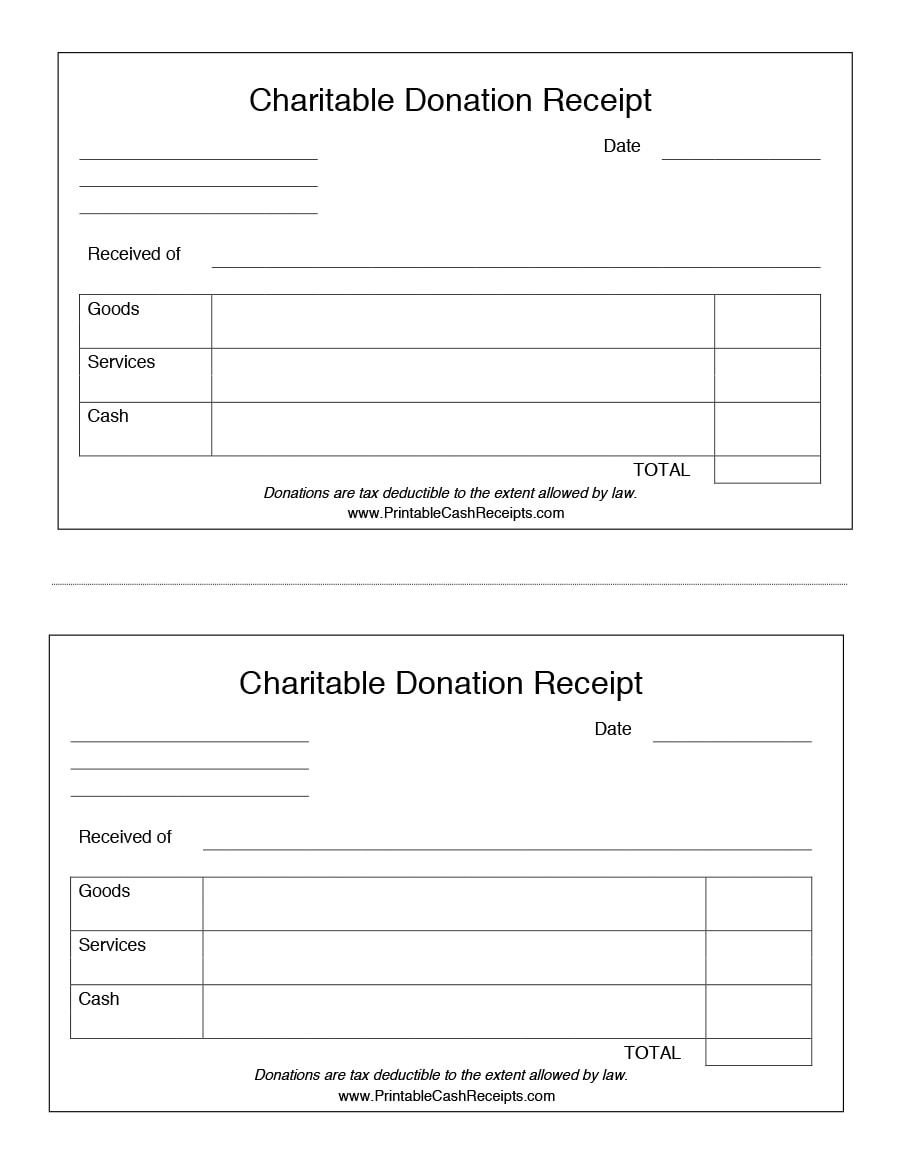

A charitable contributions receipt template is a document that organizations or individuals can use to acknowledge and record donations made to a non-profit organization. It serves as proof of donation and can be used by donors to claim tax deductions. The template typically includes important details such as the donor’s name, the amount donated, the date of the donation, and the organization’s information. By using a template, non-profit organizations can ensure consistency and accuracy in recording and acknowledging donations.

Why Should Non-Profit Organizations Use a Charitable Contributions Receipt?

