Stock certificates are an essential part of the financial world, serving as physical or digital proof of ownership in a company. These legal documents hold crucial information about an individual or entity’s stake in a corporation, including the number of shares owned and key details like the company’s name and certificate number.

But what exactly is a stock certificate and why are they important?

What is a Stock Certificate?

A stock certificate is a legal document that serves as evidence of ownership in a company. It represents the number of shares an individual or entity holds in a corporation and includes important details such as the company’s name, the certificate number, and the shareholder’s name.

Stock certificates can be either physical paper documents or digital records stored electronically.

Purpose of Stock Certificates

The primary purpose of stock certificates is to provide proof of ownership in a company. By issuing stock certificates, companies can track and verify the ownership of their shares among investors. These certificates also serve as a means of transferring ownership and can be used in legal proceedings or disputes related to ownership rights.

Ensuring Ownership Transparency

Stock certificates play a crucial role in ensuring transparency in company ownership. By issuing certificates to shareholders, companies maintain a clear record of who owns how many shares, preventing confusion or disputes over ownership stakes. This transparency is essential for maintaining trust and accountability in the business world.

Facilitating Share Transfer

Another key purpose of stock certificates is to facilitate the transfer of shares between investors. When a shareholder wishes to sell or transfer their ownership in a company, they can do so by endorsing and transferring their stock certificate to the new owner. This process ensures that ownership changes are properly recorded and acknowledged.

Legal Recognition of Ownership

Stock certificates hold legal significance in confirming ownership rights. In the event of legal disputes or challenges to ownership, stock certificates serve as concrete evidence of the shareholder’s stake in the company. Courts and regulatory bodies recognize stock certificates as valid proof of ownership, adding a layer of security for investors.

Establishing Investor Rights

Stock certificates outline the rights and privileges that come with ownership in a company. These rights may include voting in shareholder meetings, receiving dividends, and participating in major decisions affecting the company. By issuing stock certificates, companies establish a framework for investor rights and responsibilities.

Why Organizations Issue Stocks?

Companies issue stocks as a way to raise capital for their operations and expansion. By selling shares of ownership in the form of stock certificates, companies can raise funds from investors to invest in their business activities. Stocks also provide investors with an opportunity to share in the company’s profits through dividends and potential capital appreciation.

Raising Capital for Growth

One of the primary reasons companies issue stocks is to raise capital for growth and expansion. By selling shares to investors, companies can access funds that can be used for new projects, acquisitions, research and development, or other strategic initiatives. This influx of capital can fuel the company’s growth trajectory.

Attracting Investor Interest

Stock offerings can attract investor interest in a company, especially if it is seen as a promising investment opportunity. Companies with strong growth potential, innovative products or services, and a solid track record may generate significant interest from investors looking to own a piece of the company through stock ownership.

Enhancing Liquidity for Shareholders

For existing shareholders, issuing stocks can enhance liquidity by creating a market for buying and selling shares. Publicly traded companies allow shareholders to easily buy or sell their shares on stock exchanges, providing liquidity and flexibility in managing their investments. Stock certificates play a key role in facilitating these transactions.

Unlocking Value for Stakeholders

By issuing stocks, companies can unlock value for stakeholders, including employees, founders, and early investors. Stock ownership can translate into financial returns through dividends, capital gains, or stock buybacks. Companies may offer stock options or grants to incentivize employees and align their interests with the company’s success.

Types of Stock Certificates

There are two main types of stock certificates: common stock certificates and preferred stock certificates. Common stock certificates represent ownership in a company with voting rights and potential dividends. Preferred stock certificates, on the other hand, offer priority in dividend payments and asset distribution in the event of liquidation.

Common Stock Certificates

Common stock certificates are the most prevalent type of stock ownership in corporations. Holders of common stock have voting rights in company decisions, such as electing board members or approving major business transactions. Common stockholders also have the potential to receive dividends if the company generates profits.

Preferred Stock Certificates

Preferred stock certificates grant shareholders priority over common stockholders in certain aspects. Preferred stockholders typically receive fixed dividends at regular intervals, providing a predictable income stream. In the event of a company liquidation, preferred stockholders have precedence in receiving assets before common stockholders.

Differences in Voting Rights

One key distinction between common and preferred stock certificates lies in voting rights. While common stockholders have the right to vote on company matters, preferred stockholders may not have voting privileges or may have limited voting rights. This difference in voting power can impact shareholder influence on corporate decisions.

Preference in Dividend Payments

Preferred stock certificates offer shareholders a guaranteed dividend payment before common stockholders receive dividends. This preference ensures that preferred stockholders receive a fixed income from their investment, making preferred stocks an attractive option for investors seeking stable returns.

