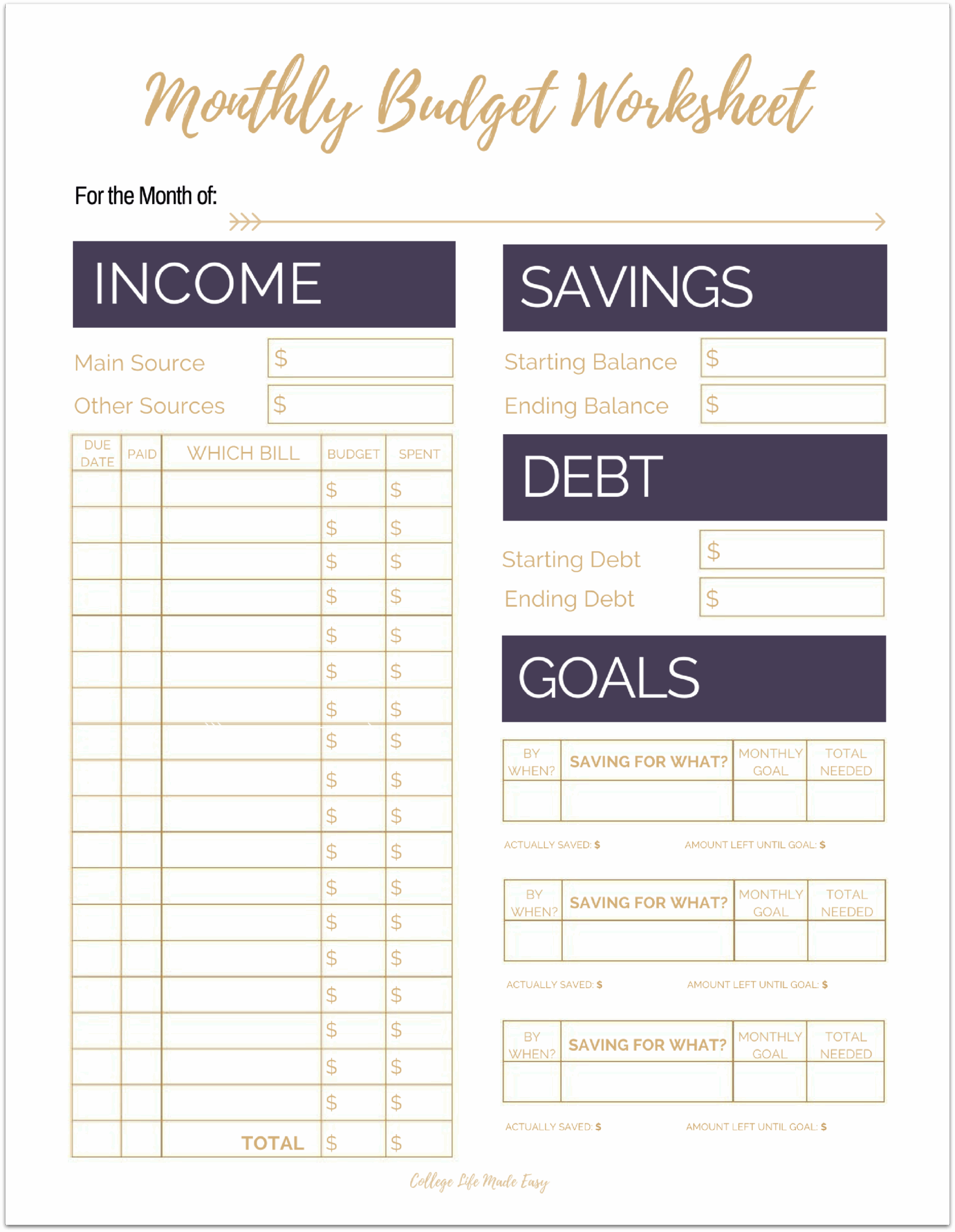

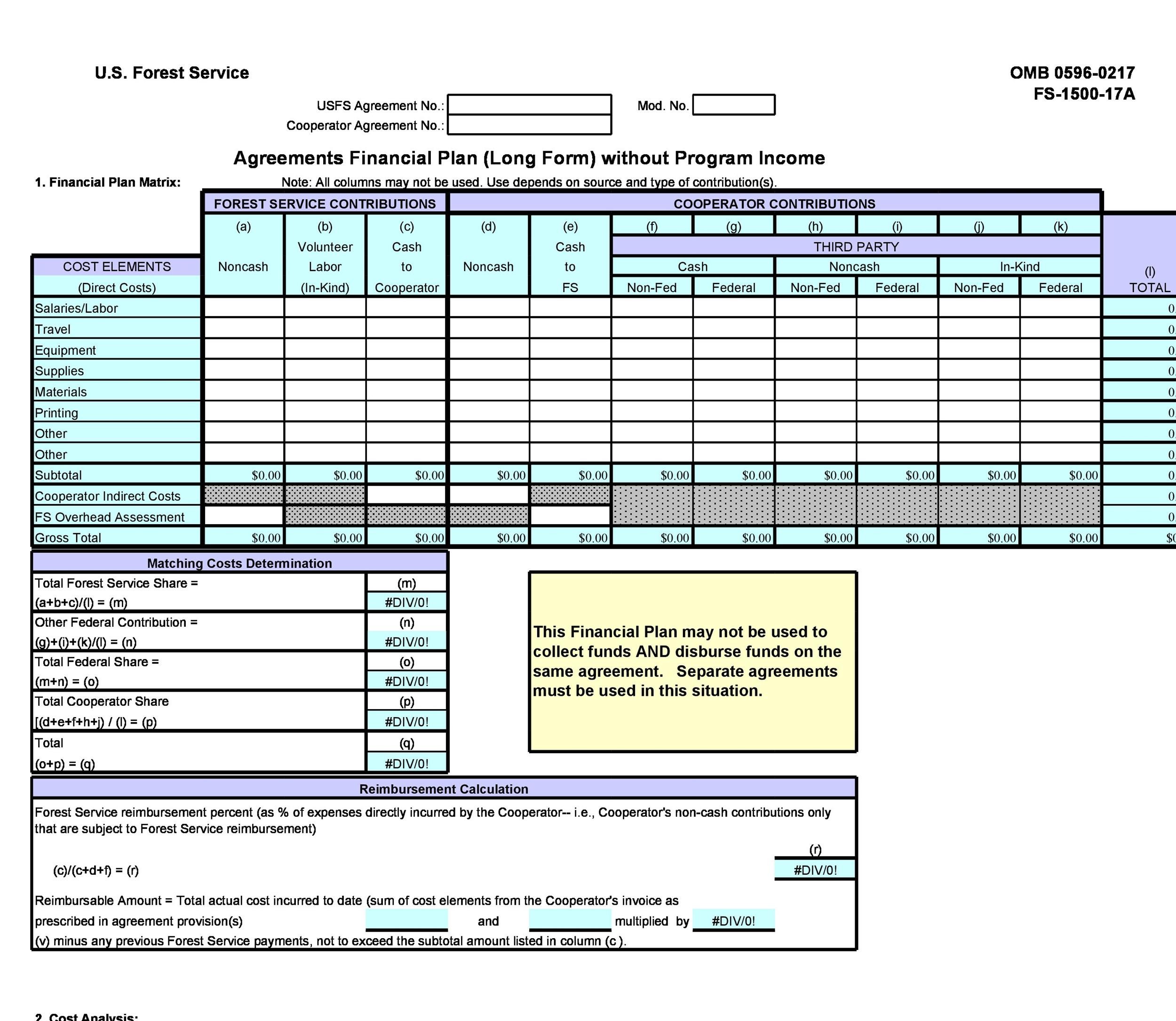

A personal financial planner is a document or template that helps individuals organize and manage their finances effectively. It typically includes sections for tracking income, expenses, savings, investments, debts, and financial goals.

By using a personal financial planner, individuals can gain a better understanding of their financial situation, identify areas for improvement, and create a roadmap to achieve their financial objectives.

Why Use a Personal Financial Planner?

There are several reasons why using a personal financial planner can be beneficial:

1. Organization: A financial planner can help you keep all your financial information in one place, making it easier to track your progress towards your goals.

2. Goal Setting: By outlining your financial goals in a planner, you can stay focused and motivated to achieve them.

3. Budgeting: A financial planner can help you create a budget and track your expenses, making it easier to manage your money effectively.

4. Financial Awareness: Using a planner can increase your financial awareness and help you make informed decisions about your money.

5. Future Planning: With a financial planner, you can plan for future expenses, such as buying a home, starting a family, or saving for retirement.

How to Use a Personal Financial Planner

Using a personal financial planner is simple. Here are some steps to help you get started:

1. Choose a Template: Select a personal financial planner template that suits your needs and preferences.

2. Fill in Your Financial Information: Begin by entering your income, expenses, savings, investments, debts, and financial goals into the planner.

3. Track Your Progress: Regularly update your planner to track your progress towards your financial goals and make adjustments as needed.

4. Review Regularly: Take time to review your financial planner regularly to ensure you are on track to meet your objectives.

5. Adjust as Necessary: If your financial situation changes, be prepared to adjust your planner accordingly to stay on top of your finances.

Examples of Personal Financial Planners

There are many free personal financial planner templates available online that you can use to get started. Some popular examples include:

- Monthly Budget Planner: This template can help you track your income and expenses each month to ensure you are staying within your budget.

