Seller financing agreements have gained popularity in real estate transactions as an alternative to traditional bank financing. This unique arrangement allows the property seller to act as the lender, providing financing directly to the buyer. The benefits of seller financing extend to both parties involved, offering advantages such as a broader buyer pool, a consistent income stream for the seller, and the potential for a higher sale price.

Let’s delve deeper into the intricacies of seller financing agreements and explore how they can benefit both buyers and sellers in real estate transactions.

What is a Seller Financing Agreement?

A seller financing agreement is a legal contract between the seller of a property or business and the buyer, wherein the seller extends financing to facilitate the purchase. Unlike traditional bank loans, where the buyer borrows from a financial institution, seller financing allows the buyer to make payments directly to the seller.

This arrangement is often structured as a promissory note or an installment sales contract, detailing the terms of the financing, including interest rates, repayment schedules, and any collateral involved. By recording the agreement with relevant authorities, both parties ensure legal compliance and protect their interests throughout the transaction.

Why Consider Seller Financing?

When evaluating financing options for a real estate transaction, both buyers and sellers may find compelling reasons to consider seller financing as a viable alternative. For buyers, the flexibility, accessibility, and personalized terms of seller financing can make it a more attractive option than traditional bank loans. By working directly with the seller to negotiate terms that suit their needs, buyers can secure financing for properties that may have been out of reach through conventional channels.

Sellers, on the other hand, benefit from the wider buyer pool and potential financial advantages that seller financing offers. By extending financing to buyers, sellers can attract a diverse range of potential purchasers and increase the likelihood of a successful sale. This increased market exposure can lead to faster transactions and potentially higher sale prices, providing sellers with a competitive edge in a crowded real estate market.

Enhanced Flexibility for Buyers

One of the primary reasons buyers may choose seller financing over traditional bank loans is the enhanced flexibility it offers. Seller financing agreements allow buyers to negotiate directly with the seller on terms such as interest rates, repayment schedules, and down payments. This personalized approach enables buyers to tailor the financing arrangement to their specific financial situation and goals, creating a more customized and accommodating transaction experience.

By bypassing the stringent requirements and standardized terms of traditional lenders, buyers can explore creative financing solutions with sellers that may not be possible through conventional channels. This flexibility can be particularly advantageous for buyers with unique financial circumstances or credit challenges, as they can work collaboratively with sellers to structure a financing agreement that meets their needs and enables them to purchase the property with confidence.

Increased Market Reach for Sellers

Sellers who offer financing to buyers can significantly expand their market reach and appeal to a broader audience of potential purchasers. By providing an alternative financing option, sellers can attract buyers who may not qualify for traditional bank loans but are still interested in the property. This expanded buyer pool increases the chances of finding a suitable buyer quickly and efficiently, leading to a faster sale and potentially a higher sale price.

Seller financing agreements can be a strategic tool for sellers looking to differentiate their property in a competitive market and stand out from the competition. By offering financing as an incentive, sellers can appeal to a wider range of buyers and create added value for their property. This unique selling proposition can attract more attention to the listing, generate increased interest from potential buyers, and ultimately facilitate a successful transaction.

What to Include in a Seller Financing Agreement?

When drafting a seller financing agreement, it is essential to incorporate all the necessary details and provisions to protect the interests of both parties and ensure a smooth transaction. From specifying the loan amount and interest rate to outlining the repayment schedule and collateral requirements, each element of the agreement plays a crucial role in shaping the financing arrangement. By including comprehensive and clear terms in the agreement, buyers and sellers can establish a solid foundation for their transaction and mitigate potential misunderstandings or disputes.

- Loan Amount: Clearly state the total amount of the loan provided by the seller to the buyer, including any down payment or additional fees.

- Interest Rate: Define the interest rate charged on the loan, whether fixed or adjustable, and specify how it will be calculated and applied.

- Repayment Schedule: Outline the terms of repayment, including the amount of each payment, the frequency of payments, and the duration of the loan.

- Collateral: Determine any collateral or security for the loan, such as the property itself or other assets pledged by the buyer.

- Default Provisions: Include provisions detailing what actions will be taken in the event of default by the buyer, such as foreclosure or repossession of the property.

- Legal Compliance: Ensure that the seller financing agreement complies with all relevant laws and regulations governing real estate transactions and financing agreements.

