Dealing with issues related to credit or debit card transactions can be a frustrating experience. Whether it’s an unauthorized charge, a billing error, or a dispute with a merchant, resolving these issues can often feel like a daunting task. However, with the help of a printable transaction dispute form, you can initiate a formal process to resolve these problems effectively.

In this article, we will explore what a printable transaction dispute form is, why it is essential, how to use it, and provide examples and tips for a successful resolution.

What is a Printable Transaction Dispute Form?

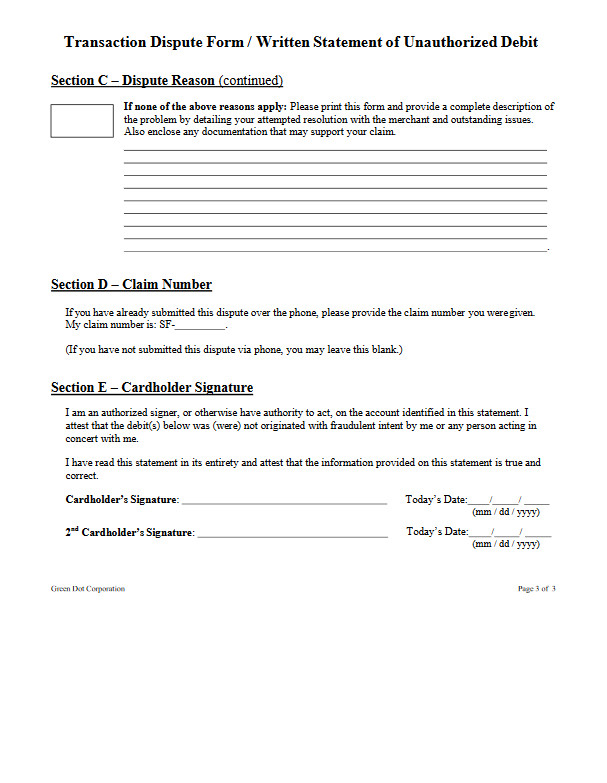

A printable transaction dispute form is a document that allows cardholders to initiate a formal process for resolving issues with their credit or debit card transactions. It provides a structured format to present all the necessary information about the dispute, such as transaction details, reasons for the dispute, and any supporting evidence. This form typically needs to be completed and submitted to the card issuer or bank that issued the card.

By using a printable transaction dispute form, cardholders can ensure that their concerns are properly documented and that the dispute is handled systematically. This form serves as a written record of the dispute and provides a clear outline for the card issuer to investigate and resolve the issue.

Why is a Printable Transaction Dispute Form Important?

A printable transaction dispute form is essential for several reasons:

- Organizes Information: The form helps cardholders organize all the necessary details related to the disputed transaction, ensuring that no critical information is missed.

- Provides a Formal Process: By using the form, cardholders can follow a formal process established by the card issuer or bank, which increases the chances of a successful resolution.

- Creates a Written Record: The completed form serves as a written record of the dispute, making it easier for the card issuer to investigate and resolve the issue.

- Supports the Cardholder’s Case: The form allows cardholders to provide supporting evidence, such as receipts, invoices, or correspondence, to strengthen their case.

Overall, a printable transaction dispute form streamlines the dispute resolution process, making it easier for both the cardholder and the card issuer to navigate through the complexities of the issue.

How to Use a Printable Transaction Dispute Form

Using a printable transaction dispute form is a simple process. Here are the steps to follow:

- Download the Form: Look for a printable transaction dispute form provided by your card issuer or bank. It is usually available on their website or can be obtained by contacting their customer service.

- Read the Instructions: Before filling out the form, carefully read any instructions or guidelines provided by the card issuer. This will ensure that you provide all the necessary information and follow the correct procedures.

- Complete the Form: Fill out the form with accurate and detailed information about the disputed transaction. Include details such as the transaction date, amount, merchant name, and a description of the issue. Be clear and concise in explaining the reason for the dispute.

