When it comes to running a nonprofit organization, keeping track of donations is crucial. Not only does it help you maintain transparency and accountability, but it also enables you to provide your donors with the necessary documentation for tax purposes. This is where a donation receipt template comes in handy.

In this article, we will explore the importance of donation receipts, how to create an effective template, and provide you with some examples and best practices.

Why are Donation Receipts Important?

Donation receipts serve as proof of donation and are essential for both the donor and the nonprofit organization. Here are a few reasons why donation receipts are important:

- Transparency and Accountability: Donation receipts help nonprofits maintain transparency by providing a record of all contributions received.

- Tax Deductibility: Donors can use donation receipts to claim tax deductions on their annual tax returns.

- Proof of Support: For donors, a receipt serves as proof of their support for a particular cause or organization.

- Record Keeping: Nonprofits can use donation receipts as a part of their financial records and audits.

Creating an Effective Donation Receipt

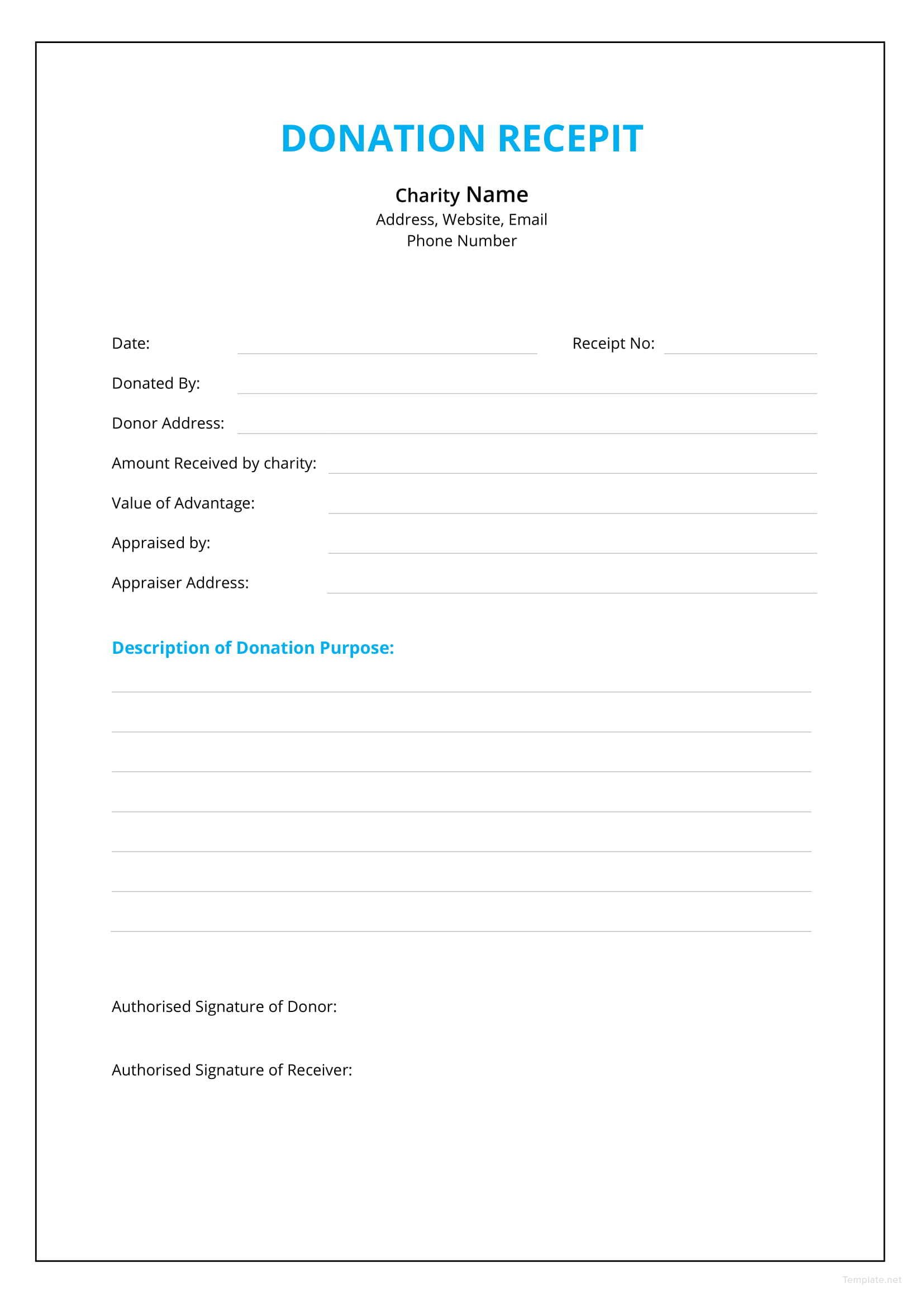

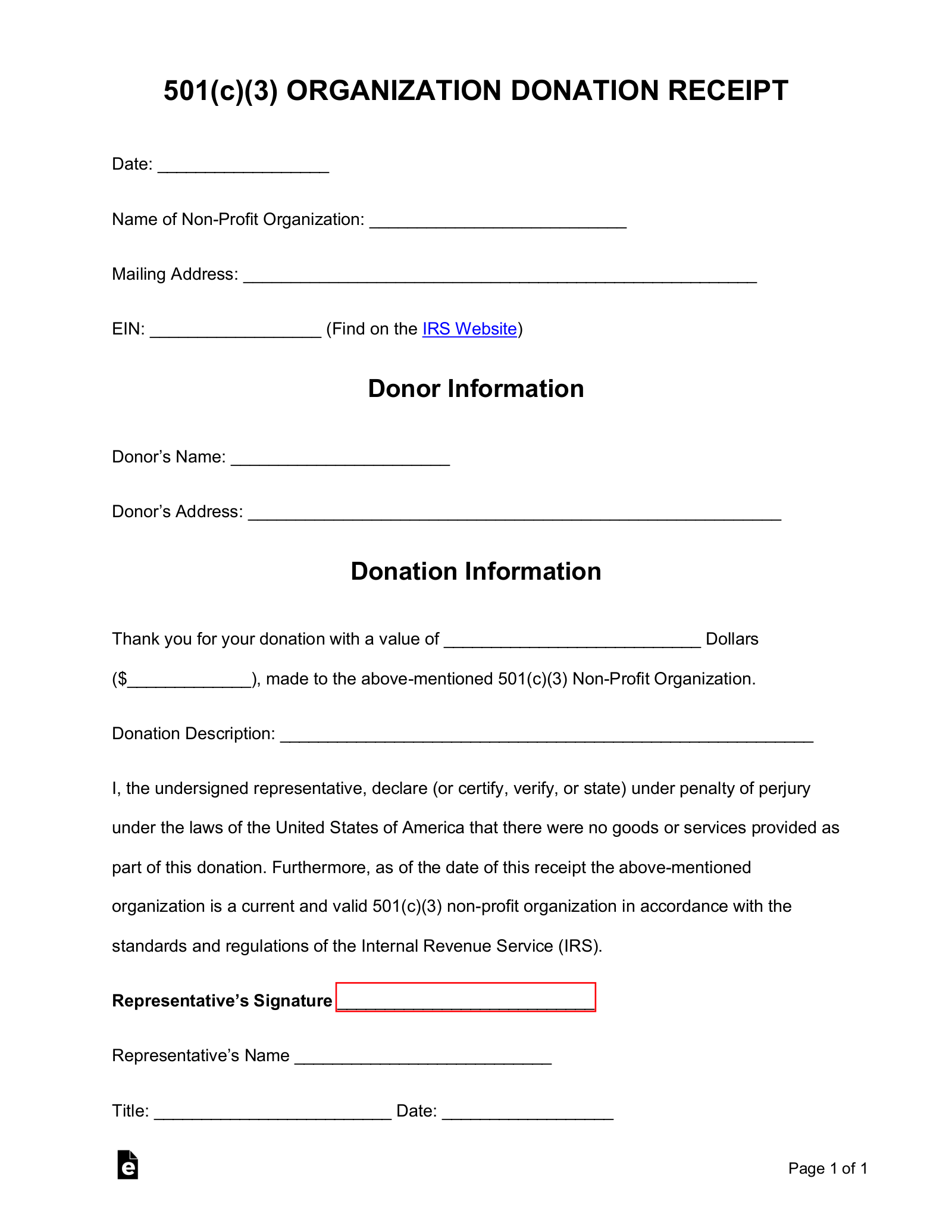

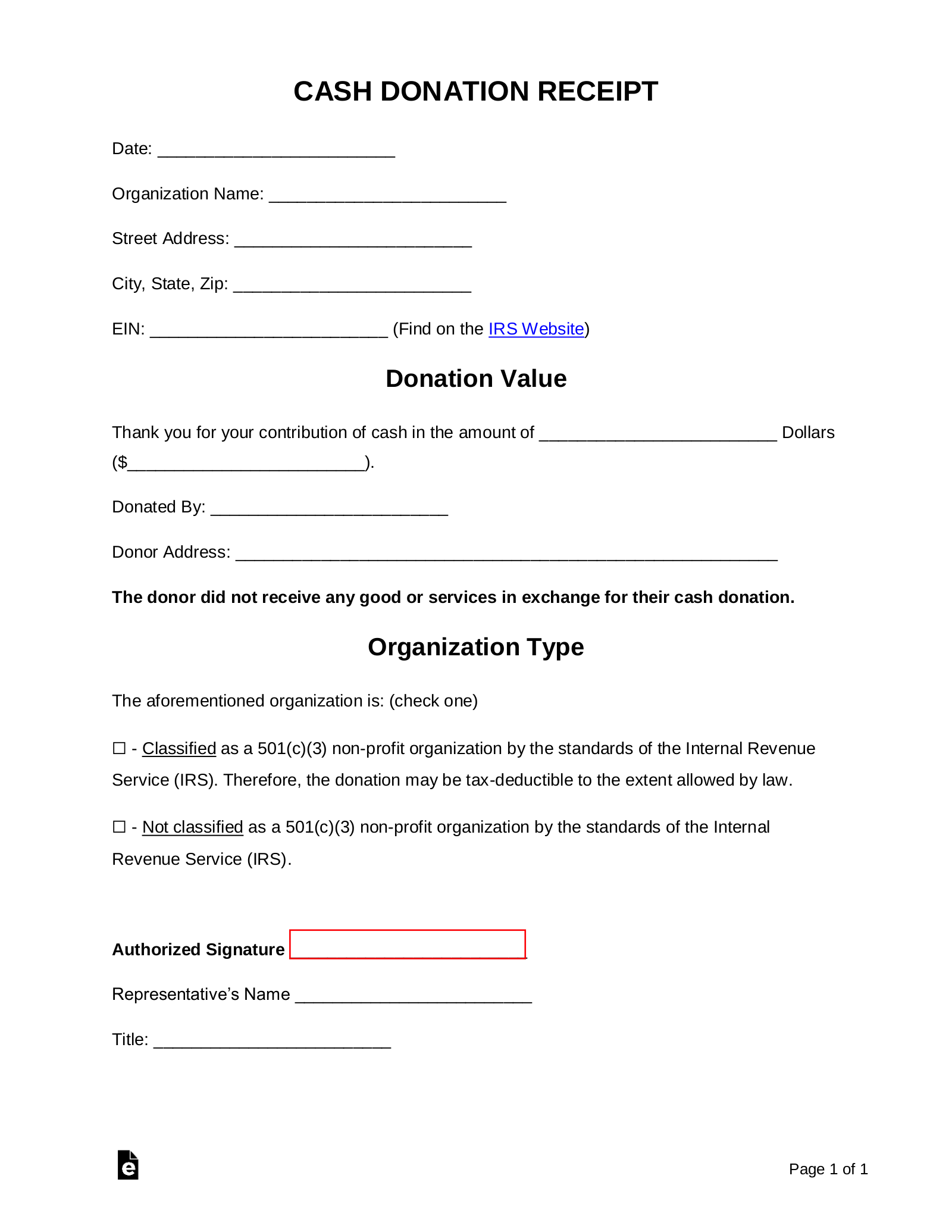

An effective donation receipt template should include certain key elements to ensure it is compliant with legal requirements and provides all the necessary information to the donors. Here are some essential components to include in your template:

- Organization Information: Include your nonprofit’s name, address, and contact information at the top of the receipt.

- Date of Donation: Clearly state the date the donation was received.

- Donor Information: Include the donor’s name, address, and contact information.

- Description of Donation: Provide a detailed description of the donated items or the purpose of the donation.

- Fair Market Value: If applicable, include the fair market value of the donated items. This is important for tax purposes.

- Statement of Tax Deductibility: Include a statement informing the donor that their donation is tax-deductible, if applicable.

- Signature and Contact Information: Provide a space for the authorized person to sign the receipt and include their contact information.

