Managing finances can be a daunting task, especially for small businesses and entrepreneurs. One essential tool that can help in tracking and analyzing financial performance is the profit and loss report. This report provides a snapshot of a company’s revenue and expenses over a specific period, allowing business owners to make informed decisions.

In this article, we will delve into the world of profit and loss reports, exploring what they are, why they are important, how to create them, examples, and tips for successful implementation.

What is a Profit and Loss Report?

A profit and loss report, also known as an income statement, is a financial statement that summarizes a company’s revenues, costs, and expenses during a specific period. It provides valuable insights into a business’s financial health by showing whether it has generated a profit or incurred a loss. The report typically includes revenue from sales, operating expenses, and net income or loss.

Creating a profit and loss report allows businesses to monitor their financial performance, identify trends, and make strategic decisions based on the data. It is a crucial tool for assessing profitability, managing cash flow, and planning for the future.

Why Profit and Loss Reports are Important

Profit and loss reports play a vital role in financial management for businesses of all sizes. Here are some key reasons why they are important:

1. Financial Performance Evaluation: Profit and loss reports provide a clear overview of a company’s financial performance, allowing business owners to assess profitability and make informed decisions.

2. Budgeting and Forecasting: By analyzing revenue and expenses in the report, businesses can create accurate budgets and forecasts for future periods.

3. Investor and Stakeholder Communication: Profit and loss reports are essential for communicating financial information to investors, lenders, and other stakeholders.

4. Tax Compliance: Accurate profit and loss reports are crucial for tax compliance and reporting to regulatory authorities.

5. Business Growth Planning: Understanding the financial health of the business through profit and loss reports helps in planning for growth and expansion.

How to Create a Profit and Loss Report

Creating a profit and loss report involves several steps to ensure accuracy and completeness. Here is a step-by-step guide on how to create a professional profit and loss report:

1. Gather Financial Data: Collect all relevant financial data, including revenue, expenses, and cost of goods sold.

2. Organize the Data: Categorize the data into revenue and expense categories to ensure proper classification.

3. Calculate Net Income: Subtract total expenses from total revenue to calculate the net income or loss for the period.

4. Format the Report: Use a spreadsheet software or accounting software to format the profit and loss report professionally.

5. Review and Analyze: Review the report for accuracy and analyze the data to draw meaningful insights.

6. Share the Report: Distribute the profit and loss report to key stakeholders, such as management, investors, and lenders.

