Managing finances can be a challenging task, especially when it comes to tracking small expenses. Petty cash funds are often used to cover these expenses, but without proper documentation, it can be difficult to keep track of where the money is going. That’s where petty cash receipts come in.

These receipts serve as a record of cash disbursements from a petty cash fund, documenting the amount, purpose, and recipient of each withdrawal. By using petty cash receipts, businesses can ensure proper tracking and accounting of small expenses.

What are Petty Cash Receipts?

Petty cash receipts are documents that serve as a record of cash disbursements from a petty cash fund. When money is withdrawn from the petty cash fund, a receipt is issued to document the transaction.

The receipt includes important information such as the amount of cash withdrawn, the purpose of the withdrawal, and the recipient of the funds. These receipts are typically printed on paper and kept in a designated folder or file for easy reference and record keeping.

Why are Petty Cash Receipts Important?

Petty cash receipts are important for several reasons.

- First and foremost, they provide a clear record of cash disbursements from a petty cash fund. This ensures that there is a paper trail for every transaction, making it easier to track where the money is going and identify any discrepancies or errors.

- Furthermore, petty cash receipts help businesses maintain proper accounting practices. By documenting the amount, purpose, and recipient of each withdrawal, businesses can ensure that their financial records are accurate and complete. This is especially important when it comes to tax reporting and audits.

- Lastly, petty cash receipts promote transparency and accountability within an organization. By requiring receipts for all petty cash withdrawals, businesses can discourage misuse or unauthorized access to the funds. Employees are more likely to think twice before making unnecessary or unauthorized withdrawals if they know that their actions are being documented and monitored.

How to Create Petty Cash Receipts

Creating petty cash receipts is a straightforward process. Here’s a step-by-step guide:

- Determine the format: Decide on the format you want to use for your petty cash receipts. You can use a pre-designed template or create your own using word processing or spreadsheet software.

- Include necessary information: Make sure to include the following information on your receipts: date of withdrawal, amount of cash withdrawn, purpose of the withdrawal, recipient’s name or department, and any additional notes or comments.

- Design the layout: Arrange the information in a clear and organized manner. Use font styles and sizes that are easy to read.

- Add your logo: If desired, you can add your company’s logo or branding elements to the receipts to give them a professional look.

- Print and distribute: Once you have finalized the design, print multiple copies of the receipts and distribute them to employees who have access to the petty cash fund.

