Are you tired of manually tracking your petty cash expenses and struggling to keep them organized? Look no further than a petty cash reconciliation form to streamline your petty cash management process. This simple yet effective tool can help you stay on top of your petty cash transactions, maintain accurate records, and ensure accountability within your organization.

In this article, we will explore what a petty cash reconciliation form is, why it is essential for businesses, how to use it effectively, examples of different formats, and tips for successful implementation.

What is a Petty Cash Reconciliation Form?

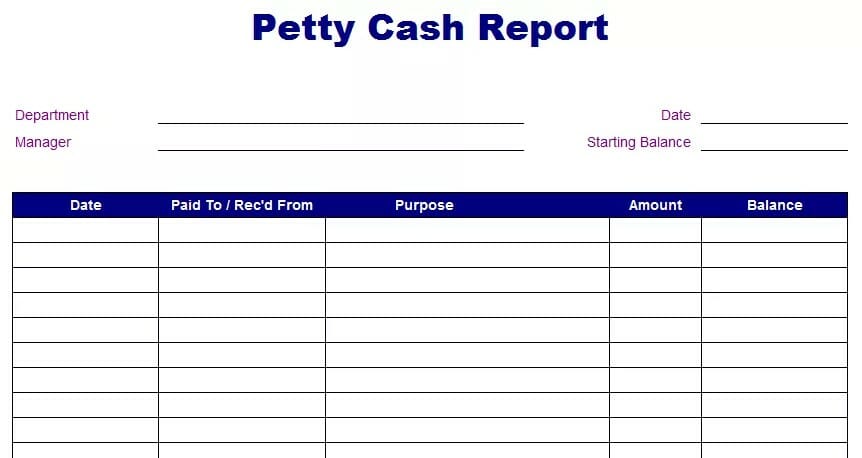

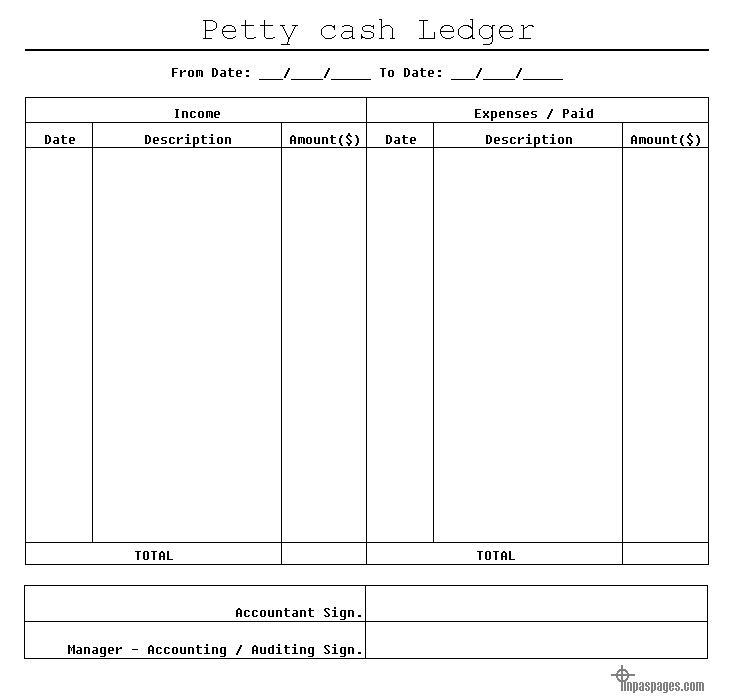

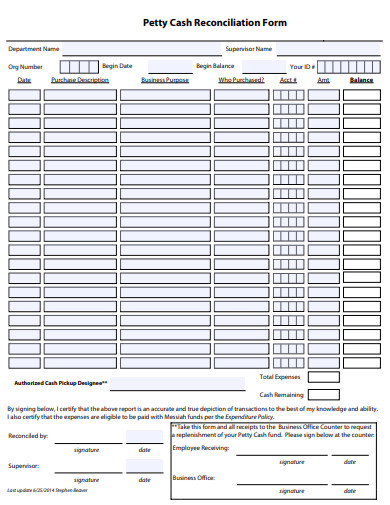

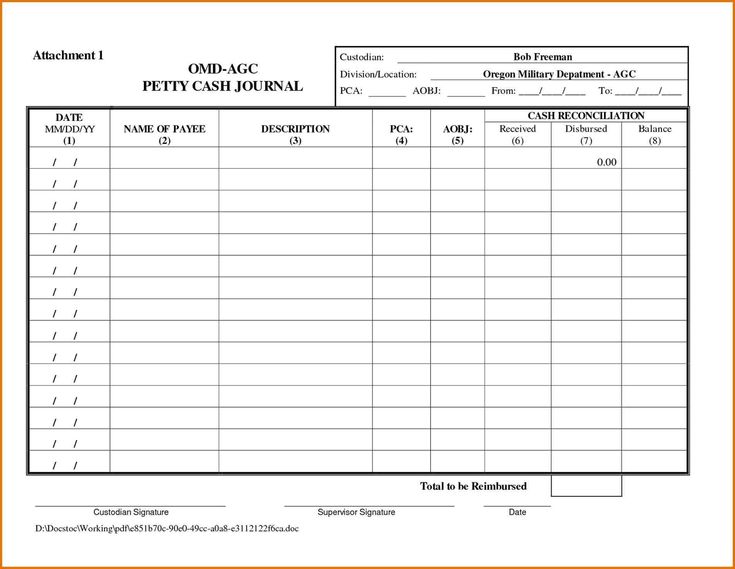

A petty cash reconciliation form is a document used by businesses to track and reconcile petty cash transactions. It serves as a record of all petty cash expenses, reimbursements, and remaining balances. This form typically includes information such as date, description of expense, amount spent, receipts attached, and signature of the person responsible for the petty cash fund.

By regularly updating and reconciling this form, businesses can ensure transparency, accuracy, and accountability in their petty cash management.

Why Use a Petty Cash Reconciliation Form?

Managing petty cash can be a challenging task, especially without proper documentation and tracking. A petty cash reconciliation form helps businesses in the following ways:

- Organize Expenses: By recording all petty cash transactions in one place, businesses can easily track and categorize their expenses.

- Prevent Misuse: Requiring signatures for each transaction helps prevent unauthorized or fraudulent use of petty cash funds.

- Ensure Accuracy: Regularly reconciling the petty cash form with actual cash on hand helps identify discrepancies and errors.

- Facilitate Reporting: Having detailed records makes it easier to generate reports for audits, budgeting, and financial analysis.

