Running a restaurant involves more than just serving delicious food to customers. It’s essential to keep track of your financial health to ensure the success and longevity of your business. One crucial tool that can help you understand the financial standing of your restaurant is the restaurant profit and loss statement, also known as an income statement.

This document provides a detailed overview of all revenues and expenses over a specific period, allowing restaurant owners to assess profitability and identify areas for improvement.

What is a Restaurant Profit and Loss Statement?

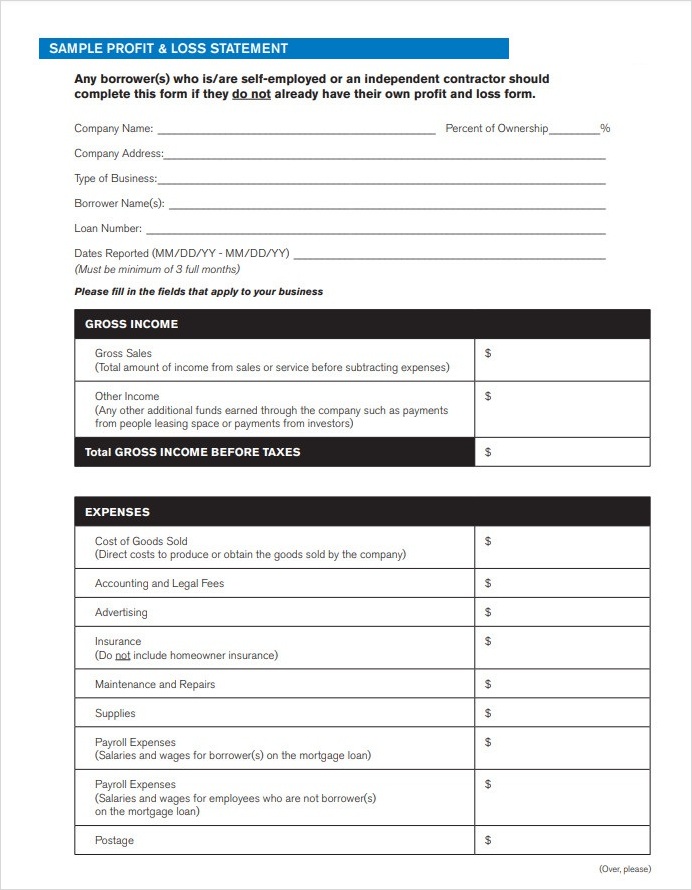

A restaurant’s profit and loss statement is a financial document that outlines all the revenues and expenses incurred by a restaurant over a specific period, typically a month, quarter, or year.

This statement provides a comprehensive overview of the financial performance of the restaurant, highlighting areas of strength and weakness. By analyzing this document, restaurant owners can make informed decisions to improve profitability and streamline operations.

Why is a Restaurant Profit and Loss Statement Important?

A restaurant’s profit and loss statement is a crucial tool for restaurant owners to gauge the financial health of their business. This document helps in assessing the profitability of the restaurant and understanding where the money is being spent.

By identifying areas of high expenses or low revenues, restaurant owners can take necessary steps to improve efficiency, reduce costs, and increase profits.

How to Create a Restaurant Profit and Loss Statement

Creating a restaurant profit and loss statement is a straightforward process that requires attention to detail and accuracy. To generate this document, follow these steps:

- Gather Financial Data. Collect all financial records, including sales receipts, invoices, and expense reports.

- Categorize Revenues and Expenses. Separate revenues (such as sales, catering, and merchandise) from expenses (such as food costs, labor, rent, and utilities).

- Calculate Net Income. Subtract total expenses from total revenues to calculate net income or loss.

- Review and Analyze. Analyze the profit and loss statement to identify trends, anomalies, and areas for improvement.

- Make Strategic Decisions. Based on the analysis, make strategic decisions to improve profitability and streamline operations.

