Managing debt is an integral part of running a successful business. It is crucial to have a clear understanding of your business debt schedule to effectively plan and budget for repayment.

In this article, we will explore what a business debt schedule is, why it is important, and how to create one. We will also provide examples and tips to help you manage your business debt more efficiently.

What is a Business Debt Schedule?

A business debt schedule is a document that outlines all the debts your business owes, including loans, credit card balances, and other financial obligations. It provides a detailed overview of your debt, including the principal amount, interest rate, repayment terms, and due dates. Think of it as a roadmap that helps you navigate your way through your business’s debt obligations.

Creating a business debt schedule allows you to visualize your debt and understand its impact on your cash flow. It helps you prioritize your debt payments and make informed decisions about your business’s financial health. By having a clear picture of your debt obligations, you can plan and budget effectively, avoid missed payments, and ultimately reduce your overall debt burden.

Why is a Business Debt Schedule Important?

A business debt schedule is important for several reasons:

- Financial Planning: A debt schedule helps you plan for the future by providing a clear overview of your debt obligations. It allows you to forecast your cash flow and make informed decisions about your business’s financial health.

- Budgeting: By understanding your debt obligations, you can allocate funds for debt repayment in your budget. This ensures that you have enough resources to meet your repayment obligations without compromising your day-to-day operations.

- Debt Management: A business debt schedule enables you to prioritize your debt payments based on interest rates, due dates, and other factors. It helps you identify opportunities for refinancing or debt consolidation, potentially reducing your interest costs and improving your overall financial position.

- Tracking Progress: With a debt schedule, you can track your progress in reducing your debt over time. This provides a sense of accomplishment and motivates you to stay on track with your debt repayment goals.

How to Create a Business Debt Schedule

Creating a business debt schedule may seem daunting, but it is a relatively straightforward process. Here are the steps to follow:

1. Gather all Relevant Information

Start by collecting all the necessary information about your debts, including loan agreements, credit card statements, and any other financial documents. Make sure to include the principal amount, interest rate, repayment terms, and due dates for each debt.

2. Organize Your Debts

Once you have gathered all the information, organize your debts logically and systematically. You can categorize them by type (e.g., loans, credit cards) or by interest rate. This will make it easier to analyze and prioritize your debt payments.

3. Input the Information into a Spreadsheet

Use a spreadsheet program like Microsoft Excel or Google Sheets to create your debt schedule. Input the relevant information for each debt, including the principal amount, interest rate, repayment terms, and due dates. You can also add additional columns to track your payments and calculate the remaining balance.

4. Calculate Total Debt and Monthly Payments

Once you have input all the information, calculate the total amount of debt you owe and the monthly payments required to repay each debt. This will give you a clear overview of your financial obligations and help you budget accordingly.

5. Analyze and Prioritize Your Debts

Review your debt schedule and analyze the interest rates, due dates, and repayment terms for each debt. Prioritize your debts based on factors such as high-interest rates, upcoming due dates, and the impact on your cash flow. This will help you determine which debts to focus on first.

6. Create a Repayment Plan

Based on your analysis, create a repayment plan that outlines how you will allocate your resources to repay your debts. Consider strategies such as snowball or avalanche methods to accelerate your debt repayment and save on interest costs.

7. Monitor and Update Your Debt Schedule

Regularly monitor and update your debt schedule as you make payments and new debts arise. This will ensure that you have an accurate and up-to-date overview of your debt obligations.

