In the world of finance and accounting, understanding a company’s financial performance over multiple periods is crucial for making informed decisions. One tool that can help in this analysis is the comparative income statement.

This statement allows for the identification of trends, changes, and overall financial health by presenting income statement data from different periods in a single document. By comparing revenue, expenses, and profitability over time, stakeholders can gain valuable insights into how a company is performing and where improvements can be made.

What is a Comparative Income Statement?

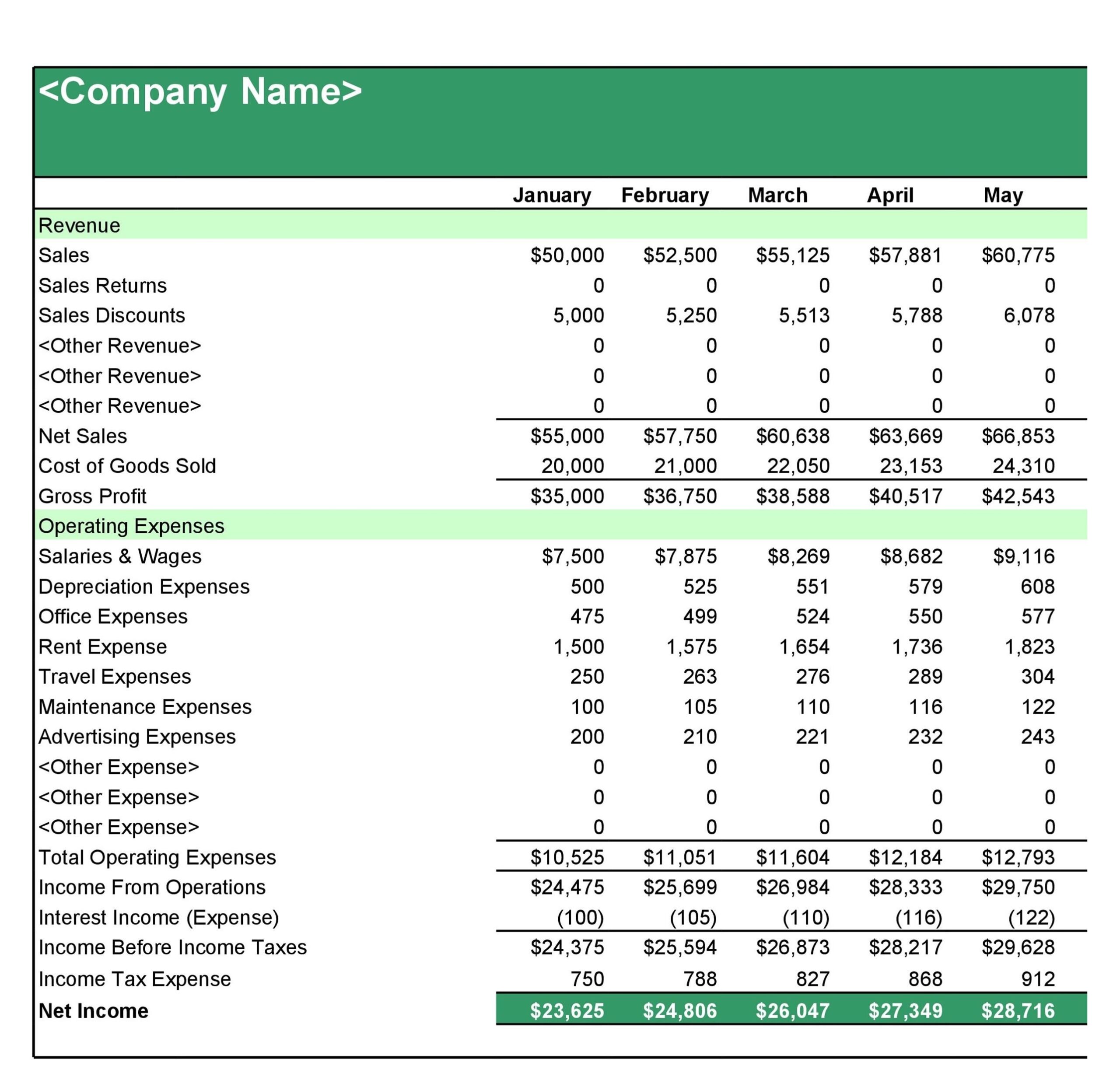

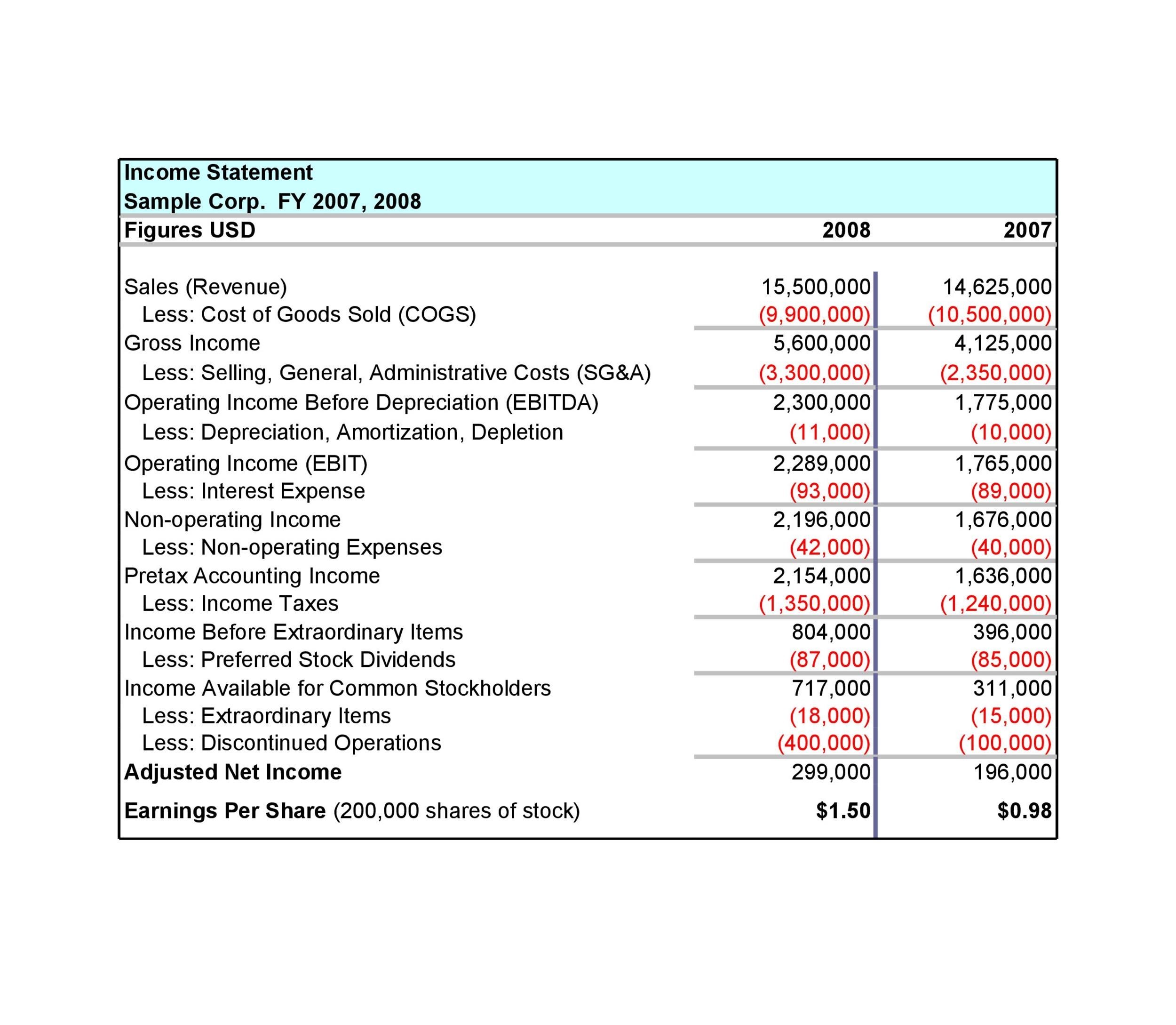

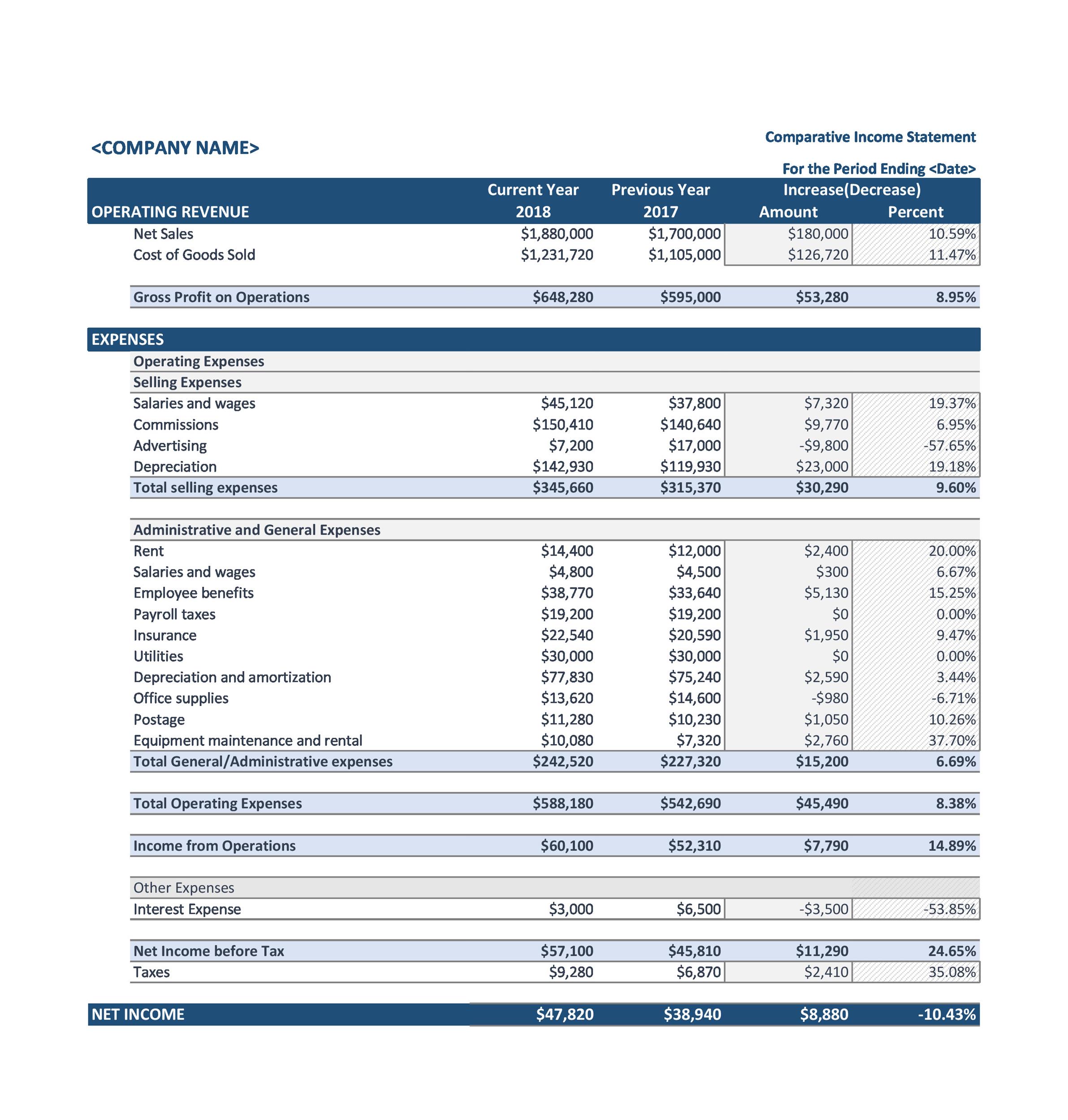

A comparative income statement is a financial document that displays a company’s income statement data from multiple periods side by side for easy comparison. This statement typically includes information on revenue, expenses, and net income for each period, allowing users to see how these key metrics have changed over time.

By presenting this data in a single document, stakeholders can quickly identify trends and analyze the financial health of the company.

Why Use a Comparative Income Statement?

Comparative income statements are essential for evaluating a company’s financial performance over time. By comparing income statement data from different periods, stakeholders can track changes in revenue, expenses, and profitability, identifying areas of strength and weakness.

This information is valuable for making strategic decisions, setting goals, and monitoring progress towards financial objectives. Additionally, comparative income statements can help investors, creditors, and other stakeholders assess the overall financial health of a company before making investment or lending decisions.

