When it comes to loans, understanding the payment schedule is crucial. Whether you’re considering taking out a loan or already have one, knowing how the payments are structured can help you better manage your finances.

In this article, we will delve into the details of loan payment schedules, answering questions such as what they are, how they work, and why they matter.

What is a Loan Payment Schedule?

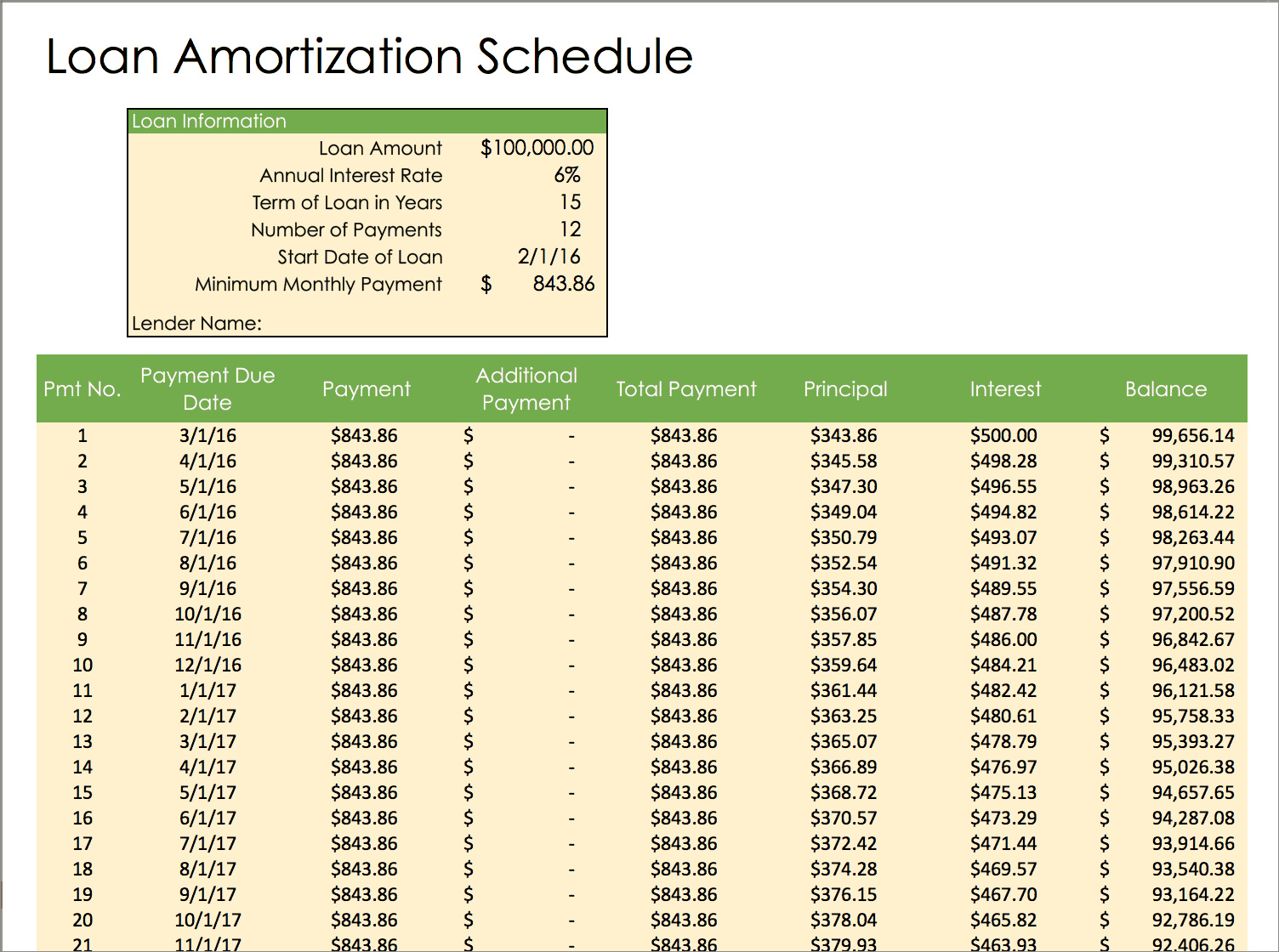

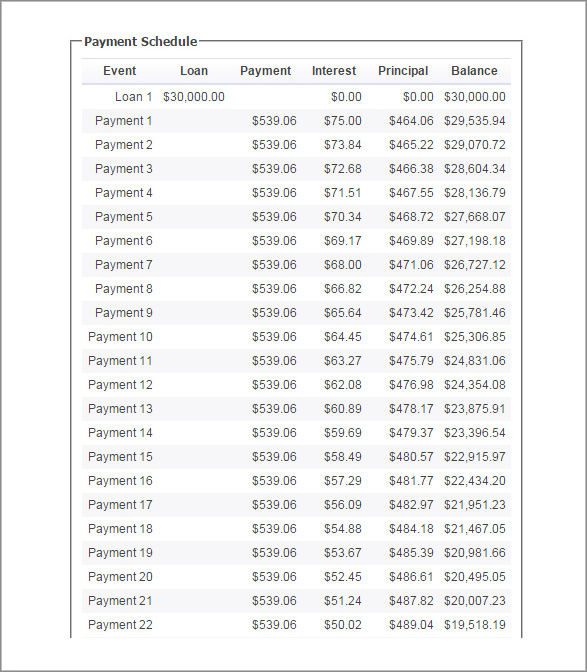

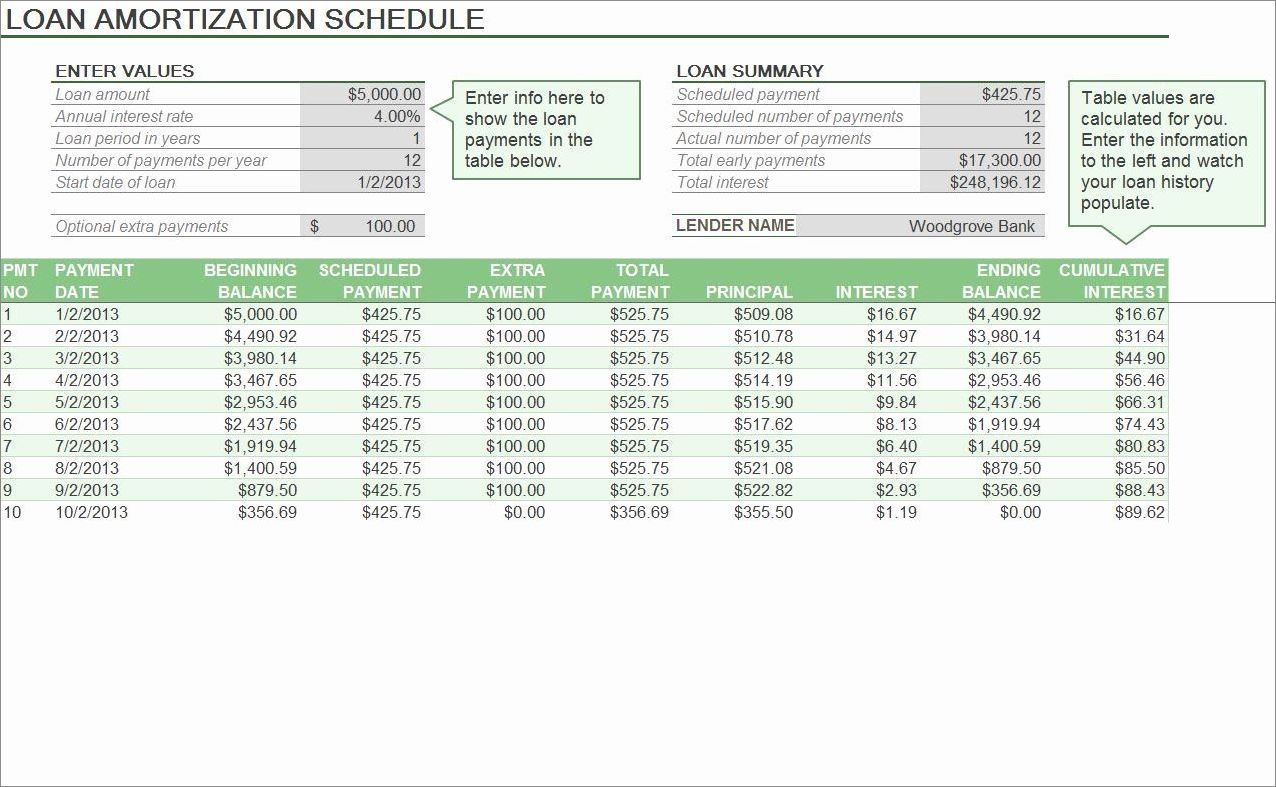

A loan payment schedule, also known as an amortization schedule, is a detailed plan that outlines the repayment terms for a loan. It provides borrowers with a clear picture of how their monthly payments will be allocated between interest and principal over the life of the loan. This schedule is typically provided by the lender and allows borrowers to understand the amount they need to pay each month and how long it will take to repay the loan in full.

Do you know how your loan payment schedule works? Let’s dive deeper into the mechanics.

How Does a Loan Payment Schedule Work?

A loan payment schedule works on the principle of amortization, which means gradually paying off the loan over time through regular payments. Each payment consists of both interest and principal, with the interest portion being higher in the early stages of the loan term and gradually decreasing as the principal balance reduces.

Here’s an example to illustrate how a loan payment schedule works:

Let’s say you take out a $10,000 loan with an interest rate of 5% for a term of 5 years. Your loan payment schedule will show that you need to make monthly payments of approximately $188.71. In the first month, a significant portion of this payment will go towards interest, while a smaller portion will be applied to the principal balance. As you make payments over time, the interest portion decreases, and the principal portion increases, gradually reducing the outstanding balance.