- Attach Supporting Documentation: If you have any supporting evidence, such as receipts, invoices, or correspondence, attach copies of these documents to the form. This will strengthen your case and help the card issuer in their investigation.

- Submit the Form: Once you have completed the form and attached any necessary documentation, submit it to the card issuer or bank according to their instructions. Make sure to keep a copy of the form for your records.

By following these steps, you can initiate the dispute resolution process and increase the chances of a successful outcome.

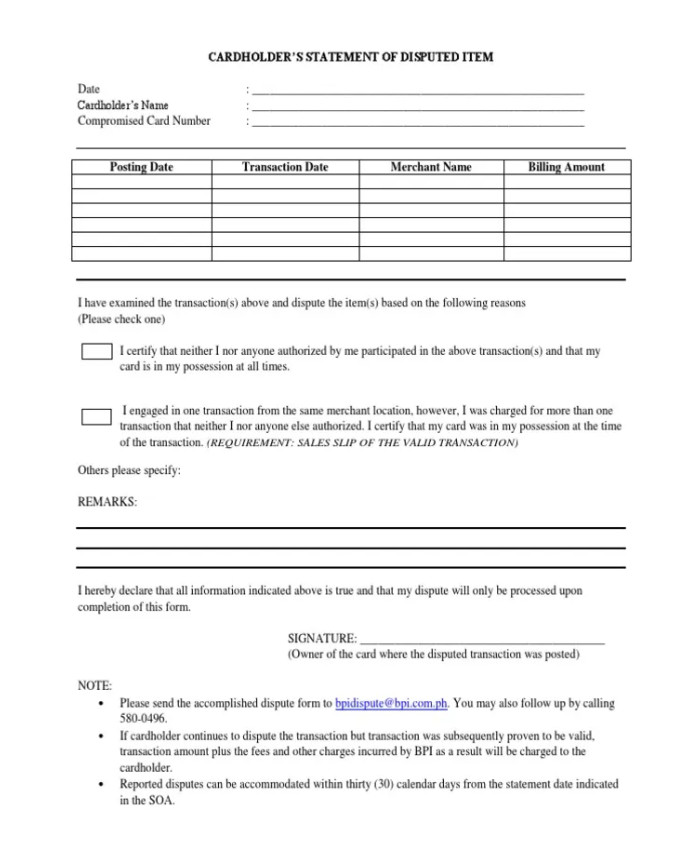

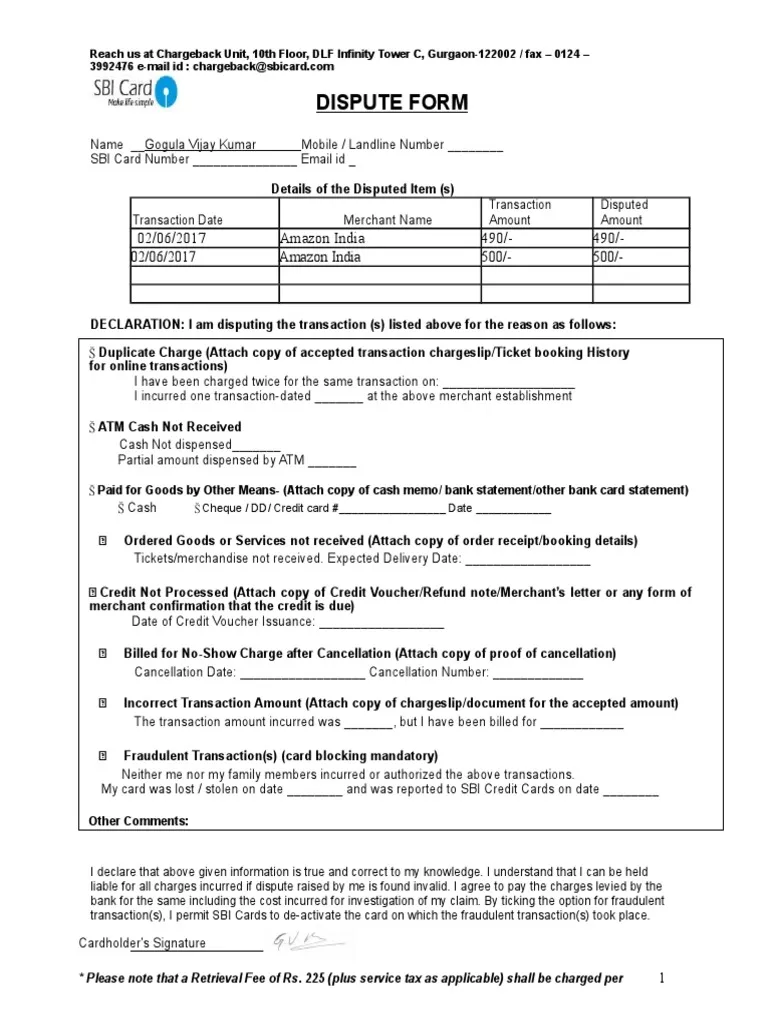

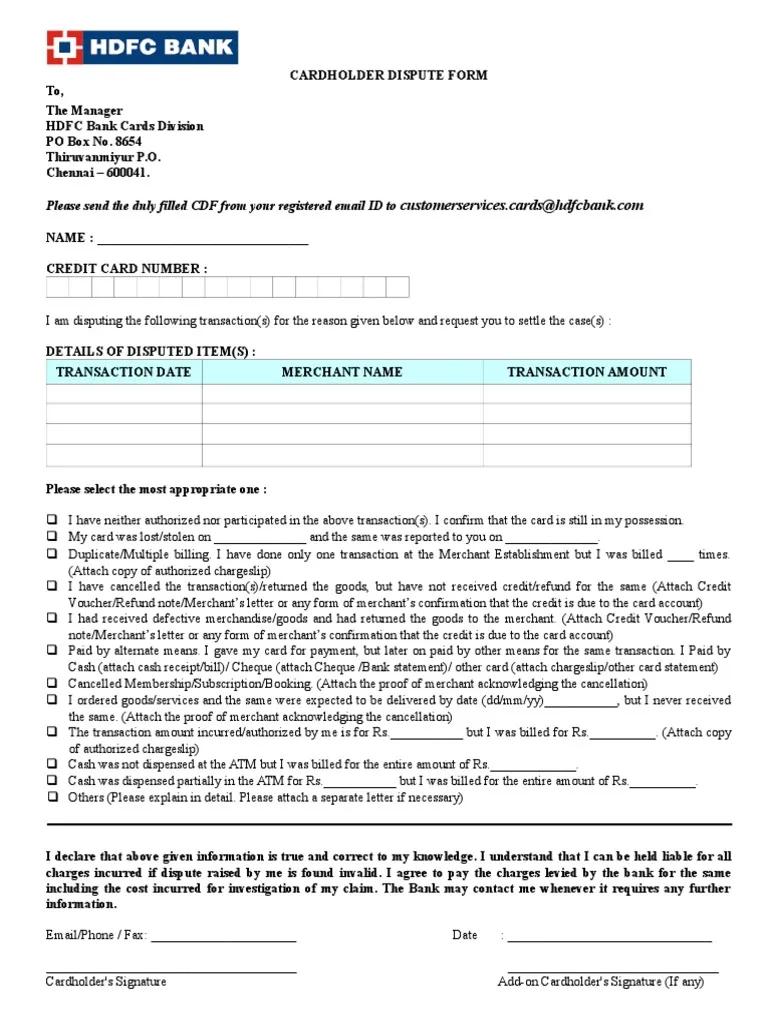

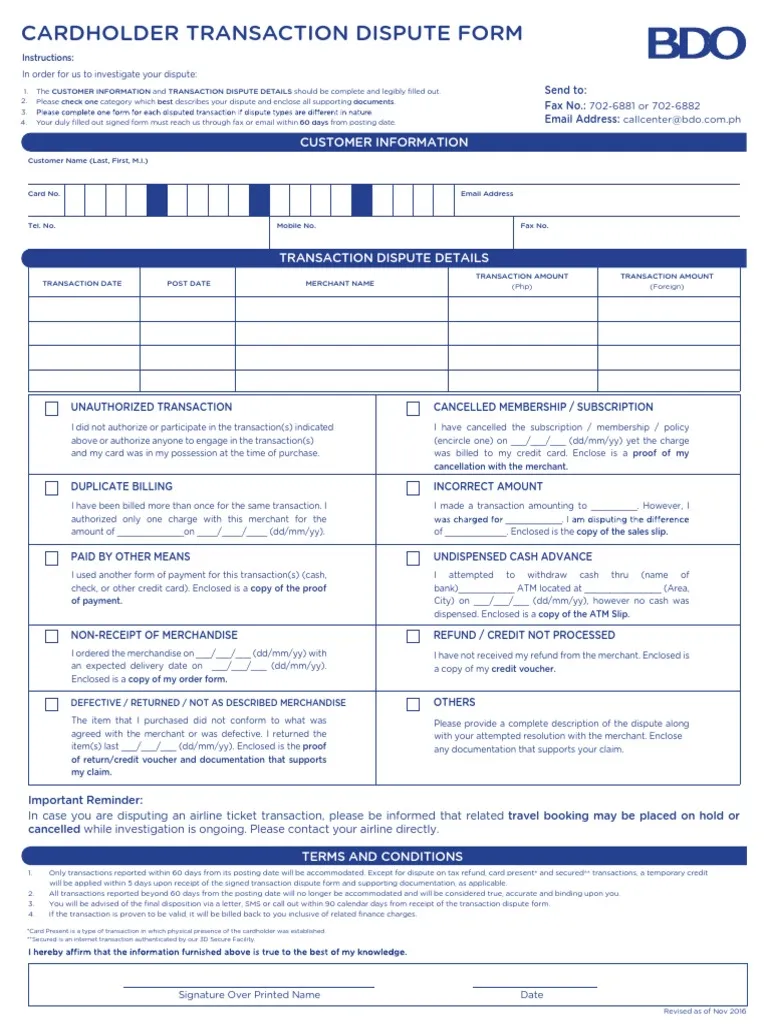

Examples of Printable Transaction Dispute Forms

While the specific layout and design of printable transaction dispute forms may vary depending on the card issuer or bank, they generally contain similar sections and fields. Here are a few examples of common sections you may find in a printable transaction dispute form:

Tips for Successful Resolution

Resolving credit or debit card transaction issues can be a complex process. Here are some tips to increase the chances of a successful resolution:

- Act Promptly: As soon as you notice an issue with a transaction, act promptly and initiate the dispute resolution process. Timely action can help prevent further complications.

- Keep Records: Maintain a record of all relevant information, such as transaction details, dates and times of communication with the card issuer, and copies of any documentation provided.

- Be Clear and Concise: When explaining the reason for the dispute, be clear and concise in presenting your case. Provide all the necessary details without unnecessary embellishments.

- Provide Supporting Evidence: Whenever possible, provide supporting evidence, such as receipts, invoices, or correspondence, to strengthen your case. This can significantly impact the outcome of the dispute.

- Follow Up: If you do not receive a response or a satisfactory resolution within a reasonable timeframe, follow up with the card issuer or bank. Persistence can often lead to a resolution.

By following these tips, you can navigate the dispute resolution process more effectively and increase the chances of a successful outcome.

Conclusion

A printable transaction dispute form is a valuable tool for resolving issues with credit or debit card transactions. By using this form, cardholders can initiate a formal process and ensure that their concerns are properly documented and addressed.

By following the steps outlined in this article and utilizing the tips provided, you can navigate the dispute resolution process more effectively and increase the likelihood of a successful resolution. Remember, acting promptly and providing accurate and detailed information are key to resolving credit or debit card transaction issues.

Transaction Dispute Form – Download