In the world of business, keeping track of your financial performance is crucial for success. One of the key tools that can help you stay on top of your company’s financial health is the income and expense statement.

This document serves as a summary of your company’s financial performance over a specific period, whether it’s a month, a quarter, or a year. It tracks your revenue, expenses, and the resulting profit or loss, giving you a clear picture of how your business is doing financially.

What is an Income and Expense Statement?

An income and expense statement is a financial document that provides a snapshot of your company’s financial performance over a specific period. It includes details of your revenue, expenses, and net profit or loss, giving you an overview of how well your business is doing financially.

This statement is essential for business owners as it helps them make informed decisions, track their progress, and identify areas for improvement.

Why Income and Expense Statements are Important

Income and expense statements play a crucial role in helping business owners understand their financial performance. Here are some reasons why these statements are important:

- Financial Planning: Income and expense statements help business owners plan for the future by providing insights into their company’s financial health.

- Decision Making: With the help of these statements, business owners can make informed decisions about their operations, investments, and expenses.

- Performance Evaluation: Income and expense statements allow business owners to evaluate their company’s performance and identify areas for improvement.

- Tax Compliance: These statements are essential for tax compliance, as they provide a detailed breakdown of your company’s revenue and expenses.

- Investor Relations: For businesses looking to attract investors, income and expense statements are essential for demonstrating financial stability and growth potential.

How to Create an Income and Expense Statement

Creating an income and expense statement may seem daunting, but with the right tools and knowledge, it can be a straightforward process. Here are some steps to help you create an effective income and expense statement for your business:

1. Start by gathering all relevant financial data, including your revenue sources and expenses.

2. Organize your data into categories, such as operating expenses, cost of goods sold, and revenue streams.

3. Calculate your total revenue by adding up all sources of income.

4. Calculate your total expenses by adding up all costs incurred in running your business.

5. Subtract your total expenses from your total revenue to calculate your net profit or loss.

6. Format your income and expense statement in a clear and organized manner, making it easy to read and understand.

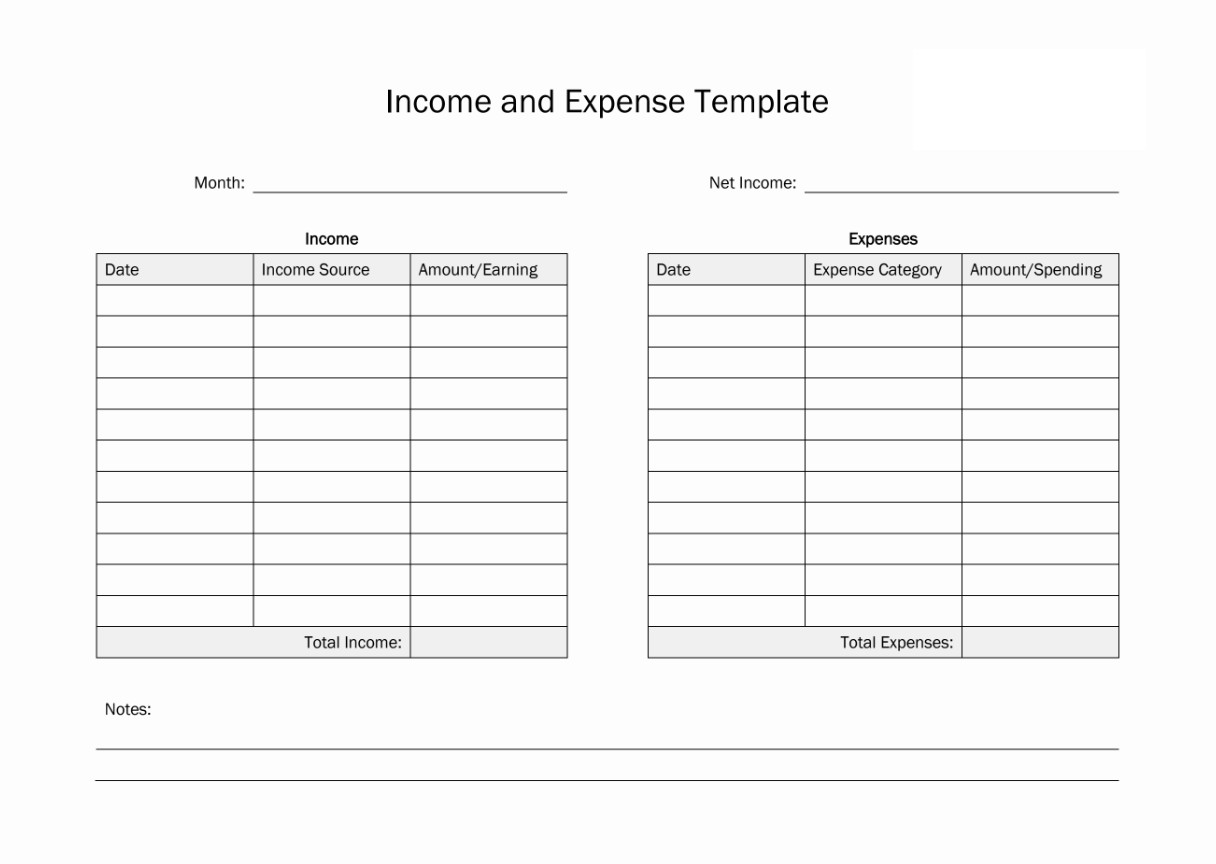

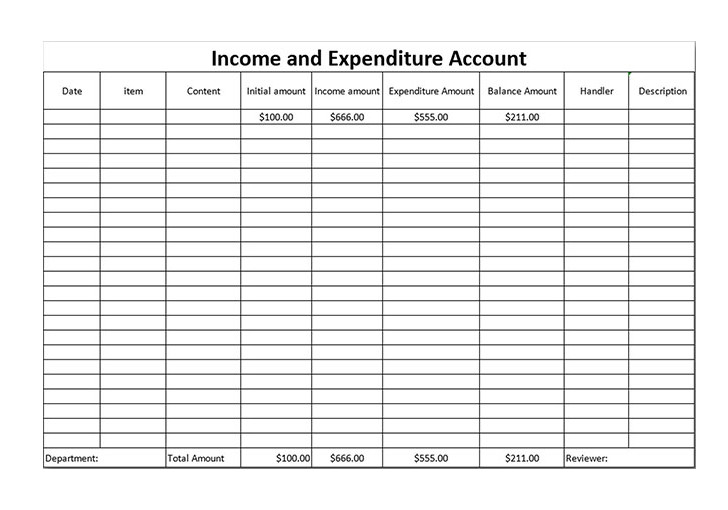

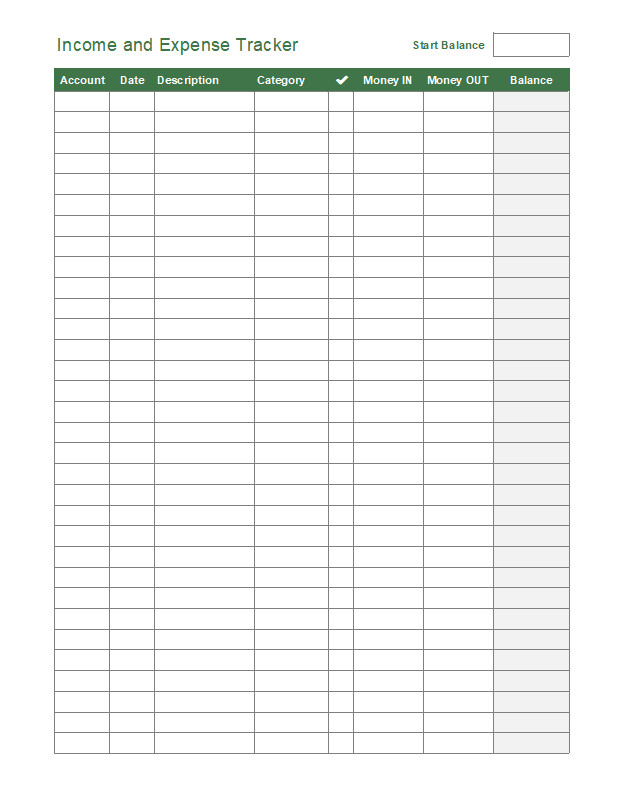

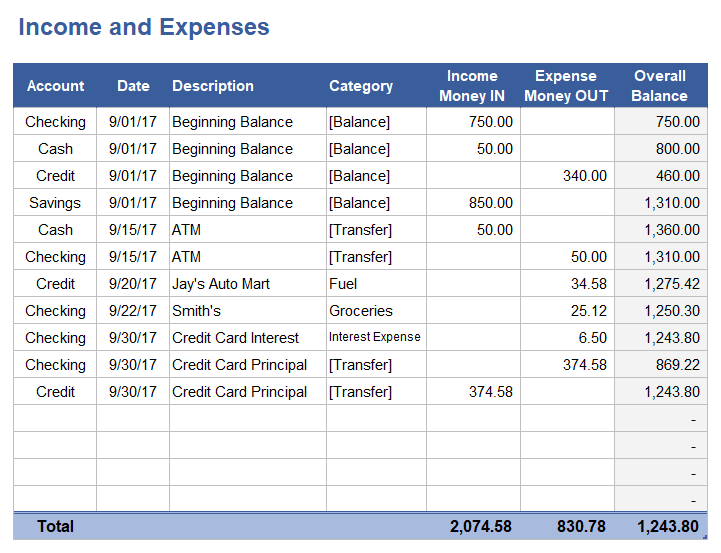

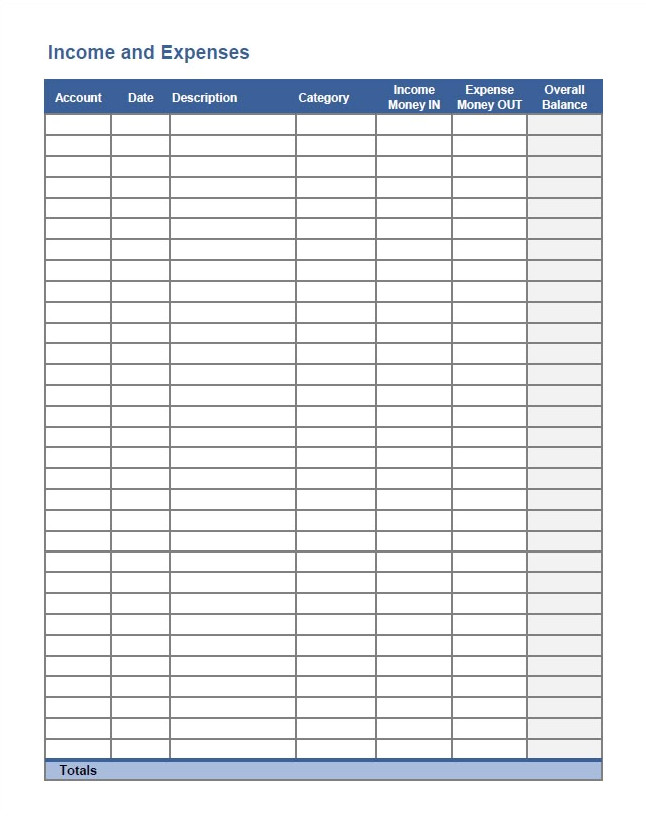

Examples of Income and Expense Statements

To give you a better idea of what an income and expense statement looks like, here are some examples:

Tips for Successful Income and Expense Statements

To make the most out of your income and expense statements, consider the following tips:

1. Regularly update your income and expense statements to stay on top of your financial performance.

2. Keep detailed records of your revenue sources and expenses to ensure accuracy in your statements.

3. Use accounting software or templates to streamline the process of creating income and expense statements.

4. Analyze your statements regularly to identify trends, opportunities for growth, and areas for cost-cutting.

5. Seek professional help if you’re unsure about creating or interpreting your income and expense statements.

6. Use your income and expense statements as a tool for strategic planning and decision-making in your business.

7. Compare your current statements with historical data to track your company’s financial progress over time.

In conclusion, income and expense statements are invaluable tools for business owners to track their financial performance, make informed decisions, and plan for the future. By understanding the significance of these statements and following best practices in creating and analyzing them, you can set your business up for long-term success.

Income And Expense Template – Download