When it comes to securing credit, having a strong credit history is crucial. Lenders rely on this information to determine whether or not they should extend credit to a borrower. But what happens if you don’t have a long credit history or if your credit has been less than stellar in the past? This is where a credit recommendation letter can make all the difference.

A credit recommendation letter is a document that vouches for your creditworthiness. It serves as a letter of reference from someone who knows you well and can attest to your ability to handle credit responsibly. This could be a former landlord, employer, or even a family friend who has witnessed your financial habits firsthand.

What is a Credit Recommendation Letter?

A credit recommendation letter is a written document that provides an evaluation of your financial responsibility and trustworthiness. It highlights your positive credit habits, such as making timely payments, managing debt effectively, and maintaining a good credit score. The letter is typically addressed to a specific lender or financial institution and is intended to support your credit application.

Why Do You Need a Credit Recommendation Letter?

In today’s competitive credit market, having a credit recommendation letter can give you a significant advantage. Here are a few reasons why you might need one:

- Building Credit: If you’re just starting to establish your credit history, a credit recommendation letter can help you overcome the lack of credit references. It provides lenders with valuable insights into your financial responsibility.

- Rebuilding Credit: If you’ve had past credit issues or a low credit score, a credit recommendation letter can demonstrate your commitment to improving your financial situation. It can help lenders see that you’ve learned from your mistakes and are now on a more responsible path.

- Securing Better Terms: Even if you have a decent credit history, a credit recommendation letter can help you negotiate better terms on loans or credit cards. Lenders may be more willing to offer you lower interest rates or higher credit limits if they have additional reassurance of your creditworthiness.

When Should You Request a Credit Recommendation Letter?

If you’re considering applying for credit and believe that a credit recommendation letter would strengthen your application, it’s essential to request it in advance. Give the person writing the letter enough time to gather the necessary information and compose a thoughtful recommendation. It’s best to ask for the letter at least a month before you plan to submit your credit application.