By including these elements in your donation receipt template, you can ensure that you provide your donors with all the necessary information while also meeting legal requirements.

Best Practices for Using Donation Receipt Templates

While using a donation receipt template is a great way to streamline the process, it’s important to follow some best practices to ensure its effectiveness. Here are some tips:

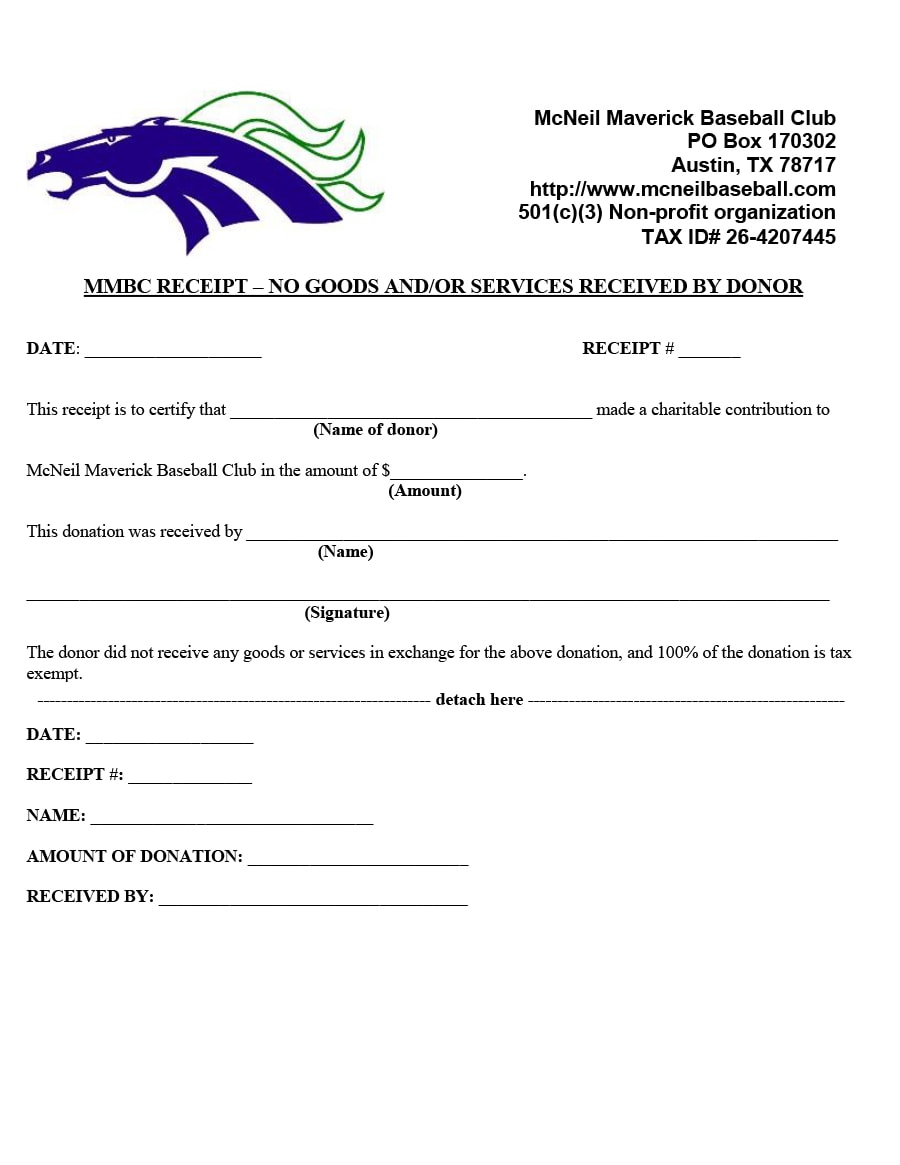

- Customize the Template: Tailor the template to fit your organization’s branding and include any additional information specific to your nonprofit.

- Automate the Process: Utilize software or online platforms that allow you to generate donation receipts automatically, saving time and effort.

- Send Receipts Promptly: Send the donation receipt to the donor as soon as possible after receiving the donation to show your appreciation and maintain transparency.

- Keep Records: Maintain a record of all donation receipts for your organization’s financial records and audits.

- Train Staff: Ensure that your staff is trained on the importance of donation receipts and how to issue them correctly.

