Shareholders’ agreements are crucial documents that outline and regulate the relationship between a company’s shareholders and the company itself. These agreements establish the rights and obligations of the shareholders, govern the management and operation of the company, and protect the interests of both the business and its investors.

By proactively addressing potential issues and providing clear procedures for decision-making, shareholder agreements help prevent disputes, especially for minority shareholders.

What is a Shareholders Agreement?

A shareholders’ agreement is a private contract that sets out the rights and obligations of the shareholders of a company. It is a legally binding document that governs the relationship between the shareholders and the company, as well as among the shareholders themselves.

This agreement supplements the company’s constitution and provides additional provisions tailored to the specific needs and circumstances of the shareholders.

Why is a Shareholders Agreement Important?

A shareholders’ agreement is essential for several reasons:

Protection of Minority Shareholders

Minority shareholders often have limited influence in a company’s decision-making process. A shareholders’ agreement can provide safeguards to protect the interests of minority shareholders and ensure their rights are respected. This protection may include provisions for veto rights, drag-along rights, tag-along rights, and preemptive rights to protect minority shareholders from being marginalized or excluded from important decisions.

Clarification of Roles and Responsibilities

The agreement clearly defines the roles and responsibilities of each shareholder, outlining their duties and obligations towards the company. By establishing clear expectations for each shareholder, the agreement helps prevent misunderstandings and conflicts that may arise from differing interpretations of roles and responsibilities. This clarity promotes transparency and accountability within the company.

Conflict Resolution

In the event of disputes or disagreements among shareholders, the agreement provides mechanisms for resolving conflicts in an orderly and efficient manner. These mechanisms may include arbitration, mediation, or buyout provisions to facilitate the resolution of disputes without resorting to costly and time-consuming litigation. By outlining the process for resolving conflicts, the agreement helps maintain the stability and continuity of the company’s operations.

Decision-Making Processes

Shareholders’ agreements establish clear procedures for making important decisions, such as appointing directors, approving financial statements, or declaring dividends. These decision-making processes help ensure that key decisions are made in the best interests of the company and its shareholders. By formalizing the decision-making structure, the agreement reduces ambiguity and minimizes the risk of disputes arising from conflicting interpretations of decision-making authority.

Key Elements of a Shareholders Agreement

Shareholders’ agreements typically include the following key elements:

Share Ownership

Details of each shareholder’s ownership stake in the company, including the number of shares held and any restrictions on transferring shares. The agreement may specify the rights and privileges associated with each class of shares, as well as any conditions for issuing new shares or transferring existing shares. By clarifying ownership rights, the agreement helps prevent disputes over share ownership and control of the company.

Decision-Making Processes

Procedures for making key decisions, such as appointing directors, approving financial statements, or declaring dividends. The agreement may outline the voting rights of each shareholder, the quorum required for decision-making, and the process for resolving deadlocks or disagreements among shareholders. By establishing clear decision-making processes, the agreement ensures that important decisions are made transparently and efficiently.

Management of the Company

Roles and responsibilities of the directors and shareholders in managing the day-to-day operations of the company. The agreement may specify the powers and duties of the board of directors, the appointment and removal of directors, and the delegation of management authority. By defining the management structure, the agreement helps prevent conflicts over management decisions and promotes effective governance of the company.

Dispute Resolution

Mechanisms for resolving disputes among shareholders, such as mediation, arbitration, or buyout provisions. The agreement may outline the process for resolving disputes, including the selection of a neutral third party to facilitate negotiations or make binding decisions. By providing clear guidelines for dispute resolution, the agreement helps prevent conflicts from escalating and damaging the company’s reputation or operations.

How to Draft a Shareholders Agreement

When drafting a shareholders’ agreement, consider the following steps:

Identify Key Issues

Determine the key issues to be addressed in the agreement, such as ownership structure, decision-making processes, and dispute resolution mechanisms. Conduct a thorough review of the company’s governance structure, existing agreements, and potential areas of conflict among shareholders. By identifying key issues early in the drafting process, you can create a comprehensive agreement that addresses the specific needs and concerns of all parties involved.

Consult Legal Advice

Seek advice from a legal professional with experience in corporate law to ensure the agreement complies with relevant laws and regulations. Legal advisors can help you navigate complex legal issues, draft clear and enforceable provisions, and protect your interests as a shareholder. By consulting with legal experts, you can avoid costly mistakes and ensure that your agreement is legally sound and effective.

Customize the Agreement

Tailor the agreement to meet the specific needs and circumstances of the shareholders, taking into account factors such as ownership percentages, voting rights, and exit strategies. Consider the unique characteristics of your company, industry trends, and potential future scenarios that may impact your agreement. By customizing the agreement to reflect your individual circumstances, you can create a document that is relevant, practical, and sustainable for the long term.

