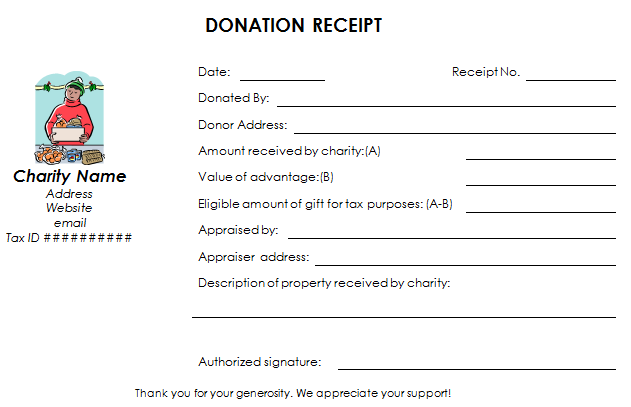

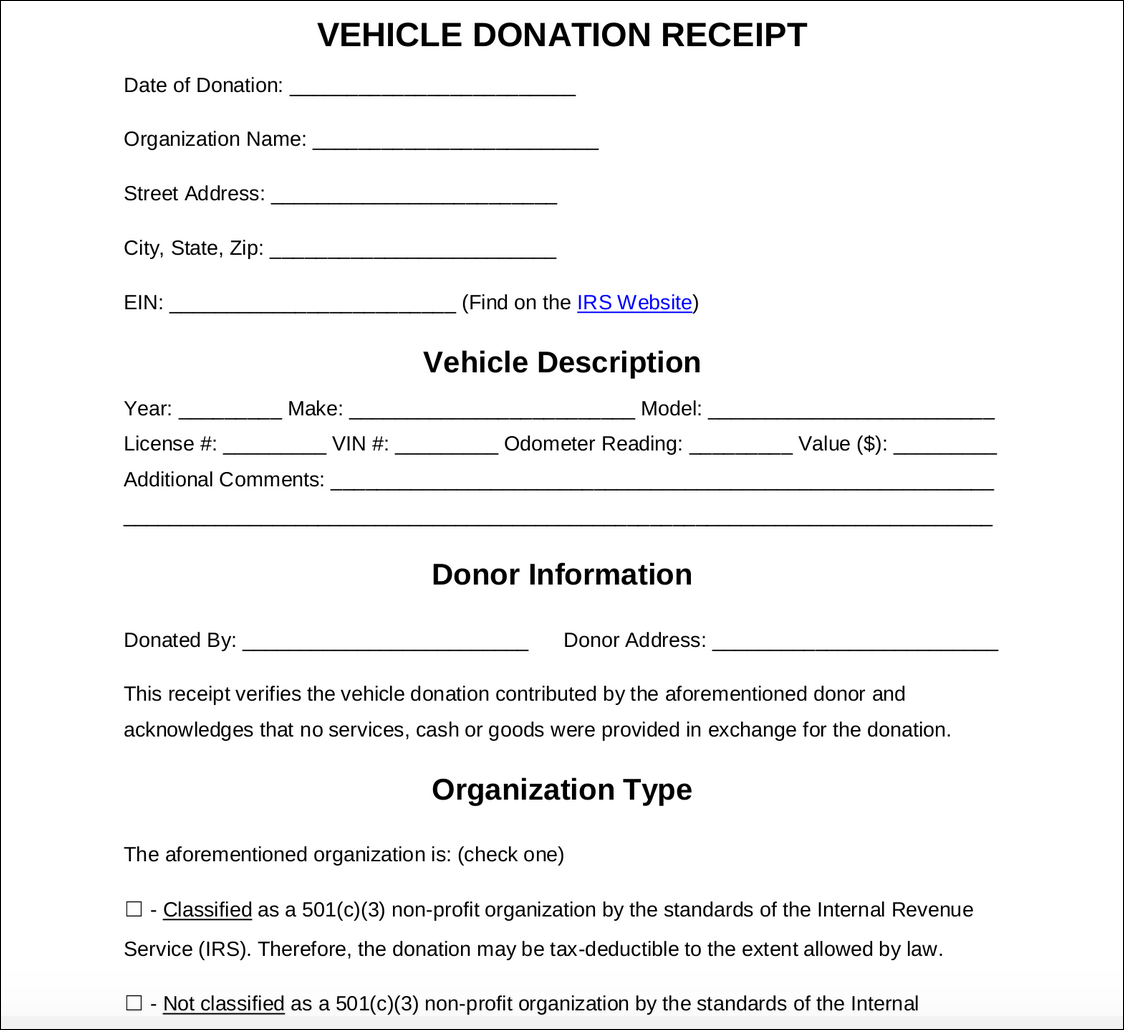

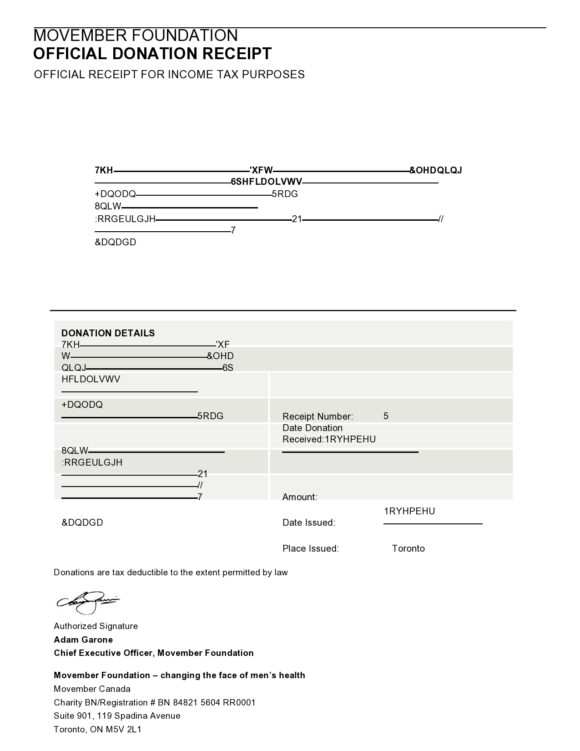

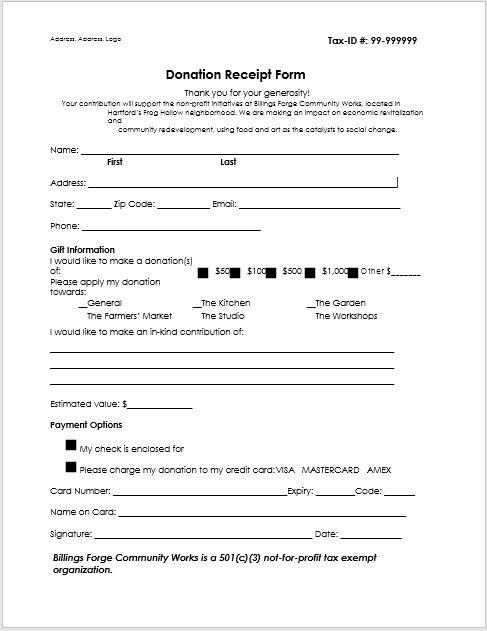

A non-profit organization receipt template is a document that serves as proof of a donation made to a non-profit organization. It includes all the necessary information about the donation, such as the donor’s name, contact information, donation amount, date of donation, and the non-profit organization’s details.

Non-profit organizations rely heavily on donations to fund their operations and support their causes. Issuing a receipt to donors is not only a legal requirement but also a way to acknowledge their contribution and build trust. Having a well-designed and professional-looking receipt template can make the donation process more efficient and organized.

Why Should Non-Profit Organizations Use Receipt?

Using receipt templates offers several benefits for non-profit organizations:

- Efficiency: Having a pre-designed template saves time and effort in creating receipts from scratch for every donation.

- Consistency: Templates ensure that all receipts follow the same format and include all the necessary information.

- Professionalism: Well-designed templates enhance the organization’s image and demonstrate professionalism to donors.

- Accuracy: Templates help minimize errors and ensure that all donation details are recorded accurately.

- Compliance: Using receipt templates helps non-profit organizations comply with tax laws and regulations regarding donation receipts.

How to Create a Non-Profit Organization Receipt

Creating a non-profit organization receipt template involves several steps:

- Choose a Format: Decide on the format of the receipt, whether it will be a printed document or an electronic receipt.

- Include Organization Details: Add the non-profit organization’s name, logo, address, and contact information at the top of the receipt.

- Donor Information: Include fields for the donor’s name, address, phone number, and email address.

- Donation Details: Include fields to capture the donation amount, date of donation, and any specific designation for the donation.