Overall, using a petty cash reconciliation form promotes transparency, accountability, and efficiency in managing petty cash within an organization.

How to Use a Petty Cash Reconciliation Form

Using a petty cash reconciliation form is simple. Here are the steps to effectively utilize this tool:

- Download a Template: Start by downloading a petty cash reconciliation form template that suits your business needs.

- Record Transactions: Fill out the form with details of each petty cash transaction, including date, description, amount, and receipts.

- Reconcile Regularly: Compare the total expenses recorded on the form with the actual cash on hand to ensure accuracy.

- Keep Records: Maintain a file of all completed petty cash reconciliation forms for future reference and auditing purposes.

By following these steps consistently, businesses can effectively track and manage their petty cash expenses using a reconciliation form.

Examples of Petty Cash Reconciliation Forms

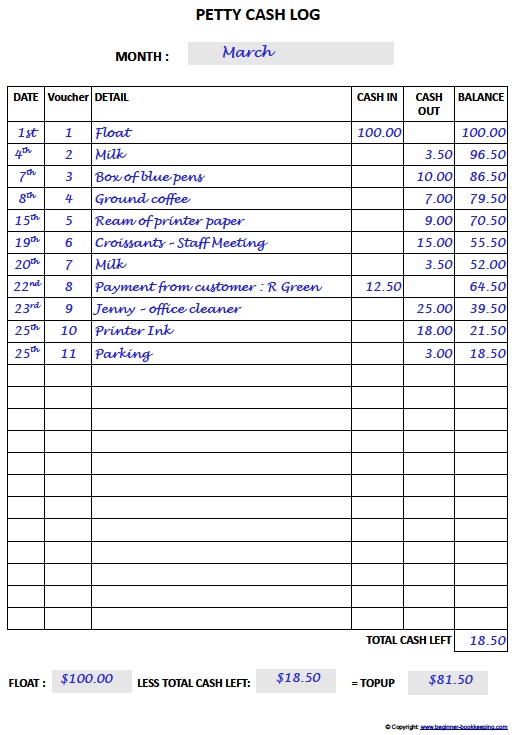

There are various formats and designs of petty cash reconciliation forms available online. Some common examples include:

Tips for Successful Implementation of a Petty Cash Reconciliation Form

Here are some tips to ensure the successful implementation of a petty cash reconciliation form in your organization:

- Train Employees: Provide training to staff members on how to properly fill out the form and follow the reconciliation process.

- Set Clear Guidelines: Establish clear guidelines for petty cash usage, limits, approvals, and documentation requirements.

- Regular Auditing: Conduct regular audits of the petty cash fund to verify the accuracy of recorded transactions.

- Review and Improve: Periodically review the reconciliation process and form design to identify areas for improvement and optimization.

- Use Software Tools: Consider using accounting software or apps to streamline the petty cash reconciliation process and enhance efficiency.

By following these tips, businesses can maximize the benefits of using a petty cash reconciliation form and enhance their petty cash management practices.

Petty Cash Reconciliation Form – Download