Asset Distribution in Liquidation

In the event of a company liquidation, preferred stockholders have priority over common stockholders in receiving assets. This means that preferred stockholders are more likely to recoup their investment before common stockholders receive any remaining funds. The hierarchy of asset distribution is outlined in terms of the preferred stock certificates.

Are Stock Certificates Worth Anything Today?

In today’s digital age, the value of physical stock certificates has diminished as many companies opt for electronic record-keeping systems. However, old stock certificates issued by companies that are no longer in existence or have been acquired by other firms may hold value as collectibles or historical artifacts.

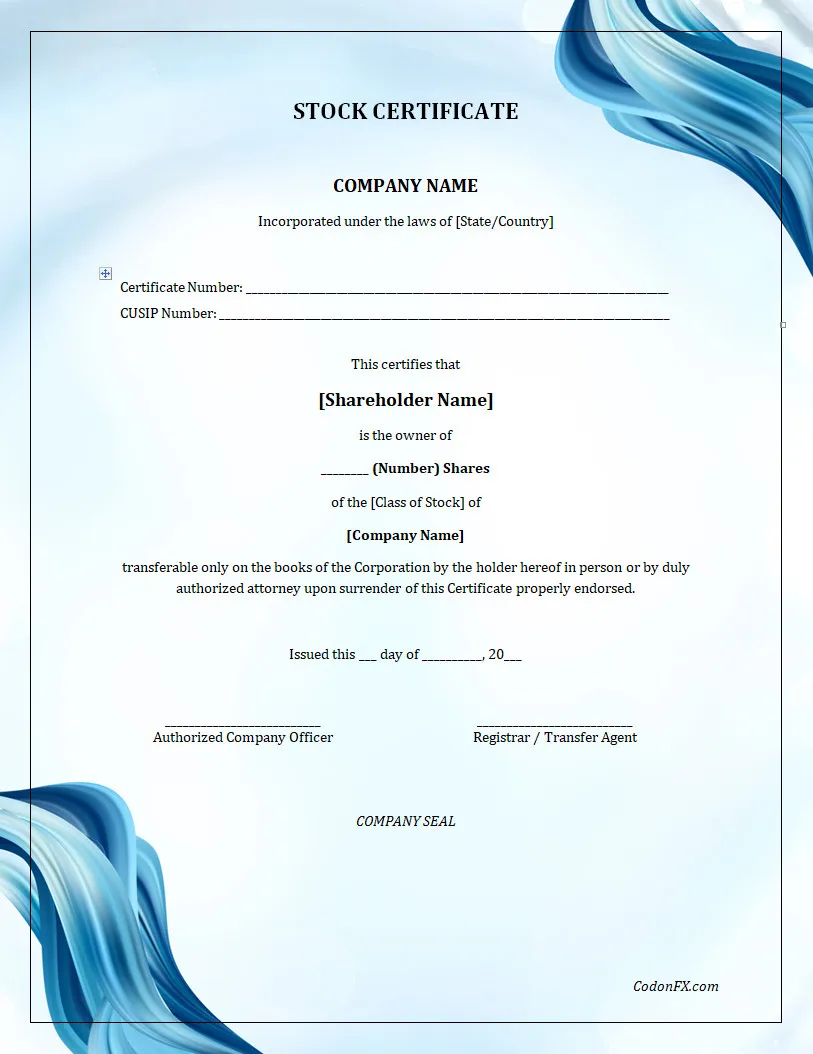

Information Necessary in a Stock Certificate

A stock certificate typically includes the following information:

Company Name

The company name is a critical component of a stock certificate, as it identifies the issuing corporation. Shareholders should verify that the company name on the certificate matches the name of the company in which they own shares to ensure accuracy and legitimacy.

Shareholder Name

The shareholder’s name is essential for identifying the individual or entity that owns

The Number of Shares

The number of shares held by the shareholder is a key detail included in a stock certificate. This information indicates the quantity of ownership in the company that the shareholder possesses. Investors must verify that the number of shares stated on the certificate aligns with their investment holdings.

Certificate Number

Each stock certificate is assigned a unique certificate number for identification purposes. This number serves as a reference point for tracking the certificate’s authenticity and ownership details. Shareholders should keep a record of their certificate numbers to facilitate communication with the company’s registrar or transfer agent.

Issue Date

The issue date of the stock certificate indicates when the certificate was initially issued by the company. This date is important for tracking the history of ownership transfers and determining the duration of the shareholder’s investment in the company. Shareholders should be aware of the issue date for record-keeping purposes.

Authorized Signatures

Stock certificates bear authorized signatures from company officials, such as the CEO, CFO, or corporate secretary. These signatures validate the authenticity of the certificate and attest to the company’s approval of the ownership transfer. Shareholders should ensure that the signatures on their stock certificates are genuine and up-to-date.

