When making purchases or reservations, especially in today’s digital age, credit card authorization forms play a crucial role in facilitating transactions between merchants and customers. This written permission allows a merchant to charge a customer’s credit card, particularly when the cardholder is not physically present.

By having this form in place, both parties are protected, as it provides a clear record of authorized charges and helps prevent potential disputes.

What Is A Credit Card Authorization Form?

A credit card authorization form is a document that permits a merchant to charge a customer’s credit card for goods or services. This form typically includes the cardholder’s information, such as name, billing address, credit card number, expiration date, and CVV code.

By obtaining this written authorization, merchants can process payments securely and efficiently, especially for recurring payments, reservations, and larger purchases.

How Does Card Authorization Work?

When a customer provides their credit card information on a form, the merchant can then verify the details with the issuing bank to ensure that the card is valid and has sufficient funds. Once the authorization is approved, the merchant can proceed with charging the card for the agreed-upon amount. This process helps prevent fraud and ensures that both parties are in agreement regarding the transaction.

Verification Process

Upon receiving the credit card information from the customer, the merchant initiates the verification process by contacting the issuing bank. The bank checks the card details against its records to confirm the card’s validity and the availability of funds. If the verification is successful, the bank provides an authorization code to the merchant to proceed with the transaction.

Transaction Approval

Once the authorization code is received from the issuing bank, the merchant can proceed with processing the payment. The code serves as confirmation that the transaction has been approved, and the merchant can charge the customer’s credit card for the specified amount. This step ensures that the transaction meets all security and compliance requirements.

Payment Processing

After receiving the authorization code, the merchant processes the payment through their payment gateway or POS system. The cardholder’s information is securely transmitted for payment authorization, and the funds are transferred from the customer’s account to the merchant’s account. This seamless payment processing ensures that the transaction is completed efficiently and accurately.

Confirmation of Transaction

Once the payment is processed successfully, both the merchant and the customer receive confirmation of the transaction. The customer may receive a receipt or confirmation email detailing the purchase, while the merchant has a record of the authorized payment. This confirmation assures both parties that the transaction was completed as intended.

Why Do Credit Card Authorization Rates Matter To Small Businesses?

For small businesses, credit card authorization rates are crucial in minimizing risks and optimizing cash flow. By having a streamlined authorization process in place, businesses can reduce the likelihood of chargebacks and fraudulent transactions. Additionally, maintaining high authorization rates can lead to lower processing fees and increased customer trust, ultimately benefiting the bottom line.

Risk Mitigation

High credit card authorization rates help small businesses mitigate the risk of fraudulent transactions and chargebacks. By ensuring that every transaction is authorized and legitimate, businesses can reduce the potential for financial losses due to unauthorized payments or disputes. This risk mitigation strategy is essential for protecting the business’s revenue and reputation.

Optimizing Cash Flow

By maintaining high authorization rates, small businesses can optimize their cash flow and ensure a steady stream of revenue. Authorized transactions are more likely to be completed successfully, resulting in timely payments and improved liquidity for the business. This financial stability allows businesses to meet their operational expenses and invest in growth opportunities.

Reduced Processing Fees

High credit card authorization rates can also lead to reduced processing fees for small businesses. Payment processors often charge lower fees for transactions that are authorized and have a lower risk of chargebacks. By demonstrating a commitment to secure transactions and high authorization rates, businesses can negotiate better rates with their payment providers, saving on processing costs.

Building Customer Trust

Customers value businesses that prioritize security and transparency in their transactions. By maintaining high credit card authorization rates, small businesses can build trust with their customers and demonstrate their commitment to protecting sensitive payment information. This trust can lead to repeat business, positive reviews, and referrals, ultimately driving growth and success for the business.

Do Credit Card Authorization Forms Help Prevent Chargeback Abuse?

Yes, credit card authorization forms are instrumental in preventing chargeback abuse, which can be detrimental to merchants. By obtaining written permission from customers before processing payments, merchants have a documented record of the transaction, making it easier to dispute any unauthorized chargebacks. This added layer of protection helps safeguard businesses from financial losses and potential disputes.

What Is Included In A Credit Card Authorization Form?

A typical credit card authorization form includes the following key elements:

Cardholder Information

The credit card authorization form includes fields for the cardholder to provide their personal information, such as their name, billing address, contact details, and email address. This information is essential for verifying the cardholder’s identity and ensuring that the transaction is authorized by the rightful owner of the credit card.

