What is a Small Business Balance Sheet?

A small business balance sheet is a critical financial document that provides a snapshot of your company’s financial health at a specific point in time. It is a summary of what your business owns (assets), what it owes (liabilities), and the difference between the two (equity).

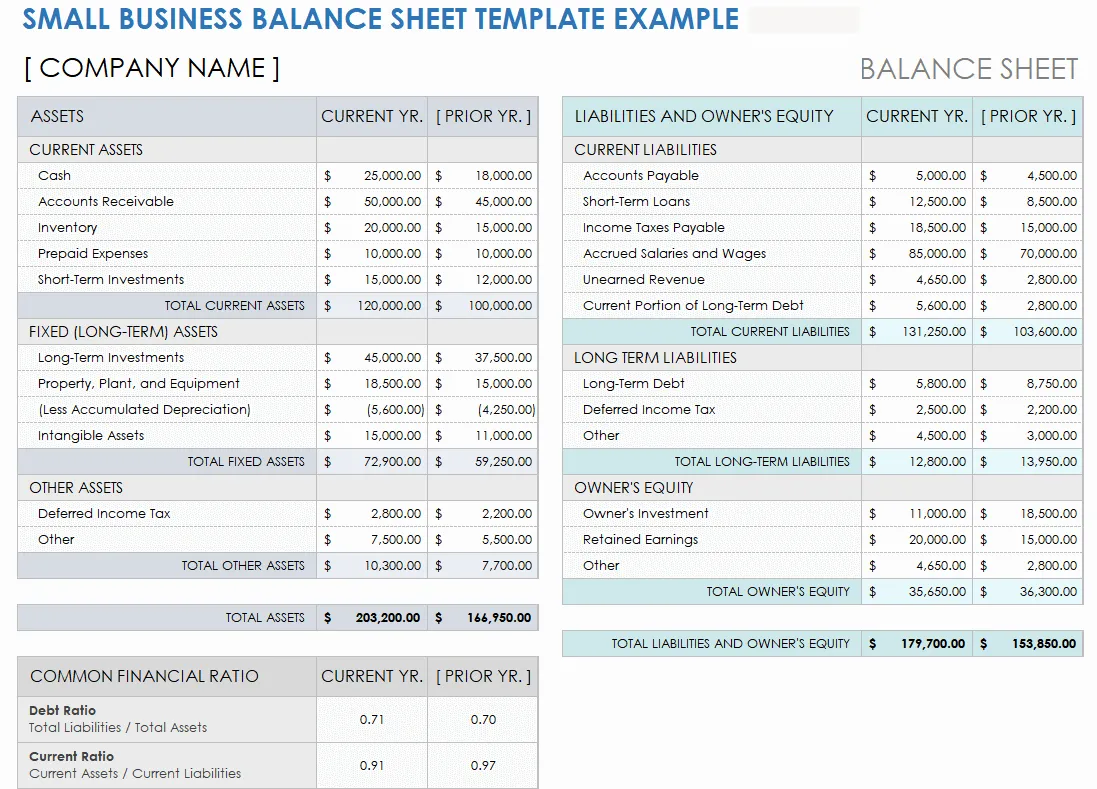

Assets include cash, inventory, equipment, and accounts receivable, while liabilities encompass loans, accounts payable, and accrued expenses. Equity represents the owner’s investment in the business after deducting liabilities from assets.

Why is a Balance Sheet Important?

A balance sheet is a vital financial tool that serves several important functions for small businesses:

Financial Health Assessment

One of the primary reasons to create a balance sheet is to assess the financial health of your small business. By providing a detailed overview of your assets, liabilities, and equity, a balance sheet allows you to understand your company’s financial standing at a specific point in time. This information helps you identify strengths, weaknesses, and areas for improvement in your business’s financial management.

Decision-Making Support

A balance sheet plays a crucial role in supporting informed decision-making for small business owners. By analyzing the financial data presented on the balance sheet, you can make strategic decisions about investments, expenses, and growth opportunities. Whether you are considering purchasing new equipment, expanding your operations, or hiring additional staff, a balance sheet provides the financial information needed to make sound choices.