Does this process seem complicated? Don’t worry; we’ll break it down further.

How to Calculate a Loan Payment Schedule

Calculating a loan payment schedule may seem daunting, but it can be simplified using online calculators or spreadsheet software. The key factors involved in the calculation include the loan amount, interest rate, loan term, and the frequency of payments.

Here’s an overview of the steps involved in calculating a loan payment schedule:

- Determine the loan amount: This is the initial amount you borrowed.

- Identify the interest rate: The interest rate determines the cost of borrowing.

- Choose the loan term: This refers to the duration over which you will repay the loan.

- Select the payment frequency: Decide whether you will make monthly, bi-weekly, or weekly payments.

- Use a loan calculator or spreadsheet software to generate the payment schedule: Input the relevant information into the calculator or software to obtain a detailed breakdown of your payment schedule.

Remember, different loan types and lenders may have variations in how they calculate loan payment schedules. It’s always a good idea to consult with your lender or use reliable online tools to ensure accuracy.

The Importance of Understanding Your Loan Payment Schedule

Understanding your loan payment schedule is vital for several reasons:

- Budgeting: Knowing how much you need to pay each month helps you plan your budget accordingly.

- Financial planning: A payment schedule allows you to see the big picture of your loan repayment journey and make informed decisions about your overall financial strategy.

