Are you a small business owner looking to track your financial performance? One essential tool you need is a profit and loss statement. Also known as an income statement, this document provides a snapshot of your business’s revenue and expenses over a specific period.

This comprehensive guide will delve into the details of a basic profit and loss statement, its importance, and how to create one effectively.

What is a Basic Profit and Loss Statement?

A profit and loss statement, commonly called a P&L statement, is a financial report that summarizes a company’s revenues, costs, and expenses during a specific period. It provides insights into the profitability of the business by revealing whether it is making a profit or incurring losses.

A basic profit and loss statement typically includes information on sales, expenses, and net income.

Why is a Profit and Loss Statement Important?

A profit and loss statement is a crucial tool for monitoring the financial health of your business. It allows you to assess your revenue sources, identify areas of high expenses, and track your overall profitability.

By analyzing this statement regularly, you can make informed decisions to improve your financial performance and achieve your business goals.

How to Create a Basic Profit and Loss Statement

Creating a basic profit and loss statement is a straightforward process that involves gathering financial data and organizing it into the appropriate categories. Here are the steps to follow:

1. Start with your revenue: List all sources of income, such as sales, services rendered, or rental income.

2. Deduct your cost of goods sold: Subtract the direct costs associated with producing your goods or services.

3. Calculate your gross profit: Subtract the cost of goods sold from your total revenue.

4. List your operating expenses: Include all expenses related to running your business, such as rent, utilities, salaries, and marketing.

5. Calculate your operating income: Subtract your operating expenses from your gross profit.

6. Factor in other income and expenses: Include any additional sources of income or expenses not captured in the operating expenses.