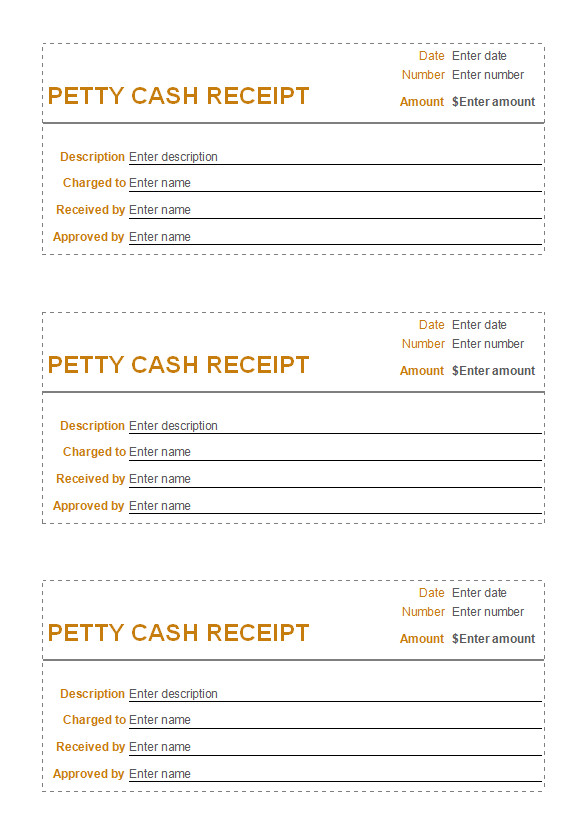

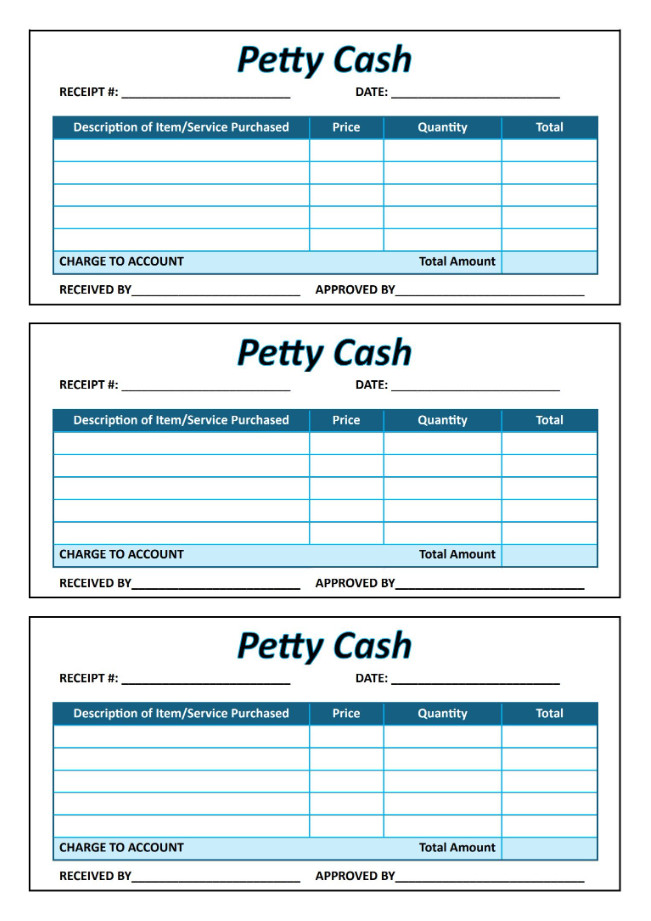

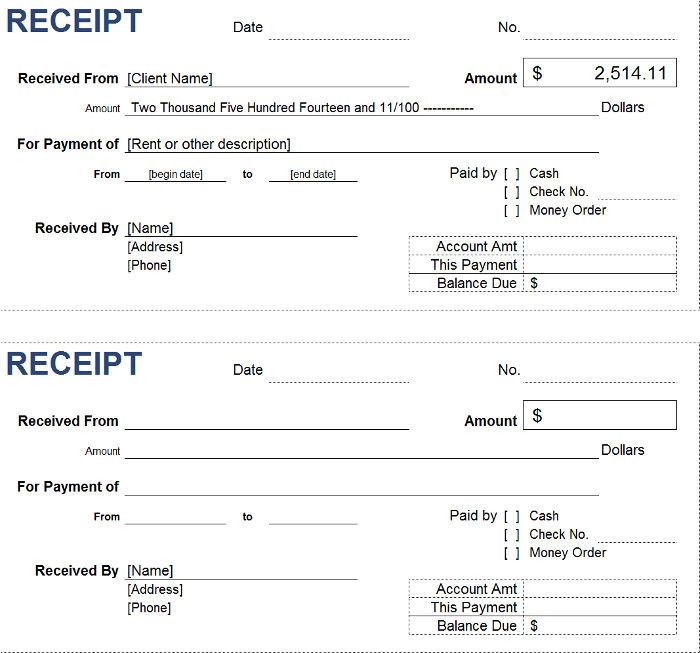

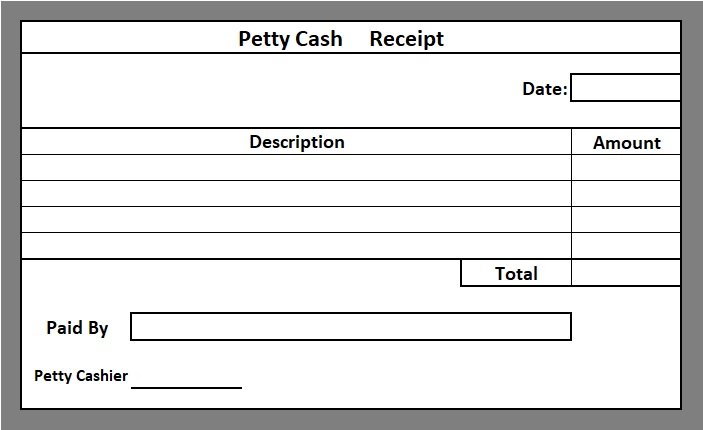

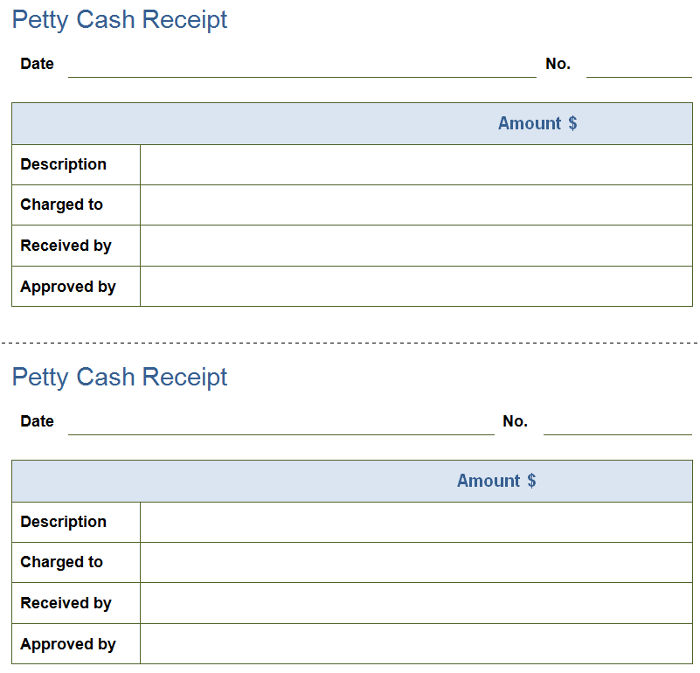

Examples of Petty Cash Receipts

Here are a few examples of how petty cash receipts can be designed:

Tips for Successful Petty Cash Receipts

- Keep receipts organized: Create a designated folder or file to store all the petty cash receipts. This will make it easier to find and reference them when needed.

- Require receipts for all withdrawals: Implement a policy that requires employees to provide a receipt for every petty cash withdrawal. This will help maintain accountability and discourage misuse of funds.

- Regularly reconcile the petty cash fund: Periodically compare the total amount of cash in the petty cash fund to the total amount documented on the receipts. This will help identify any discrepancies and ensure that the fund is balanced.

- Train employees on proper procedures: Provide training to employees on how to properly request and document petty cash withdrawals. This will help ensure consistency and accuracy in the documentation process.

- Review receipts during audits: When conducting internal or external audits, make sure to review the petty cash receipts to ensure compliance with financial policies and procedures.

- Consider using digital receipts: Instead of printing physical receipts, you can explore the option of using digital receipts. This can help reduce paper waste and make it easier to store and search for receipts.

- Keep receipts for the required period: Depending on your jurisdiction’s regulations, you may be required to keep financial records, including petty cash receipts, for a certain period. Make sure to comply with these requirements.

Conclusion

Petty cash receipts serve as an important tool for businesses to track and document cash disbursements from a petty cash fund. By using these receipts, businesses can ensure proper tracking and accounting of small expenses, promote transparency and accountability, and maintain accurate financial records.

Creating and implementing a system for petty cash receipts is essential for any organization that utilizes a petty cash fund.

Petty Cash Receipt Template – Download