As an accountant, time management is crucial to your success. Keeping track of billable hours, managing client projects, and analyzing financial data all require careful attention to detail. That’s where a timesheet comes in. In this article, we will explore the importance of using a timesheet for accountants and provide you with a comprehensive guide to effective time tracking.

What is a Timesheet and Why Do Accountants Need It?

A timesheet is a document or software tool used to record and track the amount of time spent on various tasks or projects. It allows accountants to accurately measure and manage their time, ensuring that they are allocating their resources efficiently.

For accountants, a timesheet is a valuable tool for several reasons:

- Accurate Billing: Accountants often work on a per-hour basis or charge clients based on the time spent on their projects. A timesheet helps ensure that clients are billed accurately and fairly.

- Project Management: By tracking time spent on different tasks, accountants can better manage their workload and prioritize their projects.

- Productivity Analysis: Timesheets provide valuable insights into how accountants are spending their time. This data can be used to identify inefficiencies, optimize processes, and improve productivity.

- Client Communication: Timesheets can be shared with clients to provide transparency and demonstrate the value of the accountant’s services.

How Does a Timesheet Work?

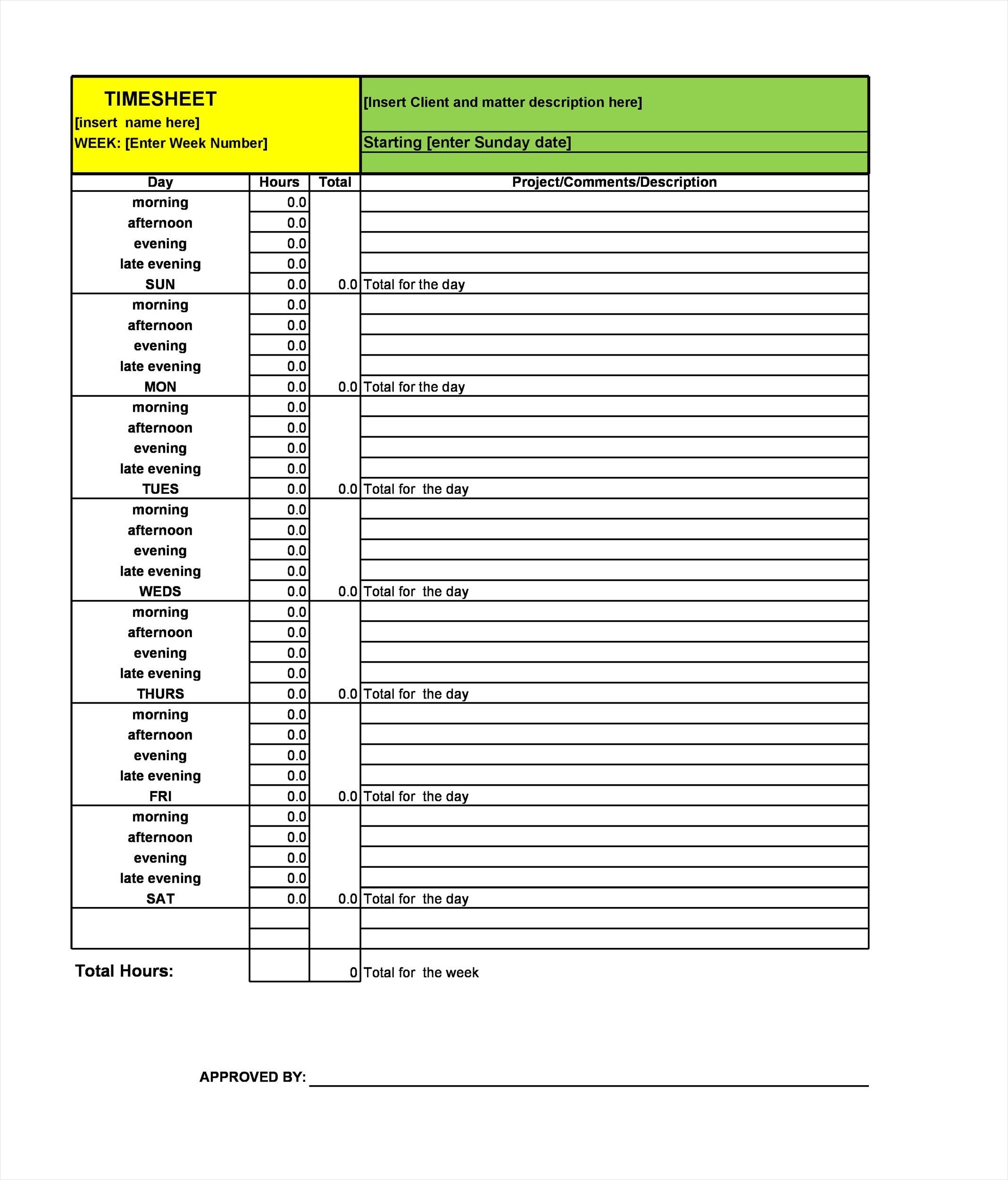

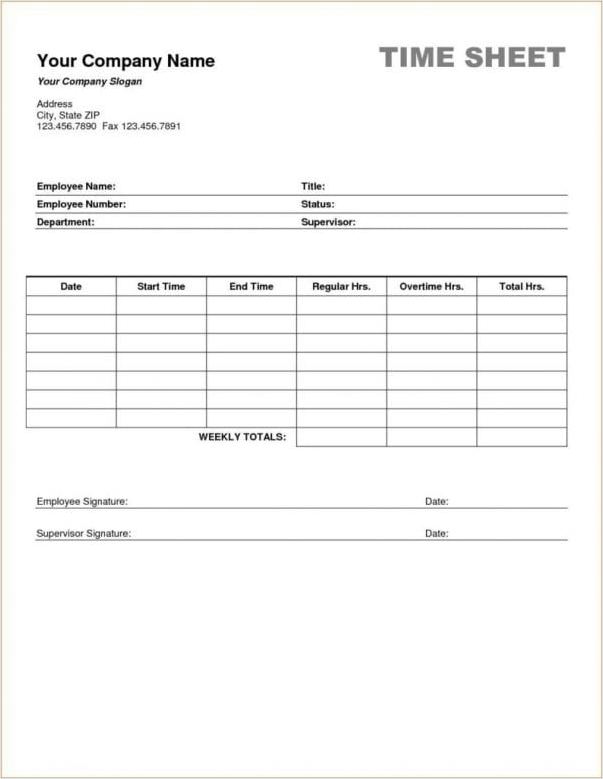

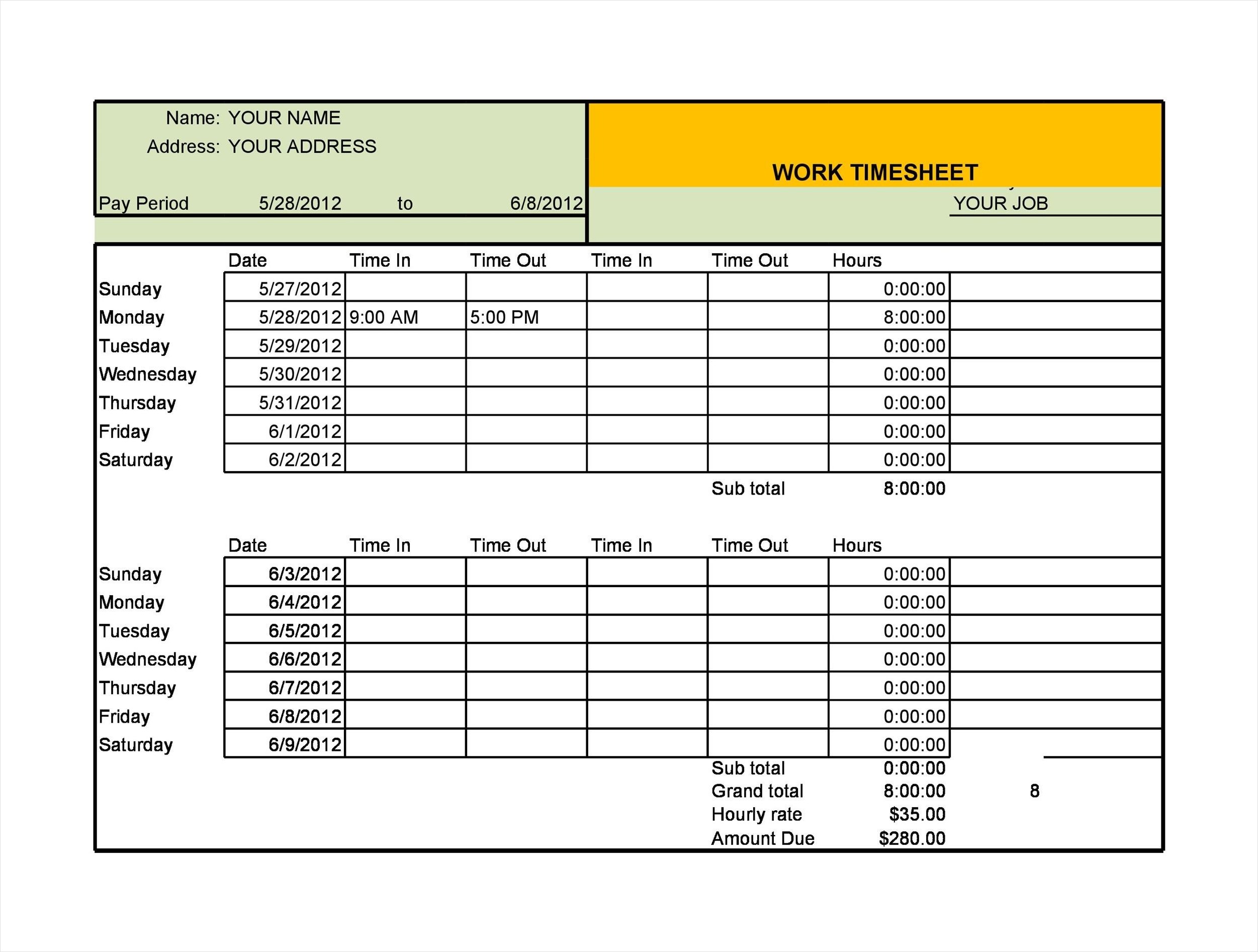

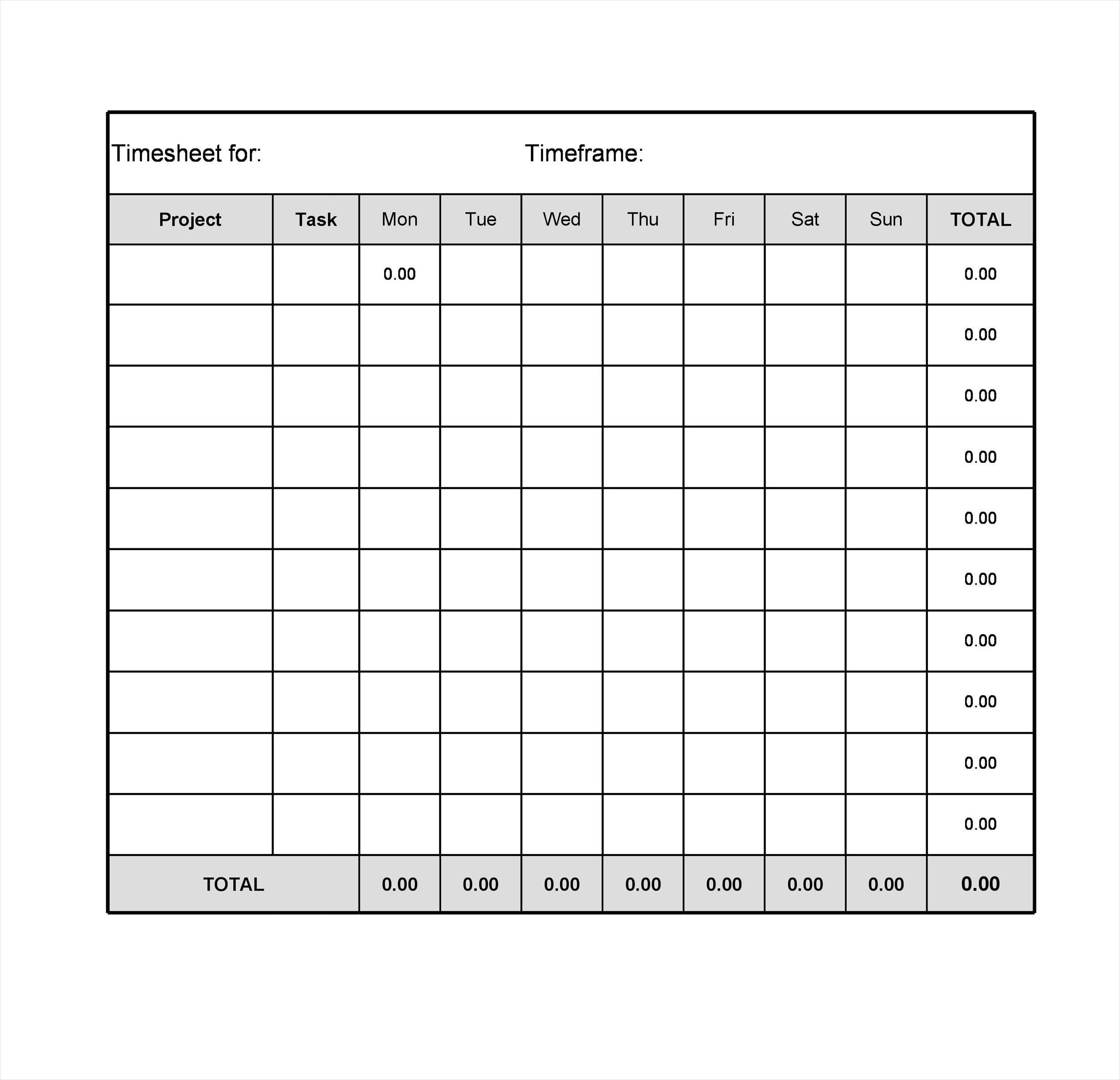

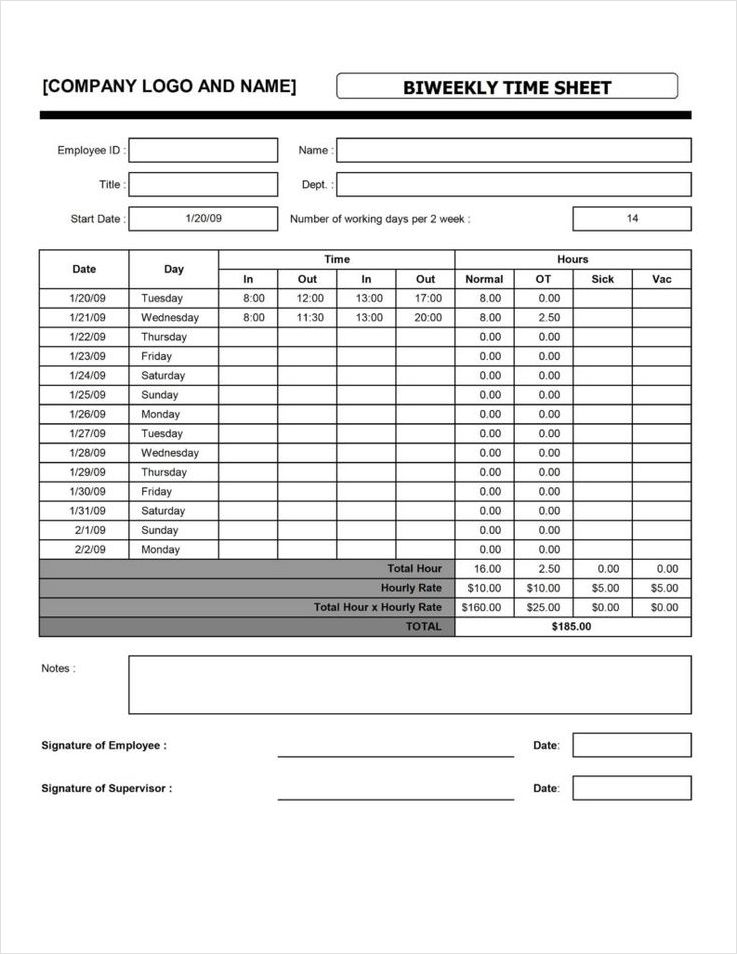

A timesheet typically includes columns for the date, project/task description, start and end times, and total hours worked. Accountants can fill in the timesheet manually on paper or use electronic timesheet software for more convenience and accuracy.

Here’s a step-by-step guide on how to use a timesheet effectively:

- Plan Ahead: Before starting a project, estimate the time it will take to complete each task. Break down the project into smaller, manageable tasks and allocate time accordingly.

