Regarding tax season, having all your documents in order is essential. One important document that you need to keep track of is the tax receipt. A tax receipt is a record that verifies a transaction, either the receipt of money or the payment of money, which can be used to support claims of income or deductions.

In this article, we will explore what a tax receipt is, why it is important, how to create one, and provide some examples and tips for successful tax receipt management.

What is a Tax Receipt?

A tax receipt is a document that serves as proof of a financial transaction, such as the payment of taxes or the receipt of income. It provides the necessary information to support claims for income or deductions on your tax return. A tax receipt typically includes details such as the date of the transaction, the amount of money involved, the names of the parties involved, and any additional relevant information.

Tax receipts are convenient because they can be easily generated and printed from a computer or mobile device. This allows individuals and businesses to keep a record of their financial transactions in an organized and accessible manner.

Why are Tax Receipts Important?

Tax receipts are important for several reasons:

- Record Keeping: Tax receipts provide a clear and organized record of your financial transactions, which is essential for accurate tax reporting.

- Audit Support: If you are ever audited by the tax authorities, having proper documentation in the form of tax receipts can help support your claims and avoid penalties.

- Claiming Deductions: Certain expenses can be deducted from your taxable income, but you need to provide proof of these expenses in the form of receipts. Tax receipts make it easy to keep track of these deductions.

- Financial Planning: Keeping track of your expenses and income through tax receipts can help you understand your financial situation and make better financial decisions.

How to Create a Tax Receipt

Creating a tax receipt is relatively simple. Here’s a step-by-step guide to help you get started:

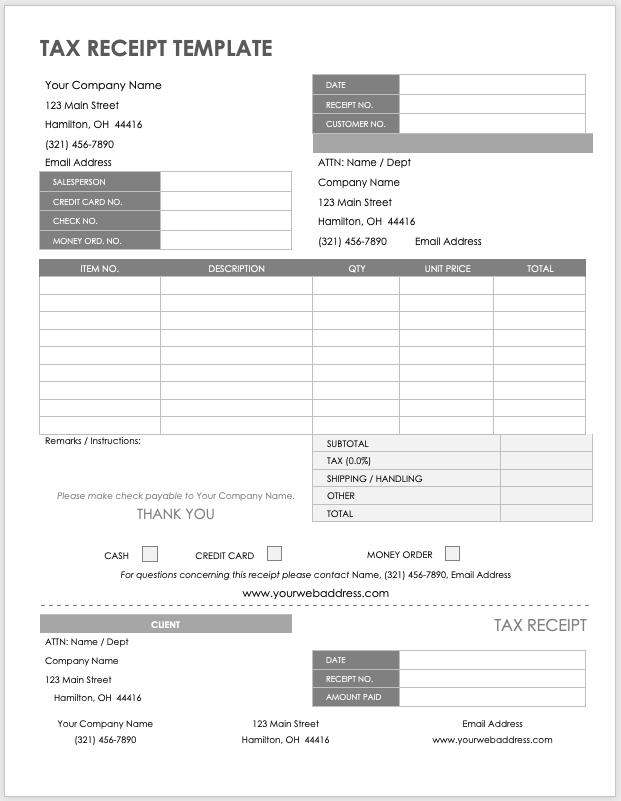

- Choose a Template: There are many free templates available online that you can use to create your tax receipt. Choose one that suits your needs and download it to your computer or mobile device.

- Fill in the Details: Open the template in a word processing or spreadsheet program and fill in the necessary details, such as the date of the transaction, the amount of money involved, and the names of the parties involved.

- Add Additional Information: Depending on your specific needs, you may need to add additional information to the tax receipt. This could include details about the nature of the transaction, any applicable tax codes, or any other relevant information.

- Review and Print: Once you have filled in all the necessary information, review the tax receipt for accuracy. Make any necessary corrections and then print the receipt.

Remember to keep a digital copy of the tax receipt for your records. This can be done by saving the document on your computer or by taking a screenshot and storing it securely.