7. Determine your net income: Subtract all expenses from your total income to arrive at your net profit or loss.

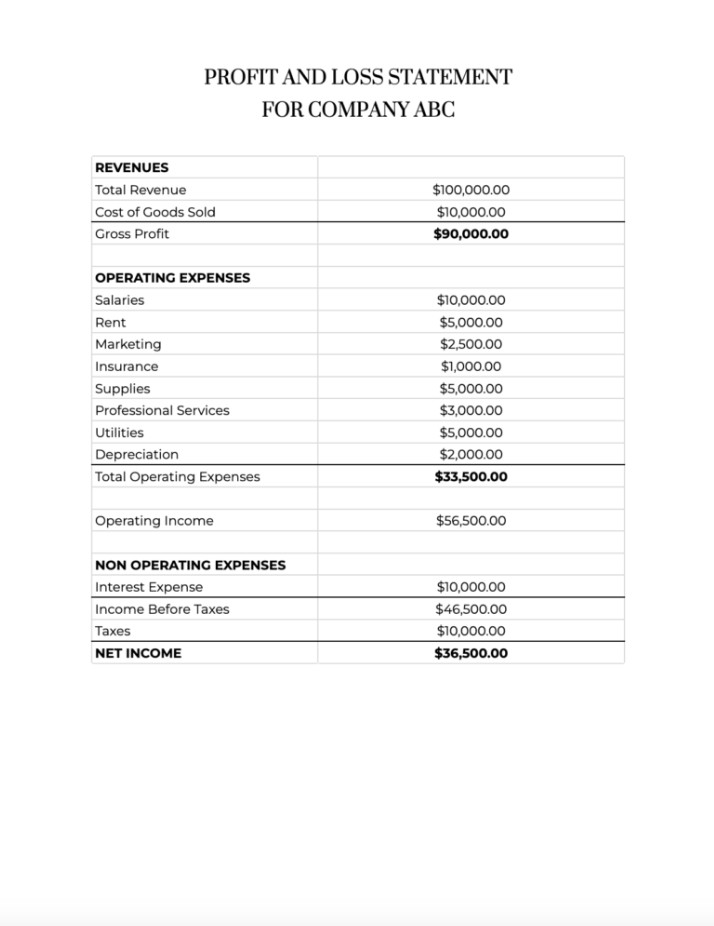

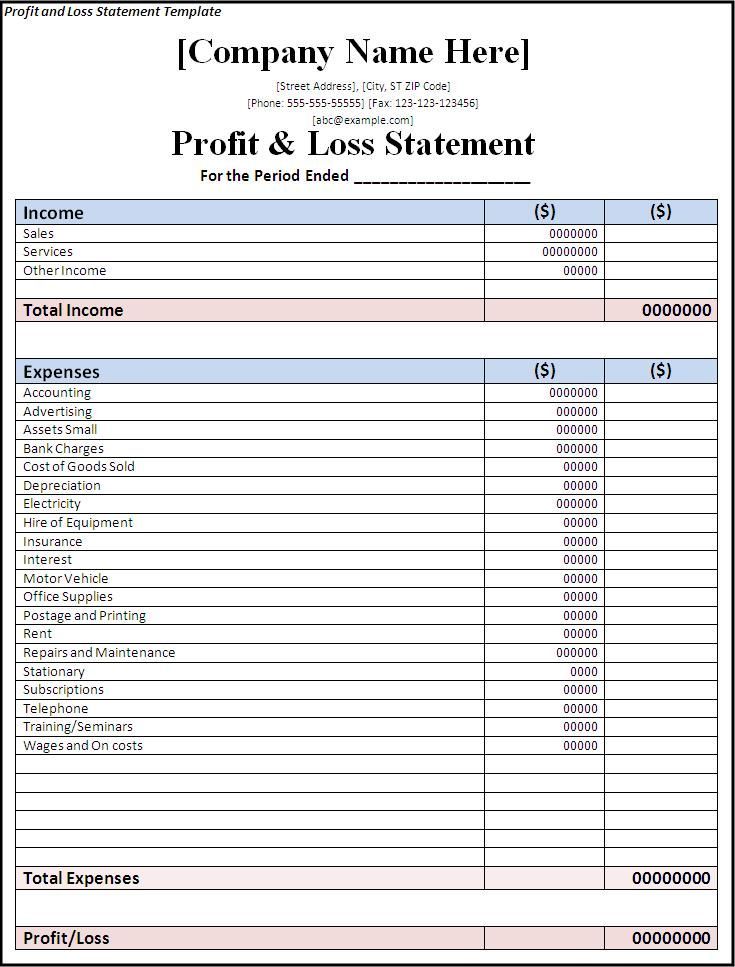

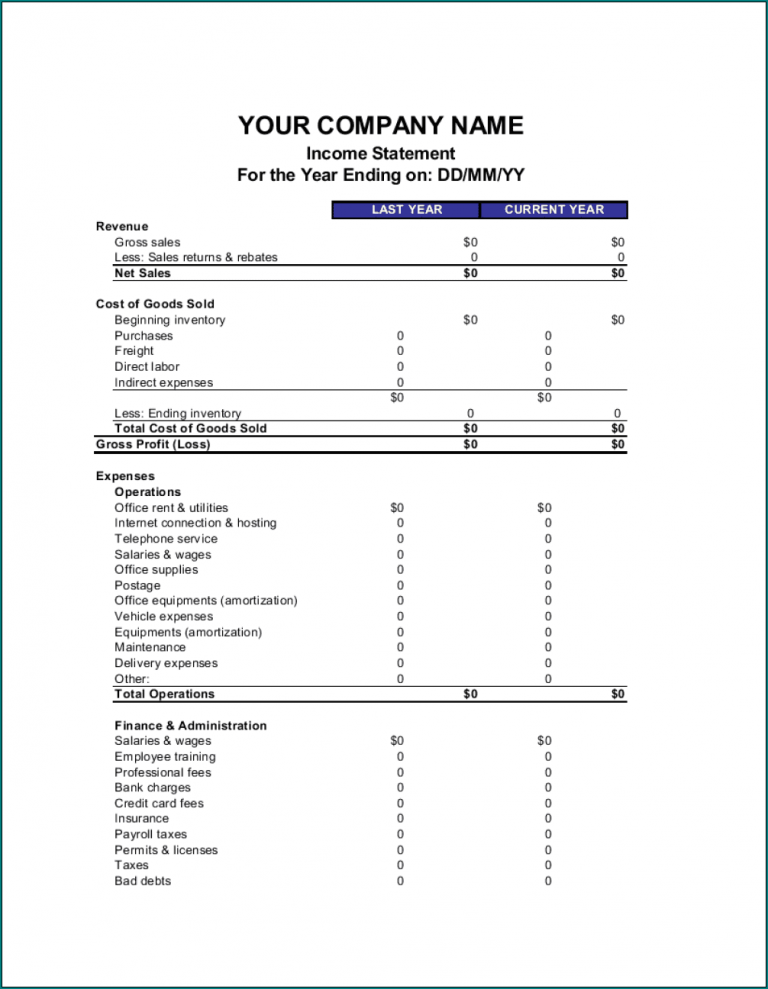

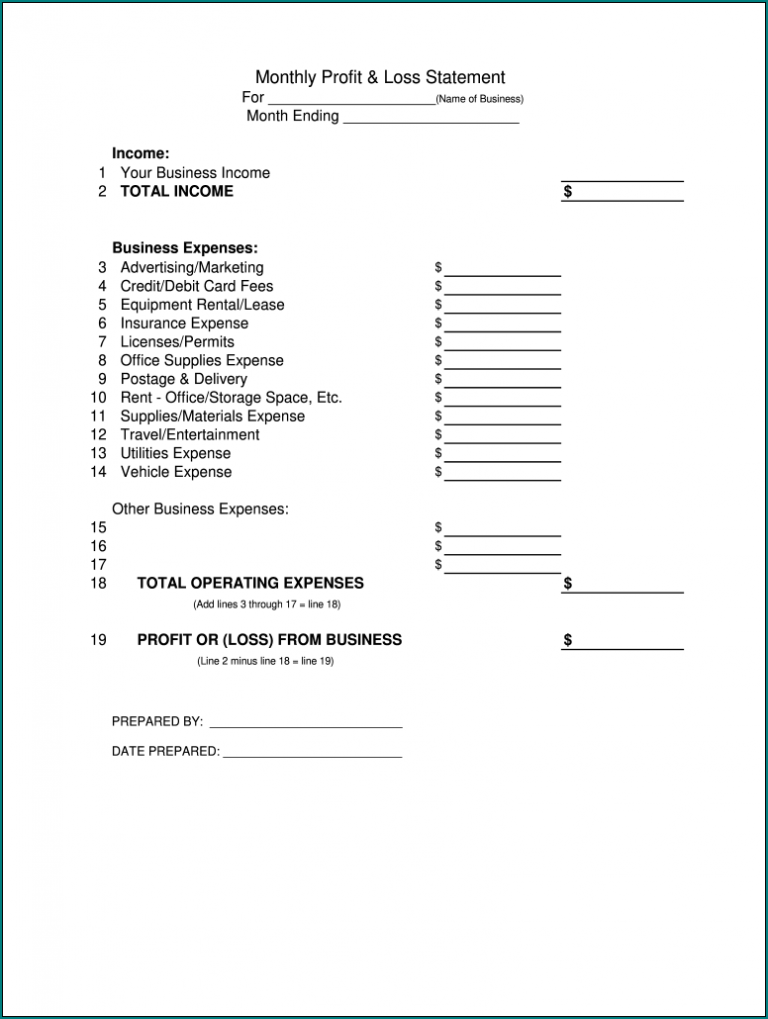

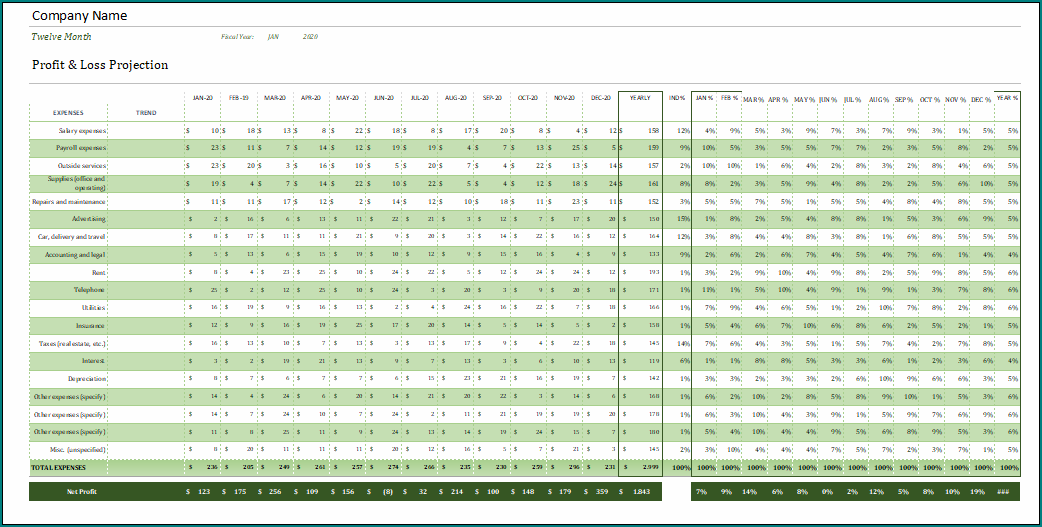

Examples of Basic Profit and Loss Statements

To better understand what a profit and loss statement looks like, here are some examples of typical P&L statements:

Tips for a Successful Profit and Loss Statement

To ensure the accuracy and effectiveness of your profit and loss statement, consider the following tips:

– Keep detailed records of all your financial transactions.

– Categorize your expenses correctly to provide a clear picture of your business operations.

– Review your profit and loss statement regularly to track your progress and identify areas for improvement.

– Seek professional advice if you are unsure about preparing your financial statements.

– Use accounting software or templates to streamline the process of creating a profit and loss statement.

In conclusion, a basic profit and loss statement is a valuable tool for any business owner to monitor their financial performance effectively. By understanding the importance of this financial document and following the steps outlined in this guide, you can confidently manage your business finances and make informed decisions for future growth.

Basic Profit And Loss Statement Template – Download