Restrictions or Special Provisions

Some stock certificates may include restrictions or special provisions that dictate how the shares can be traded or transferred. These restrictions could involve limitations on selling shares to certain parties, requirements for board approval on transfers, or conditions for exercising voting rights. Shareholders should review any restrictions carefully to understand their implications.

Seals or Embossments

Stock certificates may feature seals, embossments, or watermarks as security measures to prevent counterfeiting or tampering. These visual elements add an extra layer of authenticity to the certificate and enhance its value as a legal document. Shareholders should verify the presence of seals or embossments on their stock certificates.

Registration Details

Stock certificates are typically registered with a transfer agent or registrar, who maintains records of ownership and facilitates share transfers. The registration details on the certificate indicate the name and contact information of the transfer agent responsible for managing shareholder records. Shareholders should keep this information handy for inquiries or transactions.

Common Considerations When Applying for a Stock Certificate

When applying for a stock certificate, investors should consider the following factors:

Ownership Rights

Understanding the rights associated with owning shares in a company is essential before applying for a stock certificate. Shareholders should be aware of their voting rights, dividend entitlements, and other privileges that come with ownership. This knowledge helps investors make informed decisions regarding their investments.

Transferability

Knowing the process for transferring ownership of shares is crucial when applying for a stock certificate. Shareholders should understand the steps involved in endorsing and transferring their certificates to another party. Proper documentation and compliance with transfer procedures ensure smooth and legal ownership transitions.

Dividend Payments

Awareness of potential dividends and payment schedules is important for shareholders seeking stock certificates. Dividends are distributions of a company’s profits to shareholders, typically paid out regularly. Understanding how dividends are calculated, declared, and distributed can help investors assess the income-generating potential of their investments.

Legal Implications

Being informed about legal rights and responsibilities as a shareholder is crucial for those applying for stock certificates. Shareholders should familiarize themselves with the laws and regulations governing ownership in companies, as well as their obligations towards the company and other shareholders. Compliance with legal requirements safeguards investors’ interests.

Record-Keeping Practices

Maintaining accurate records of stock certificates and related documents is essential for proper portfolio management. Shareholders should establish organized record-keeping practices to track their investments, monitor ownership changes, and facilitate communication with companies or transfer agents. Keeping detailed records enhances transparency and efficiency in managing investments.

Communication with Registrars

Establishing effective communication channels with registrars or transfer agents is important for shareholders applying for stock certificates. Registrars handle shareholder records, share transfers, and other administrative tasks related to ownership. Building a rapport with registrars can facilitate the swift resolution of queries, updates to ownership details, and smooth transaction processes.

Compliance with Policies

Adhering to company policies and procedures regarding stock ownership is critical for shareholders seeking stock certificates. Companies may have specific guidelines on share transactions, ownership transfers, dividend payments, and other shareholder-related activities. By following these policies, investors uphold corporate governance standards and contribute to a harmonious shareholder environment.

Tax Implications

Awareness of tax implications related to stock ownership is important for shareholders applying for stock certificates. Dividends, capital gains, and other investment income may be subject to taxation depending on the investor’s jurisdiction and tax laws. Understanding tax obligations helps investors plan their finances and comply with regulatory requirements.

Risk Management

Considering risk management strategies is crucial for shareholders holding stock certificates. Diversifying investments, monitoring market trends, and staying informed about company performance are key elements of effective risk management. Shareholders should assess their risk tolerance and implement strategies to mitigate potential financial risks associated with stock ownership.

Long-Term Investment Goals

Aligning stock ownership with long-term investment goals is essential for shareholders applying for stock certificates. Whether seeking capital appreciation, income generation, or portfolio diversification, investors should have a clear investment strategy in place. Setting realistic goals and periodically reviewing investment objectives can help shareholders make informed decisions regarding their holdings.

Professional Advice

Seeking professional advice from financial advisors, accountants, or legal experts can provide valuable insights for shareholders applying for stock certificates. Professionals can offer guidance on investment strategies, tax planning, risk management, and compliance with regulatory requirements. Consultation with experts can enhance investors’ understanding of complex financial matters and support informed decision-making.

Conclusion

Stock certificates serve as tangible representations of ownership in a company, providing investors with proof of their stakes in corporations. While the landscape of stock ownership has evolved with digital advancements, the fundamental principles of stock certificates remain rooted in financial transparency, legal compliance, and investor protection.

Understanding the intricacies of stock certificates, from their purpose and types to distribution methods and considerations, empowers shareholders to engage confidently in the world of investing. By recognizing the value of stock certificates as legal documents and symbols of ownership, shareholders can navigate the complexities of the financial markets with clarity and assurance.

Stock Certificate Template – WORD