Have you ever needed to set up direct deposit for your paycheck but didn’t know where to start? Bank letters for direct deposit can make the process much easier for you.

In this comprehensive guide, we will walk you through everything you need to know about bank letters for direct deposit, including what they are, why they are important, how to use them, and tips for successful implementation.

What are Bank Letters for Direct Deposit?

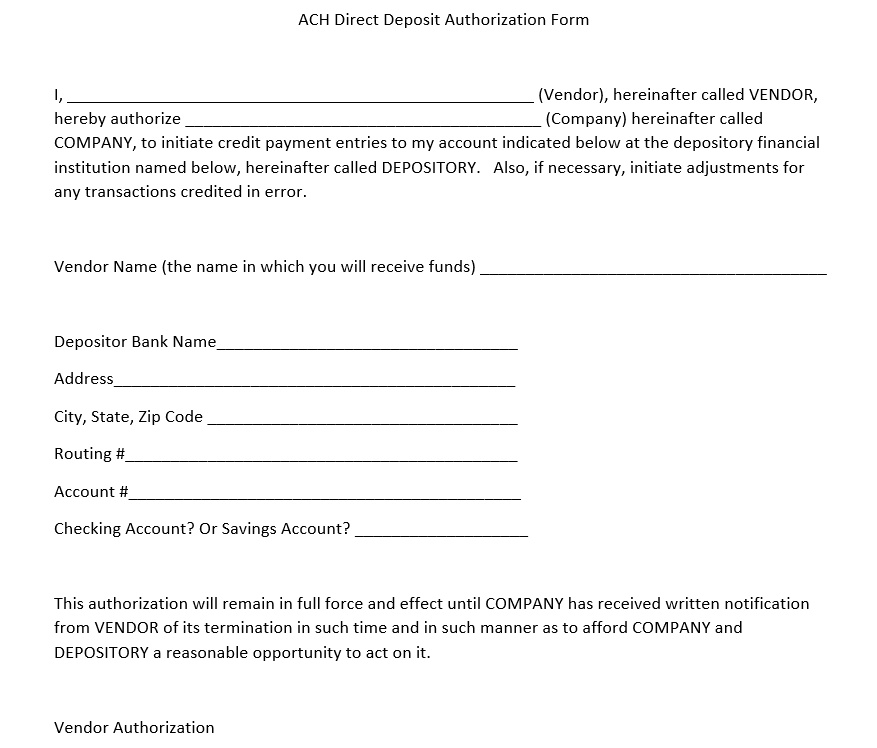

