Regarding international trade, import financing plays a crucial role in enabling businesses to procure goods and expand their operations. One financial instrument that facilitates import financing is the trust receipt.

This document allows importers to take possession of goods before fully paying for them, acting as a short-term loan against the sale of those goods.

What is a Trust Receipt?

A trust receipt is a financial instrument primarily used in international trade to facilitate import financing. It allows importers to obtain possession of goods from a bank or lender before making full payment. The trust receipt acts as a form of security for the lender, ensuring that the imported goods are used appropriately and sold to generate funds for repayment.

Typically, the importer is required to sign a trust receipt agreement with the lender, which outlines the terms and conditions of the transaction. The agreement specifies the details of the goods, the amount financed, the repayment schedule, and any other relevant terms. The trust receipt is a legally binding document that protects the interests of both the importer and the lender.

Why Use a Trust Receipt?

The use of a trust receipt offers several benefits for importers and lenders alike:

- Importers: By utilizing a trust receipt, importers can take possession of goods and start selling them without having to make immediate full payment. This allows them to generate revenue and cover the cost of the goods, making it an effective tool for managing cash flow.

- Lenders: Lenders benefit from the trust receipt as it provides them with security against the financed goods. If the importer fails to repay the loan, the lender can reclaim the goods and sell them to recover their funds. This reduces the risk associated with import financing.

How to Obtain a Trust Receipt?

If you are an importer looking to obtain a trust receipt, here are the steps involved:

- Identify a lender or financial institution that offers import financing services and specializes in trust receipts. It is important to choose a reputable and reliable lender.

- Submit the necessary documents to the lender, including invoices, purchase orders, and any other supporting documentation related to the import transaction.

- Negotiate the terms and conditions of the trust receipt agreement with the lender. This includes the amount financed, repayment schedule, interest rate, and other relevant terms.

- Once the agreement is finalized, sign the trust receipt and take possession of the goods.

- Ensure that you comply with the terms of the trust receipt agreement, including making timely repayments and using the goods as intended.

- Once the loan is fully repaid, you will gain full ownership of the goods.