- Record Time: As you work on each task, record the start and end times in your timesheet. Be diligent in tracking your time and avoid multitasking, as it can lead to inaccurate time tracking.

- Be Specific: Describe each task in detail to provide clarity and context. This will help you and others understand what was done during that period.

- Review and Update: Regularly review your timesheet to ensure accuracy. Make any necessary adjustments or additions as you go along.

- Analyze and Reflect: At the end of each week or month, analyze your timesheet data. Reflect on how you spent your time, identify areas for improvement, and make adjustments for future projects.

Benefits of Using a Timesheet for Accountants

Using a timesheet can bring numerous benefits to accountants and their practice. Here are some key advantages:

- Accurate Time Tracking: A timesheet helps accountants track their time with precision, reducing the risk of underbilling or overbilling clients.

- Improved Productivity: By tracking time, accountants can identify time-wasting activities and focus on high-priority tasks, leading to increased productivity.

- Efficient Resource Allocation: Timesheets provide insights into how much time is spent on different tasks or projects. This information helps accountants allocate their resources effectively and make informed decisions about staffing and project timelines.

- Data for Performance Evaluation: Timesheet data can be used to evaluate the performance of accountants and their teams. It provides objective metrics that can be used to set goals, measure progress, and reward high performers.

- Improved Client Communication: Sharing timesheets with clients builds trust and transparency. It allows clients to see the value they are receiving and understand how their resources are being utilized.

Conclusion

Using a timesheet for accountants is essential for effective time management, accurate billing, and improved productivity. By tracking time with precision, accountants can gain valuable insights into their work patterns, optimize their processes, and provide transparency to clients. Whether using a manual timesheet or electronic timesheet software, accountants can leverage this tool to enhance their practice and achieve greater success.

Timesheet Template For Accountants – Download