When it comes to buying or selling a property, the real estate closing process can be both exciting and overwhelming. It’s the final step in the transaction where all the necessary documents are signed, funds are transferred, and ownership is officially transferred from the seller to the buyer. To ensure a smooth and successful closing, it’s important to have a comprehensive checklist in place.

In this article, we will provide you with an ultimate real estate closing checklist that covers everything you need to know.

What is a Real Estate Closing Checklist?

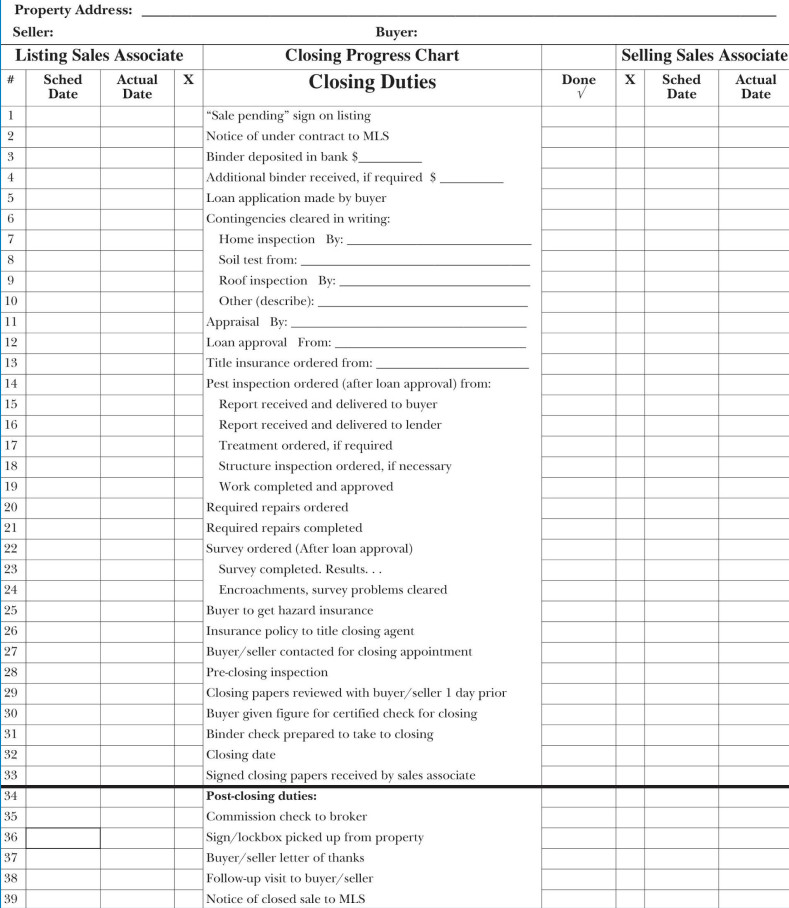