Credit Card Details

The form also requires the cardholder to input their credit card details, including the card number, expiration date, and CVV code. These details are crucial for processing the payment securely and accurately, as they confirm the validity of the card and authorize the transaction to proceed.

Authorization Terms and Conditions

The credit card authorization form outlines the terms and conditions of the transaction, including the goods or services being purchased, the total amount charged to the card, and any additional fees or charges. By clearly defining these terms, both the merchant and the customer have a shared understanding of the transaction details.

Date and Signature

One of the most important elements of a credit card authorization form is the date and signature section. The cardholder is required to sign and date the form to indicate their consent to the transaction. This signature serves as a legal agreement between the parties involved and confirms that the cardholder authorizes the merchant to charge their credit card accordingly.

When Should You Use A Form To Authorize Credit Card Payments?

It is recommended to use a credit card authorization form in the following scenarios:

Recurring Payments For Subscription-Based Services

For businesses that offer subscription-based services, using a credit card authorization form is essential to secure recurring payments. Customers can provide their payment information upfront and authorize the merchant to charge their credit card periodically for the subscription fee. This streamlined process ensures that payments are made on time and reduces the risk of interrupted service due to payment issues.

Reservations

When customers make reservations for services or bookings, such as hotel rooms, rental cars, or event tickets, it is advisable to use a credit card authorization form. This form allows the merchant to secure the reservation by obtaining the cardholder’s permission to charge their credit card for any applicable fees or deposits. By having this authorization in place, businesses can guarantee the reservation and prevent no-shows or last-minute cancellations.

For Larger Purchases

For high-value transactions or larger purchases, using a credit card authorization form is essential to protect both the merchant and the customer. By obtaining written authorization for the transaction, businesses can verify the cardholder’s consent to the charges and ensure that the purchase is legitimate. This added security measure reduces the risk of fraud and disputes, particularly for significant transactions.

Online Transactions

When conducting online transactions or e-commerce sales, utilizing a credit card authorization form is crucial to verify the identity of the cardholder and protect against fraudulent activity. Customers can securely input their payment information on the form, and merchants can validate the details before processing the transaction. This verification step helps prevent unauthorized charges and enhances the security of online payments.

International Transactions

For businesses that engage in international transactions or cater to customers from different countries, using a credit card authorization form is vital to ensure compliance with cross-border payment regulations. By collecting the necessary cardholder information and authorization, merchants can facilitate secure transactions across borders and minimize the risk of payment disputes or regulatory issues. This proactive approach helps businesses expand their reach globally while maintaining financial security.

Customized Services

For businesses that offer customized services or unique payment arrangements, having a credit card authorization form allows merchants to tailor the transaction terms to meet specific customer needs. Whether it involves installment payments, customized pricing, or add-on services, the form can capture the customer’s consent and authorization for the transaction details. This customization enhances the customer experience and ensures that both parties are in agreement regarding the payment terms.

Event Registrations

When hosting events or workshops that require attendees to register and pay in advance, utilizing a credit card authorization form streamlines the registration process and secures payments. Attendees can provide their payment details on the form, authorizing the event organizer to charge their credit card for the registration fees. This efficient method reduces administrative tasks and ensures that registrations are confirmed promptly.

Non-Profit Donations

For non-profit organizations or charitable causes that rely on donations to support their mission, implementing a credit card authorization form simplifies the donation process and ensures that contributions are processed securely. Donors can provide their payment information on the form, authorizing the organization to charge their credit card for the donation amount. This transparency and convenience encourage more donors to contribute and support the organization’s initiatives.

Consulting Services

For businesses that provide consulting services or professional advice, using a credit card authorization form is essential to secure payments for the services rendered. Clients can authorize the consultant to charge their credit card for the consulting fees or project costs, ensuring that payments are made promptly. This formal agreement protects both the consultant and the client by establishing clear payment terms and preventing billing disputes.

Membership Renewals

For membership-based organizations or clubs that offer recurring memberships, having a credit card authorization form in place simplifies the renewal process for members. By obtaining authorization from members to charge their credit cards for the membership fees, organizations can ensure seamless renewals and continued access to benefits. This automatic renewal process enhances member retention and streamlines the membership management process.