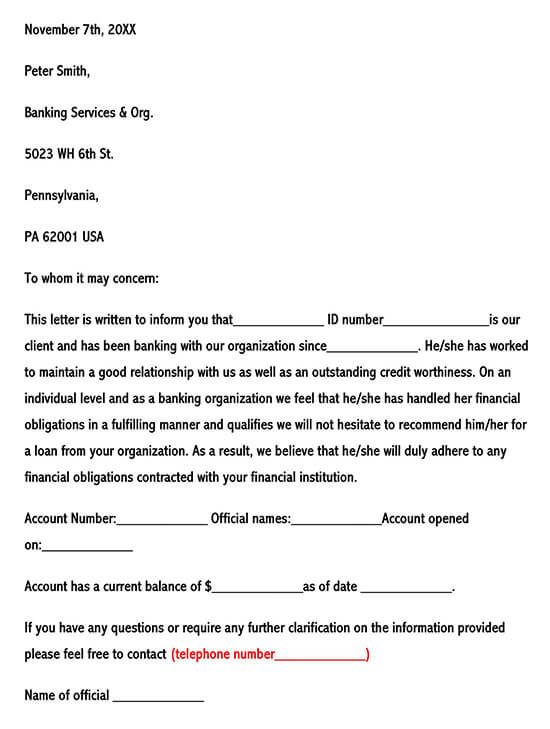

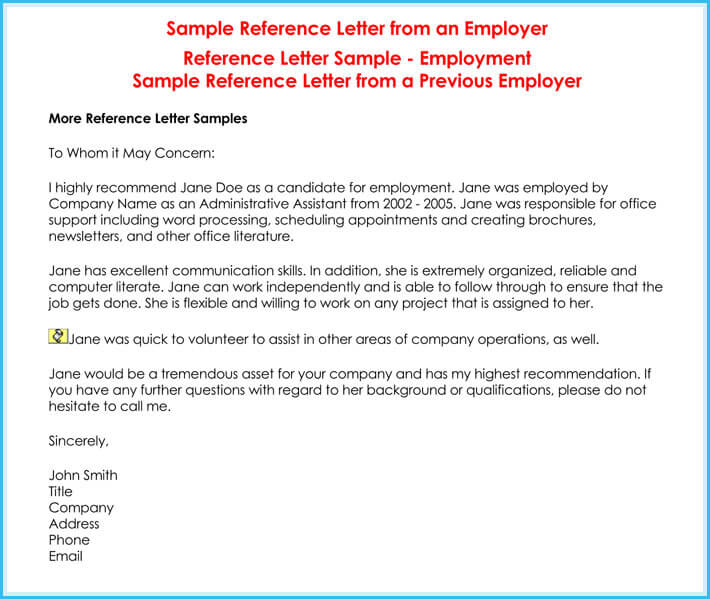

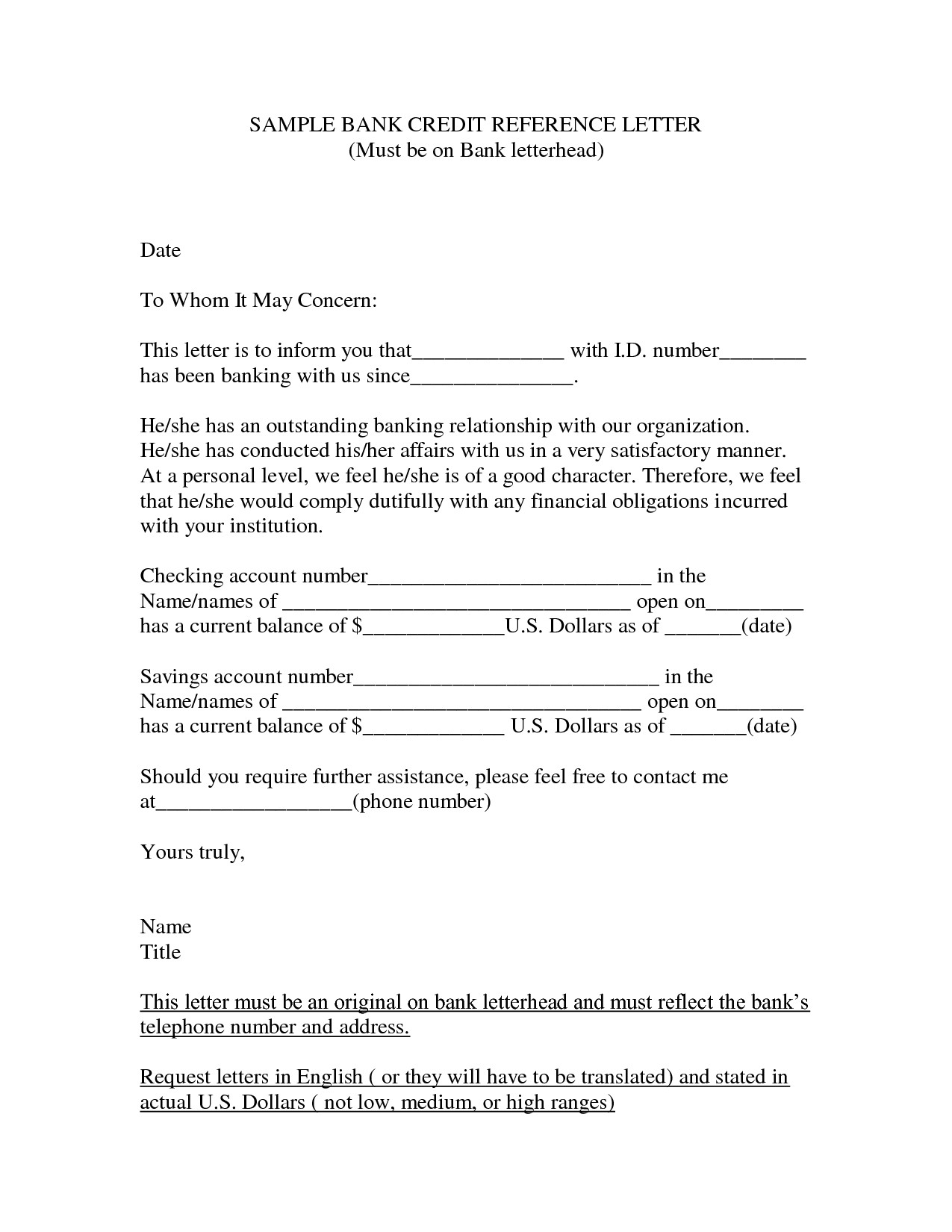

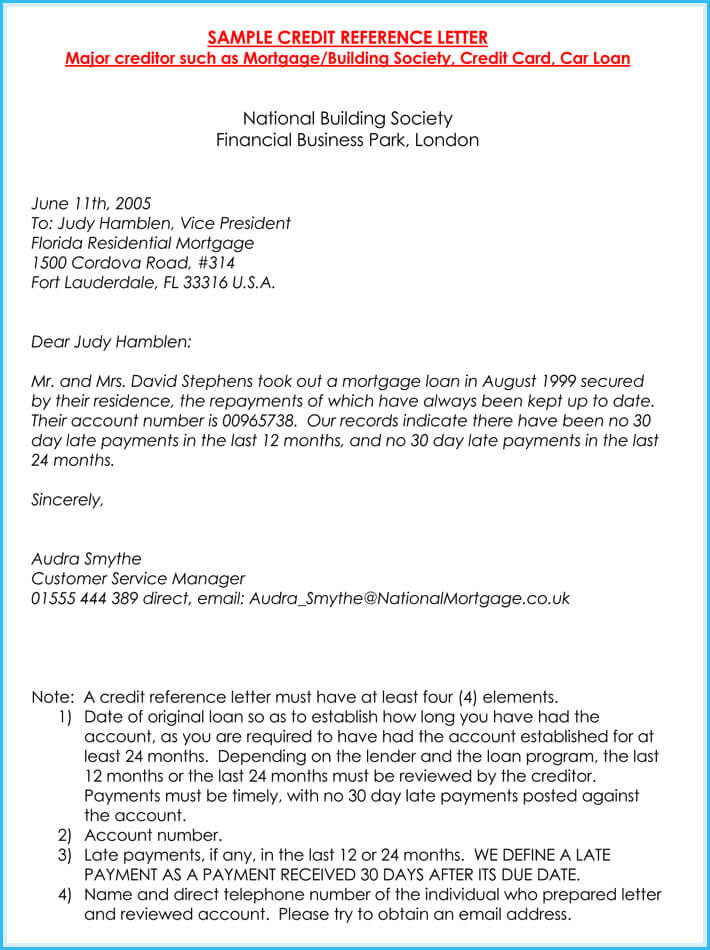

What to Include in a Credit Recommendation Letter?

A credit recommendation letter should contain specific information to help lenders assess your creditworthiness. Here are some key elements to include:

- Your Full Name and Contact Information: Begin the letter by providing your full name, address, phone number, and email address. This helps lenders identify you and contact you if necessary.

- The Recommender’s Information: Include the recommender’s name, title, and contact information. This could be their address, phone number, or email address.

- The Nature of Your Relationship: Explain how the recommender knows you and for how long. This helps establish the credibility of the recommendation.

- Positive Financial Habits: Highlight specific examples of your responsible financial behavior. This could include making timely payments, managing debt effectively, or consistently paying off credit card balances in full.

- Character Traits: Discuss your personal qualities that make you a trustworthy borrower. These could include honesty, integrity, and a strong work ethic.

- Additional Information: If any other relevant details could support your creditworthiness, such as your employment history or educational background, include them in the letter.

How to Write a Credit Recommendation Letter?

Writing a credit recommendation letter requires careful thought and attention to detail. Here are some steps to help you compose an effective letter:

- Start with a Polite Salutation: Begin the letter with a professional greeting, addressing the lender or financial institution by name if possible.

- Introduce Yourself and Your Relationship: Briefly introduce yourself and explain how you know the borrower. This could be through a professional relationship, personal connection, or both.

- Highlight Positive Financial Habits: Provide specific examples of the borrower’s responsible financial behavior. Discuss their ability to make timely payments, manage debt effectively, and maintain a good credit score.

- Discuss Personal Qualities: Share your observations of the borrower’s character traits that make them a trustworthy borrower. Emphasize qualities such as honesty, integrity, and a strong work ethic.

- Offer a Balanced Assessment: While it’s important to highlight the borrower’s strengths, it’s also essential to acknowledge any areas for improvement. Be honest and objective in your assessment.

- Close with a Strong Recommendation: End the letter by expressing your confidence in the borrower’s ability to handle credit responsibly. Offer your contact information if the lender has any further questions or requires additional information.

By following these steps and providing a well-written credit recommendation letter, you can significantly improve your chances of securing the credit you need. Remember, a credit recommendation letter serves as a powerful tool to showcase your creditworthiness and financial responsibility.

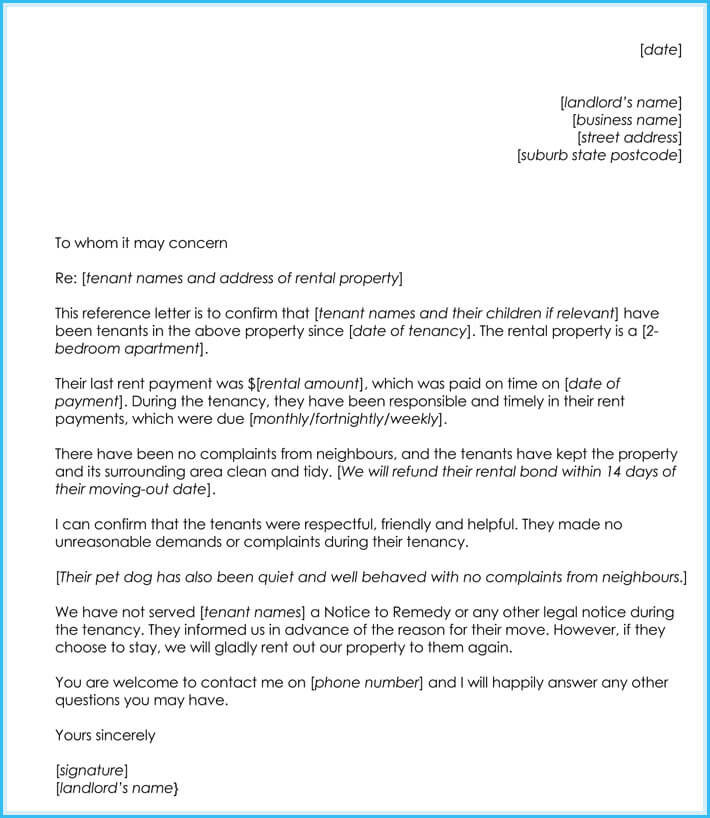

Credit Recommendation Letter Template Word – Download