What is a contractor payment agreement?

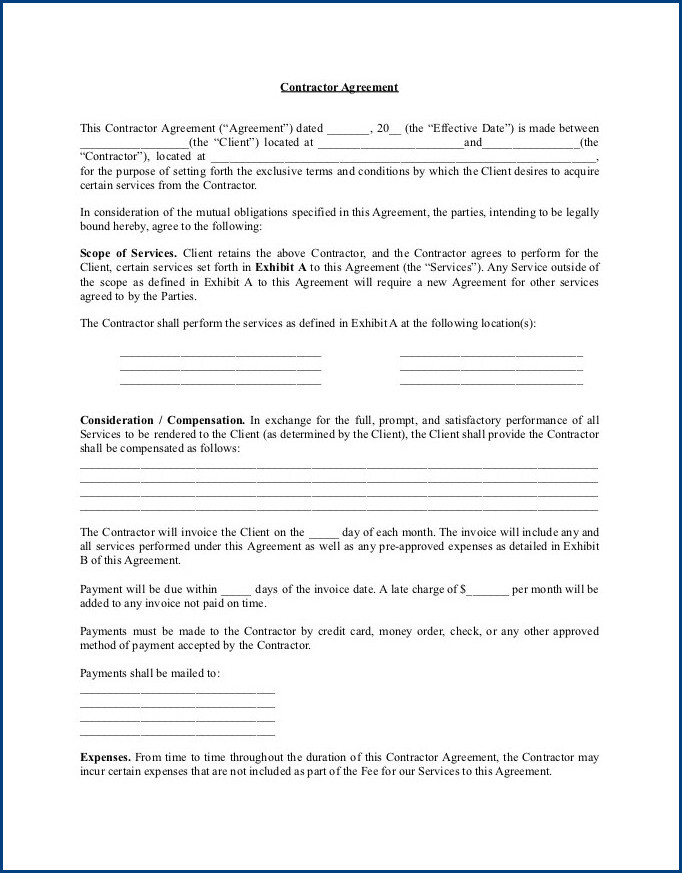

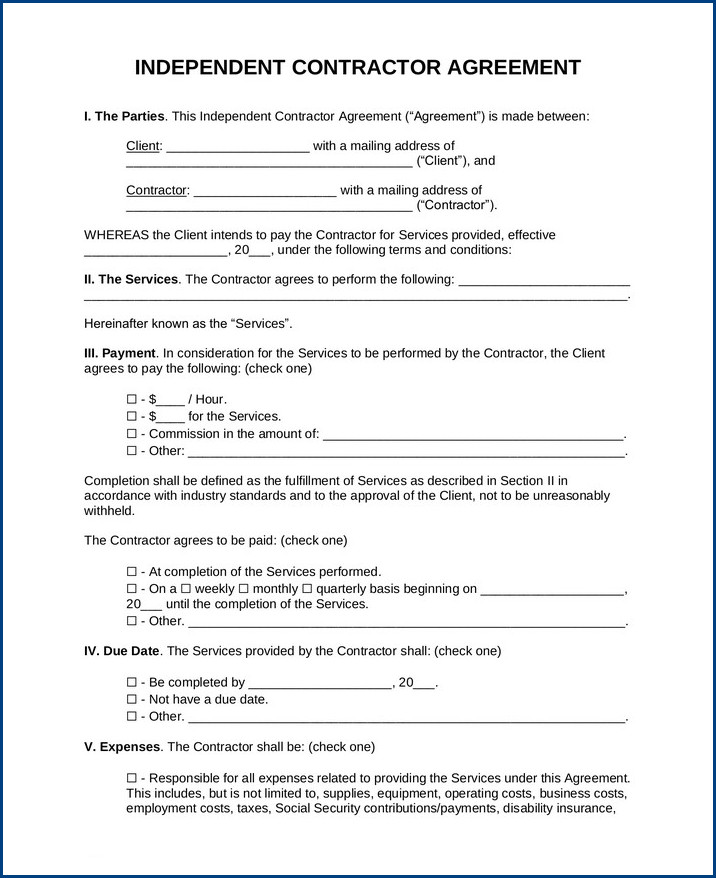

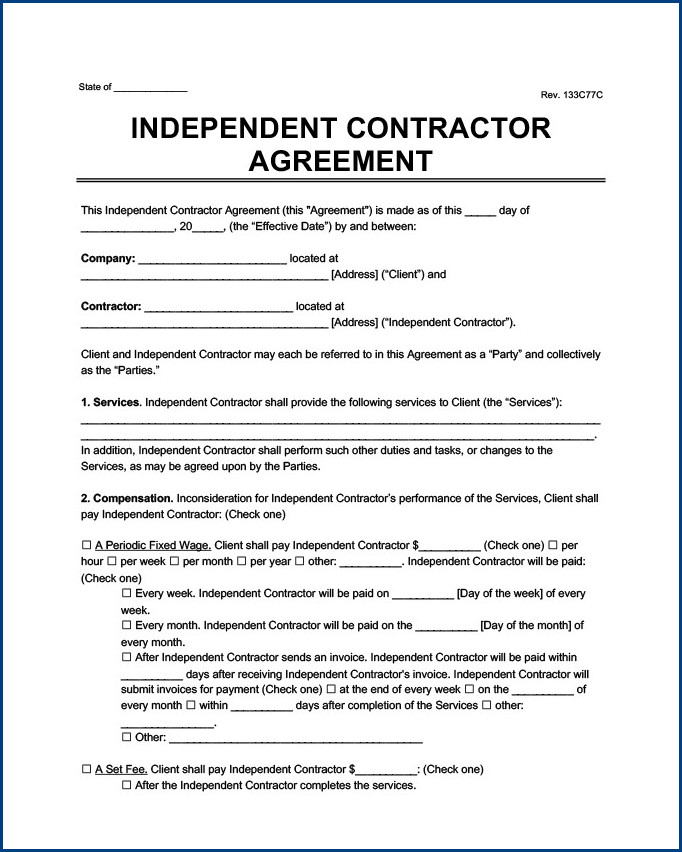

A contractor payment agreement is a legal document that outlines the terms and conditions for payment between a contractor and their client. It serves as a formal agreement that ensures both parties are on the same page regarding payment expectations.

The purpose of a contractor payment agreement is to provide clarity and protection for both the contractor and the client. It specifies the agreed-upon payment terms, such as the amount, frequency, and method of payment. Additionally, it may include provisions for late payment penalties or incentives for early payment. This agreement helps establish a professional and fair relationship between the contractor and the client, ensuring that both parties understand their financial obligations and responsibilities.

Do I really need a payment agreement?

Here are some reasons why a contractor payment agreement is important and the benefits it provides:

- Clarity and transparency: One of the key benefits of a contractor payment agreement is that it provides clarity and transparency regarding payment terms. It clearly outlines the scope of work, payment amounts, due dates, and any additional fees or penalties. This helps to avoid any misunderstandings or disputes between the contractor and the client.

- Legal protection: By having a written payment agreement, both the contractor and the client are legally protected. In case of a payment dispute or non-payment, the contract can be used as evidence in court. It ensures that both parties are accountable for fulfilling their financial obligations.

- Financial security: A contractor payment agreement ensures that the contractor is paid in a timely manner for the services provided. It helps to establish a clear payment schedule, allowing the contractor to manage their cash flow effectively. This financial security is beneficial for contractors, especially in situations where there may be delays or changes in the project.