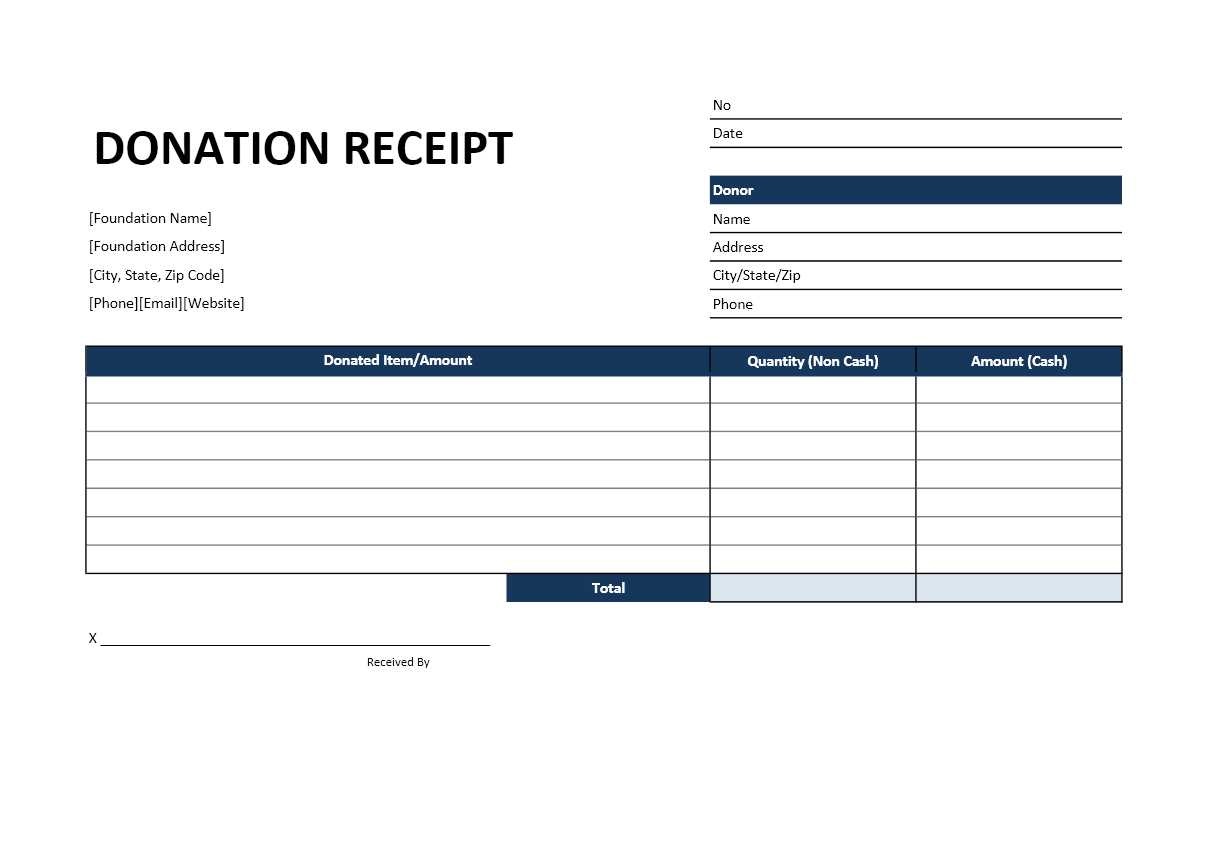

Example Donation Receipt Template

Here is an example of a donation receipt template:

[Your Nonprofit’s Name]

[Address]

[City, State, Zip]

[Phone Number]

[Email Address]

Date of Donation: [Date]

Donor Information:

[Donor’s Name]

[Address]

[City, State, Zip]

[Phone Number]

[Email Address]

Description of Donation:

[Description of the donated items or the purpose of the donation]

Fair Market Value: [Fair market value, if applicable]

Statement of Tax Deductibility:

This donation is tax-deductible to the extent allowed by law.

Authorized Signature: _______________________

Contact Information:

[Authorized person’s name]

[Phone Number]

[Email Address]

Conclusion

Donation receipts are an essential part of running a nonprofit organization. By providing your donors with well-designed and informative donation receipt templates, you not only maintain transparency and accountability but also help them with their tax deductions. Remember to customize your template, automate the process, and send receipts promptly to ensure a smooth and efficient donation tracking system for your nonprofit.

Donation Receipt Template Word – Download