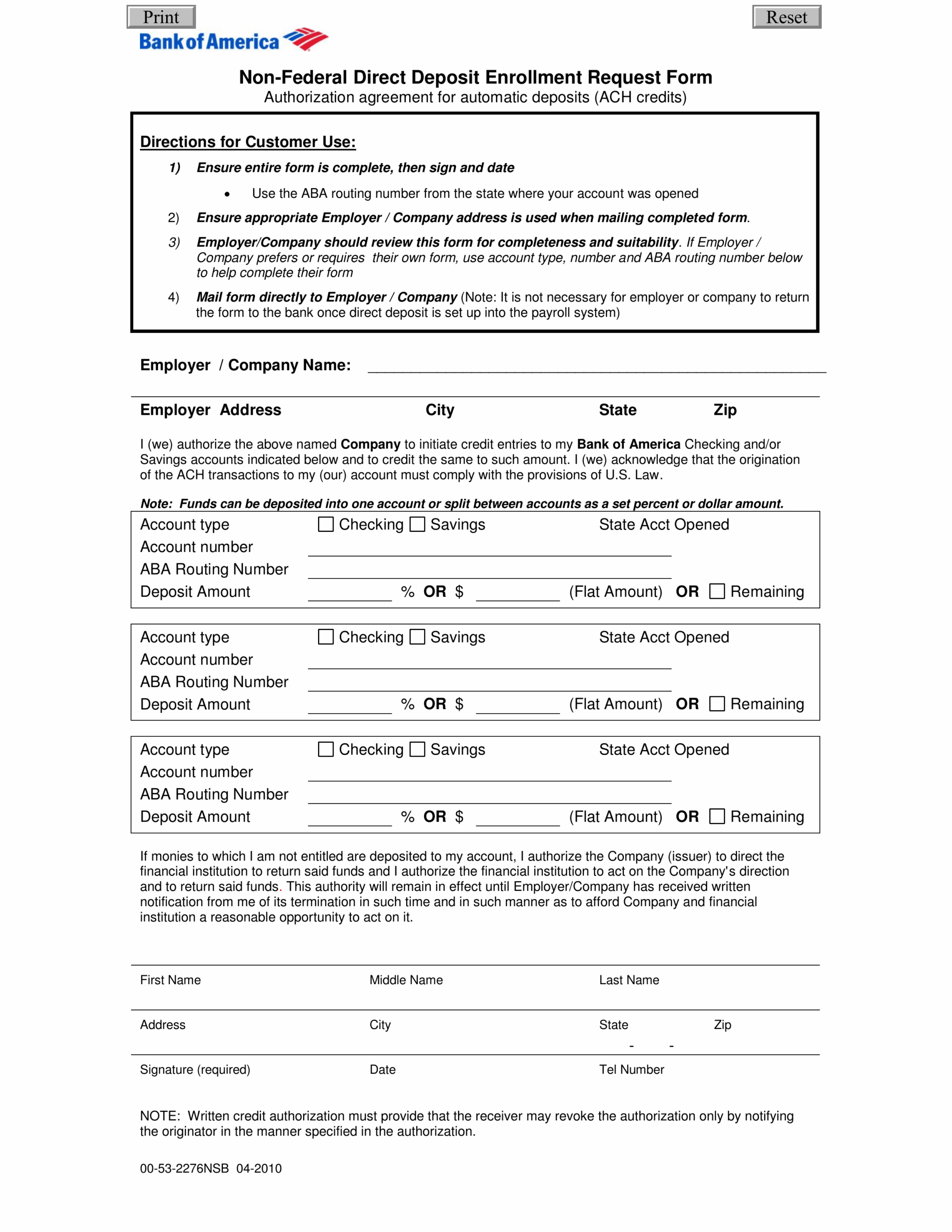

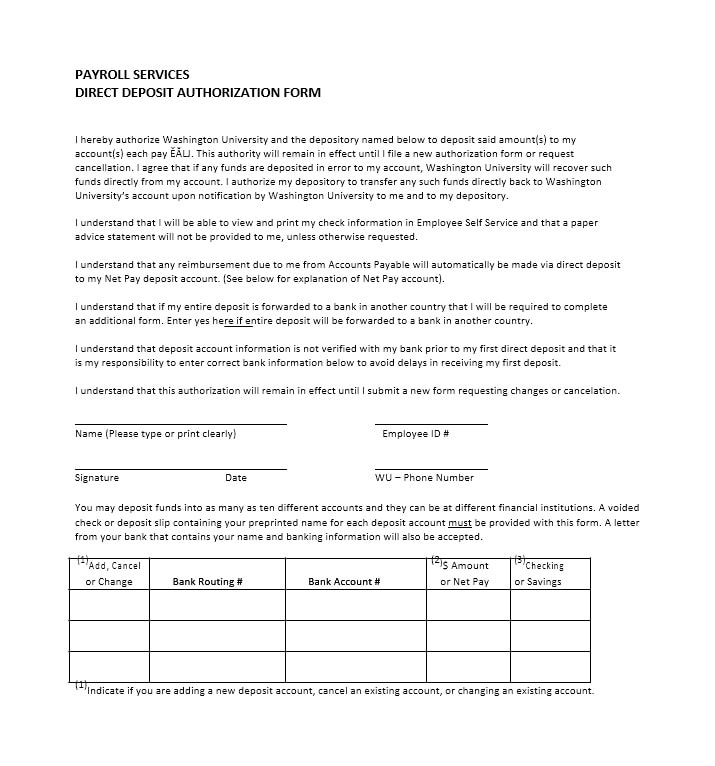

Bank letters for direct deposit are official documents provided by your bank that authorize your employer to deposit your paycheck directly into your bank account. These letters typically include your bank account information, such as your account number and routing number, and any other necessary details required by your employer to set up direct deposit.