- Professionalism and trust: Having a well-drafted payment agreement demonstrates professionalism and builds trust between the contractor and the client. It shows that both parties are committed to a fair and transparent working relationship. This can help to foster a positive working environment and lead to repeat business or referrals.

- Dispute resolution: In the event of a payment dispute, the contractor payment agreement can serve as a reference point for resolving the issue. It provides a framework for discussing and resolving any payment-related conflicts. This can save both time and money by avoiding costly legal battles.

- Enforceability: A contractor payment agreement is a legally enforceable document. If either party fails to fulfill their payment obligations, the other party can take legal action to seek compensation or enforce the terms of the agreement. This ensures that both the contractor and the client are held accountable for their financial responsibilities.

Does a payment agreement need to be witnessed?

When entering into a payment agreement, many individuals wonder whether it is necessary to have a witness present. The answer to this question depends on various factors, such as the jurisdiction and the nature of the agreement. In some cases, having a witness may be advisable to ensure the validity and enforceability of the agreement. However, in other situations, it may not be a legal requirement. It is always recommended to consult with a legal professional to determine the specific requirements and implications of having a witness for a payment agreement.

In some jurisdictions, a payment agreement may need to be witnessed in order to be legally enforceable. This is particularly important when the agreement involves a significant amount of money or complex terms. The presence of a witness provides an extra layer of assurance that both parties have willingly entered into the agreement and understand its terms. Additionally, a witnessed agreement may also be more difficult to challenge in court, as the witness can testify to the signing and authenticity of the document. However, it is important to note that these requirements can vary, so it is essential to research the specific laws and regulations applicable to your jurisdiction before finalizing a payment agreement.

