What is a year-to-date profit and loss statement?

A year-to-date profit and loss statement, also known as a YTD P&L statement, is a financial report that provides a summary of a company’s revenues, expenses, and net income or loss from the beginning of the current fiscal year up to a specific date. It allows businesses to analyze their financial performance over a specific period and compare it to previous years. This statement includes all the income and expenses incurred by the company, such as sales revenue, operating expenses, overhead costs, and taxes paid.

The purpose of a year-to-date profit and loss statement is to provide an accurate snapshot of a company’s financial health. It helps business owners and stakeholders to assess the profitability and overall performance of the business. By comparing the current year’s YTD P&L statement to previous years, businesses can identify trends, evaluate the effectiveness of their financial strategies, and make informed decisions. It also enables them to identify areas where they can reduce costs, improve efficiency, or increase revenue. Additionally, YTD P&L statements are often required by investors, lenders, and regulatory authorities to assess the financial stability and viability of a company.

Why is a profit and loss statement important?

It is important for several reasons:

- Assessing profitability: The primary benefit of a profit and loss statement is that it allows businesses to evaluate their profitability. By comparing revenues and expenses, organizations can determine whether they are generating a profit or incurring losses. This information is vital for making informed decisions about the company’s financial strategies.

- Identifying trends: Profit and loss statements enable businesses to identify patterns and trends in their revenue and expenses. By analyzing these trends, companies can gain a better understanding of their financial health and make necessary adjustments to their operations. For example, if expenses are consistently exceeding revenue, the company can identify areas where cost-cutting measures can be implemented.

- Evaluating performance: Another benefit of profit and loss statements is that they allow businesses to evaluate their performance over time. By comparing statements from different periods, companies can track their progress, identify areas of improvement, and set realistic financial goals for the future. This analysis aids in measuring the effectiveness of business strategies and making necessary adjustments for growth and success.

- Informing stakeholders: Profit and loss statements are essential for providing accurate and transparent financial information to stakeholders, such as investors, lenders, and potential business partners. These statements offer a comprehensive overview of a company’s financial health, which helps stakeholders make informed decisions about their involvement with the organization.

- Compliance with regulations: Profit and loss statements are required by law in many jurisdictions. Companies must prepare and present these statements to comply with financial reporting regulations. By ensuring accurate and up-to-date profit and loss statements, businesses can avoid legal complications and maintain transparency in their financial activities.

- Budgeting and forecasting: Profit and loss statements are valuable tools for budgeting and forecasting future financial performance. By analyzing past statements, companies can make informed predictions about revenue and expenses, allowing them to create realistic budgets and set achievable financial goals.

How do I make a year-to-date profit and loss statement?

Here are the steps to help you create an accurate year-to-date profit and loss statement:

1. Gather financial records: Collect all relevant financial documents such as income statements, balance sheets, cash flow statements, and any other records that provide information about your company’s revenue and expenses.

2. Calculate revenue: Determine your total revenue for the year by adding up all sources of income, including sales, services rendered, and any other income generated by your business.

3. Calculate expenses: Identify and categorize all expenses incurred during the year. This may include costs related to production, marketing, rent, utilities, payroll, and any other expenses relevant to your business.

4. Calculate net profit or loss: Subtract your total expenses from your total revenue to calculate your net profit or loss. If the result is positive, it indicates a profit, while a negative result represents a loss.

5. Include YTD figures: To create a year-to-date profit and loss statement, you need to include the figures for the current year up until the current date. This allows for a more accurate representation of your business’s financial performance.

6. Analyze and interpret the statement: Once you have prepared the year-to-date profit and loss statement, carefully analyze the data to gain insights into your business’s financial health. This will help you make informed decisions and identify areas for improvement.

By following these steps, you can create a comprehensive year-to-date profit and loss statement that provides a clear overview of your business’s financial performance. It is essential to update this statement regularly to ensure you have up-to-date information to guide your decision-making process.

