In the world of small business ownership, keeping track of your financial health is crucial for success. One important tool that can help you understand your company’s financial standing is a profit and loss statement.

This document lists your sales and expenses, showing you how much profit you’re making or how much you’re losing. Typically completed on a monthly, quarterly, or yearly basis, a profit and loss statement can provide valuable insights into your business’s performance.

What is a Profit and Loss Statement for a Small Business?

A profit and loss statement, also known as an income statement, is a financial document that summarizes your company’s revenues, costs, and expenses during a specific period. It provides a snapshot of your business’s financial performance, showing whether you are operating at a profit or loss. By comparing your revenue to your expenses, you can determine your net income or net loss for the period.

Creating a profit and loss statement can help you track your business’s financial progress, identify areas of improvement, and make informed decisions about your operations. It can also be a useful tool for investors, lenders, and other stakeholders who want to assess the health of your business.

Why Use a Profit and Loss Statement for Small Business?

A profit and loss statement is essential for small business owners for several reasons:

1. Financial Visibility: It provides a clear overview of your company’s financial performance, allowing you to see how well your business is doing.

2. Decision-Making: By analyzing your revenue and expenses, you can make informed decisions about pricing, budgeting, and investments.

3. Tax Compliance: Profit and loss statements are often required for tax purposes, helping you accurately report your income and expenses to the IRS.

4. Investor Confidence: Potential investors or lenders may request a profit and loss statement to assess the viability of your business and decide whether to provide funding.

5. Performance Evaluation: Regularly reviewing your profit and loss statement can help you track your progress over time and identify trends that may impact your business’s profitability.

How to Create a Profit and Loss Statement for Small Business

Creating a profit and loss statement for your small business doesn’t have to be complicated. Here are the basic steps to follow:

1. Gather Financial Data: Collect information about your revenues, expenses, and costs for the period you want to analyze.

2. Calculate Revenue: Total up all your income sources, including sales, services, and other sources of revenue.

3. Determine Expenses: List all your expenses, such as rent, utilities, salaries, supplies, and other operating costs.

4. Calculate Net Income: Subtract your total expenses from your total revenue to calculate your net income or net loss.

5. Review and Analyze: Take a close look at your profit and loss statement to identify areas where you can cut costs, increase revenue, or improve efficiency.

6. Adjust as Needed: Use the insights from your profit and loss statement to make adjustments to your business operations and financial strategies.