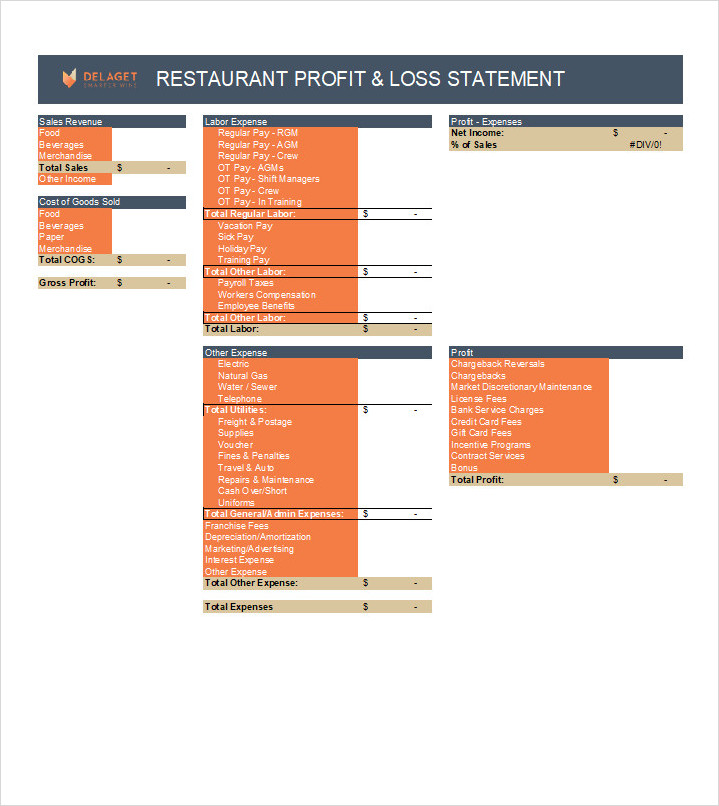

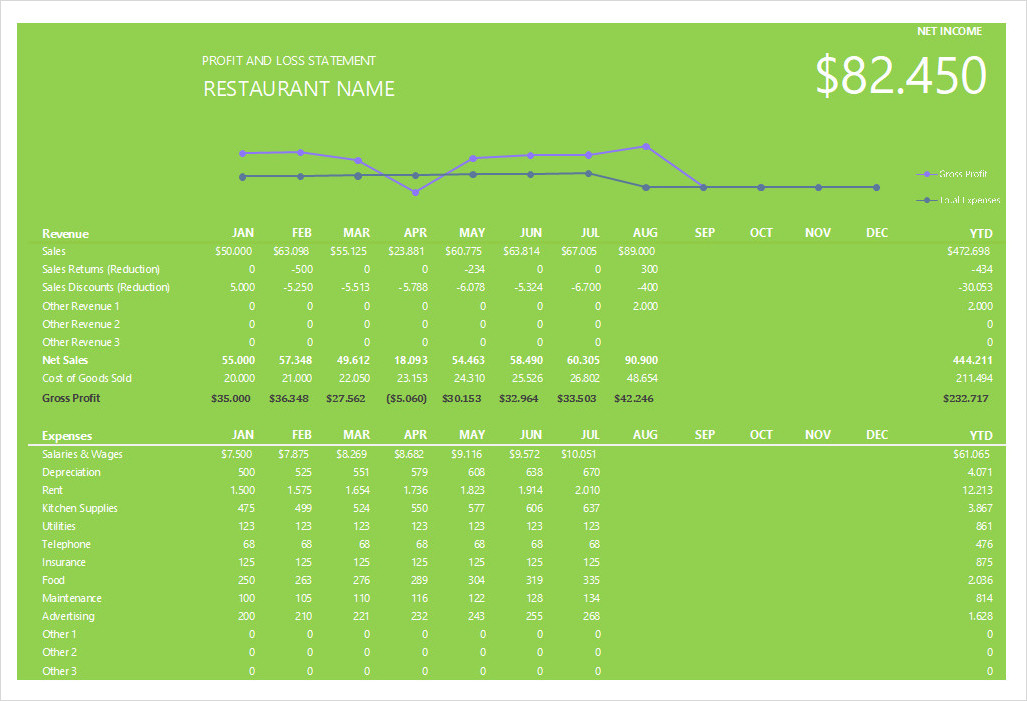

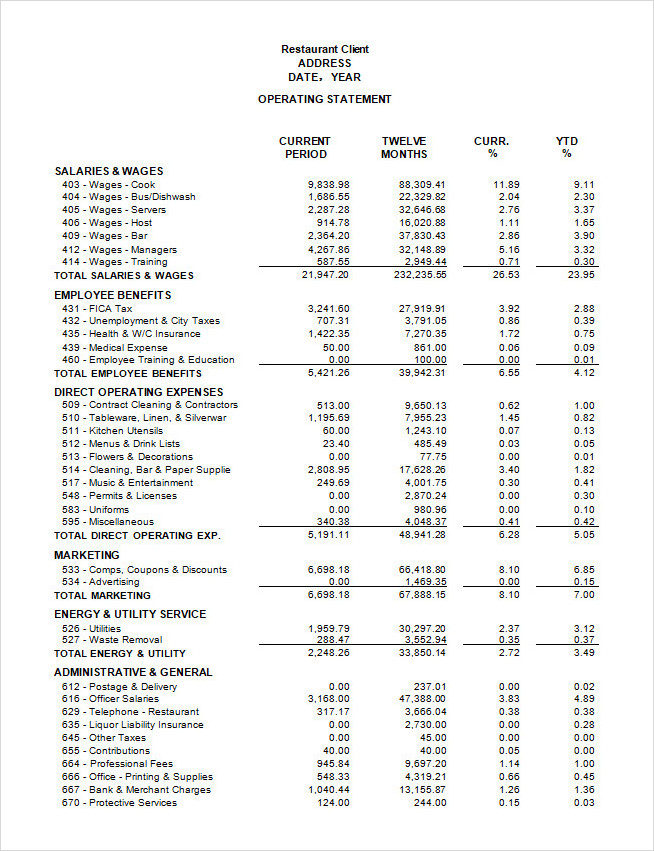

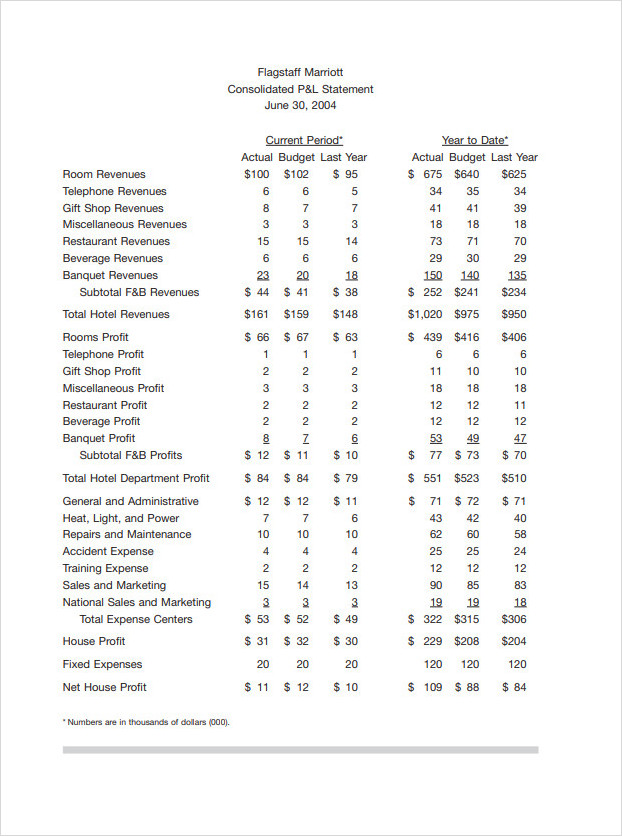

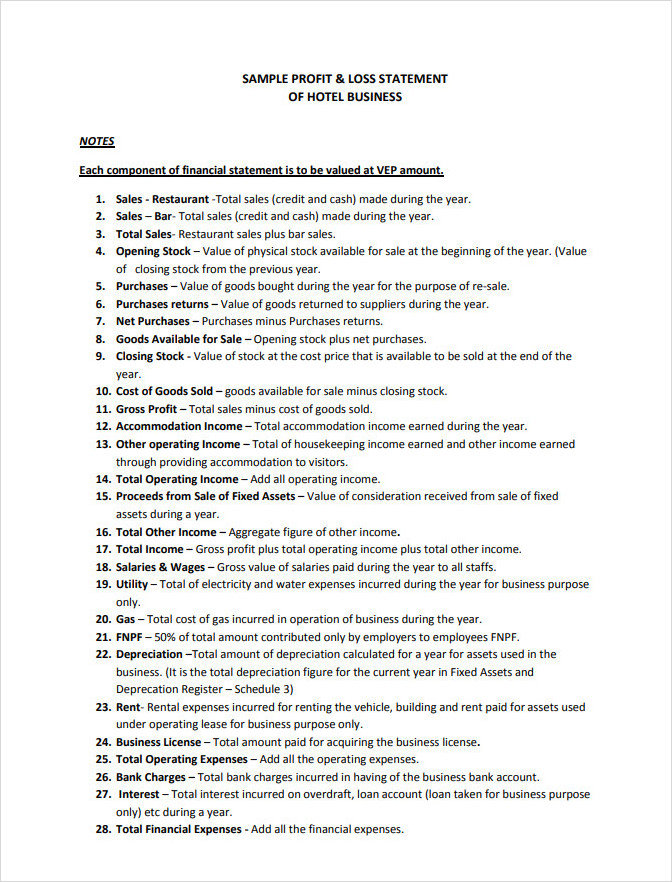

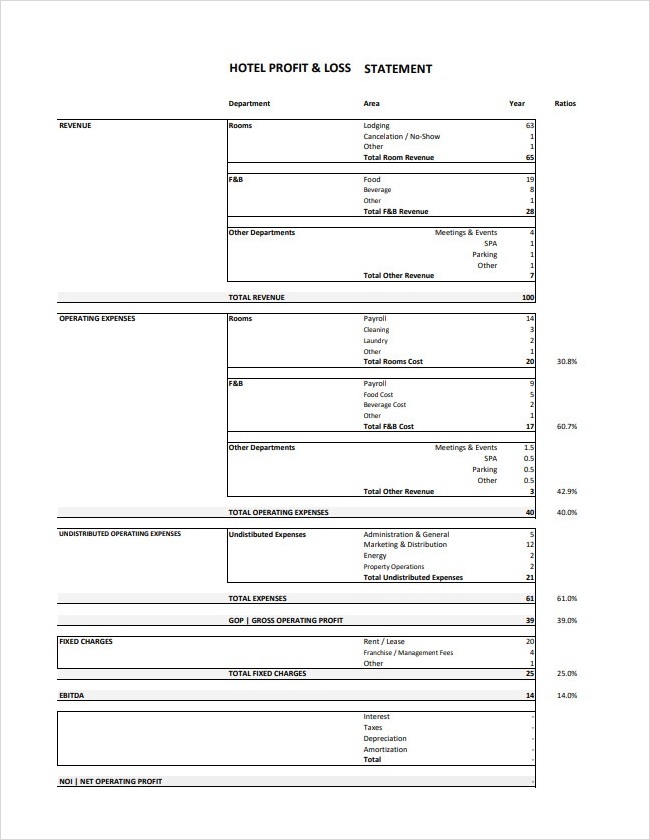