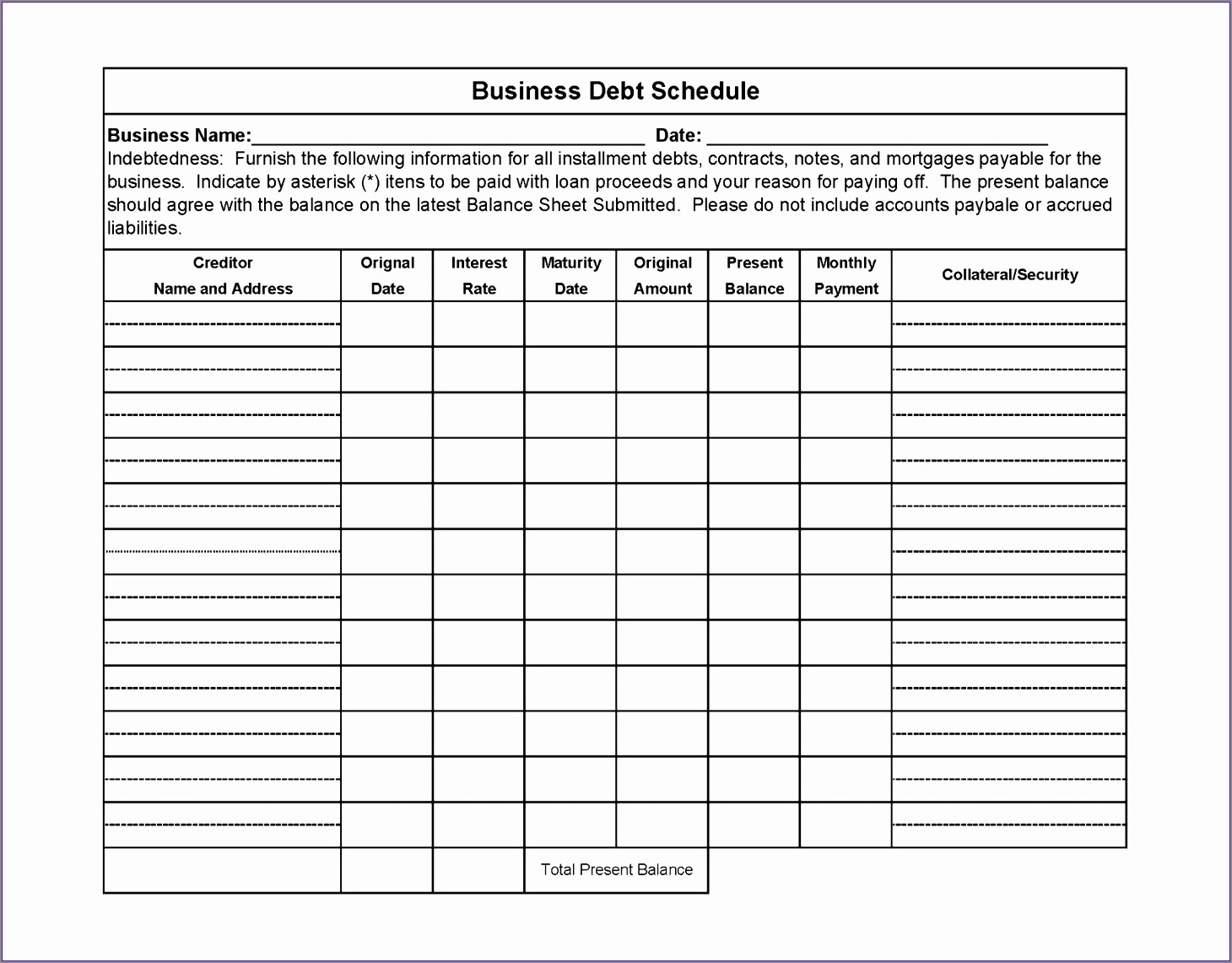

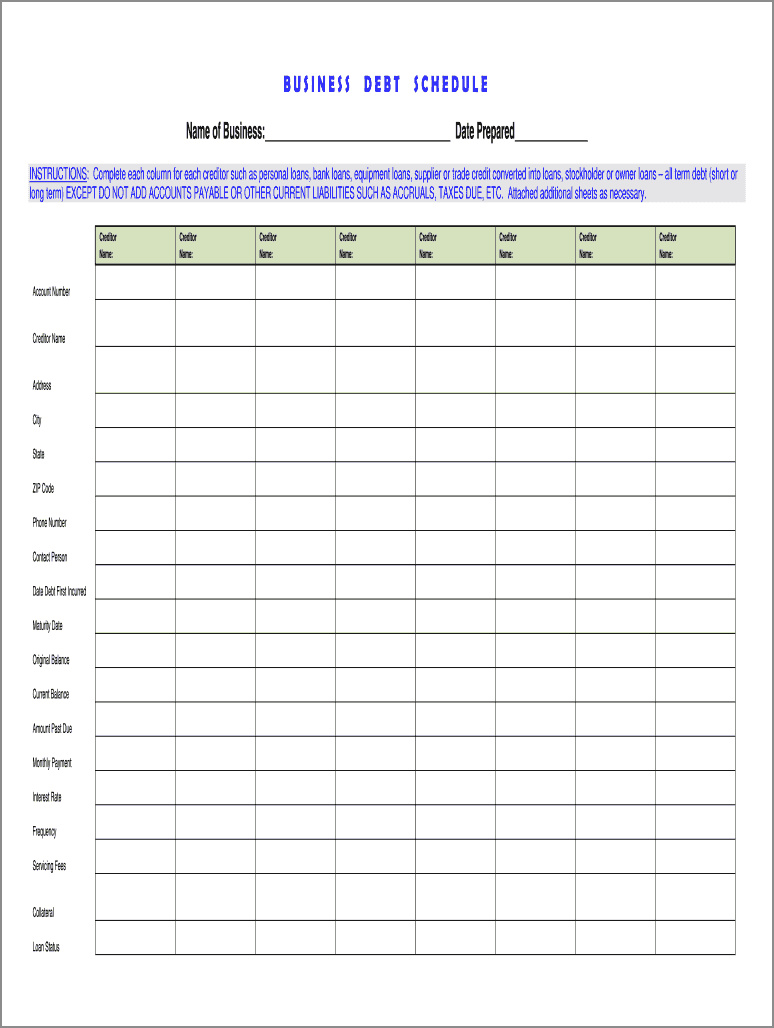

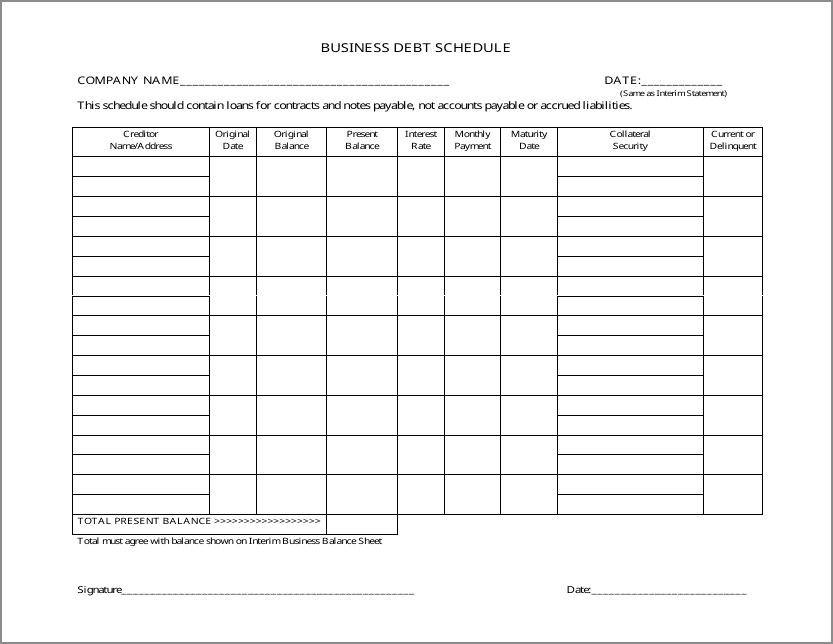

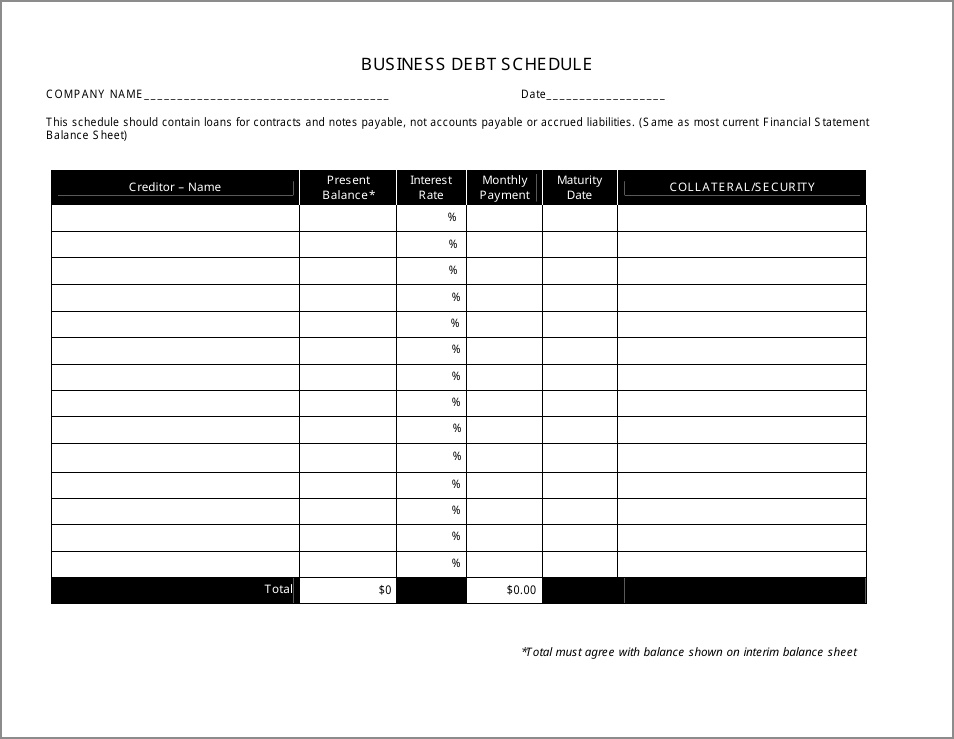

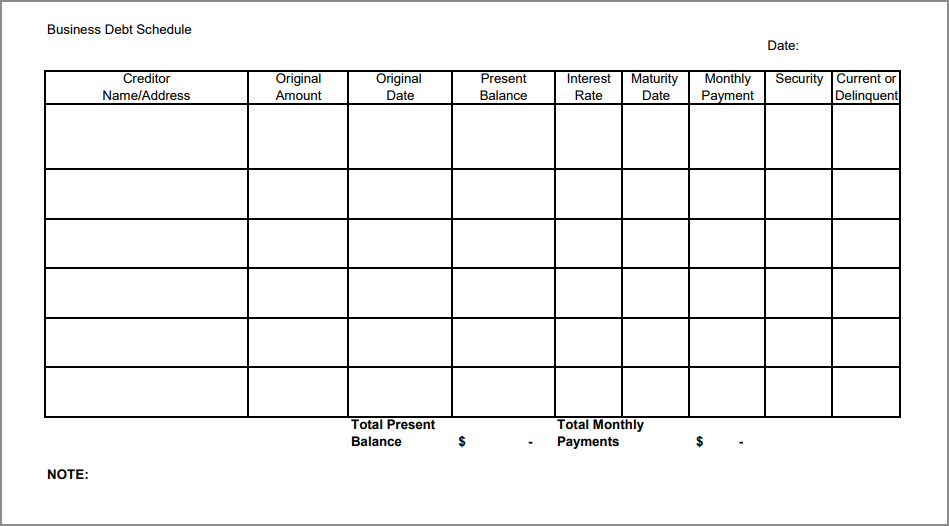

Sample Business Debt Schedule

Here is a sample business debt schedule to give you an idea of how it could look:

| Debt | Principal Amount | Interest Rate | Repayment Terms | Due Date |

|---|---|---|---|---|

| Loan A | $50,000 | 5% | 5 years | 15th of every month |

| Loan B | $30,000 | 7% | 3 years | 1st of every month |

| Credit Card A | $10,000 | 15% | Minimum payment + interest | 10th of every month |

In this example, the business has three debts: Loan A, Loan B, and Credit Card A. The debt schedule provides information about the principal amount, interest rate, repayment terms, and due dates for each debt.

Tips for Managing Your Business Debt