Non-profit organizations should use a charitable contributions receipt template for several reasons:

- Legal compliance: Non-profit organizations are required to provide donors with a receipt for tax purposes if the donation exceeds a certain amount. Using a template ensures that the organization meets its legal obligations.

- Record keeping: A template helps organizations maintain organized and accurate records of all donations received. This is important for financial reporting and transparency.

- Donor satisfaction: Providing a professional and well-designed receipt to donors shows appreciation for their contribution and helps build trust and loyalty.

- Tax benefits: Donors can use the receipt as evidence when claiming tax deductions for their charitable contributions.

How to Create a Charitable Contributions Receipt

Creating a charitable contributions receipt template can be done in a few simple steps:

- Choose a format: Decide on the format of your receipt template, whether it’s a physical document or a digital file.

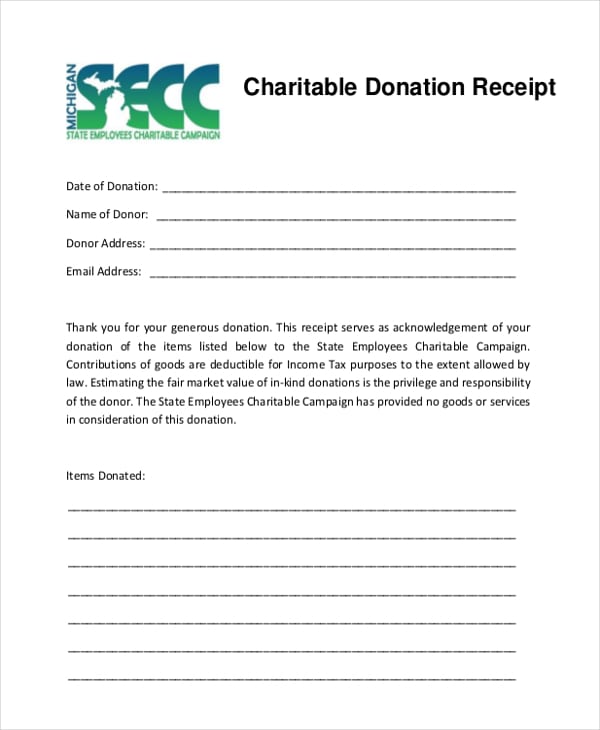

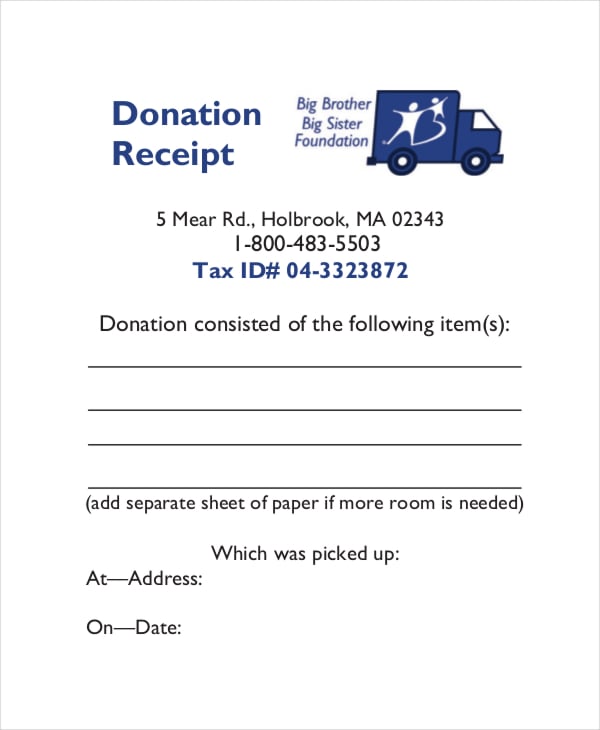

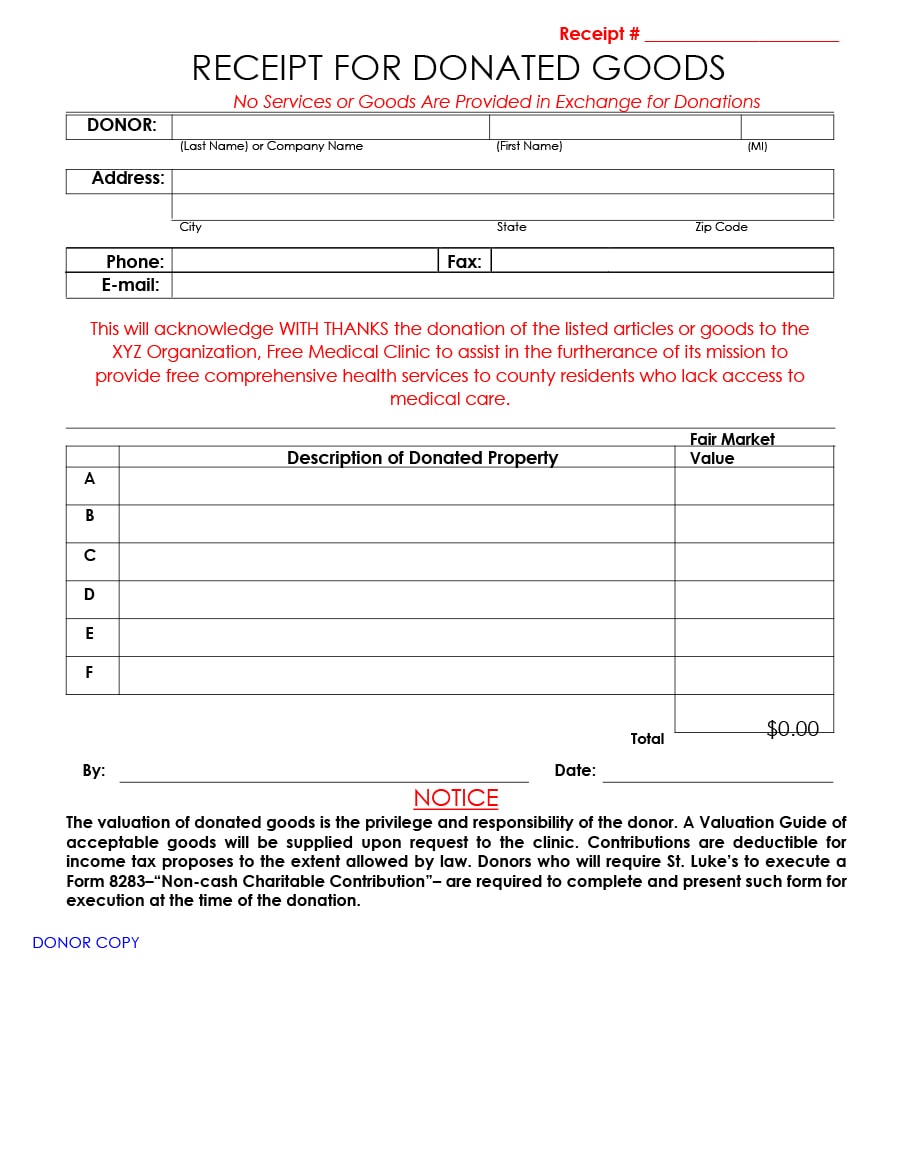

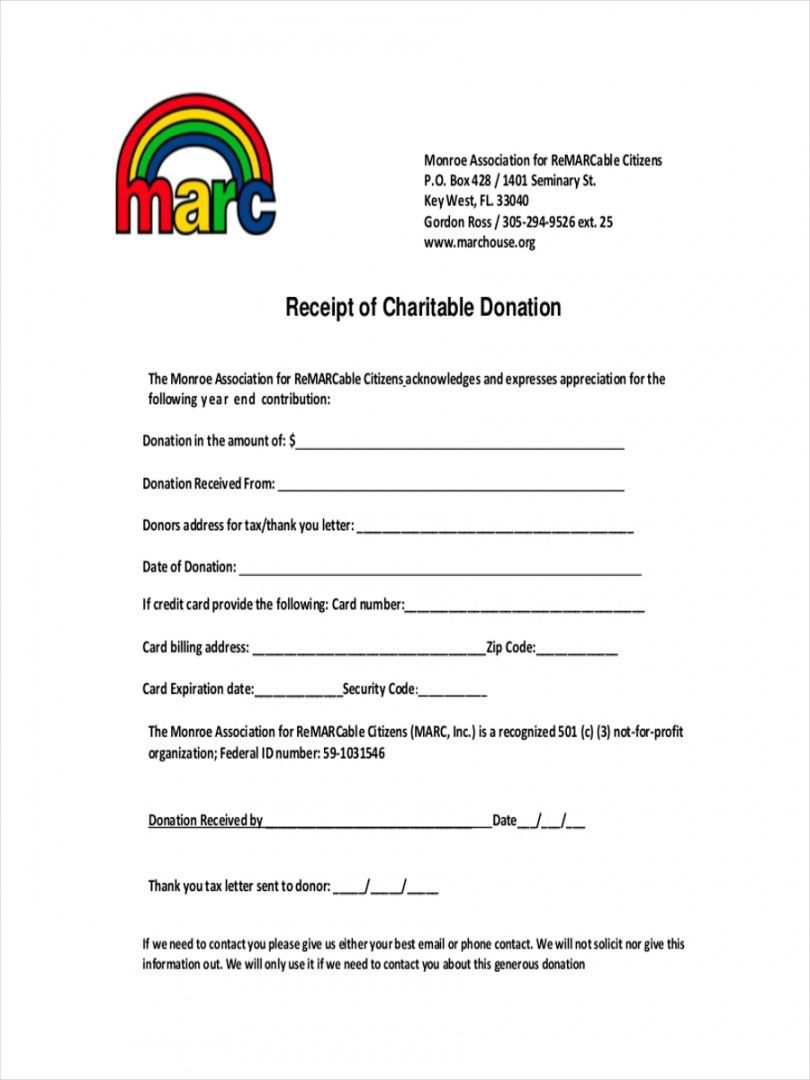