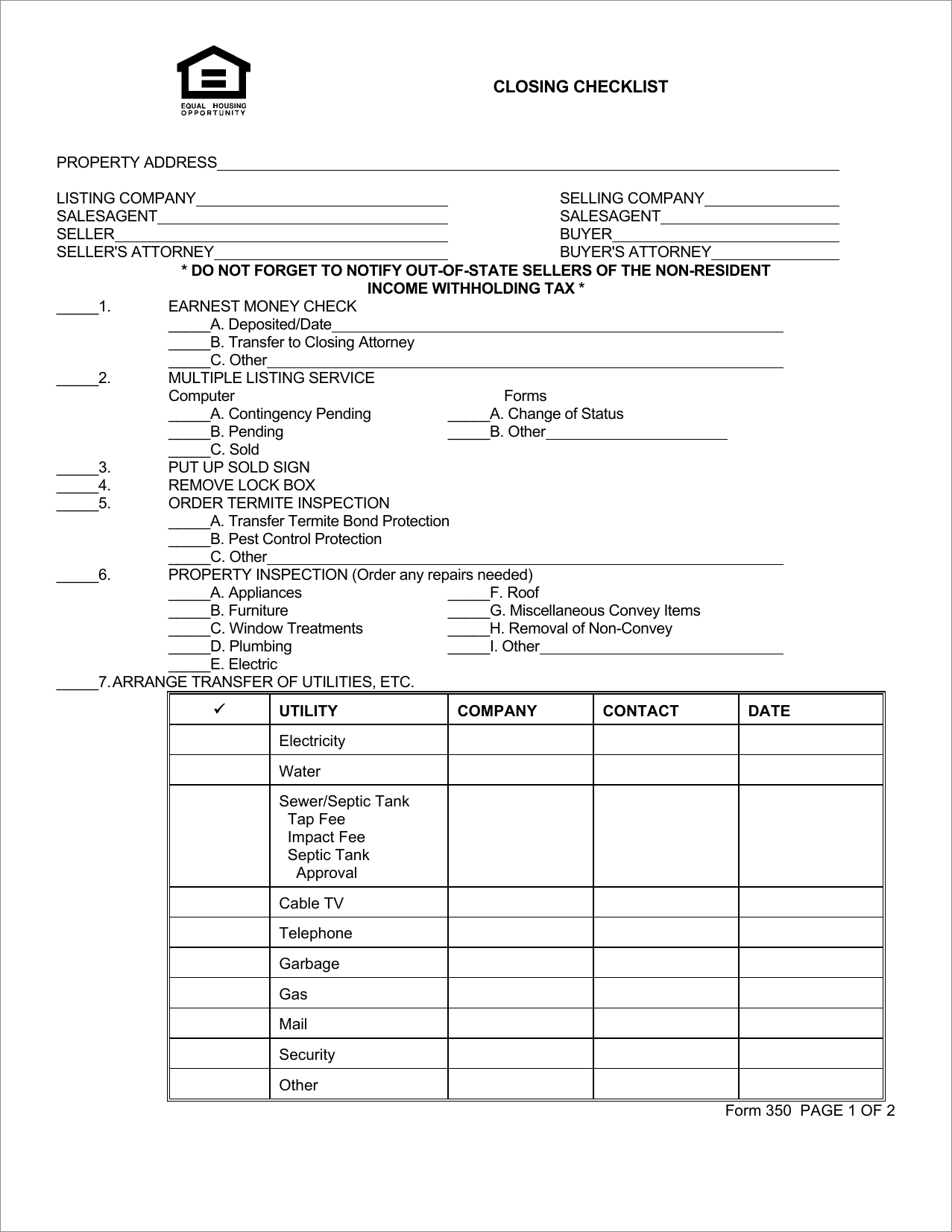

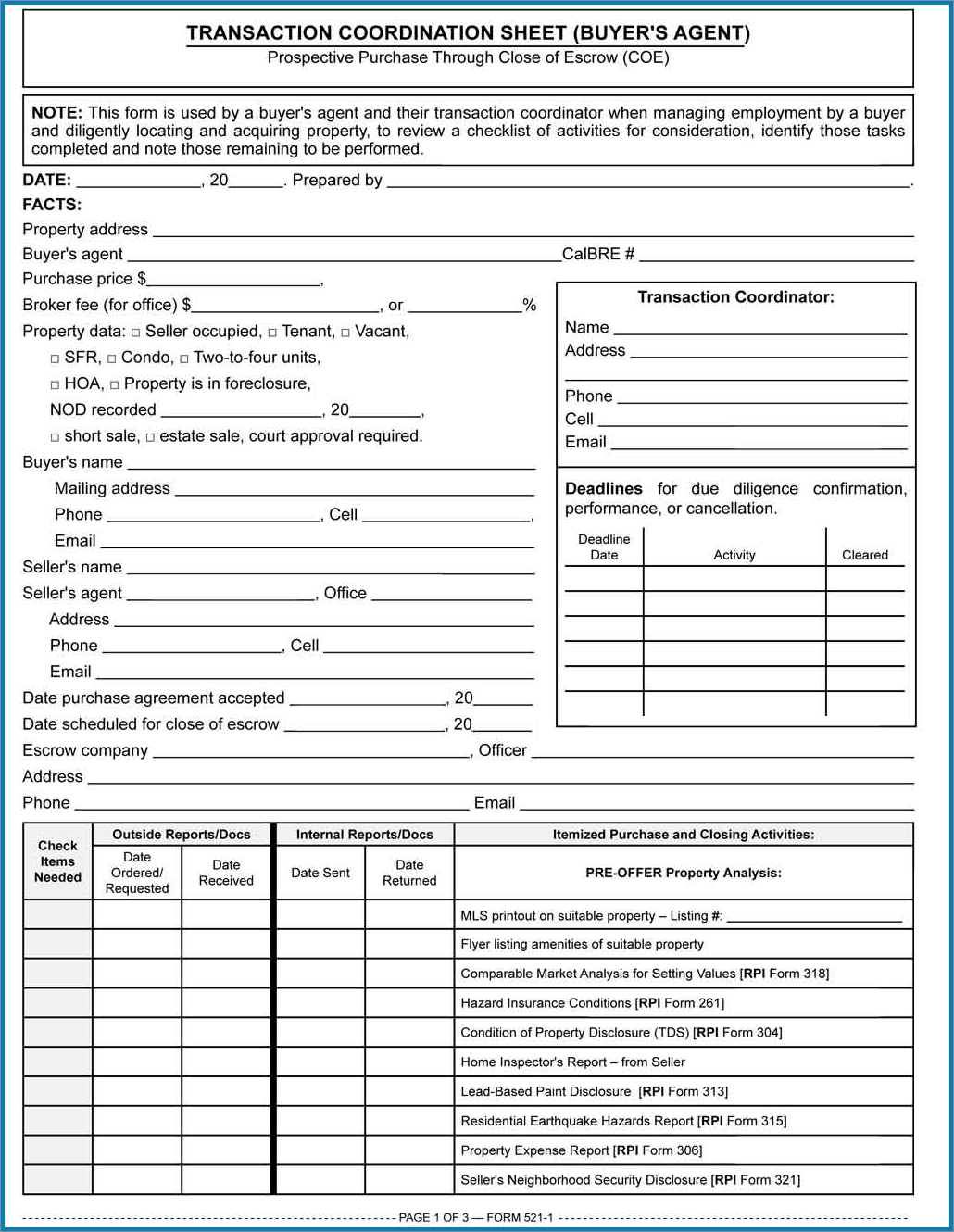

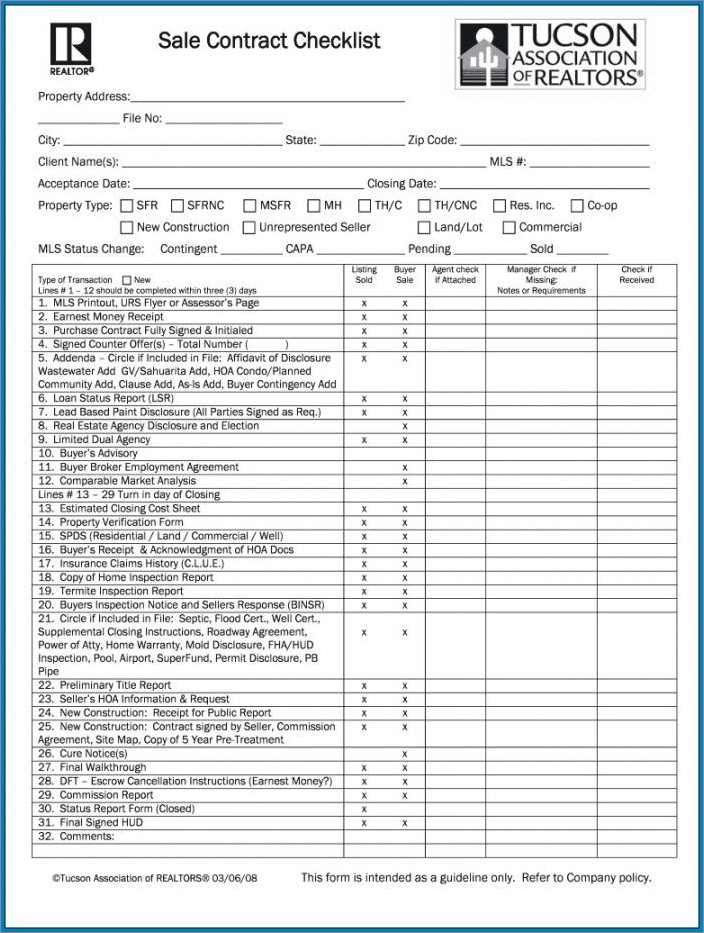

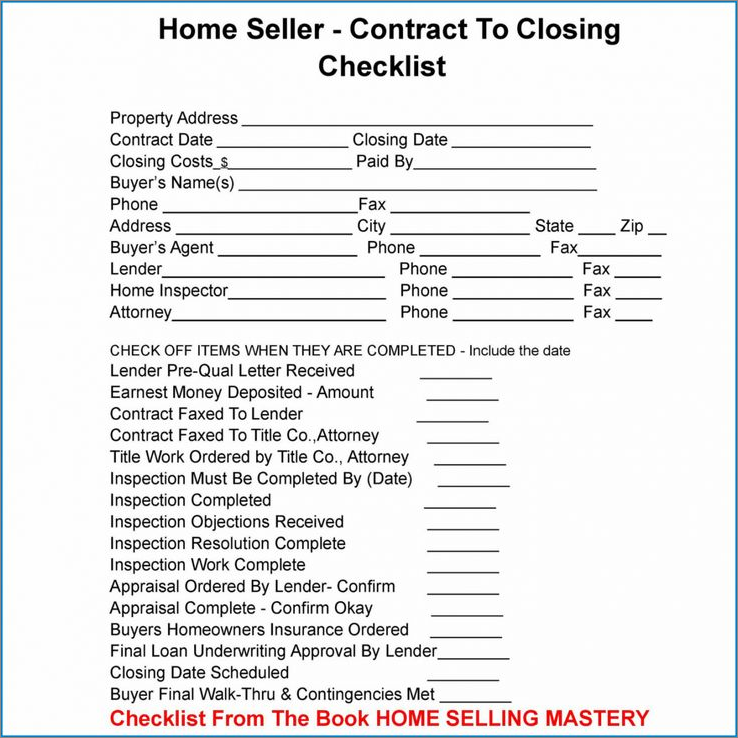

A real estate closing checklist is a detailed list of tasks and documents that need to be completed and reviewed before the closing can take place. It serves as a guide for both buyers and sellers, as well as their respective agents and attorneys, to ensure that all necessary steps are taken to finalize the transaction. By following a real estate closing checklist, you can avoid any potential delays or issues that may arise during the closing process.

Preparing for the Closing

Before the actual closing date, several important tasks need to be completed. Here are some key steps to take:

1. Gather all the necessary documents

Make sure you have all the required documents, such as the purchase agreement, property deed, title insurance policy, and any other relevant paperwork. Review them carefully to ensure their accuracy.

2. Schedule a final walkthrough

Arrange a final walkthrough of the property to make sure it is in the same condition as when you made the offer. Check for any repairs or issues that need to be addressed before closing.

3. Coordinate with your lender

If you are taking out a mortgage, communicate with your lender to ensure that all necessary loan documents are prepared and ready for the closing.

The Closing Day

On the day of the closing, you will need to complete several important tasks. Here’s what you should expect:

1. Reviewing and signing documents

During the closing, you will be presented with various legal documents, including the settlement statement, loan documents, and any additional agreements. Carefully review each document and ask questions if anything is unclear.