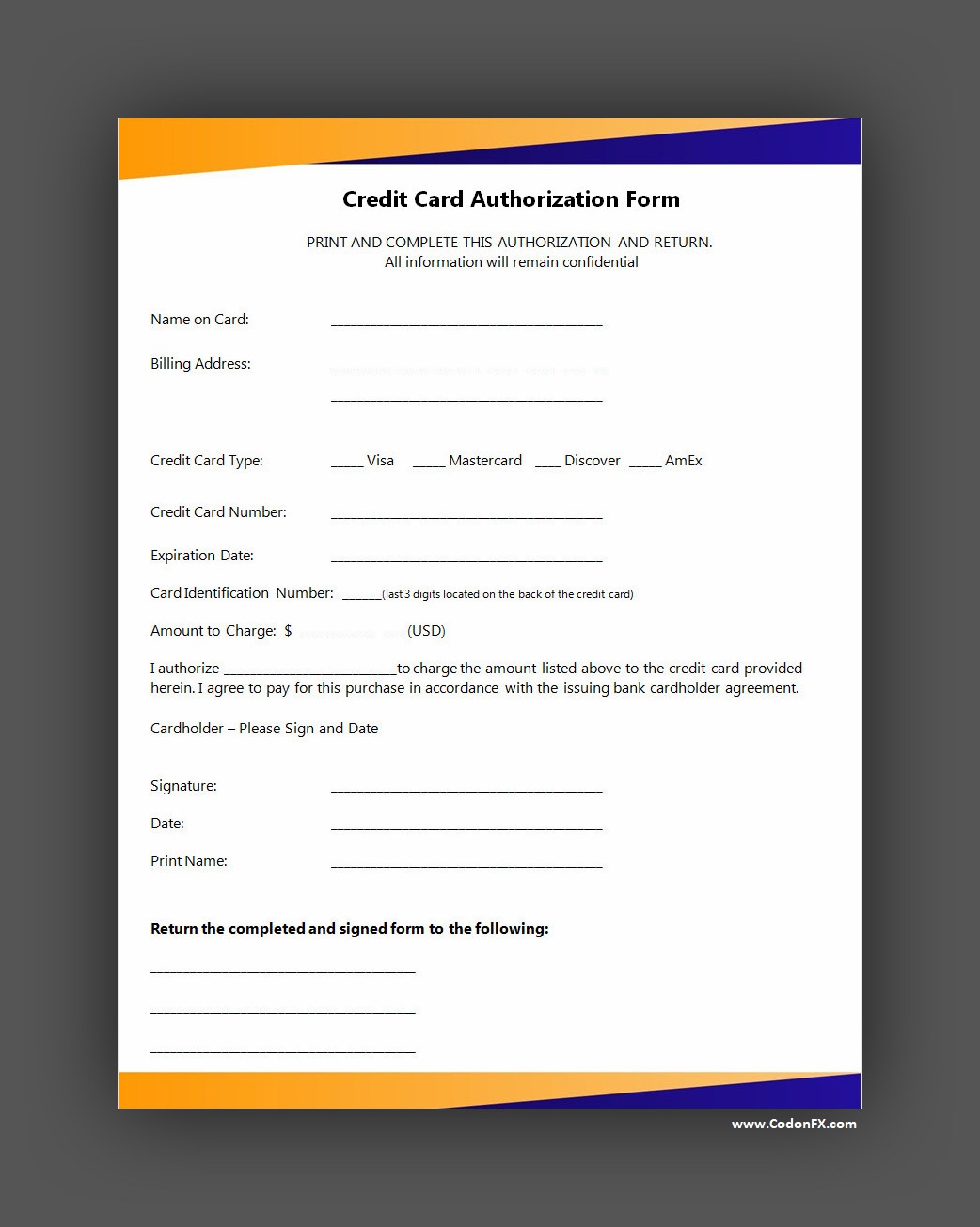

Credit Card Authorization Form

A credit card authorization form is a secure document that allows a business to charge a customer’s credit card for approved transactions. It helps prevent disputes, ensures transparency, and provides written consent for payments—whether one-time or recurring. Using a clear and professional template simplifies the process and protects both the customer and the business.

Download and use our credit card authorization form today to streamline payments and safeguard your transactions with confidence.

Credit Card Authorization Form – Word