- Payment Information: If applicable, include fields for recording payment method details, such as check number or credit card information.

- Tax Information: Add a statement explaining the tax-exempt status of the non-profit organization and any tax-deductible information for the donor.

- Terms and Conditions: Include any necessary legal disclaimers or terms and conditions related to the donation.

- Design and Branding: Ensure that the receipt template aligns with the organization’s branding and design guidelines.

Once the template is created, it can be easily customized for each donation by filling in the relevant information.

Best Practices for Non-Profit Organization Receipt Templates

Here are some best practices to consider when designing and using non-profit organization receipt templates:

- Keep it Simple: Avoid cluttering the receipt with unnecessary information. Stick to the essential details and make the receipt easy to read.

- Use Clear and Concise Language: Ensure that the language used in the receipt is easy to understand and free of jargon.

- Add a Thank You Message: Express gratitude to the donor by including a personalized thank you message on the receipt.

- Provide Contact Information: Include the organization’s contact information in case the donor has any questions or needs further assistance.

- Keep a Record: Maintain a copy of each receipt issued for future reference and auditing purposes.

- Regularly Review and Update: Periodically review the receipt template to ensure it remains up to date with any changes in tax laws or regulations.

Bottom Line

A non-profit organization receipt template is a valuable tool for efficiently managing and acknowledging donations. By using a well-designed template, non-profit organizations can streamline their receipting process, ensure compliance with tax laws, and build stronger relationships with donors. Whether it’s a simple receipt or a more comprehensive template, the key is to provide donors with a professional and personalized acknowledgment of their contribution.

Non-profit Organization Receipt Template Word – Download