Review and Revise

Once the agreement is drafted, review it carefully to ensure that it accurately reflects the intentions and expectations of all parties involved. Consider seeking feedback from other shareholders, legal advisors, or industry experts to identify any potential gaps or ambiguities in the agreement. Revise the agreement as needed to address any concerns or incorporate new information that may arise during the review process. By conducting a thorough review and revision, you can finalize a shareholders’ agreement that is comprehensive, balanced, and tailored to your specific needs.

Tips for Negotiating a Shareholders Agreement

When negotiating a shareholders’ agreement, keep the following tips in mind:

Communicate Openly

Maintain open and honest communication with other shareholders to ensure all parties are on the same page. Discuss your expectations, concerns, and priorities openly and transparently to build trust and consensus among shareholders. By fostering a culture of open communication, you can create a positive negotiation environment that promotes collaboration and mutual understanding.

Seek Compromise

Be willing to compromise on certain issues to reach a mutually beneficial agreement that protects the interests of all shareholders. Prioritize your objectives and be prepared to make concessions on less critical issues to achieve a balanced and fair agreement. By demonstrating flexibility and willingness to compromise, you can build goodwill and facilitate productive negotiations that lead to a successful outcome for all parties involved.

Focus on the Long-Term

Consider the long-term implications of the agreement and how it will impact the company’s growth and success. Align your interests with the strategic goals and objectives of the company to ensure that the agreement supports its long-term sustainability and competitiveness. By focusing on the big picture and thinking beyond immediate concerns, you can negotiate an agreement that positions the company for future growth and prosperity.

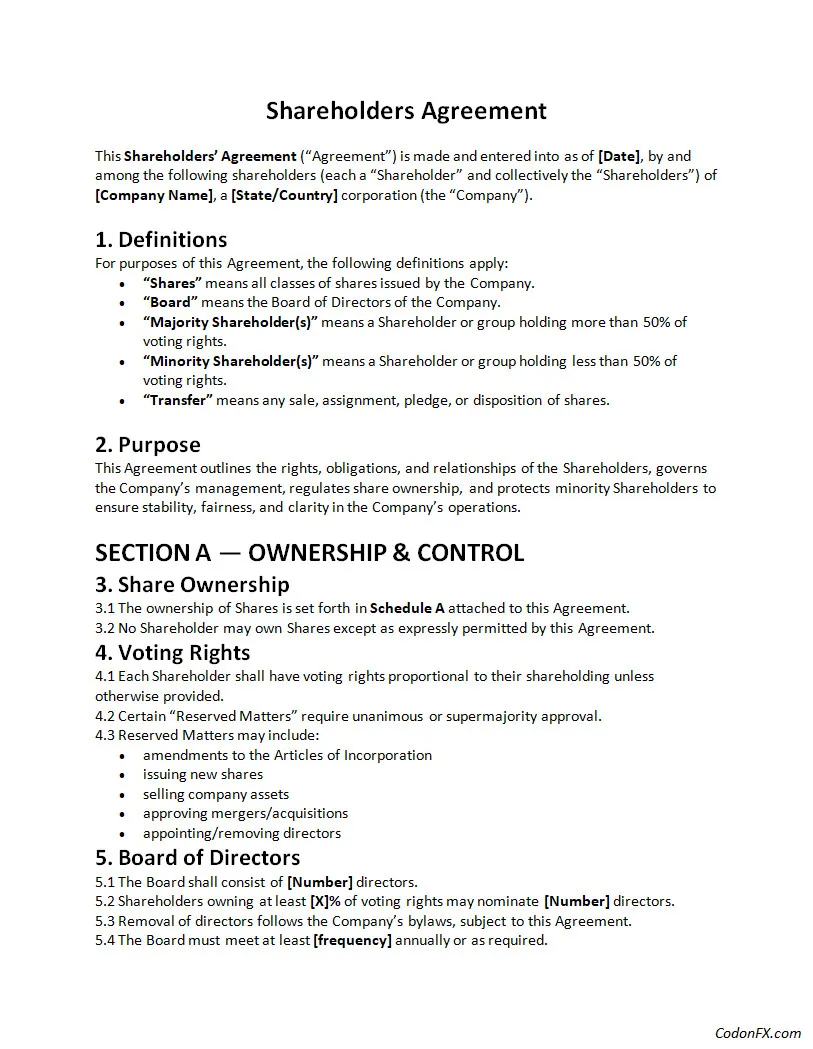

Shareholders Agreement Template

A Shareholders Agreement helps establish clear rules, rights, and responsibilities among the owners of a company. It outlines decision-making procedures, share distribution, voting rights, dispute resolution methods, profit sharing, and what happens if a shareholder wants to leave or sell their shares. By using a structured template, you can prevent misunderstandings, protect each shareholder’s interests, and ensure the business operates smoothly and transparently.

Download our Shareholders Agreement Template today to create a clear, professional agreement that safeguards your company’s stability and your shareholders’ rights.

Shareholders Agreement Template – DOWNLOAD