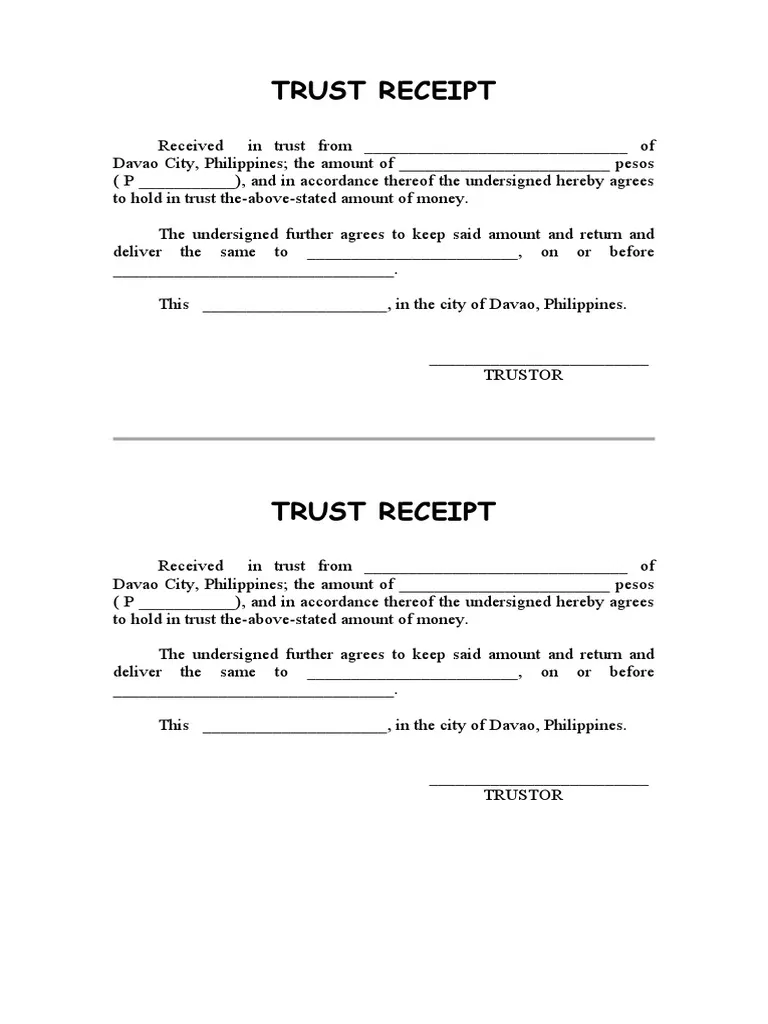

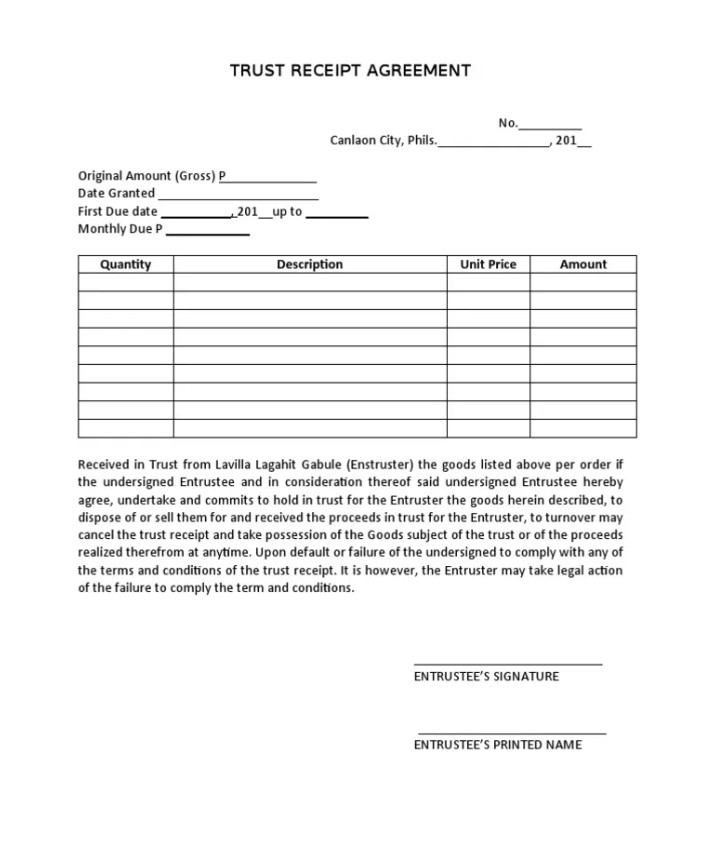

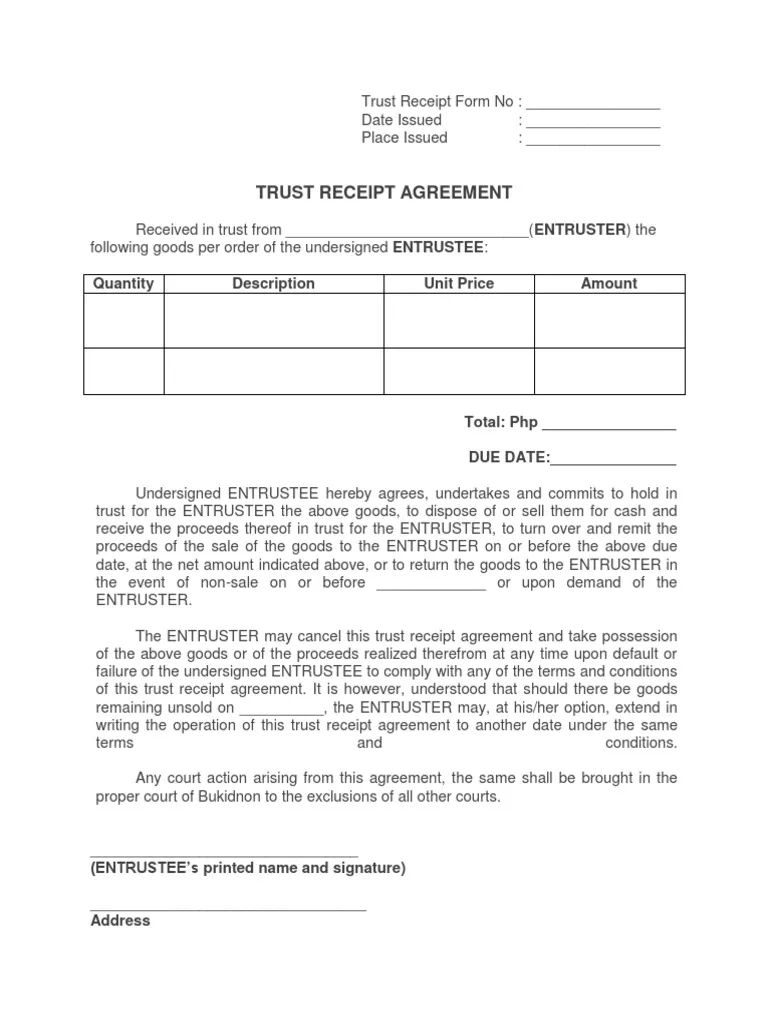

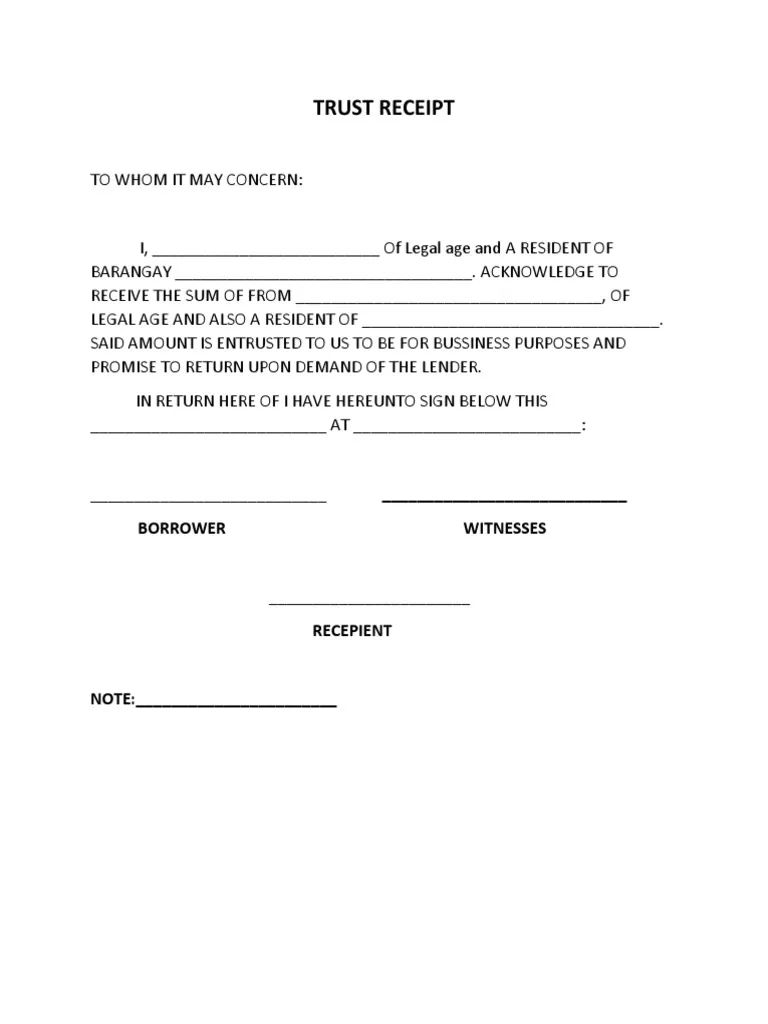

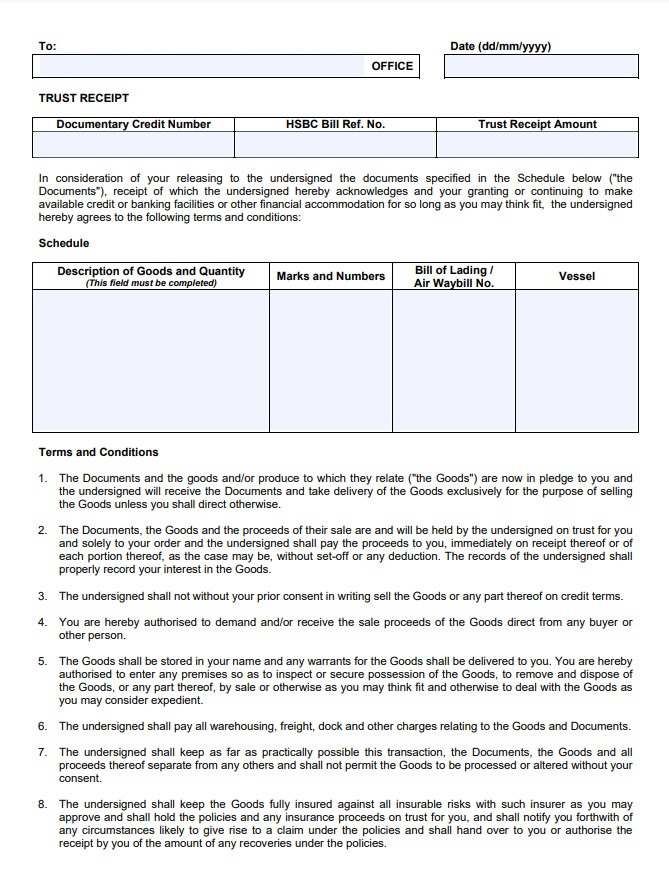

Examples of Trust Receipts

To provide a better understanding of how a trust receipt looks, here are a few examples:

Tips for Successful Trust Receipt Transactions

Here are some tips to ensure a successful trust receipt transaction:

- Choose the right lender: Select a lender with experience in import financing and a solid reputation in the industry.

- Understand the terms: Carefully review and understand the terms and conditions of the trust receipt agreement before signing.

- Manage cash flow: Use the imported goods to generate revenue and cover the cost of the goods to ensure timely repayment.

- Comply with the agreement: Adhere to the terms of the trust receipt agreement, including using the goods as intended and making timely repayments.

- Maintain proper documentation: Keep all relevant documents related to the import transaction, including invoices, purchase orders, and the trust receipt agreement.

- Communicate with the lender: Maintain open lines of communication with the lender to address any concerns or issues that may arise during the transaction.

- Seek professional advice: If you are new to import financing or unsure about the process, it is advisable to seek guidance from professionals who specialize in international trade and finance.

Conclusion

A trust receipt is a valuable financial instrument that allows importers to obtain possession of goods before making full payment. By understanding the purpose, benefits, and process of using a trust receipt, importers can effectively manage their cash flow and expand their international trade operations.

Remember to choose a reputable lender, carefully review the terms of the agreement, and comply with the trust receipt to ensure a successful transaction.

Trust Receipt Template – Download