How to Create a Comparative Income Statement

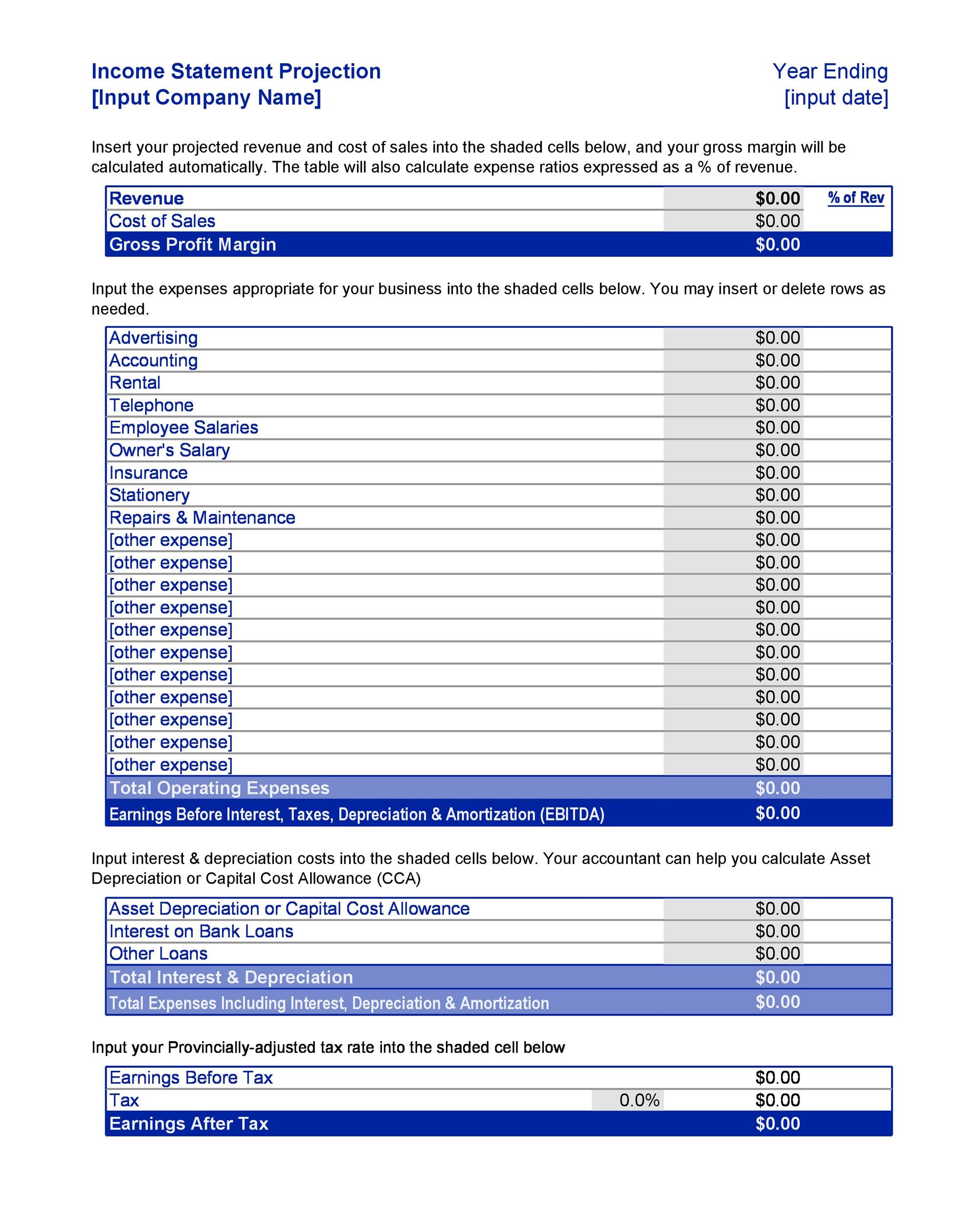

Creating a comparative income statement involves gathering income statement data from multiple periods and organizing it into a single document for easy comparison. Here are the steps to follow:

