In the realm of personal finance, keeping track of your expenses and monitoring your credit card statements is a crucial task. For American Express cardholders, the billing statement plays a vital role in understanding their spending habits, managing their finances, and ensuring timely payments. The American Express billing statement template serves as a structured document that outlines all the essential information related to your credit card account clearly and concisely.

In this article, we will delve into the details of the American Express billing statement template, how to interpret it, and why cardholders need to review it regularly.

What is an American Express Billing Statement Template?

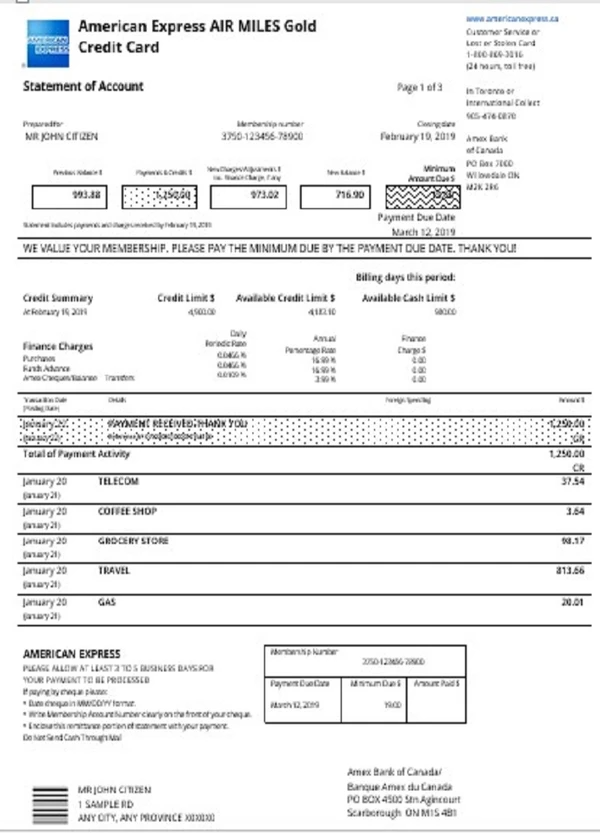

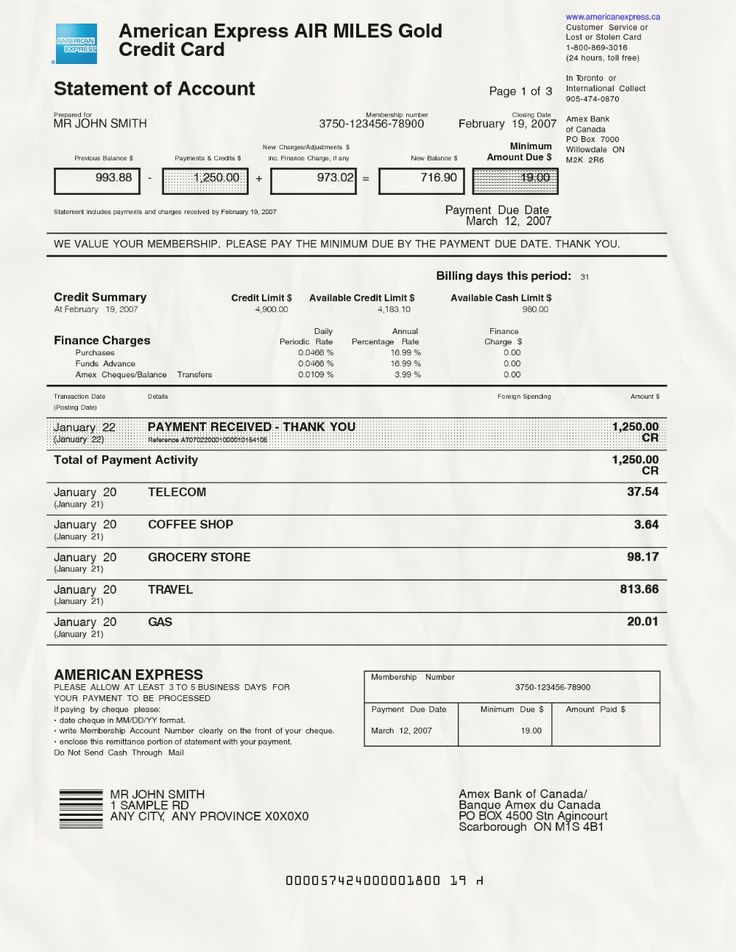

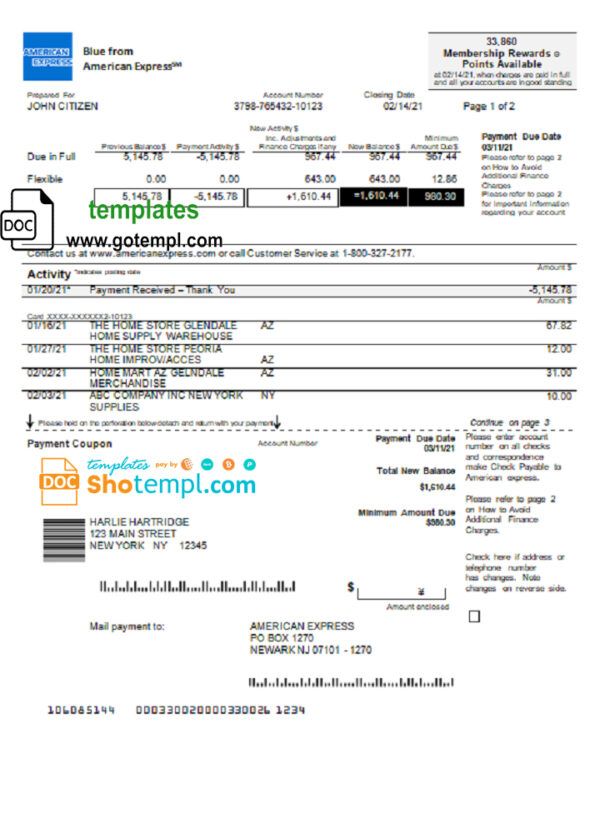

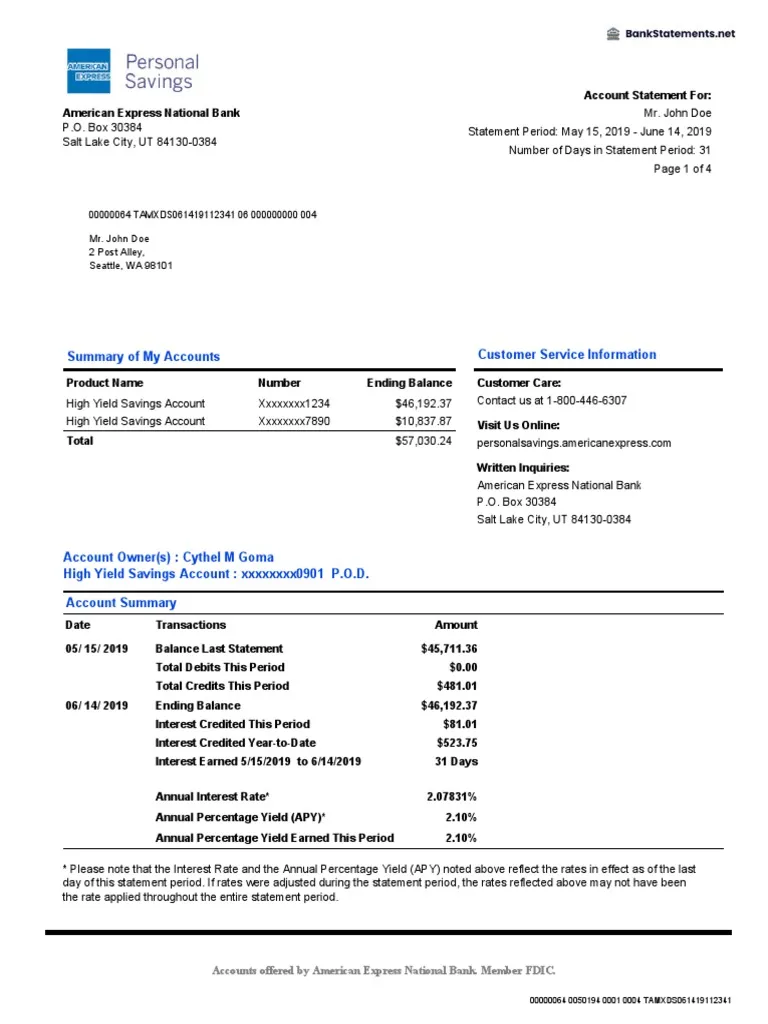

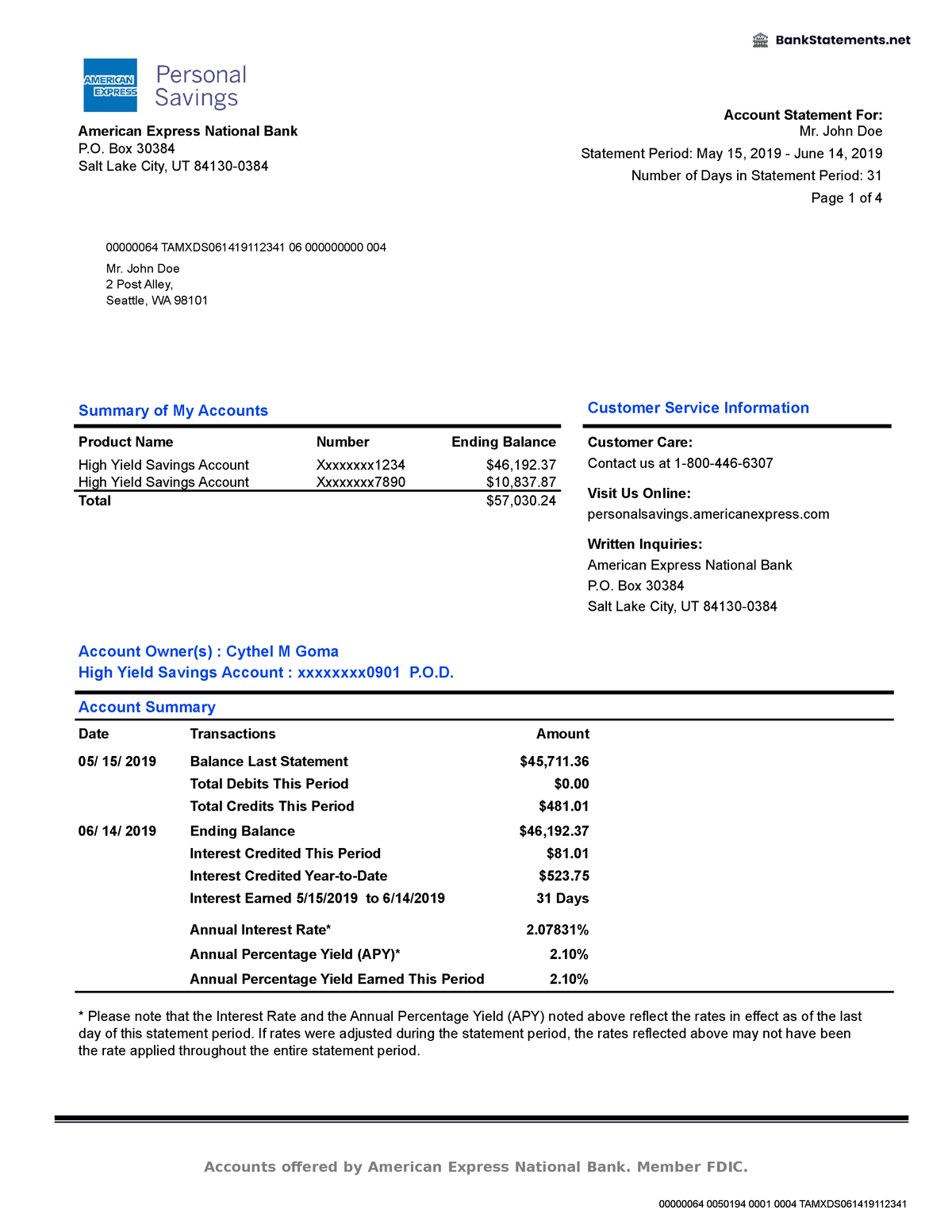

An American Express billing statement template is a standardized format provided by the credit card issuer to cardholders every month. It contains a detailed summary of the cardholder’s account activity for a specific billing cycle, usually spanning 30 days. The statement includes information such as the opening and closing balance, transactions made during the billing cycle, payments received, fees charged, rewards earned, and the due date for the next payment.