How to Structure Seller Financing for Success

Structuring seller financing for success involves careful planning, communication, and attention to detail to ensure a smooth and mutually beneficial transaction. By following best practices and leveraging expert guidance, sellers and buyers can navigate the complexities of seller financing agreements with confidence and achieve their desired outcomes

Setting Realistic Terms

When structuring a seller financing agreement, it is essential to establish realistic and fair terms that align with the financial capabilities and objectives of both parties. Sellers should consider factors such as market conditions, property value, and the buyer’s financial stability when determining the loan amount, interest rate, and repayment schedule. By setting realistic terms that reflect the current market environment and the financial landscape, sellers can create a sustainable and viable financing arrangement that benefits both parties in the long run.

Buyers, on the other hand, should assess their financial situation and negotiating leverage to ensure they can meet the obligations of the financing agreement. By conducting a thorough financial analysis and understanding the terms of the agreement, buyers can make informed decisions and avoid entering into an arrangement that may be financially burdensome or unsustainable. Setting realistic terms from the outset helps establish a strong foundation for the seller financing agreement and promotes a successful outcome for all parties involved.

Conducting Due Diligence

Prior to entering into a seller financing agreement, both buyers and sellers should conduct thorough due diligence to assess the financial viability and risks associated with the transaction. Sellers should evaluate the buyer’s creditworthiness, income stability, and financial history to ensure they are capable of meeting the terms of the agreement. By verifying these critical factors, sellers can mitigate the risk of default and protect their financial interests throughout the financing period.

Buyers should also conduct due diligence on the property or business being purchased, including inspections, appraisals, and title searches, to ensure they are making an informed investment decision. By conducting a comprehensive review of the property and its financial implications, buyers can assess the risks and benefits of the transaction and proceed with confidence. Due diligence is a critical step in the seller financing process that helps both parties evaluate the transaction’s feasibility and identify potential red flags or issues that need to be addressed.

Seeking Legal Advice

Given the legal complexities and implications of seller financing agreements, both buyers and sellers are encouraged to seek legal advice from experienced real estate attorneys. Legal professionals can provide valuable guidance on drafting, reviewing, and negotiating the terms of the agreement to ensure compliance with applicable laws and regulations. By consulting with legal experts, buyers and sellers can clarify their rights and responsibilities under the agreement and address any legal concerns or ambiguities that may arise.

Real estate attorneys can also help protect the interests of both parties by including essential provisions in the agreement that address potential contingencies and risks. From default provisions to collateral requirements, legal counsel can draft a comprehensive seller financing agreement that safeguards the rights of buyers and sellers and promotes a transparent and equitable transaction process. By enlisting the expertise of legal professionals, buyers and sellers can navigate the complexities of seller financing agreements with confidence and clarity.

Maintaining Communication

Effective communication is essential for the success of any seller financing arrangement, as it fosters transparency, trust, and collaboration between buyers and sellers. Throughout the financing period, both parties should maintain open lines of communication to address any questions, concerns, or issues that may arise. By staying in regular contact and keeping each other informed of developments or changes, buyers and sellers can build a strong working relationship and facilitate a smooth and efficient transaction process.

Communication is particularly crucial in seller financing agreements, where buyers and sellers have a direct financial relationship that requires ongoing coordination and cooperation. By proactively communicating about payment schedules, property maintenance, or any unforeseen circumstances, buyers and sellers can prevent misunderstandings and resolve potential conflicts before they escalate. Clear and consistent communication lays the groundwork for a successful seller financing agreement and promotes a positive and mutually beneficial transaction experience.

Monitoring Payments

One of the key responsibilities of both buyers and sellers in a seller financing agreement is to monitor and track payments throughout the financing period. Sellers should keep detailed records of the buyer’s payments, including the amount, date, and method of payment, to ensure compliance with the terms of the agreement. By maintaining accurate payment records, sellers can identify any discrepancies or delinquencies and take appropriate action to address them promptly.

Buyers, too, should track their payments and maintain documentation to verify their compliance with the terms of the agreement. By monitoring their payment history and staying organized with their financial records, buyers can demonstrate their commitment to fulfilling their obligations under the seller financing agreement. Consistent and timely payments not only benefit the buyer by building a positive payment history but also instill confidence in the seller that the agreement is being upheld as agreed.