1. Gather income statement data from the periods you want to compare.

2. Organize the data into a table format, with columns for each period and rows for revenue, expenses, and net income.

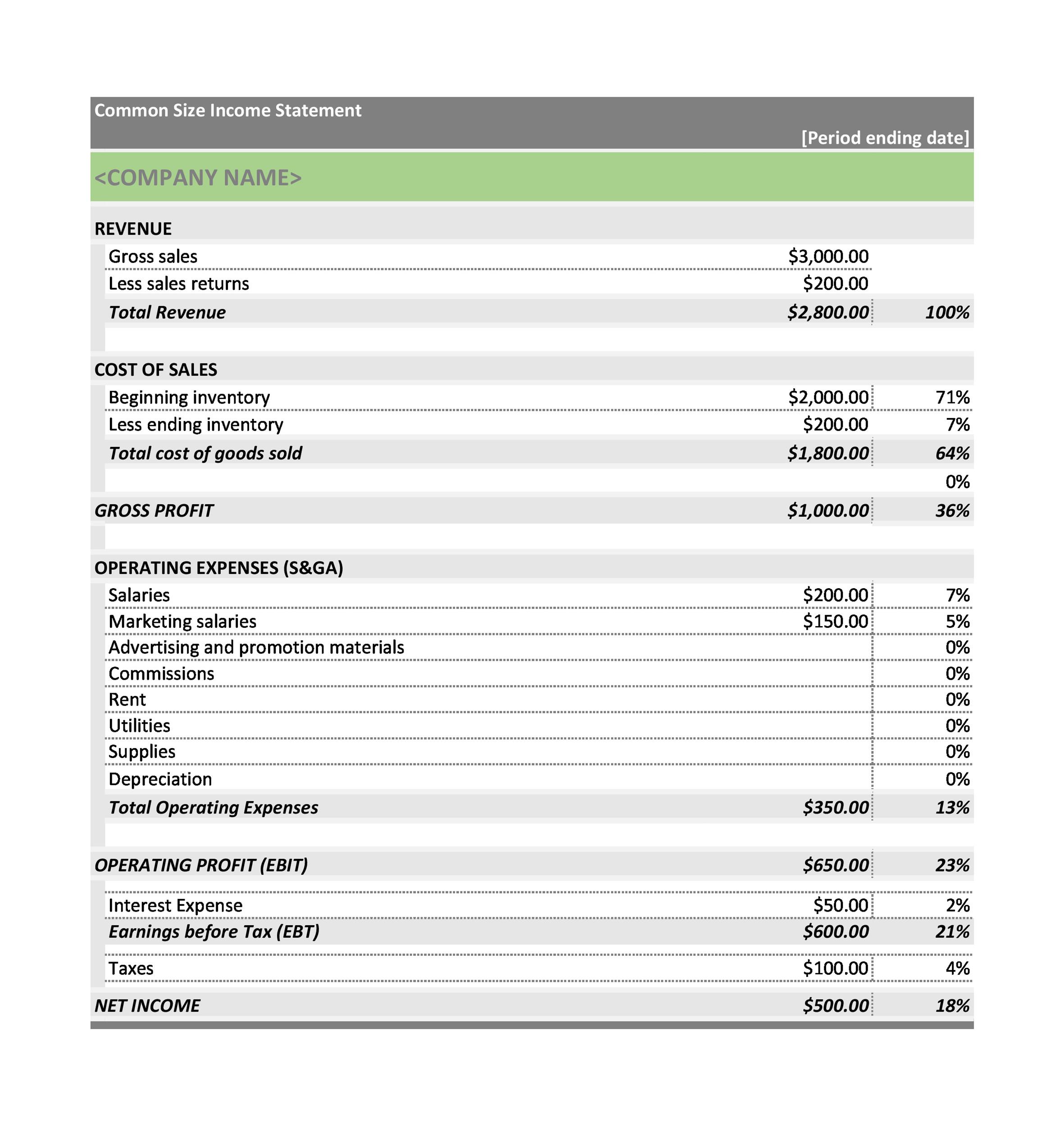

3. Calculate any necessary ratios or percentages to provide additional insight into the data.

4. Include a brief analysis of the trends and changes observed in the data.

5. Format the document for easy printing and distribution.

Examples of Comparative Income Statements

To better understand how a comparative income statement works, let’s look at an example. Below is a simplified version comparing a company’s income statement data from two consecutive years:

Year 1:

– Revenue: $1,000,000

– Expenses: $800,000

– Net Income: $200,000

Year 2:

– Revenue: $1,200,000

– Expenses: $900,000

– Net Income: $300,000

By comparing these two periods side by side, stakeholders can see that the company’s revenue increased by $200,000, while expenses increased by $100,000. This resulted in a higher net income of $100,000 in Year 2 compared to Year 1.

Tips for Successful Analysis

When using a comparative income statement for financial analysis, consider the following tips:

– Look for trends and patterns in the data to identify areas of improvement or concern.

– Calculate key financial ratios, such as profit margin and return on investment, to gain deeper insights into the company’s performance.

– Consider external factors that may have influenced the financial results, such as changes in the industry or economic conditions.

– Use the information from the comparative income statement to make informed decisions and set realistic financial goals for the future.

In conclusion, a comparative income statement is a powerful tool for analyzing and comparing a company’s financial performance over multiple periods. By presenting income statement data from different periods in a single document, stakeholders can easily identify trends, changes, and overall financial health.

This information is invaluable for making strategic decisions, setting goals, and monitoring progress towards financial objectives.

Comparative Income Statement Template – Download