- Include necessary information: Make sure to include the donor’s name, address, contact information, the organization’s name, address, tax identification number, the date of the donation, and the amount donated.

- Add a thank-you message: Show gratitude to the donor by including a personalized thank-you message in the receipt.

- Design and branding: Customize the template to reflect your organization’s branding and make it visually appealing.

- Save and distribute: Save the template in a secure location and distribute it to donors either physically or electronically.

How to Use a Charitable Contributions Receipt Template

Using a charitable contributions receipt template is straightforward:

- Download or create a template: Choose a template that suits your organization’s needs or create your own.

- Customize the template: Add your organization’s information, logo, and branding to the template.

- Fill in donor information: Enter the donor’s name, address, contact information, and the date and amount of the donation.

- Add a thank-you message: Personalize the receipt by including a heartfelt thank-you message to the donor.

- Save and distribute: Save the completed receipt and provide a copy to the donor either physically or electronically.

Common Mistakes to Avoid with Charitable Contributions Receipts

When using charitable contributions receipt templates, it’s important to avoid common mistakes:

- Inaccurate information: Double-check all information provided on the receipt to ensure accuracy.

- Missing donor details: Make sure to collect all necessary donor information to include on the receipt.

- Failure to provide a thank-you message: Take the opportunity to express gratitude to the donor for their contribution.

- Not keeping records: Keep a copy of all receipts issued for your organization’s records.

- Using outdated templates: Regularly update your receipt template to ensure it complies with current tax laws and regulations.

Conclusion

A charitable contributions receipt template is an essential tool for non-profit organizations to acknowledge and record donations. By using a template, organizations can ensure legal compliance, maintain accurate records, and provide a positive experience for donors. Whether using a pre-designed template or creating your own, it’s important to customize the receipt to reflect your organization’s branding and include all necessary information. Avoid common mistakes and regularly update your template to ensure it remains compliant with tax laws. By following these guidelines, non-profit organizations can effectively manage and acknowledge charitable contributions.

Charitable Contributions Receipt Template Word – Download