Managing business debt can be challenging, but with the right strategies, you can effectively navigate your way to financial stability. Here are some tips to help you manage your business debt:

- Create a Budget: Develop a comprehensive budget that includes your debt repayment obligations. This will help you allocate funds and avoid overspending.

- Negotiate with Creditors: If you are struggling to meet your debt obligations, consider reaching out to your creditors to negotiate more favorable terms. They may be willing to lower interest rates or extend repayment periods.

- Explore Debt Consolidation: If you have multiple high-interest debts, consolidating them into a single loan with a lower interest rate can help simplify payments and save on interest costs. However, carefully evaluate the terms and fees associated with debt consolidation before proceeding.

- Seek Professional Help: If you are overwhelmed by your debt or need expert guidance, consider consulting a financial advisor or debt counselor. They can provide personalized advice and help you develop a plan to manage your debt effectively.

- Stay Organized: Regularly update your debt schedule and keep all relevant financial documents in one place. This will help you stay on top of your debt obligations and avoid missed payments.

- Focus on Cash Flow: Prioritize debts that have a significant impact on your cash flow, such as those with high interest rates or upcoming due dates. By managing your cash flow effectively, you can ensure that you have enough resources to meet your debt obligations.

- Monitor Your Credit Score: Regularly check your business credit score to track your progress and identify areas for improvement. A higher credit score can provide access to better financing options in the future.

By implementing these tips and strategies, you can take control of your business debt and work towards a more secure financial future.

Business Debt Schedule Template Excel – Download