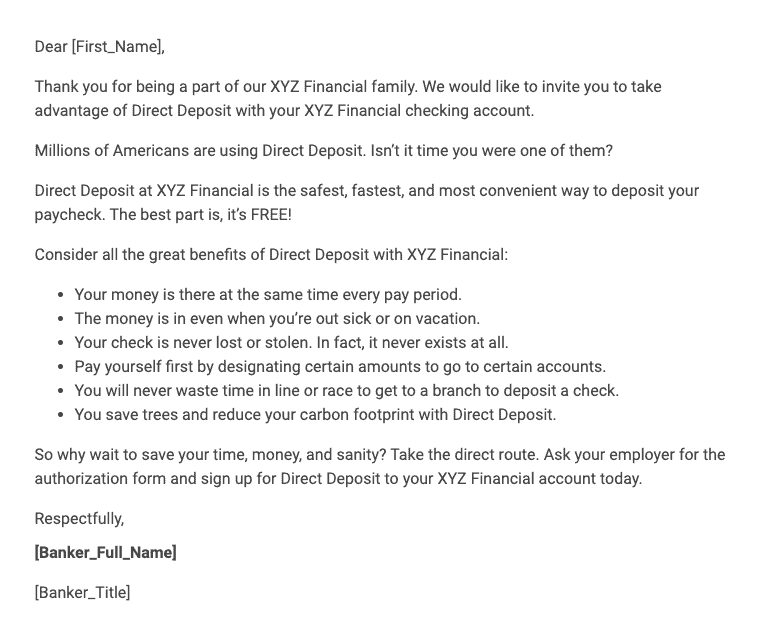

Direct deposit is a convenient and secure way to receive your paycheck without having to physically go to the bank to deposit it. By using bank letters for direct deposit, you can streamline the process and ensure that your paycheck is deposited into your account accurately and on time.

Why are Bank Letters for Direct Deposit Important?

Bank letters for direct deposit are important because they provide a clear and official authorization for your employer to deposit your paycheck directly into your bank account. Without this document, your employer may not be able to process your direct deposit request, which could result in delays in receiving your paycheck.

Additionally, bank letters for direct deposit help protect your sensitive bank account information by ensuring that it is securely transmitted to your employer. This can help prevent unauthorized access to your account and reduce the risk of fraud or identity theft.

How to Use Bank Letters for Direct Deposit

Using bank letters for direct deposit is a simple process. Here are the steps you can follow to set up direct deposit with your employer:

1. Obtain a bank letter for direct deposit from your bank. This may be available on your bank’s website or by visiting a branch in person.

2. Fill out the necessary information on the letter, including your name, bank account number, routing number, and any other required details.

3. Provide the completed bank letter to your employer’s payroll department. They will use this information to set up direct deposit for your paycheck.

4. Verify with your employer that direct deposit has been successfully set up and that your paycheck will be deposited into your account.

Examples of Bank Letters for Direct Deposit

Here are some examples of bank letters for direct deposit from popular banks:

1. Wells Fargo Direct Deposit Authorization Form

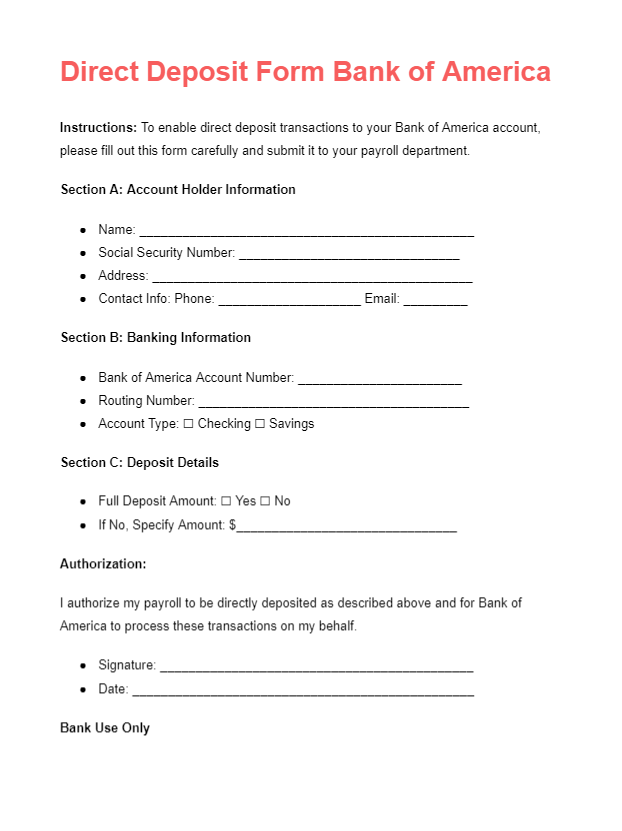

2. Bank of America Direct Deposit Form

3. Chase Direct Deposit Enrollment Form

4. Citibank Direct Deposit Authorization Form

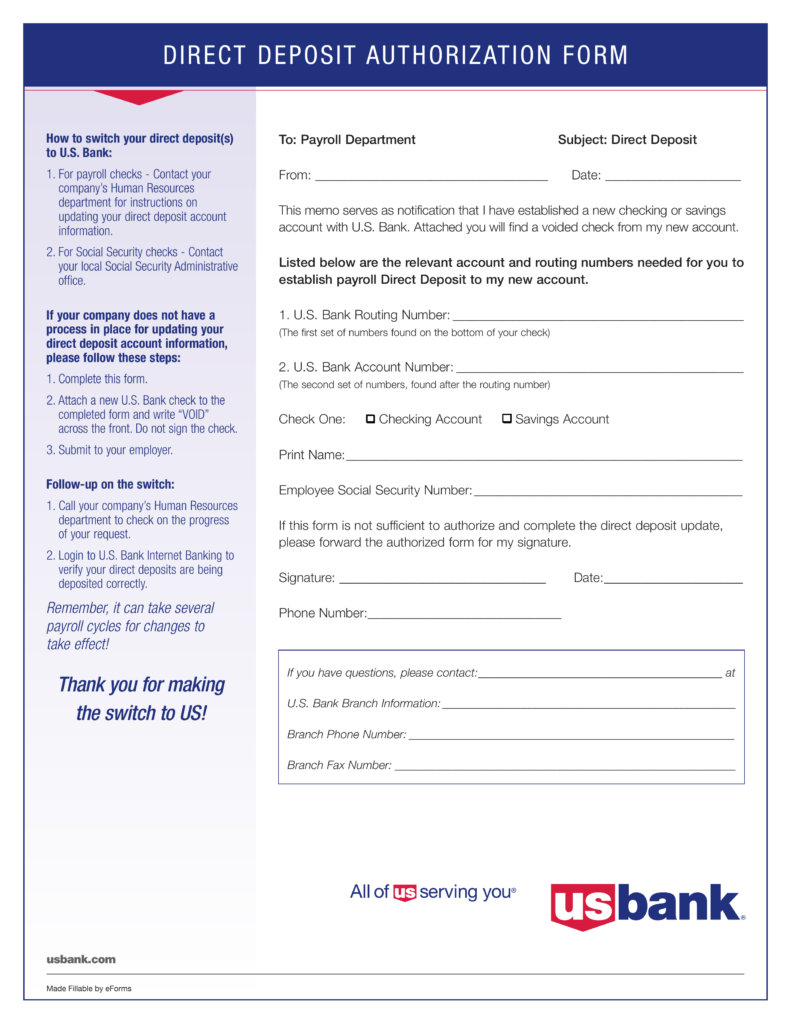

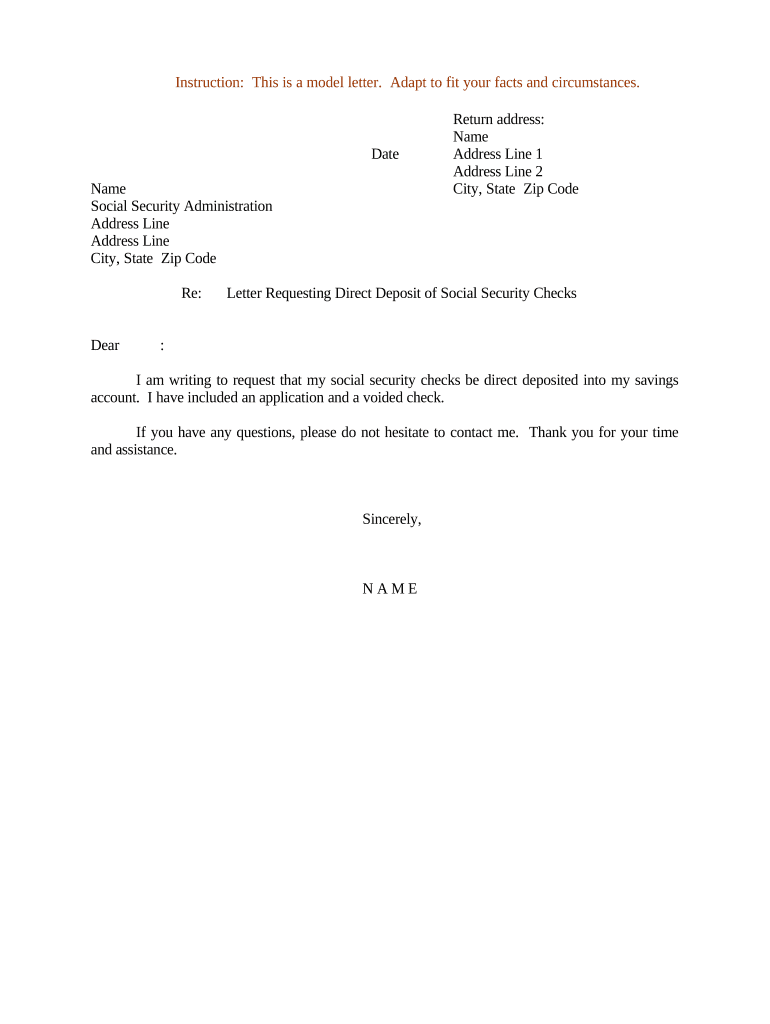

These examples can serve as a reference for creating your bank letter for direct deposit, tailored to your specific bank and account information.

Tips for Successful Direct Deposit Setup

Setting up direct deposit with bank letters requires attention to detail and accuracy. Here are some tips to ensure a successful direct deposit setup:

- Double-check your bank account information: Make sure all the details on the bank letter are accurate, including your account number and routing number.

- Submit the form on time: Provide the completed bank letter to your employer as soon as possible to avoid any delays in processing.

- Follow up with your employer: Confirm with your employer that direct deposit has been successfully set up and that your paycheck will be deposited into your account on time.

- Keep a copy for your records: Retain a copy of the completed bank letter for your records in case you need to reference it in the future.

- Update your bank letter as needed: If there are any changes to your bank account information, make sure to update the bank letter accordingly and provide it to your employer.

In Conclusion

Bank letters for direct deposit are essential documents that streamline the process of setting up direct deposit for your paycheck. By understanding what they are, why they are important, how to use them, and following our tips for successful implementation, you can ensure a smooth and secure direct deposit setup with your employer.

Take advantage of this convenient payment method and enjoy the convenience of having your paycheck deposited directly into your bank account.

Bank Letter For Direct Deposit – Download