How to Access Your American Express Billing Statement Template

Cardholders can access their American Express billing statement template through various channels, including online banking portal, mobile app, or by mail. To view the statement online, cardholders need to log in to their American Express account using their username and password. Once logged in, they can navigate to the billing section to download or view the current and past statements. For those who prefer to receive a physical copy of the statement, American Express sends it by mail to the cardholder’s registered address.

Why Should You Review Your American Express Billing Statement Template?

Reviewing your American Express billing statement template is essential for several reasons. First and foremost, it allows you to verify the accuracy of the transactions recorded on your account. By carefully examining each line item, you can identify any unauthorized charges, billing errors, or fraudulent activities. Additionally, reviewing your statement helps you track your spending patterns, identify areas where you may be overspending, and plan your budget accordingly. Moreover, checking your statement regularly enables you to ensure that you make timely payments and avoid late fees or penalties.

1. Detecting Fraudulent Activities

One of the primary reasons to review your American Express billing statement template is to detect any signs of fraudulent activities on your account. By scrutinizing each transaction, you can identify any unauthorized charges or suspicious activities that may indicate that your card has been compromised. If you notice any discrepancies or unfamiliar transactions, it is crucial to report them to American Express immediately to prevent further fraudulent activities.

2. Tracking Your Spending Habits

Another benefit of reviewing your billing statement is that it helps you track your spending habits and monitor your financial health. By analyzing the categories of your expenses, the frequency of your transactions, and the total amount spent, you can gain valuable insights into where your money is going. This information can help you make informed decisions about budgeting, saving, and prioritizing your expenses to achieve your financial goals.

3. Avoiding Late Payments and Fees

Regularly reviewing your American Express billing statement template also helps you stay on top of your payment deadlines and avoid incurring late fees or penalties. By noting the due date for your next payment and the minimum amount due, you can plan to ensure that you make timely payments. Setting up automatic payments or reminders can also help you avoid missing deadlines and damaging your credit score.

4. Maximizing Rewards and Benefits

Finally, reviewing your billing statement allows you to take full advantage of the rewards and benefits offered by your American Express card. By keeping track of the rewards earned, the points accumulated, and the special offers available, you can make strategic decisions to maximize your benefits. Whether it’s redeeming points for travel rewards, cash back, or exclusive perks, staying informed about your rewards can help you make the most of your credit card experience.

Conclusion

In conclusion, the American Express billing statement template is a valuable tool that provides cardholders with a comprehensive overview of their credit card account activity. By reviewing the statement regularly, cardholders can detect fraudulent activities, track their spending habits, avoid late payments and fees, and maximize their rewards and benefits. Cardholders need to take the time to carefully review their billing statements, understand the information presented, and take proactive steps to manage their finances effectively. By staying informed and vigilant, cardholders can ensure a positive credit card experience and achieve their financial goals.

American Express Billing Statement Template – Download