Tax Compliance

Small businesses are required to file taxes accurately and on time to comply with regulatory requirements. A balance sheet is an essential document for tax preparation, as it provides detailed information about your business’s financial position. By including the data from your balance sheet in your tax filings, you can ensure compliance with tax laws and avoid potential penalties or audits.

Loan Approval

When seeking financing or loans for your small business, lenders will often request a balance sheet to assess your creditworthiness and ability to repay the borrowed funds. A well-prepared balance sheet demonstrates to lenders that your business has sufficient assets to cover liabilities and is in a strong financial position. This can increase your chances of securing the funding needed to support business growth and expansion.

Investor Attraction

Small businesses looking to attract investors or potential buyers can benefit from having a detailed balance sheet. Investors use balance sheets to evaluate the financial stability, performance, and growth potential of a company. By presenting a clear and accurate balance sheet, you can showcase the value of your business and attract potential investors who are interested in supporting your growth initiatives.

How to Create a Balance Sheet for a Small Business

Creating a balance sheet for your small business involves several steps to ensure accuracy and completeness:

Gather Financial Information

Start by collecting all relevant financial data for your small business, including details about your assets, liabilities, and equity. This may involve reviewing bank statements, financial reports, invoices, and other financial records to compile the necessary information for your balance sheet.

Organize Assets and Liabilities

Once you have gathered the financial information, organize your assets and liabilities into separate categories on your balance sheet. List your assets in order of liquidity, from most liquid (cash) to least liquid (long-term investments), and categorize your liabilities based on their due dates and obligations to external parties.

Calculate Equity

After listing your assets and liabilities, calculate the equity of your small business by subtracting total liabilities from total assets. This calculation will provide you with the owner’s equity or net worth of the business, indicating the value that belongs to the owner after all liabilities are settled.

Review and Analyze

Once you have created your balance sheet, take the time to review and analyze the financial data presented. Look for any discrepancies, errors, or inconsistencies that may require correction. Analyze trends in your assets, liabilities, and equity over time to identify areas of strength or weakness in your business’s financial performance.

Seek Professional Help

If you are unsure about creating a balance sheet or interpreting the financial data accurately, consider seeking assistance from a financial professional, such as an accountant or bookkeeper. These experts can provide guidance on preparing a comprehensive balance sheet and offer insights into how to use the information effectively for financial planning and decision-making.

Tips for Growing a Successful Small Business

Building and growing a successful small business requires strategic planning, financial management, and a focus on sustainable growth. Consider the following tips to help your small business thrive:

Monitor Cash Flow

Managing cash flow effectively is essential for the financial health of your small business. Monitor your inflows and outflows of cash regularly to ensure you have enough liquidity to cover expenses, invest in growth opportunities, and sustain operations during lean periods.

Set Financial Goals

Establish clear financial goals for your small business and create a budget to track your progress toward achieving these goals. Whether you aim to increase revenue, reduce expenses, or expand into new markets, setting milestones and targets can help keep your business on track for success.

Invest in Technology

Embracing technology can streamline operations, improve efficiency, and enhance the customer experience for your small business. Consider investing in digital tools, software solutions, and automation to optimize processes, reduce costs, and stay competitive in the market.

Build Relationships

Cultivating strong relationships with customers, suppliers, and business partners is crucial for the growth and success of your small business. Focus on providing exceptional customer service, communicating effectively with suppliers, and collaborating with strategic partners to foster loyalty and support long-term business growth.

Stay Flexible

The business landscape is constantly evolving, and small businesses need to be adaptable and flexible to respond to changing market conditions and customer needs. Stay agile in your approach, be open to new opportunities, and be willing to pivot your business strategy as needed to stay ahead of the competition.

Educate Yourself

Continuous learning and education are essential for small business owners to stay informed about industry trends, best practices, and emerging technologies. Take advantage of online resources, workshops, seminars, and networking events to expand your knowledge, sharpen your skills, and stay ahead of the curve in your industry.

Small Business Balance Sheet Template – DOWNLOAD