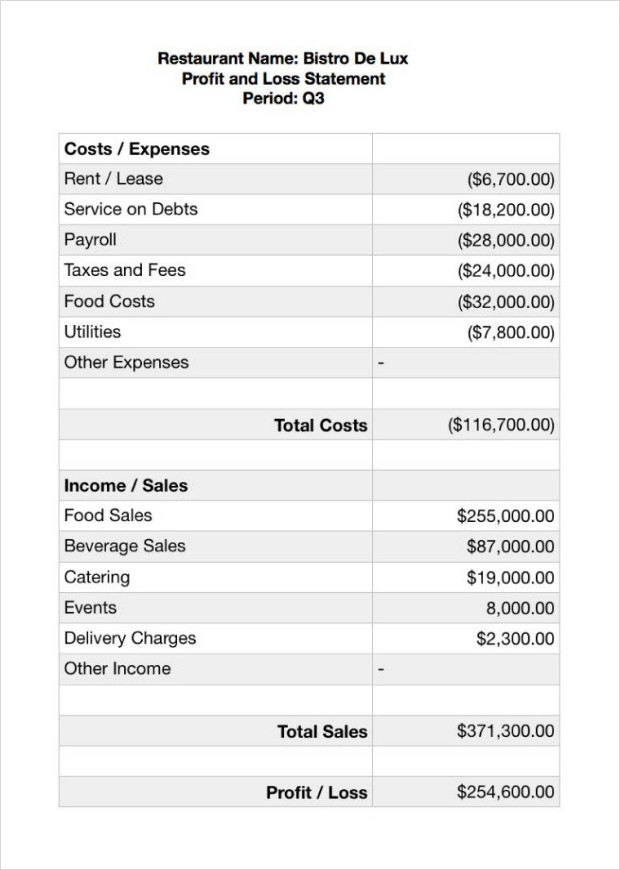

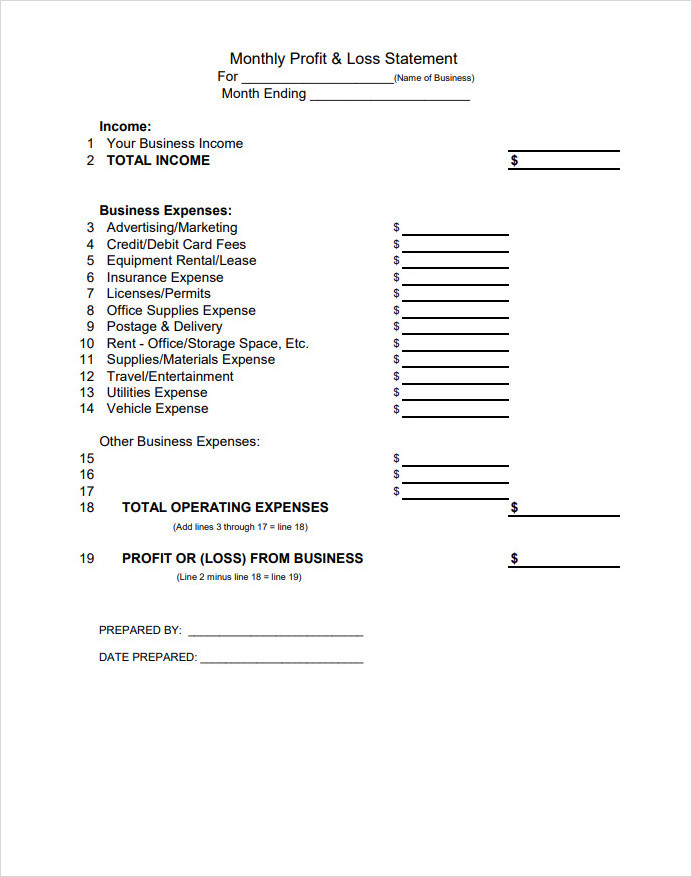

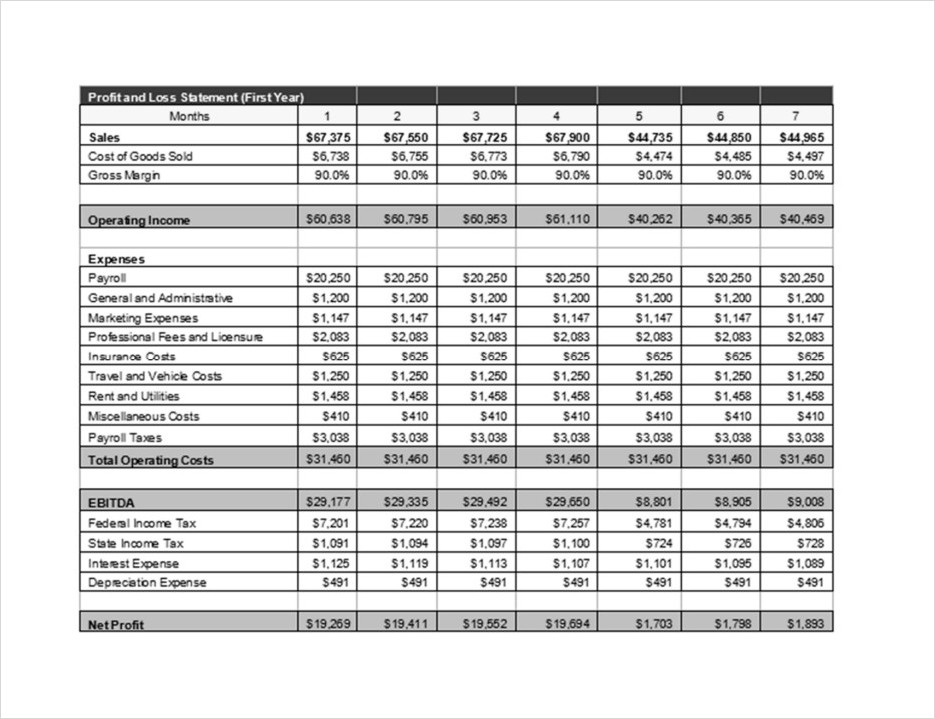

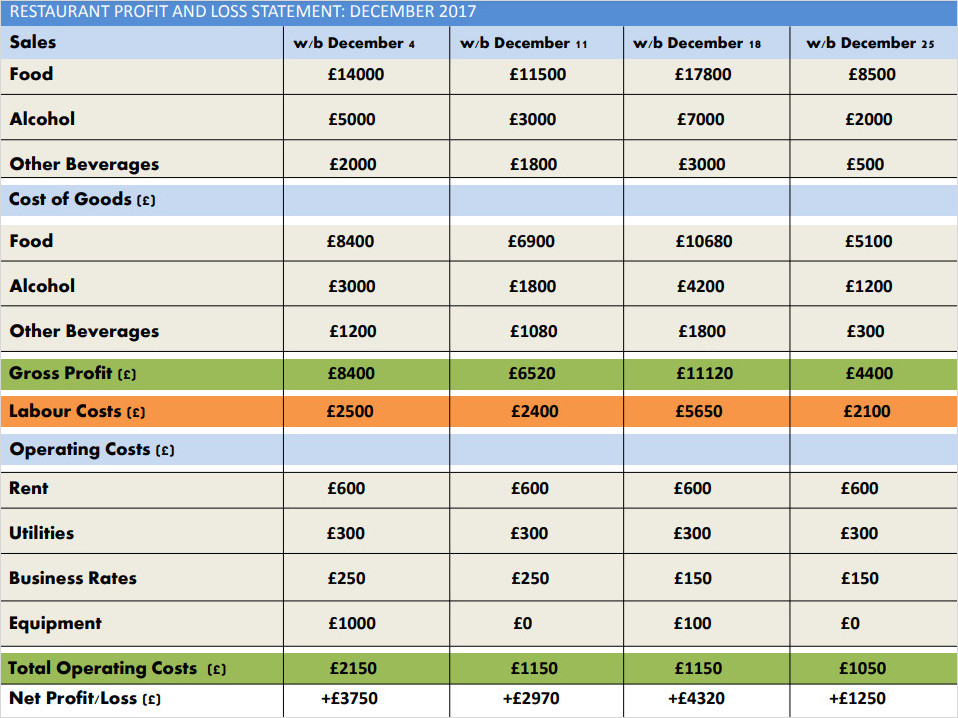

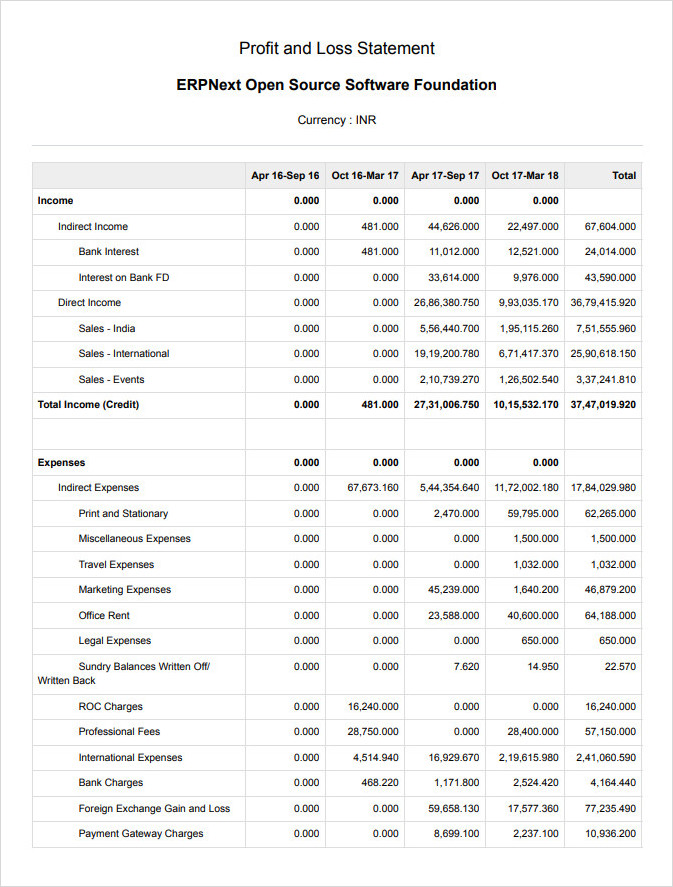

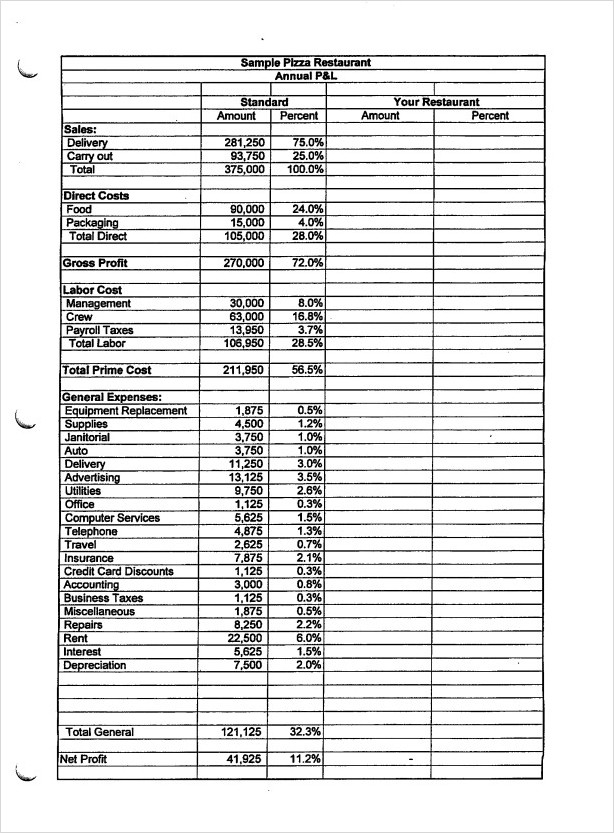

Examples of Restaurant Profit and Loss Statements

Here are some examples of key components that you may find in a restaurant profit and loss statement:

Tips for Successful Restaurant Profit and Loss Statements

Here are some tips to ensure that your restaurant profit and loss statement is accurate and effective:

- Regularly Update. Update the profit and loss statement regularly to reflect the most recent financial data.

- Be Detailed. Include all revenues and expenses, even small items, to get a comprehensive view of your financial performance.

- Compare Periods. Compare current statements with previous periods to track progress and identify trends.

- Seek Professional Help. Consider hiring a financial advisor or accountant to help you create and analyze the profit and loss statement.

- Use Software. Utilize accounting software to streamline the process of creating and analyzing profit and loss statements.

Restaurant Profit and Loss Statement Template – Download