Direct deposit has revolutionized how payments are made, offering a secure and convenient method for transferring funds directly into a recipient’s bank account. A crucial component of this process is the bank direct deposit form, which serves as authorization from the recipient to the paying entity for electronic fund transfers.

Let’s delve into the specifics of bank direct deposit forms and how they streamline the payment process.

What Is Direct Deposit?

Direct deposit is a payment method that electronically transfers funds into a recipient’s bank account, eliminating the need for physical checks. This process is commonly used by employers to pay their employees’ salaries, as well as by government agencies for benefits distribution.

Direct deposit offers numerous advantages, such as faster access to funds, increased security, and reduced administrative costs.

What is a Bank Direct Deposit Form?

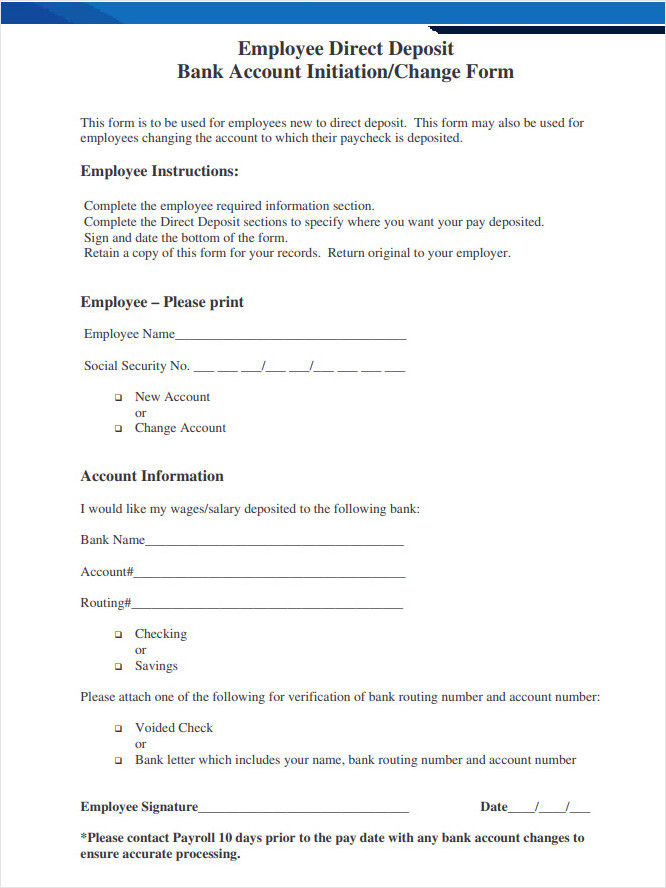

A bank direct deposit form is a document that authorizes a paying entity, such as an employer, to electronically deposit funds directly into a recipient’s bank account.

This form typically includes the recipient’s personal and banking details, such as account and routing numbers, along with a signed authorization statement. In some cases, the form may allow for splitting payments among multiple bank accounts.

Personal Information

The bank direct deposit form requires the recipient to provide their personal information, including their full name, address, and contact details. This information is used to verify the recipient’s identity and ensure accurate payment processing.

Banking Details

Recipients must also provide their bank account information, including the account number and routing number. This information is essential for directing the electronic funds transfer to the correct bank account securely.

Authorization Statement

The recipient is required to sign an authorization statement on the bank direct deposit form, giving consent for the paying entity to deposit funds into their bank account electronically. This signature serves as a legal agreement between the recipient and the paying entity, authorizing the electronic fund transfers.

Splitting Payments

Some bank direct deposit forms allow recipients to divide their payments among multiple bank accounts. This feature is beneficial for recipients who wish to allocate funds to different accounts for various financial purposes, such as savings, expenses, or investments.

Recurring Payments

Bank direct deposit forms can be used for setting up recurring payments, such as monthly salaries or benefits. Recipients can specify the frequency and amount of the payments, ensuring consistent and reliable income directly deposited into their bank accounts.

Flexibility

Bank direct deposit forms offer flexibility in payment options, allowing recipients to customize their preferences for receiving funds. Whether it’s a one-time payment or recurring deposits, recipients can easily manage their payment arrangements using the bank’s direct deposit form.

How Direct Deposit Works

Direct deposit works by electronically transferring funds from the paying entity’s bank account to the recipient’s bank account. The process begins with the recipient completing and submitting a bank direct deposit form to the paying entity, authorizing the electronic fund transfers.

The paying entity then initiates the transfer on the scheduled payment date, sending the funds directly to the recipient’s bank account.

Advantages and Disadvantages of Direct Deposit

Direct deposit offers numerous benefits for both paying entities and recipients, but it also comes with its own set of drawbacks. Understanding the advantages and disadvantages of direct deposit can help individuals make informed decisions about their payment preferences.

Advantages

- Convenience: Direct deposit provides recipients with a hassle-free way to receive payments directly into their bank accounts.

- Security: Electronic fund transfers are secure and protected, reducing the risk of lost or stolen paper checks.

- Efficiency: Direct deposit streamlines the payment process, ensuring timely and accurate fund transfers.