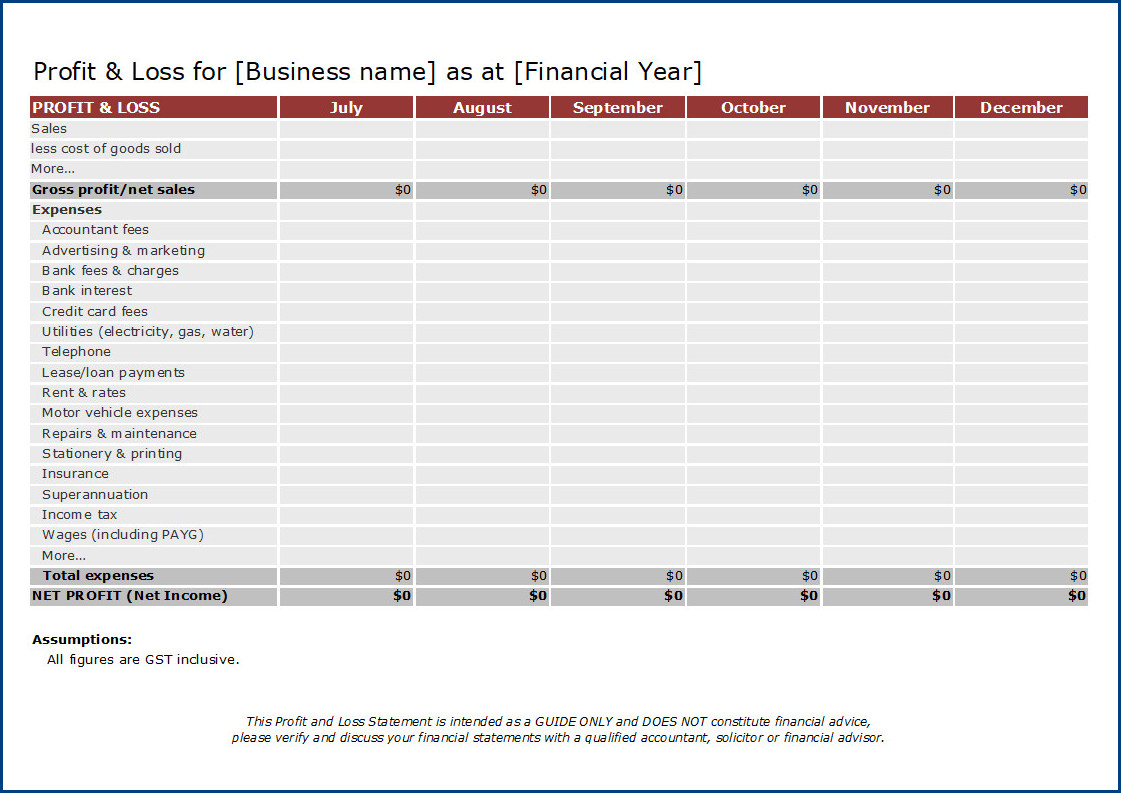

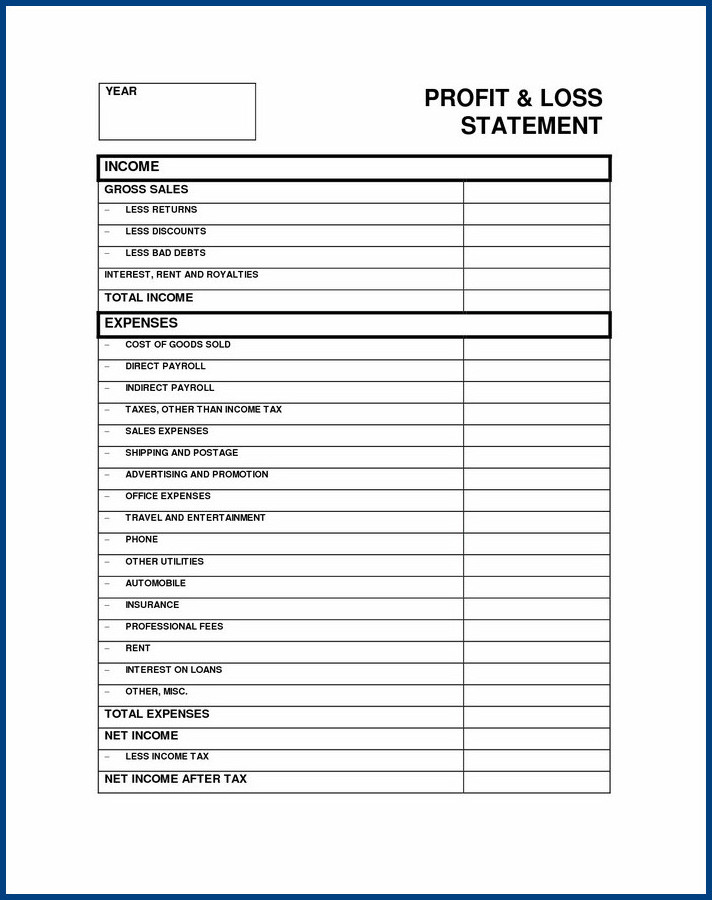

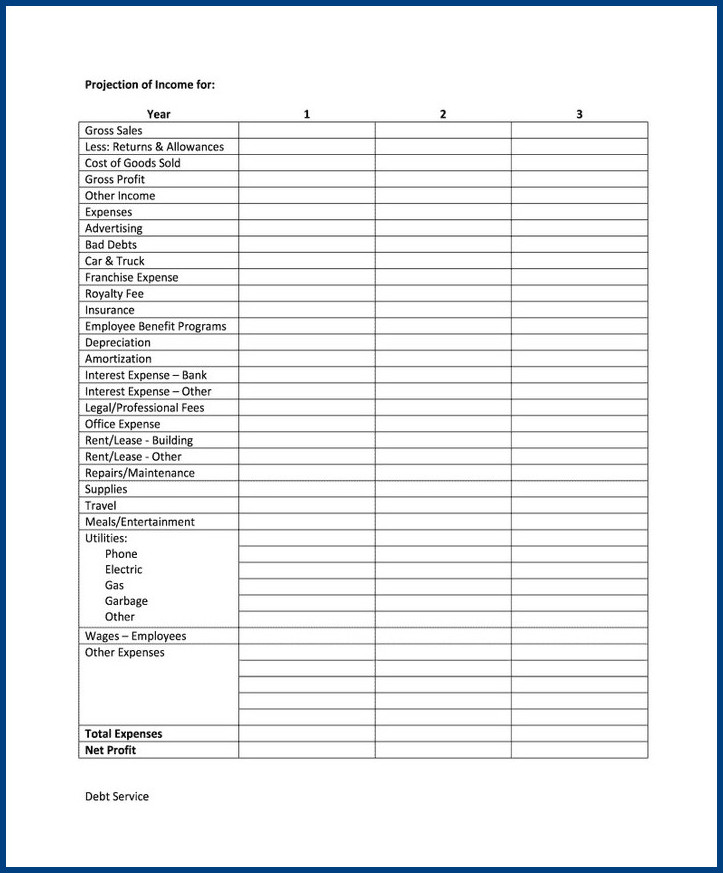