2. Paying closing costs

At the closing, you will be required to pay the closing costs, which typically include fees for the lender, title company, and other third-party services. Make sure you have the necessary funds available in the form of a cashier’s check or wire transfer.

3. Transferring ownership

Once all the documents have been signed and the funds have been transferred, the seller will transfer the property’s title to the buyer. This is typically done through a deed.

Post-Closing Tasks

After the closing is complete, there are a few important tasks that should be addressed:

1. Recording the deed

It is important to record the deed with the appropriate government office to officially document the transfer of ownership. This helps protect your rights as the new property owner.

2. Updating utilities and services

Contact the necessary utility companies and service providers to update your information and transfer the accounts into your name. This includes electricity, water, gas, internet, and any other services you may need.

3. Obtaining homeowner’s insurance

Make sure you have homeowner’s insurance in place to protect your investment. Contact insurance providers to obtain quotes and choose a policy that suits your needs.

4. Change of address

Update your address with the postal service, banks, credit card companies, and any other organizations or individuals who need to be notified of your new address.

Common Issues During the Closing Process

While the real estate closing process is generally smooth, some common issues may arise. Here are a few examples:

1. Title issues

Issues with the property’s title, such as liens, encroachments, or undisclosed easements, can cause delays or even cancel the closing. It’s important to conduct a thorough title search and obtain title insurance to protect against such issues.

2. Financing problems

If the buyer’s financing falls through or the appraisal value comes in lower than expected, it can lead to delays or complications during the closing process. It’s crucial to have a solid pre-approval and work closely with your lender to prevent any financing issues.

3. Inspection Concerns

If the property inspection reveals significant issues, such as structural damage or safety hazards, it may require negotiations between the buyer and seller to address these concerns before closing.

4. Document errors

Mistakes or errors in the closing documents can cause delays or legal issues. It’s essential to carefully review all documents and consult with your attorney or agent if you notice any discrepancies.

5. Last-minute changes

Unexpected changes, such as changes in the terms of the agreement or requests for additional repairs, can occur right before the closing. It’s important to have clear communication between all parties involved and be prepared for any last-minute adjustments.

The Importance of a Real Estate Closing Checklist

A real estate closing checklist is a critical tool that helps ensure a successful and stress-free closing process. It provides a systematic approach to follow, helping you stay organized and focused on completing all necessary tasks. By using a checklist, you can minimize the risk of overlooking important details and prevent potential issues from derailing the closing.

- Properly review all documents. Take the time to carefully review all the documents provided during the closing. If anything is unclear or you have questions, don’t hesitate to ask for clarification.

- Prepare the necessary funds. Make sure you have the required funds available for the closing costs. This includes obtaining a cashier’s check or arranging a wire transfer in advance.

- Communicate with all parties involved. Maintain open lines of communication with your real estate agent, attorney, lender, and other parties involved in the transaction. This helps ensure that everyone is on the same page and can address any issues promptly.

- Stay organized. Keep all important documents and records related to the closing in one place. This makes it easier to reference and locate them when needed.

- Be prepared for delays. While you may have everything in order, there can still be unforeseen delays during the closing process. Stay patient and be prepared to adapt to any changes that may arise.

- Seek professional guidance. If you are unsure about any aspect of the closing process, don’t hesitate to seek guidance from a real estate attorney or experienced real estate agent. They can provide valuable advice and help navigate any complexities.

Conclusion

The real estate closing process can be complex, but with a well-prepared checklist, you can navigate it smoothly. By following the steps outlined in this ultimate real estate closing checklist, you can ensure that all necessary tasks are completed and minimize the risk of complications. Remember to stay organized, communicate effectively, and seek professional guidance when needed. With proper planning and attention to detail, you can achieve a successful and stress-free real estate closing.

Real Estate Closing Checklist Template – Download