- Interest savings: By understanding how payments are allocated, you can explore strategies to pay off your loan faster and potentially save on interest.

- Early repayment: If you have the means to make extra payments, understanding the payment schedule can help you determine the most effective way to reduce your loan balance.

Now that you know why it’s important, let’s explore some tips for managing your loan payment schedule effectively.

Tips for Managing Your Loan Payment Schedule

Managing your loan payment schedule doesn’t have to be overwhelming. Here are some tips to help you stay on top of your payments:

- Automate your payments: Set up automatic payments to ensure you never miss a due date.

- Create a separate account: Consider opening a dedicated account for loan payments to keep your finances organized.

- Pay extra when possible: If you have the means, making additional payments can help reduce your loan balance and save on interest.

- Communicate with your lender: If you encounter financial difficulties, reach out to your lender to explore options such as loan modification or refinancing.

- Review your schedule periodically: Regularly review your loan payment schedule to ensure it aligns with your financial goals and make adjustments if necessary.

- Stay informed: Stay updated on changes in interest rates or loan terms that could impact your payment schedule.

Conclusion

A loan payment schedule is a vital tool that helps borrowers understand their repayment terms and manage their finances effectively. By understanding how these schedules work, calculating them accurately, and staying on top of your payments, you can navigate your loan journey with confidence. Remember, always consult with your lender and explore reliable resources to ensure you have the most accurate and up-to-date information.

Loan Payment Schedule Template Excel – Download