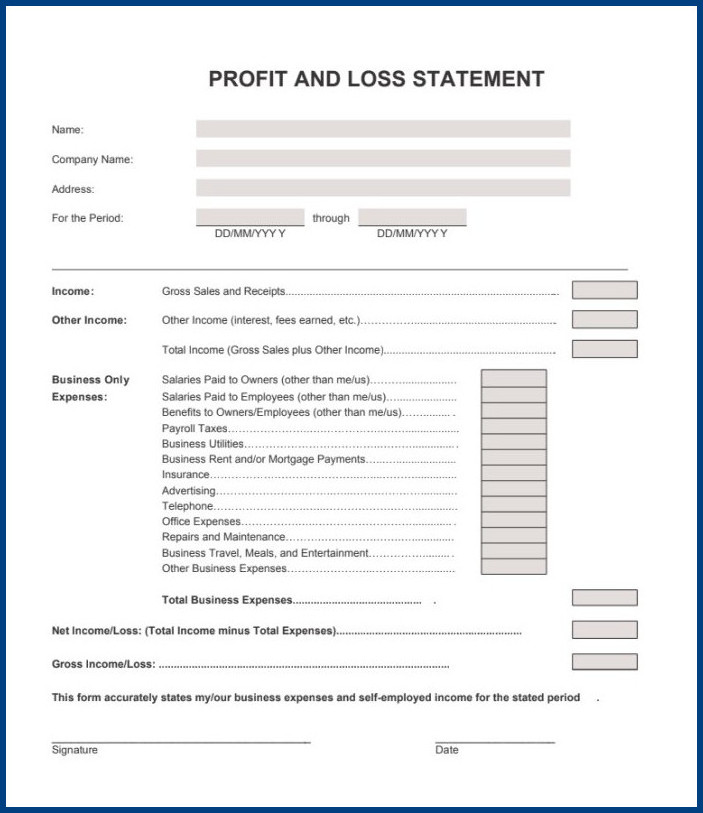

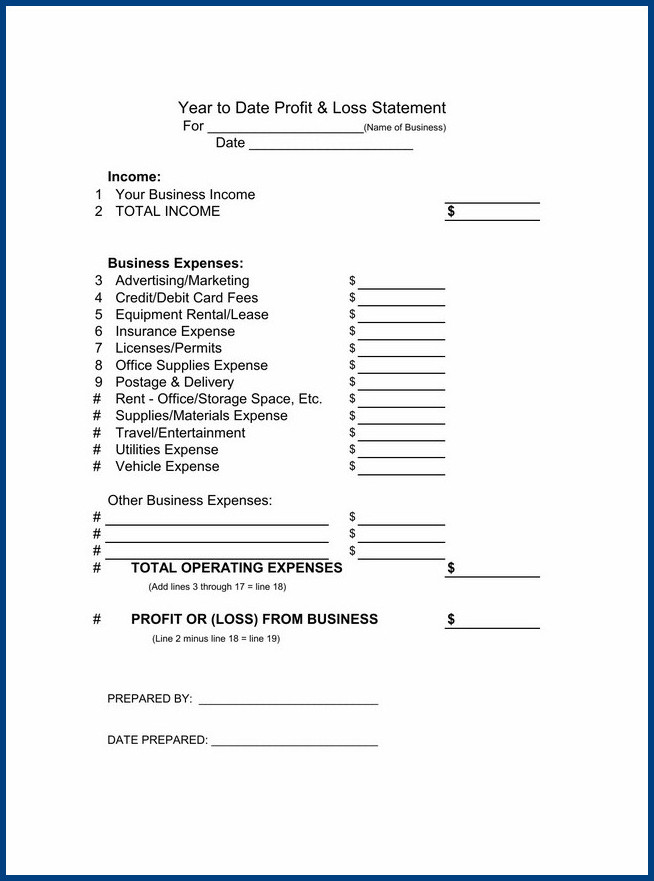

Year-To-Date Profit and Loss Statement Template | Excel – Download