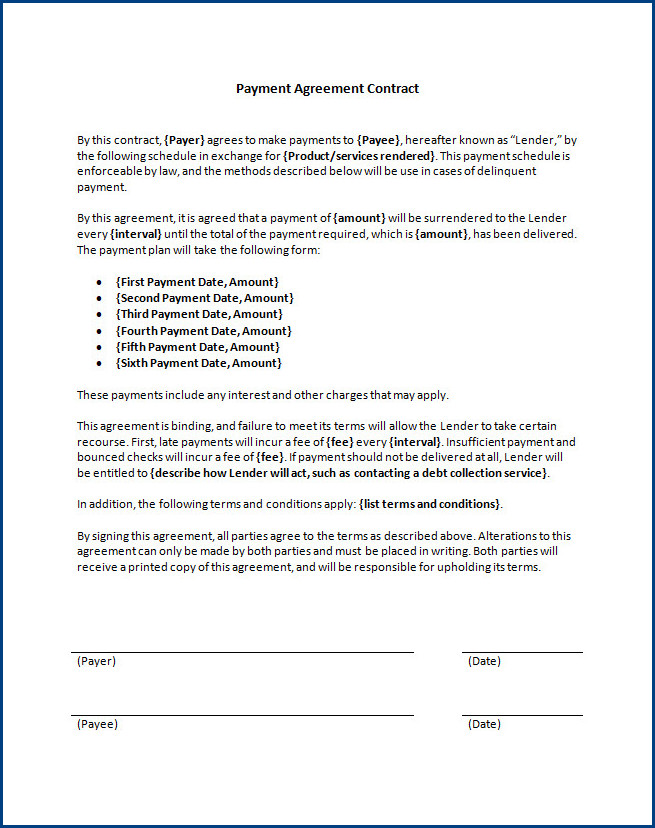

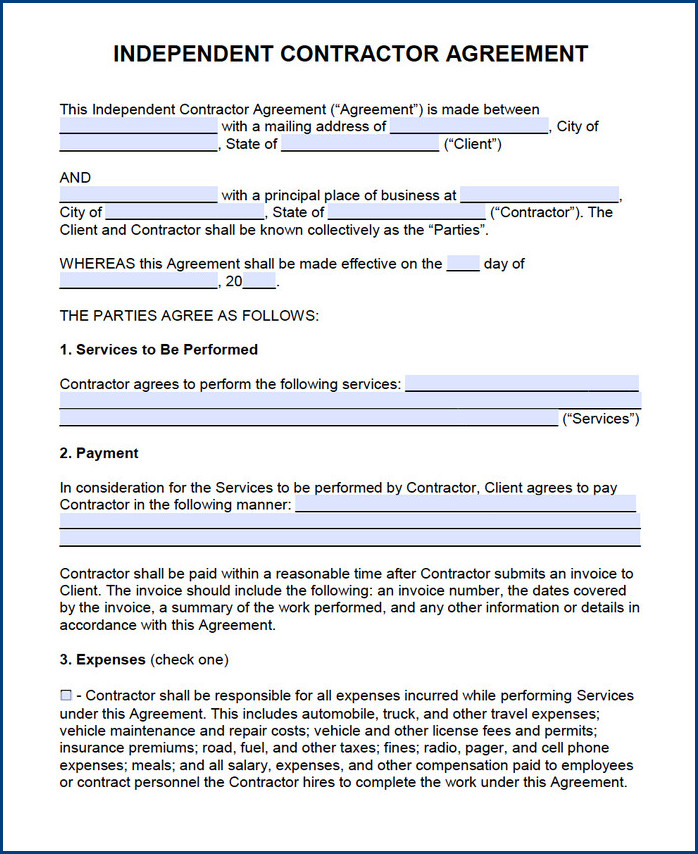

What should a payment agreement include?

Here are some of the key components that should be included in a payment agreement:

- Parties involved: Clearly identify and provide the full names and contact information of both the payer and payee. This will help establish the individuals or entities responsible for fulfilling the financial obligations outlined in the agreement.

- Payment terms: Specify the agreed-upon payment terms, including the amount owed, due dates, and frequency of payments. It is important to be specific and detailed to avoid any confusion regarding the payment schedule.

- Payment methods: Outline the acceptable methods of payment, such as cash, check, bank transfer, or online payment platforms. This ensures that both parties are aware of the available options for making and receiving payments.

- Late payment consequences: Clearly state the consequences or penalties that may be imposed in case of late payments. This may include late fees or interest charges, providing an incentive for timely payments.

- Dispute resolution: Include a section that outlines the process for resolving any disputes that may arise during the payment agreement. This could involve mediation, arbitration, or any other agreed-upon method of dispute resolution.

- Termination clause: Specify the conditions under which the payment agreement can be terminated by either party. This may include non-payment, breach of contract, or any other relevant circumstances.

- Signatures: Finally, ensure that the payment agreement is signed and dated by both parties. This serves as evidence of their consent and understanding of the terms and conditions outlined in the agreement.

How do I terminate a payment contract?

To terminate a payment contract, there are a few steps you can take.

- Review your contract to understand the termination clause and any penalties or fees associated with ending the agreement early. This will give you an idea of what to expect and help you make an informed decision.

- Communicate your intent to terminate the contract to the other party in writing. Be sure to clearly state your reasons for termination and provide any necessary documentation or evidence to support your decision. It is important to maintain a professional tone and avoid any personal attacks or accusations.

- Negotiate a mutually agreeable resolution with the other party, if possible. This may involve reaching a settlement or agreeing to alternative terms. Ensure that all parties involved sign a written agreement documenting the termination and any agreed-upon terms to protect yourself legally.

Contractor Payment Agreement Template | Word – Download

Contractor Payment Agreement Template | PDF – Download