Planning for Contingencies

In any real estate transaction, it is essential to anticipate and plan for contingencies that may arise during the financing period. Seller financing agreements should include provisions that address potential scenarios such as buyer default, property damage, or changes in financial circumstances. By outlining these contingencies upfront and establishing protocols for addressing them, buyers and sellers can mitigate risks and prepare for unforeseen circumstances that may impact the transaction.

Sellers may include provisions in the agreement that outline the steps to be taken in the event of buyer default, such as initiating foreclosure proceedings or repossessing the property. By clearly defining these provisions upfront, sellers can minimize the potential impact of default on their financial interests and take appropriate action to protect their investment. Similarly, buyers can benefit from provisions that clarify their rights and responsibilities under the agreement, ensuring transparency and accountability in the financing process.

Seller financing agreements offer a flexible and advantageous alternative to traditional bank financing for real estate transactions. By allowing the seller to act as the lender, both parties can benefit from a wider buyer pool, a steady income stream, and potentially a higher sale price for the property or business. By carefully structuring the terms of the agreement and maintaining open communication, seller financing can be a successful and mutually beneficial arrangement for all parties involved.

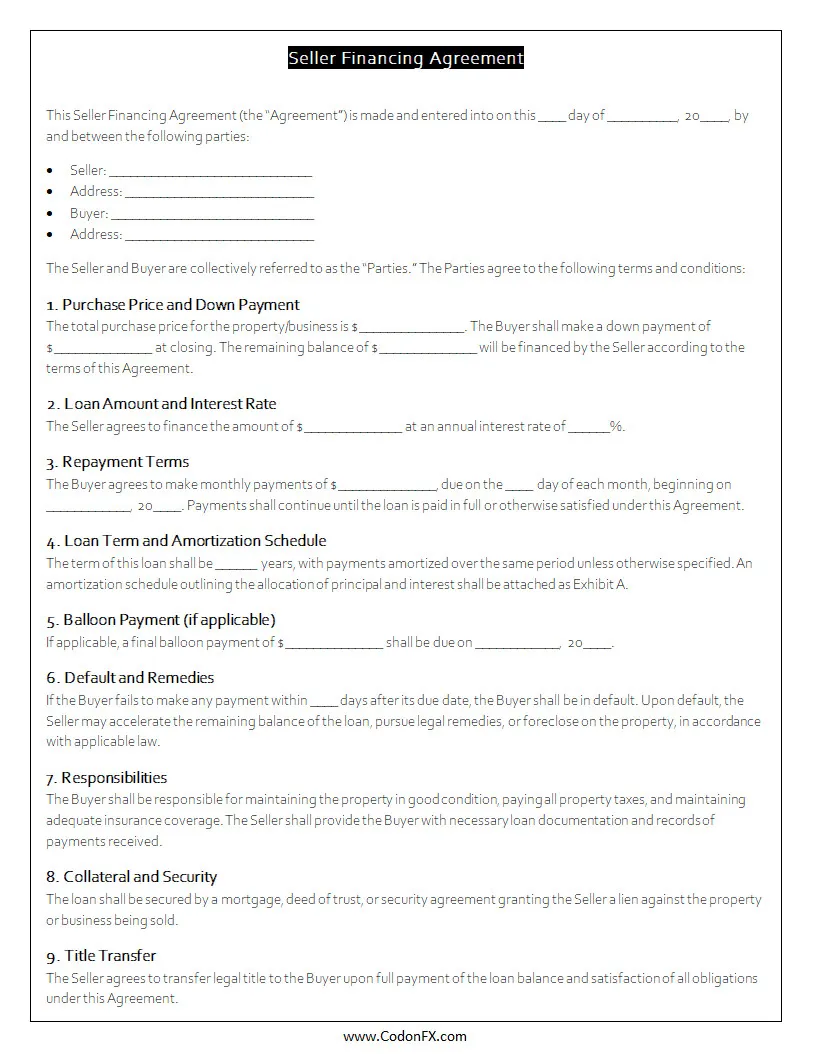

Seller Financing Agreement Template

A Seller Financing Agreement helps outline clear, fair terms when the seller provides financing directly to the buyer, offering flexibility and simplifying the path to closing. It protects both parties by defining payment schedules, interest rates, and responsibilities in a transparent, organized way. With a solid agreement in place, the transaction becomes smoother, more secure, and easier to manage from start to finish.

Download the Seller Financing Agreement Template today to create a clear, reliable document for your real estate deal.

Seller Financing Agreement Template – DOWNLOAD