An IRS mileage reimbursement form is a document used by employees and self-employed individuals to claim reimbursement for business-related mileage expenses. The Internal Revenue Service (IRS) allows taxpayers to deduct mileage expenses when they use their vehicles for business purposes. To claim this deduction, individuals must track their mileage and submit a mileage reimbursement form to their employers or the IRS.

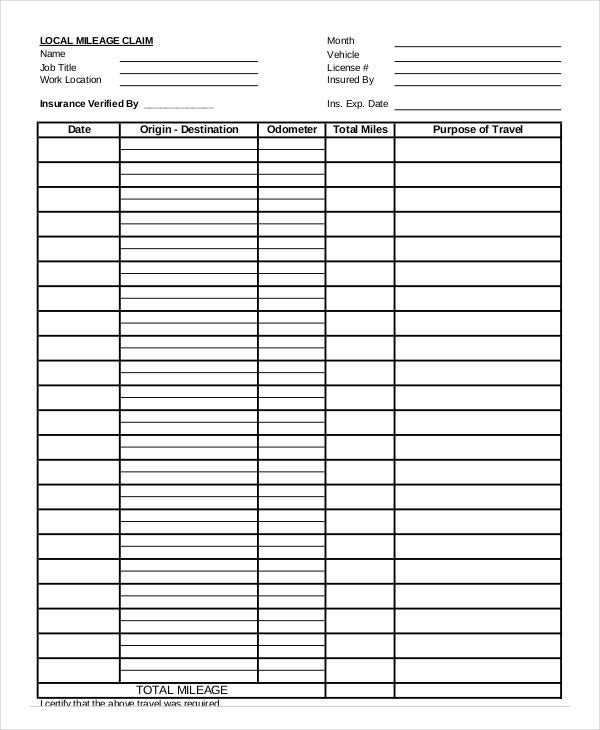

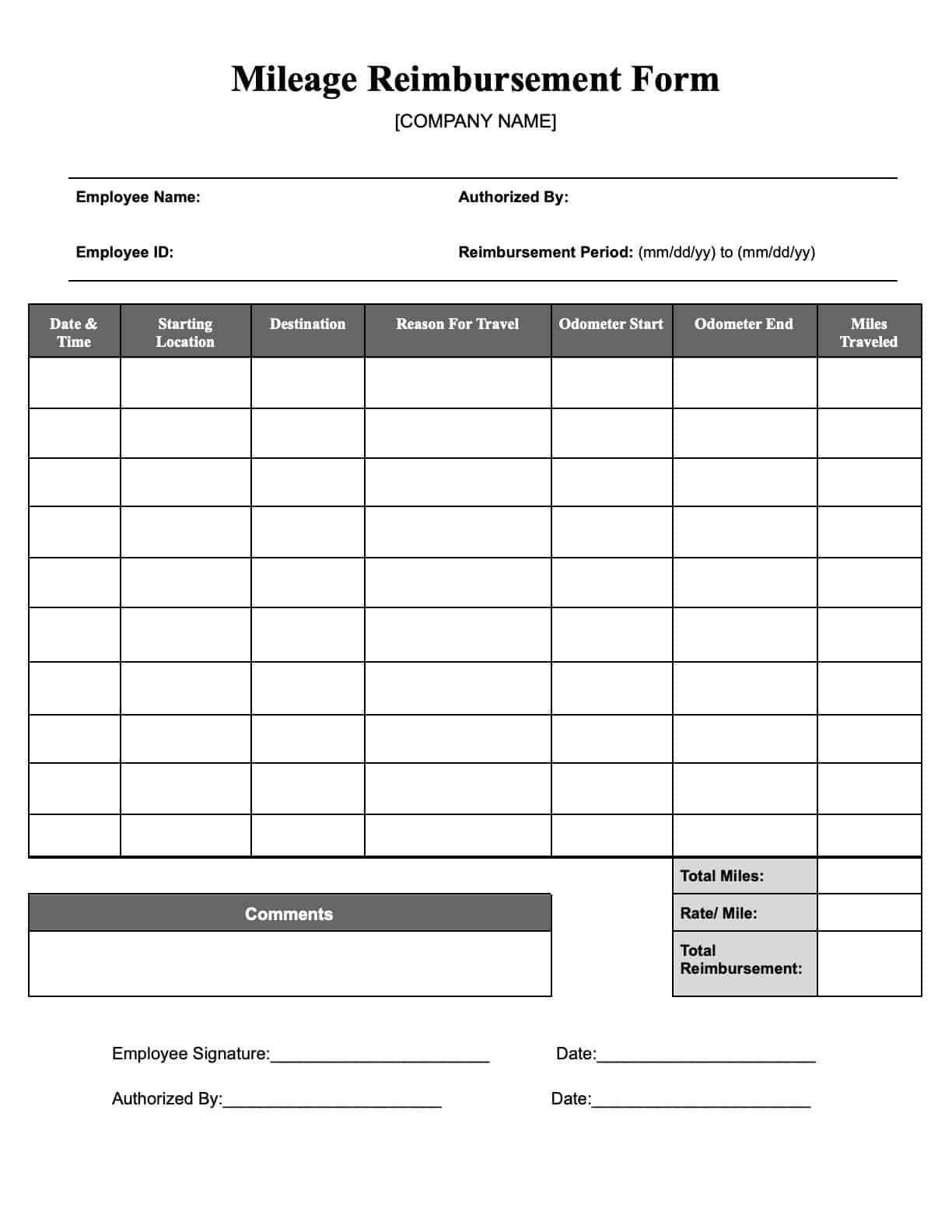

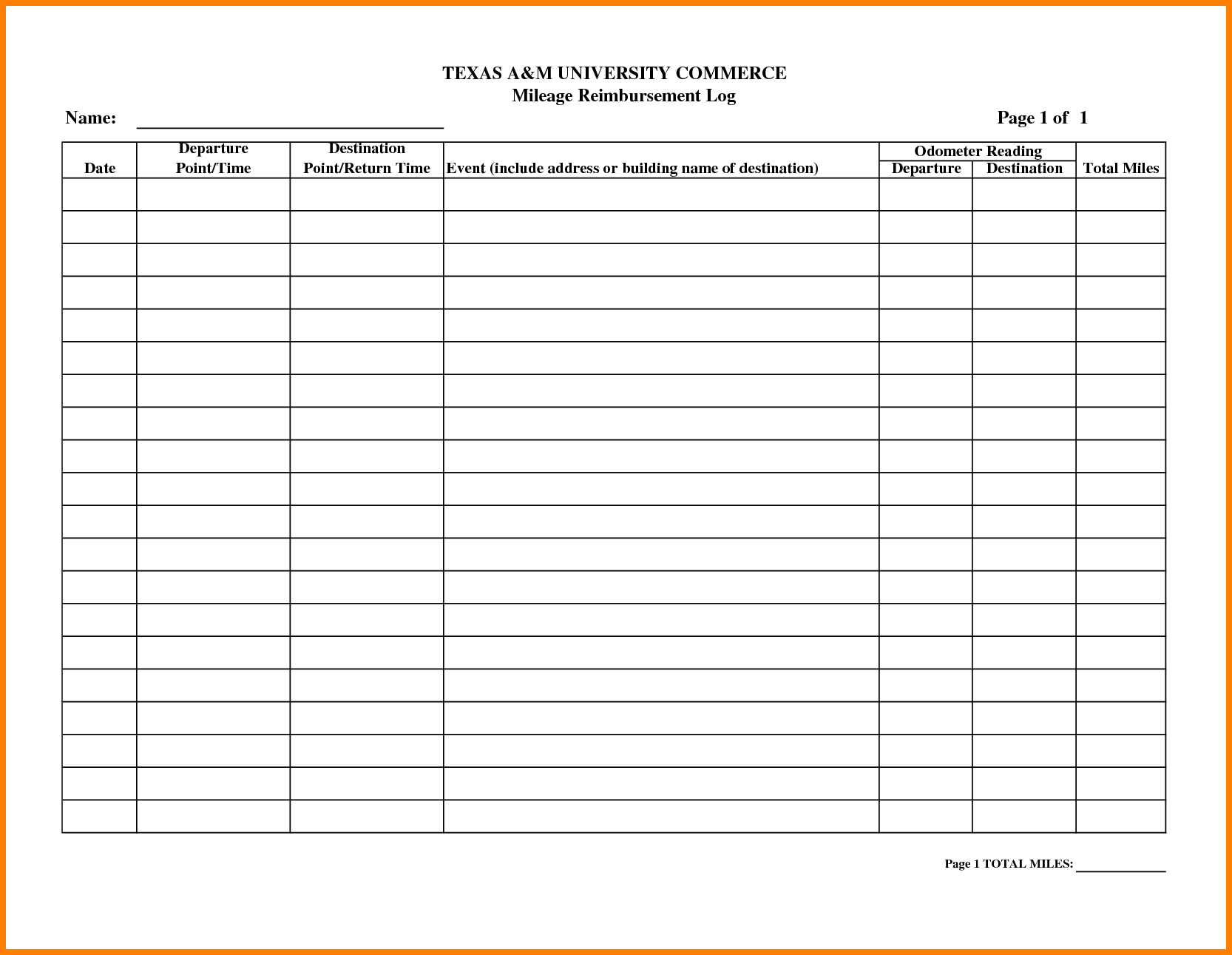

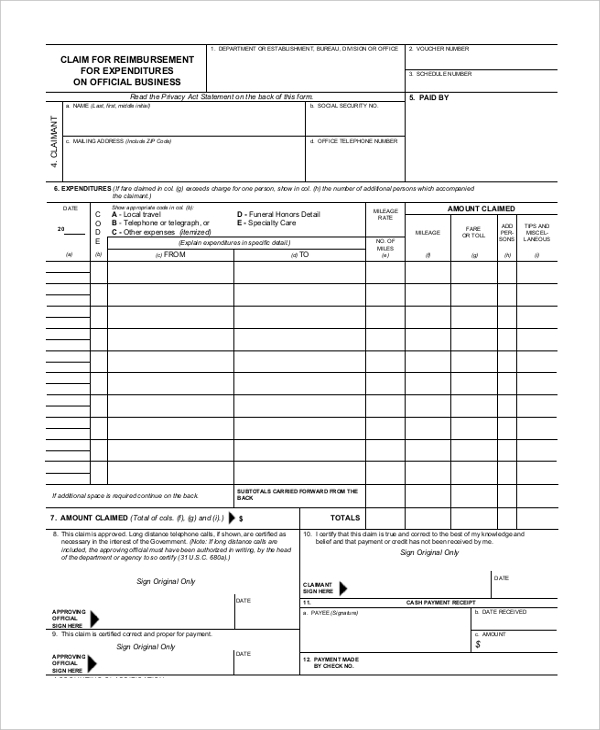

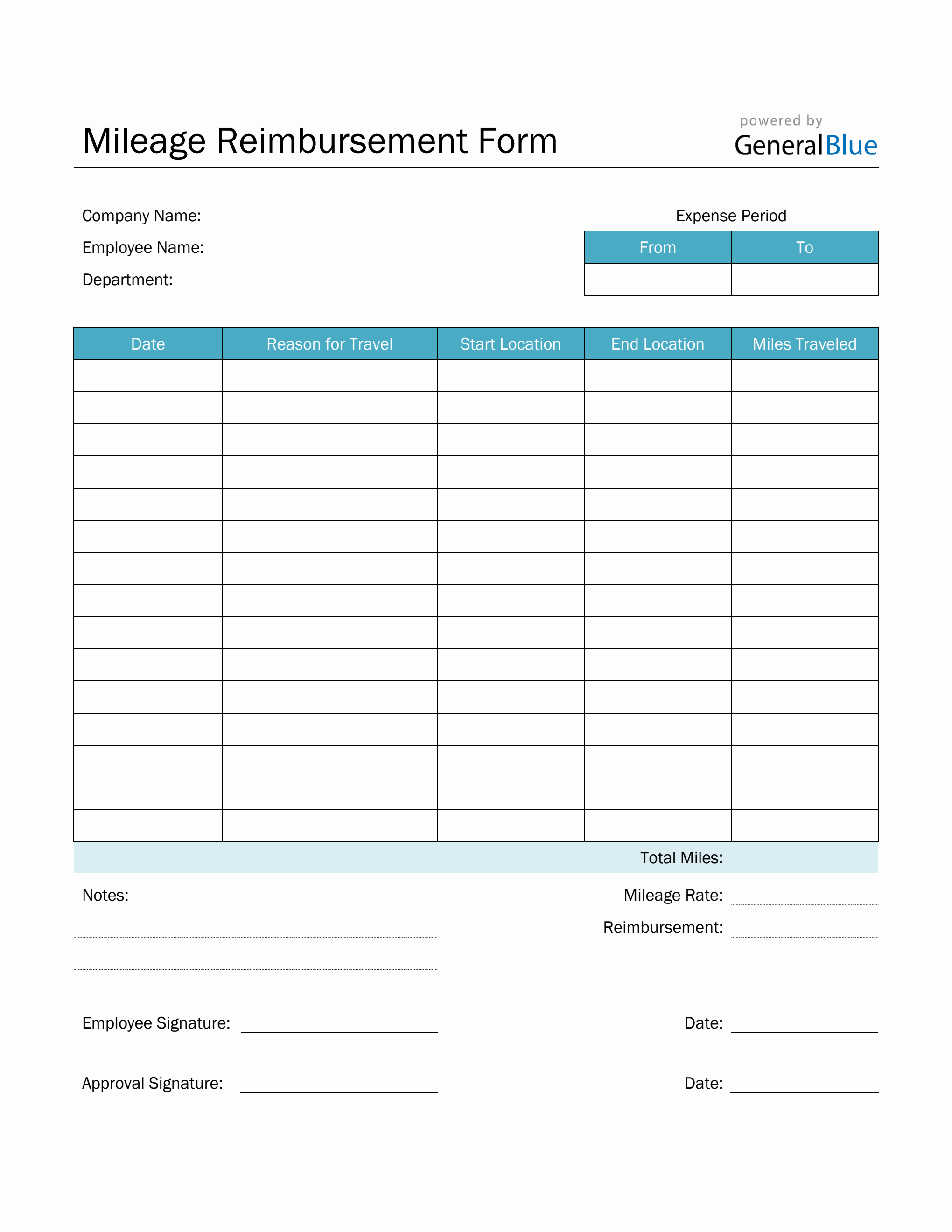

The form typically includes information such as the name of the taxpayer, the date and purpose of the trip, the starting and ending locations, and the total number of miles driven. It is important to accurately record all business-related mileage to ensure the appropriate reimbursement or tax deduction.

Who Should Use an IRS Mileage Reimbursement Form?

An IRS mileage reimbursement form can be used by anyone who uses their vehicle for business purposes. This includes employees who are not reimbursed by their employers for mileage expenses and self-employed individuals who need to track their business-related driving for tax purposes.

Common examples of individuals who should use a mileage reimbursement form include:

- Delivery drivers: Individuals who make deliveries as part of their job, such as couriers or food delivery drivers.