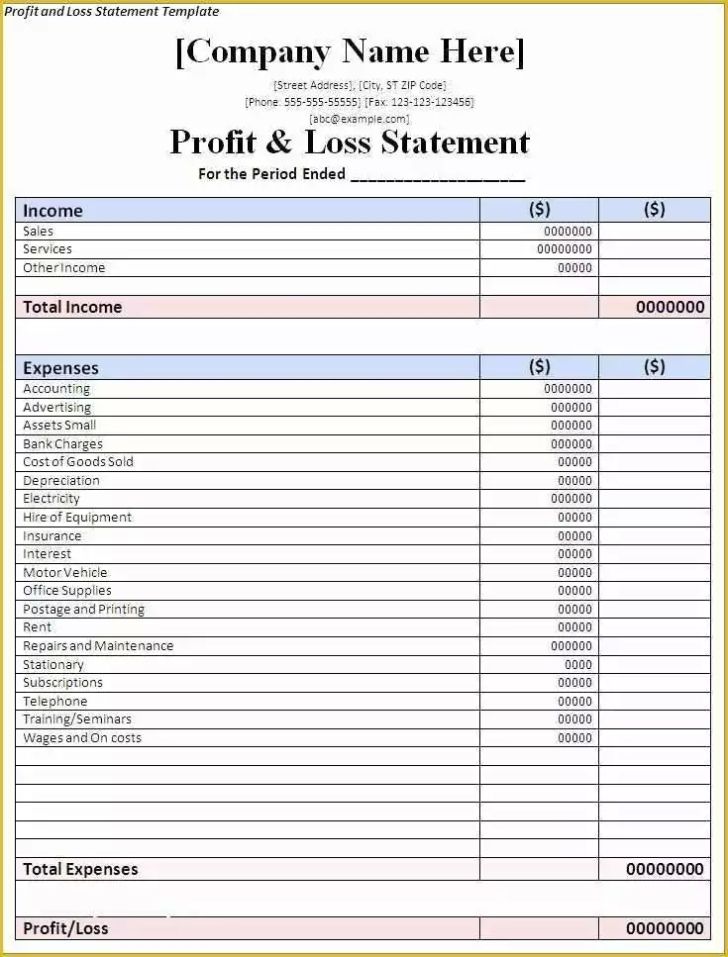

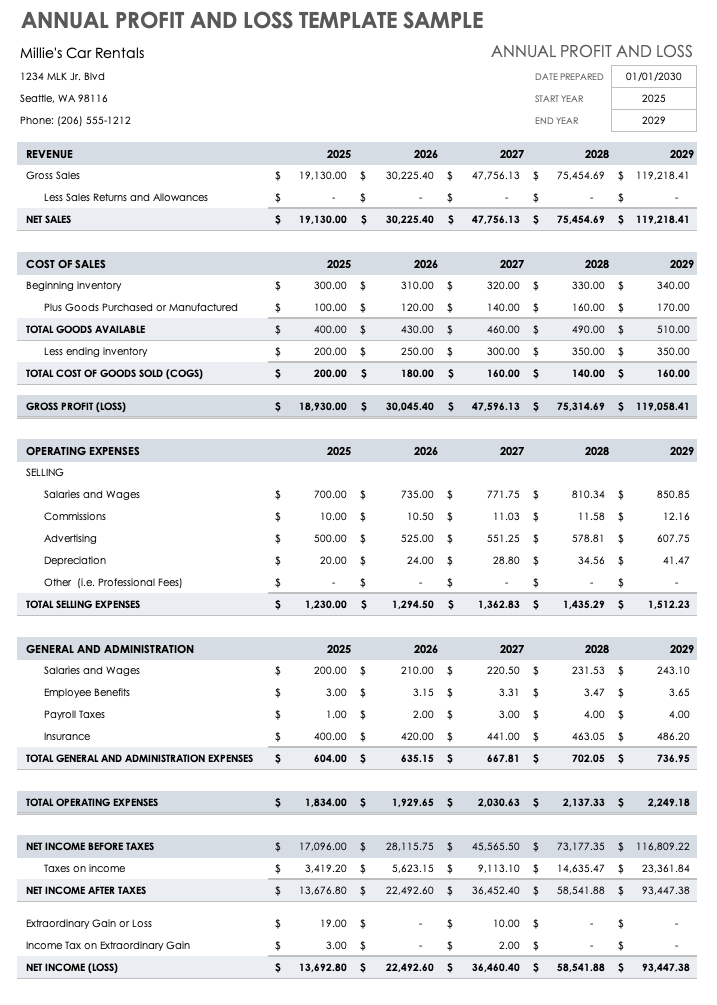

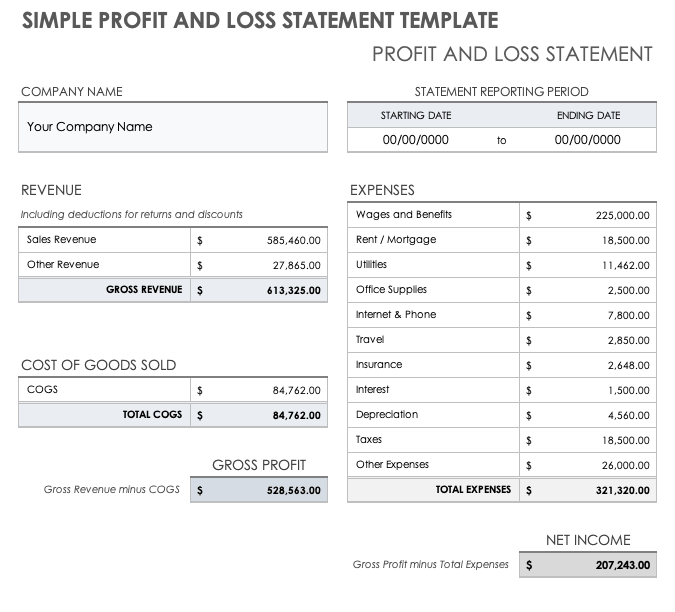

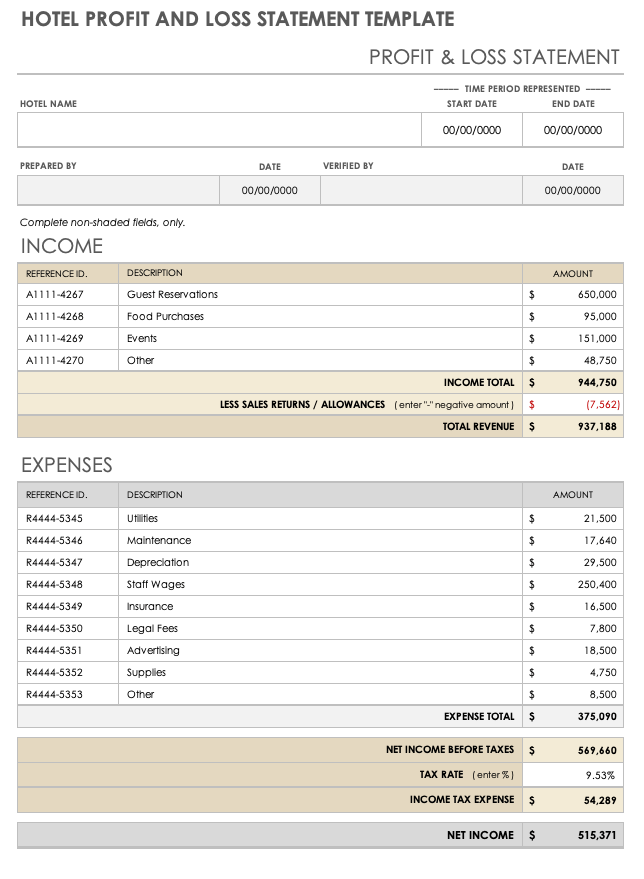

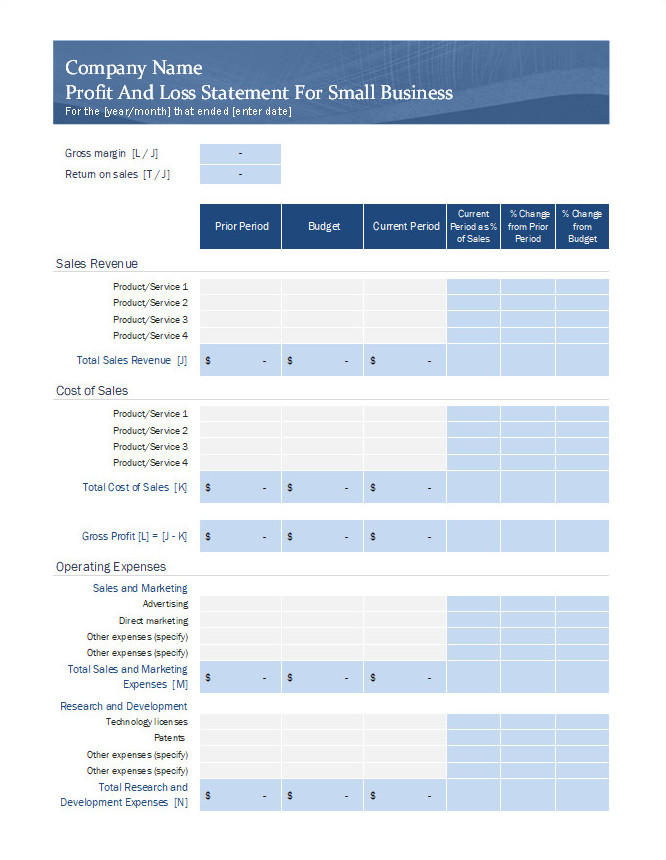

Examples of Profit and Loss Statements

To better understand what a profit and loss statement looks like for a small business, here are some example categories that you might find on a typical statement:

Tips for Successful Profit and Loss Management

To make the most of your profit and loss statement, consider the following tips:

1. Regular Updates: Keep your profit and loss statement up to date to ensure you have accurate financial information.

2. Compare Periods: Compare your current statement to previous periods to track your business’s progress.

3. Seek Professional Help: If you’re unsure about creating or interpreting a profit and loss statement, consider consulting with a financial advisor or accountant.

4. Use Accounting Software: Utilize accounting software to streamline the process of creating and analyzing your profit and loss statement.

5. Set Goals: Use your profit and loss statement to set financial goals for your business and track your progress towards achieving them.

6. Stay Informed: Stay informed about changes in tax laws or accounting standards that may impact how you prepare your profit and loss statement.

7. Regularly Review: Make it a habit to review your profit and loss statement regularly to stay on top of your business’s financial health.

8. Seek Improvement: Use the insights from your profit and loss statement to identify areas where you can improve your business’s profitability.

9. Educate Yourself: Take the time to educate yourself about financial statements and how they can help you make better business decisions.

10. Seek Feedback: Discuss your profit and loss statement with other business owners or financial professionals to gain valuable insights and feedback.

Conclusion

In conclusion, a profit and loss statement is a valuable tool for small business owners to track their financial performance, make informed decisions, and ensure the long-term success of their business. By regularly creating and analyzing your profit and loss statement, you can gain valuable insights into your business’s financial health and take proactive steps to improve your profitability. Remember to seek professional help if needed and stay informed about best practices for managing your finances effectively.

Profit And Loss Statement Template For Small Business – Download