- Cost Savings: Businesses can save money on administrative costs associated with paper checks by transitioning to direct deposit.

Disadvantages

- Dependency: Recipients may become dependent on direct deposit and lose touch with traditional banking methods.

- Technical Issues: Electronic fund transfers may experience technical glitches or delays, impacting the timely receipt of payments.

- Privacy Concerns: Some individuals may be concerned about sharing their banking information for direct deposit purposes.

- Banking Fees: Recipients should be aware of any potential banking fees associated with receiving direct deposit payments.

What Do You Need for Direct Deposit?

To set up direct deposit, recipients must have the necessary information and complete the required steps for electronic fund transfers. Understanding what you need for direct deposit can help simplify the process and ensure seamless payment transactions.

Bank Account Information

Recipients need to provide their bank account details, including the account number and routing number, to set up direct deposit. This information is essential for directing the funds into the correct bank account securely.

Bank Direct Deposit Form

Recipients must complete and submit a bank direct deposit form to the paying entity, authorizing the electronic fund transfers. The form typically includes personal information, banking details, and a signed authorization statement.

Valid Identification

Recipients may be required to provide valid identification, such as a driver’s license or passport, to verify their identity when setting up direct deposit. This step ensures that the funds are deposited securely into the correct bank account.

Contact Information

Recipients should ensure that their contact information, such as address and phone number, is up to date with the paying entity. This information is used for communication purposes and to confirm the successful transfer of funds.

Payment Schedule

Recipients should be aware of the payment schedule for direct deposit, including the frequency and amount of the payments. Understanding the payment schedule helps recipients manage their finances effectively and anticipate incoming funds.

Banking Policies

Recipients should familiarize themselves with their bank’s policies and fees related to direct deposit. It’s important to understand any requirements or restrictions imposed by the bank to ensure smooth and hassle-free electronic fund transfers.

How Long Does Direct Deposit Take?

The time it takes for direct deposit to be processed and funds to be available in the recipient’s bank account can vary depending on various factors.

Direct deposit processing time typically ranges from one to three business days, depending on the paying entity and the recipient’s bank. Once the electronic fund transfer is initiated, it may take a few days for the funds to be processed and deposited into the recipient’s account.

Direct Deposit for Business Owners

For business owners, direct deposit offers a streamlined payment solution for employees and vendors. By setting up direct deposit for payroll and accounts payable, business owners can save time, reduce costs, and improve payment efficiency.

Employee Payroll

Business owners can use direct deposit to pay employees’ salaries electronically. By collecting employees’ bank account information and setting up direct deposit payments, business owners can ensure timely and secure salary deposits.

Vendor Payments

Business owners can also use direct deposit to pay vendors and suppliers for goods and services. By collecting vendors’ banking details and setting up electronic fund transfers, business owners can streamline accounts payable processes and improve vendor relationships.

Cost Savings

Direct deposit offers cost savings for business owners by reducing administrative expenses associated with paper checks. By transitioning to electronic fund transfers, business owners can save money on check printing, postage, and processing fees.

Efficiency

Direct deposit improves payment efficiency for business owners by eliminating the time-consuming task of issuing and mailing paper checks. Electronic fund transfers are processed quickly, ensuring that employees and vendors receive their payments on time.

Security

Direct deposit provides enhanced security for business owners and their recipients by reducing the risk of lost or stolen paper checks. Electronic fund transfers are encrypted and secure, protecting sensitive financial information and preventing fraud.

Direct Deposit FAQs

Q: Is direct deposit safe?

A: Yes, direct deposit is a secure payment method that encrypts electronic fund transfers to protect sensitive financial information. Recipients can rest assured that their payments are deposited securely into their bank accounts.

Q: How do I sign up for direct deposit?

A: To sign up for direct deposit, recipients must obtain a bank direct deposit form from the paying entity, fill out their personal and banking information, sign the authorization statement, and submit the form for processing.

Q: Can I split my direct deposit payments among multiple accounts?

A: Some bank direct deposit forms allow recipients to split their payments among multiple bank accounts. This feature is beneficial for managing funds for different financial purposes, such as savings, expenses, or investments.

Q: How long does direct deposit take to process?

A: Direct deposit processing time typically ranges from one to three business days, depending on the paying entity and the recipient’s bank. Recipients can anticipate when their funds will be available in their bank accounts based on the payment schedule.

Q: Are there any fees associated with direct deposit?

A: Most banks do not charge fees for receiving direct deposit payments. However, recipients should be aware of any potential banking fees related to maintaining a bank account or receiving electronic fund transfers.

Q: Can I cancel direct deposit once I’ve signed up?

A: Recipients can cancel direct deposit by notifying the paying entity and providing updated banking information for future payments. It’s essential to communicate any changes to avoid payment processing errors.

Bank Direct Deposit Form

A bank direct deposit form is a convenient document that authorizes an employer or payer to send funds directly to an individual’s bank account. It ensures secure, timely, and paperless payments while reducing errors and delays.

To make setting up direct deposits simple and efficient, use our free bank direct deposit form and manage payments with ease!

Bank Direct Deposit Form – Download