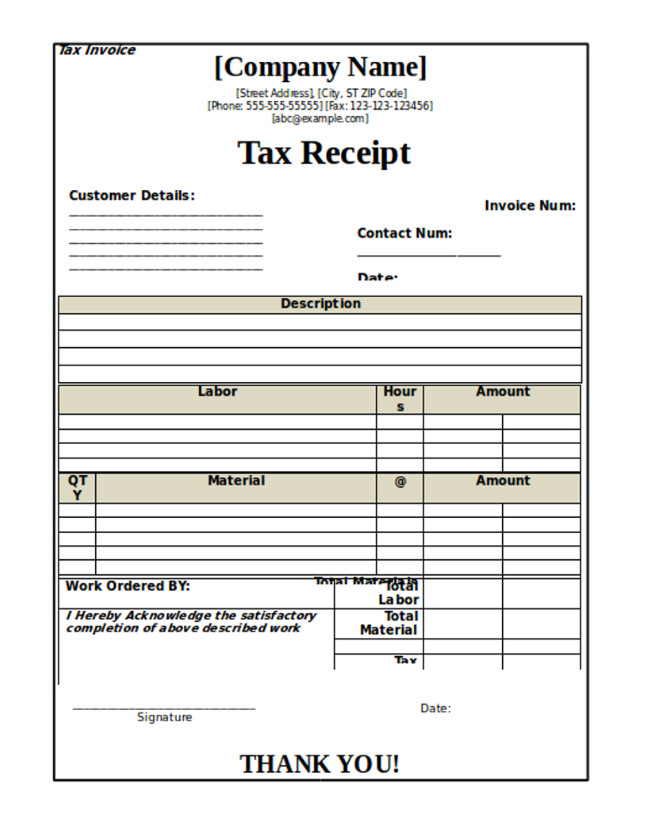

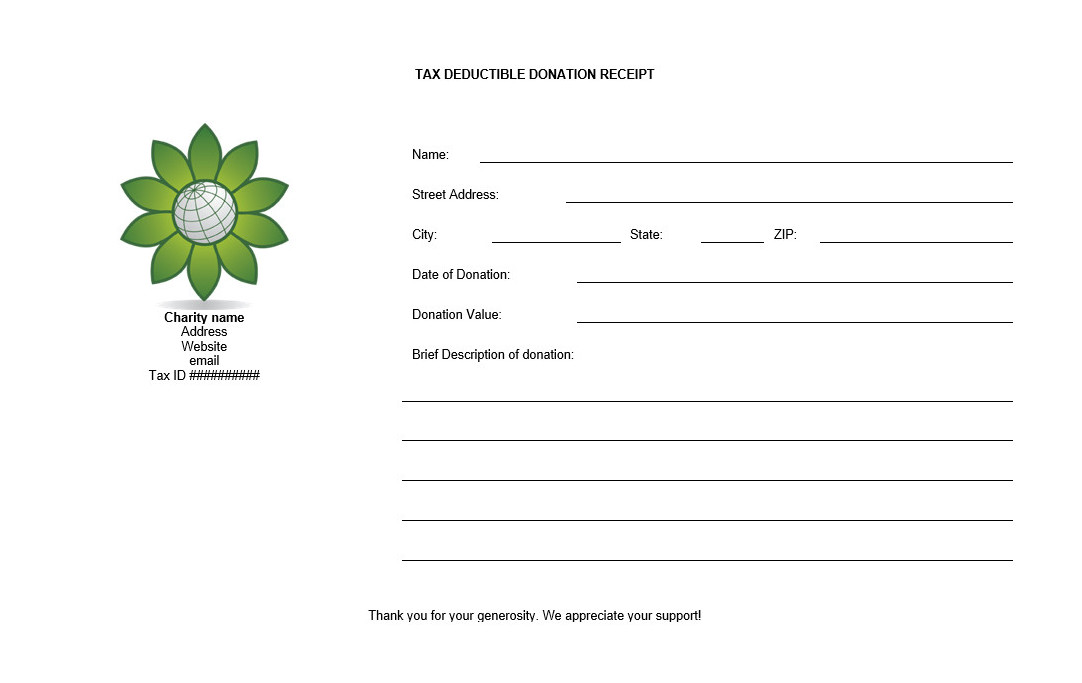

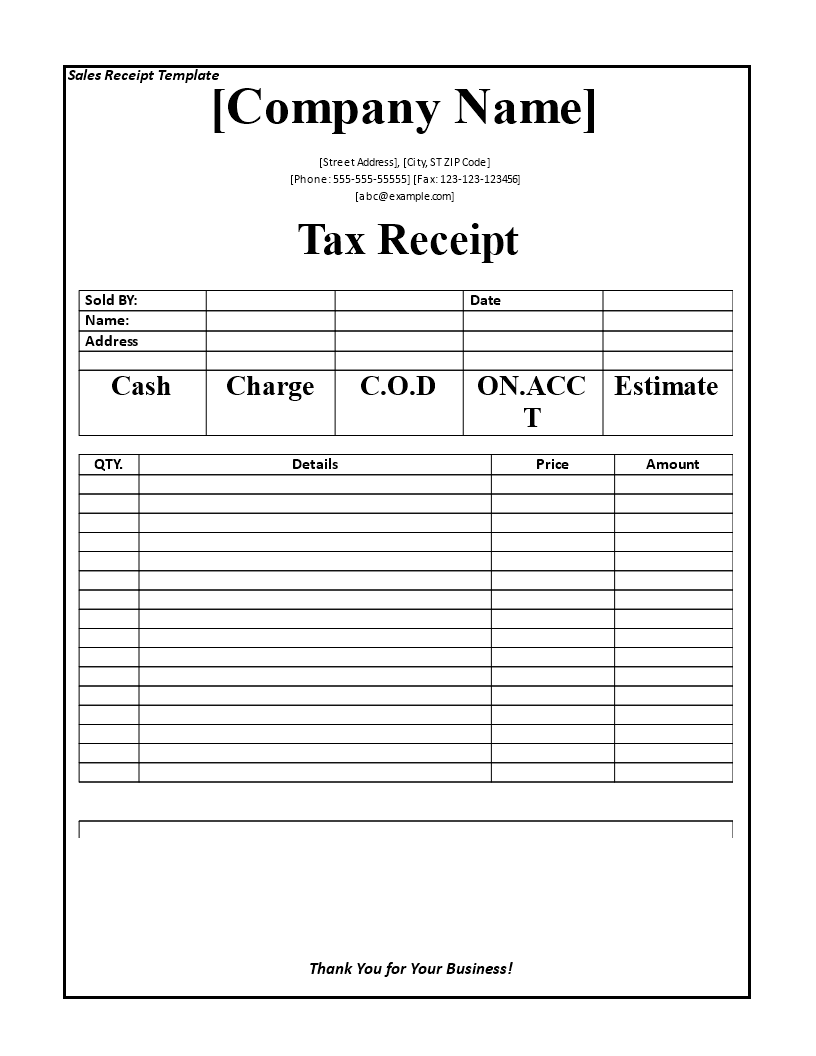

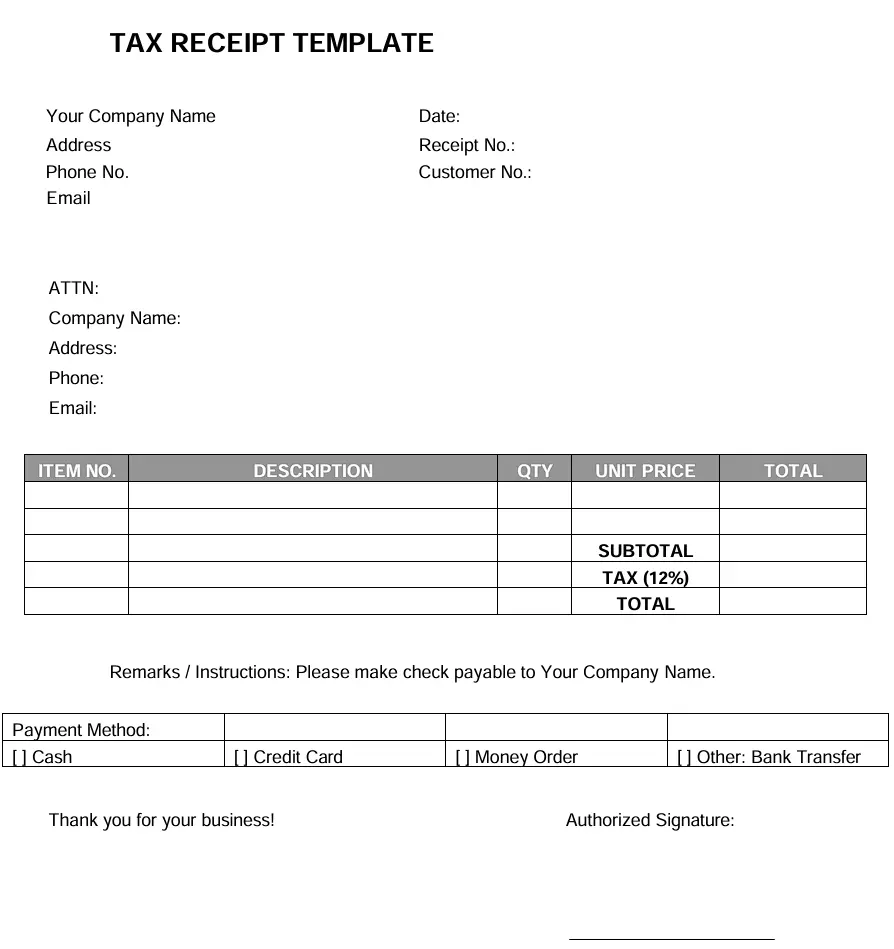

Examples of Tax Receipts

Here are a few examples of tax receipts:

Tips for Successful Tax Receipt Management

Managing your tax receipts effectively can save you time and stress during tax season. Here are some tips to help you stay organized:

- Create a System: Develop a system for organizing your tax receipts, whether it’s using physical folders or digital folders on your computer.

- Label and Categorize: Clearly label each receipt with relevant information, such as the date and purpose of the transaction. Categorize your receipts based on the type of expense or income.

- Keep Digital Copies: In addition to printing physical copies, keep digital copies of your tax receipts. This provides an extra layer of backup and makes it easier to search for specific receipts.

- Regularly Review and Update: Set aside time regularly to review your tax receipts and make any necessary updates or corrections. This will help keep your records accurate and up to date.

- Consult with a Tax Professional: If you’re unsure about any aspect of tax receipt management or need assistance with your taxes, consider consulting with a tax professional who can provide guidance and advice.

By following these tips, you can ensure that your tax receipts are well-organized and easily accessible, making tax season a smooth and stress-free process.

Conclusion

A tax receipt is a valuable tool for individuals and businesses alike. It provides a record of financial transactions that can support claims for income or deductions on your tax return. By understanding what a tax receipt is, why it is important, and how to create and manage one effectively, you can navigate tax season with confidence and peace of mind.

Tax Receipt Template – Download