- Sales representatives: Salespeople who travel to meet clients or attend sales meetings.

- Real estate agents: Agents who drive to show properties to clients.

- Contractors: Self-employed individuals who travel to job sites.

- Consultants: Professionals who travel to meet with clients or attend conferences.

Using a printable IRS mileage reimbursement form can help these individuals keep track of their business-related mileage and ensure they receive the appropriate reimbursement or tax deduction.

How to Use a Printable IRS Mileage Reimbursement Form

Using a printable IRS mileage reimbursement form is a simple process. Follow these steps to ensure accurate and complete documentation:

- Download the form: Find a printable IRS mileage reimbursement form online or visit the IRS website to download the official form.

- Fill in your information: Enter your name, address, and other personal information at the top of the form.

- Date and purpose of the trip: Indicate the date and provide a brief description of the purpose of the trip, such as “client meeting” or “business conference.”

- Starting and ending locations: Record the starting and ending locations of your trip, including the address or city names.

- Total number of miles: Calculate the total number of miles driven for the trip and enter it in the appropriate field.

- Sign and submit: Sign the form and submit it to your employer or keep it for your records if you are self-employed.

It is important to keep a copy of the completed form for your records and to ensure accuracy when reporting mileage for reimbursement or tax purposes.

Why Should You Use a Printable IRS Mileage Reimbursement Form?

Using a printable IRS mileage reimbursement form offers several benefits:

- Accurate recordkeeping: By using a mileage reimbursement form, you can accurately track and document your business-related mileage, ensuring you have the necessary records for reimbursement or tax deductions.

- Maximize deductions: By keeping detailed records of your mileage, you can maximize your deductions and potentially reduce your tax liability.

- Compliance with IRS requirements: The IRS has specific requirements for documenting and claiming mileage deductions. By using their official form or a reputable printable form, you can ensure compliance with these requirements.

Overall, using a printable IRS mileage reimbursement form is a simple and effective way to track and document your business-related mileage, whether you are an employee seeking reimbursement or a self-employed individual looking to claim deductions on your taxes.

Benefits of Using a Printable IRS Mileage Reimbursement Form

Using a printable IRS mileage reimbursement form offers several benefits:

- Organization: By using a standardized form, you can keep your mileage records organized and easily accessible.

- Efficiency: A printable form allows you to quickly fill in the necessary information, saving you time and effort.

- Accuracy: The form provides a structured format for recording your mileage, reducing the risk of errors or omissions.

- Documentation: A completed form serves as documentation of your business-related mileage, which may be required for reimbursement or tax purposes.

- Consistency: Using a consistent form ensures that all necessary information is recorded consistently, making it easier to review and analyze your mileage records.

Overall, using a printable IRS mileage reimbursement form can streamline the process of tracking and documenting your business-related mileage, providing you with the necessary records for reimbursement or tax deductions.

Conclusion

A printable IRS mileage reimbursement form is a valuable tool for individuals who use their vehicles for business purposes. It allows them to track and document their business-related mileage accurately, ensuring they receive the appropriate reimbursement or tax deduction.

By using a standardized printable form, individuals can streamline the process of recording their mileage, maximize deductions, and comply with IRS requirements. Whether you are an employee seeking reimbursement or a self-employed individual looking to claim deductions, using a printable IRS mileage reimbursement form is a smart and efficient way to manage your business-related mileage.

IRS Mileage Reimbursement Form – Word