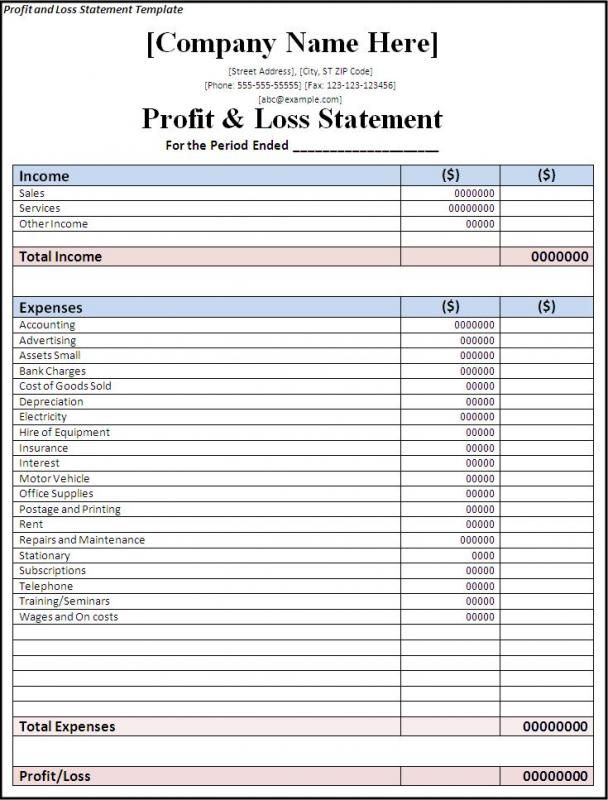

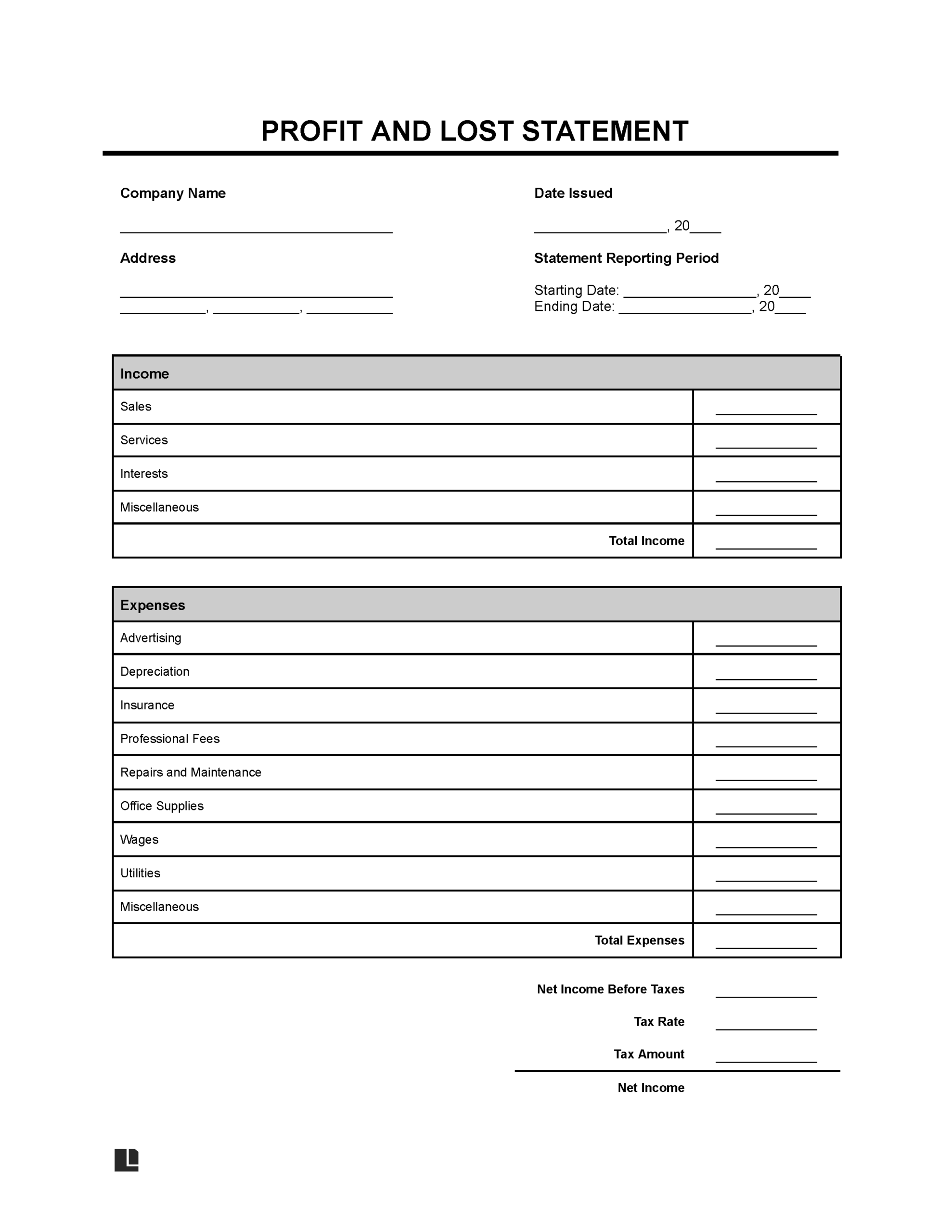

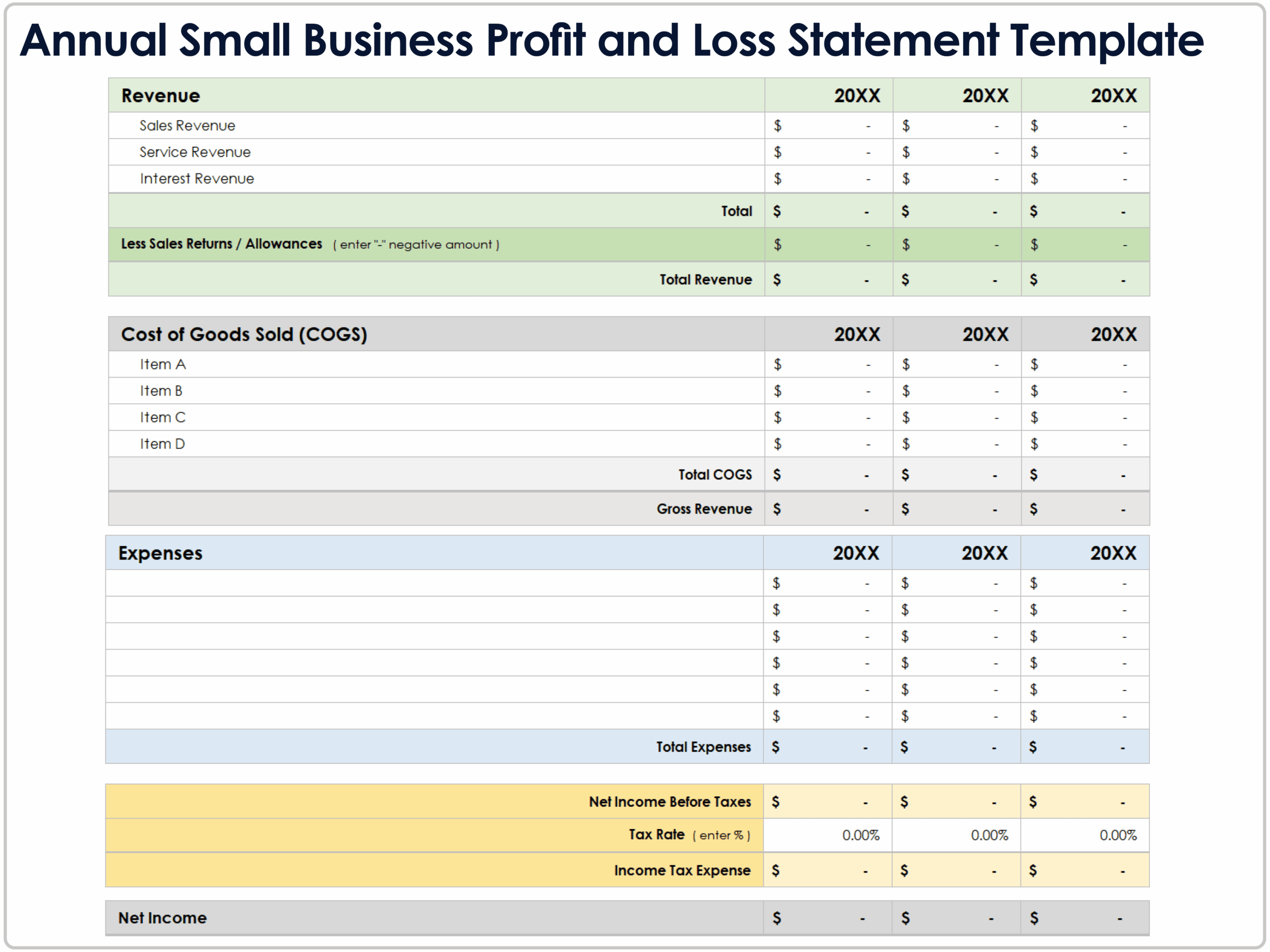

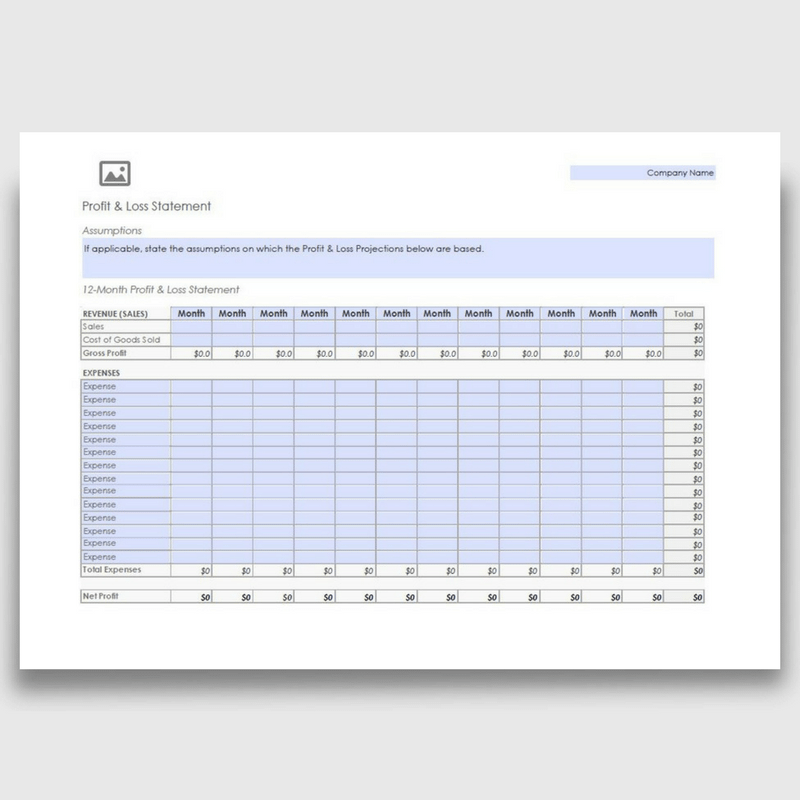

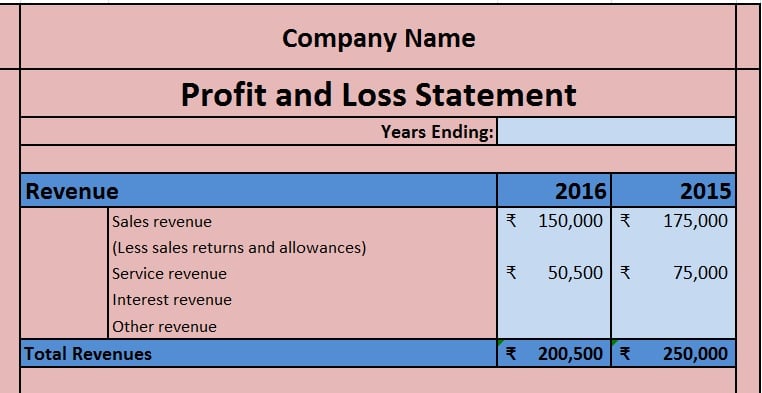

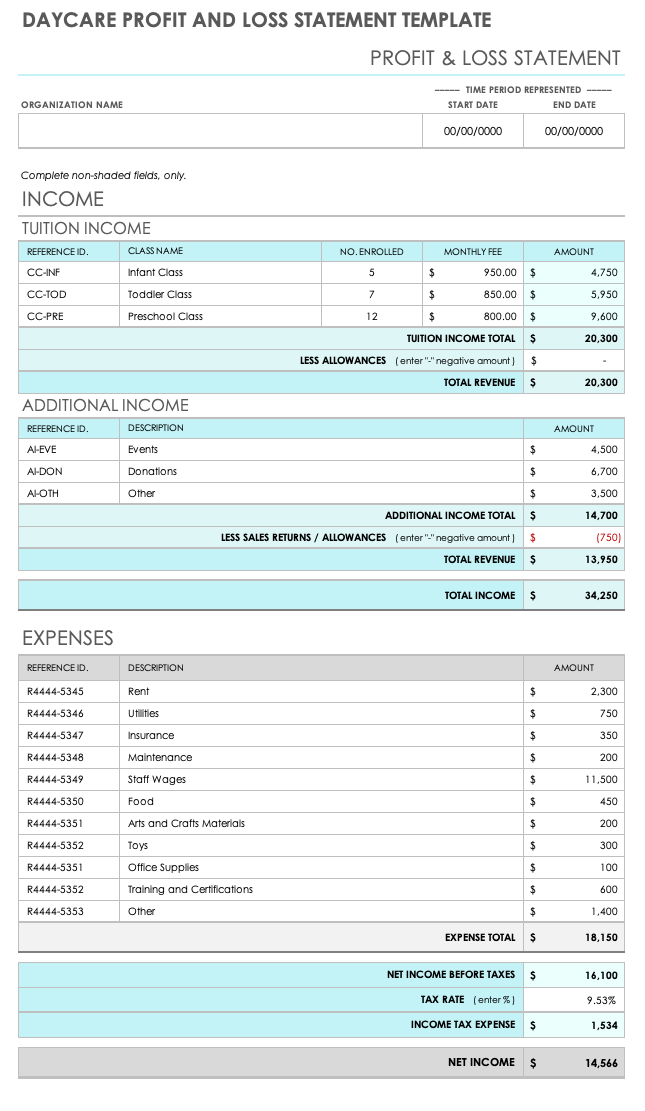

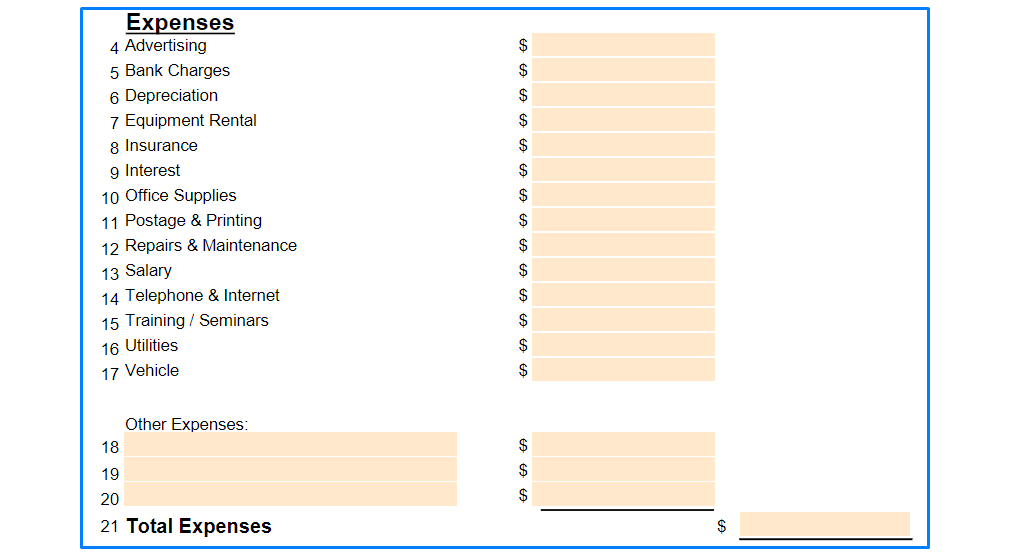

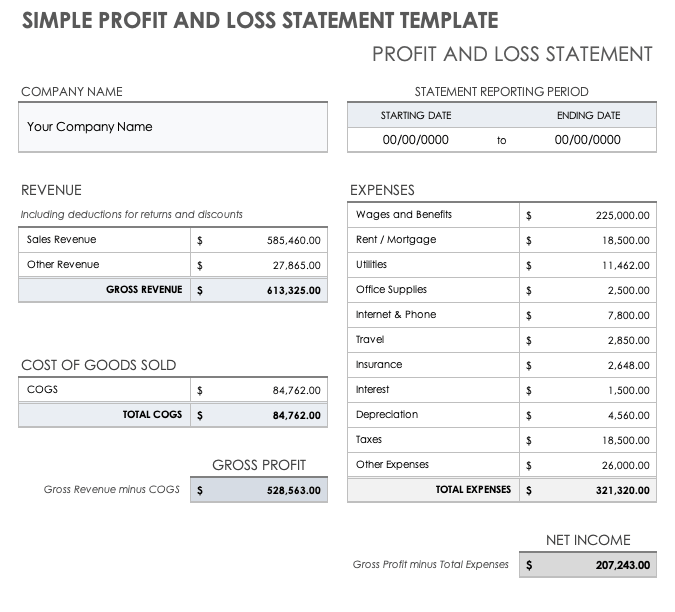

Examples of Profit and Loss Reports

To better understand what a profit and loss report looks like, here are some examples of profit and loss reports for different types of businesses:

Tips for Successful Profit and Loss Reports

Creating an effective profit and loss report requires attention to detail and accuracy. Here are some tips for successful profit and loss reports:

1. Regular Updates: Update the profit and loss report regularly to reflect the most current financial data.

2. Use Accounting Software: Consider using accounting software to automate the process of generating profit and loss reports.

3. Compare Periods: Compare current profit and loss reports with previous periods to identify trends and fluctuations.

4. Seek Professional Advice: Consult with a financial advisor or accountant to ensure the accuracy and relevance of the profit and loss report.

5. Customize for Your Business: Tailor the profit and loss report to include specific metrics and KPIs relevant to your business goals.

In conclusion, profit and loss reports are indispensable tools for monitoring financial performance, analyzing profitability, and making informed business decisions. By understanding the importance of profit and loss reports, learning how to create them, and following best practices, businesses can effectively manage their finances and pave the way for sustainable growth.

Profit And Loss Report Template – Download