- Savings Goal Tracker: Use this template to set specific savings goals and track your progress towards achieving them.

- Debt Payoff Plan: This template can help you create a plan to pay off your debts in a systematic and timely manner.

- Investment Portfolio Tracker: Use this template to monitor the performance of your investments and make informed decisions about your portfolio.

- Retirement Planning Worksheet: This template can help you estimate your future expenses and savings needs to plan for a comfortable retirement.

Tips for Successful Financial Planning

To make the most of your personal financial planner, consider the following tips:

1. Set Clear Goals: Define your financial goals clearly and prioritize them in your planner.

2. Be Realistic: Set achievable goals and timelines to avoid becoming discouraged.

3. Monitor Your Progress: Regularly review and update your financial planner to track your progress.

4. Seek Professional Advice: If needed, consult a financial advisor for guidance on creating and implementing your financial plan.

5. Stay Disciplined: Stick to your budget and financial plan to achieve your long-term objectives.

6. Celebrate Milestones: Acknowledge and celebrate your achievements along the way to stay motivated.

7. Stay Informed: Stay up to date on financial news and trends that may impact your financial goals.

8. Review Regularly: Make it a habit to review your financial planner regularly and make adjustments as necessary.

9. Educate Yourself: Take the time to educate yourself about personal finance to make informed decisions.

10. Be Flexible: Be prepared to adjust your financial plan as needed to adapt to changes in your financial situation.

Conclusion

In conclusion, using a personal financial planner can be a valuable tool for individuals looking to take control of their finances and work towards their financial goals. By assessing their current financial situation, setting long-term objectives, and developing a plan to reach those goals, individuals can create a roadmap to financial success. With the right tools, resources, and mindset, anyone can achieve financial stability and security.

So why wait? Start using a personal financial planner today and take the first step towards a brighter financial future.

Personal Financial Planner Template – Download