Managing bills can be a challenging task, especially when you have multiple due dates to keep track of. A bill pay schedule can help you stay organized and ensure that all your bills are paid on time.

In this guide, we will walk you through everything you need to know about creating a bill pay schedule, from why it is important to how to set it up effectively.

Why Should You Create a Bill Pay Schedule?

A bill pay schedule is a system that helps you keep track of your bills and their due dates. By creating a bill pay schedule, you can:

- Ensure that all your bills are paid on time

- Avoid late payment fees and penalties

- Maintain a good credit score

- Reduce financial stress by staying organized

Overall, a bill pay schedule can help you take control of your finances and ensure that you are meeting your financial obligations promptly.

How to Create a Bill Pay Schedule

Creating a bill pay schedule is a straightforward process that begins with gathering all the necessary information. Here are the steps to follow:

1. Gather Your Bills

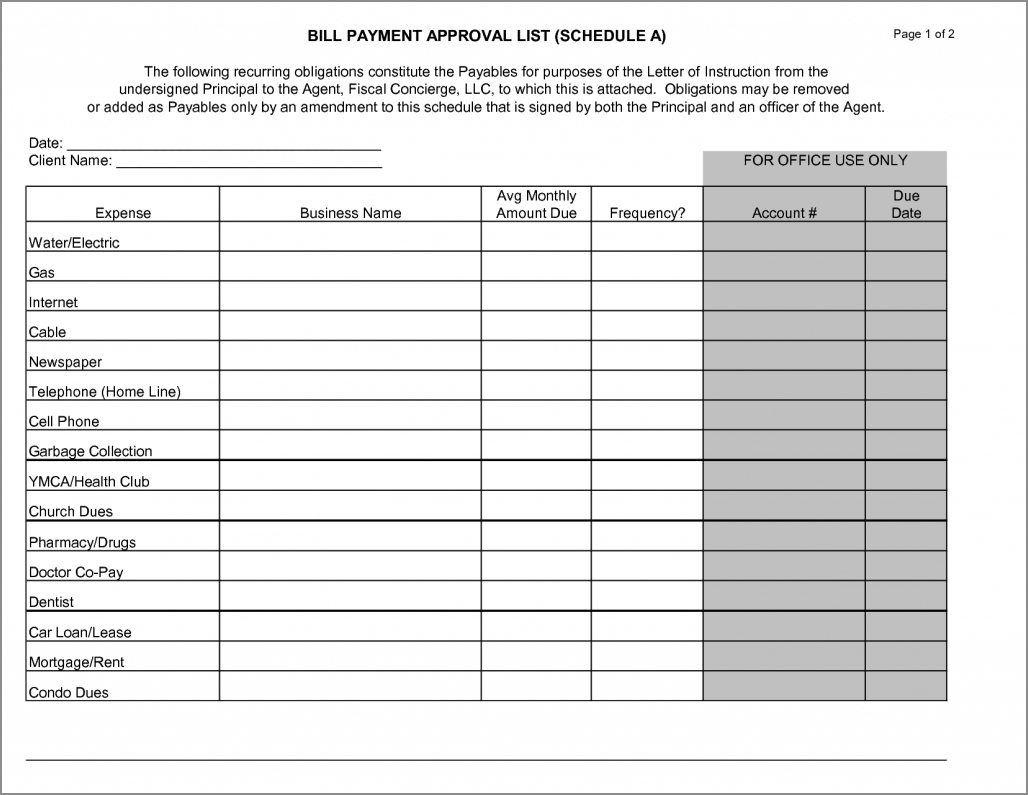

Start by collecting all your bills, including credit card statements, utility bills, mortgage or rent payments, and any other recurring expenses. It is important to have a complete list of all your bills to create an accurate schedule.

2. Determine Due Dates and Amounts

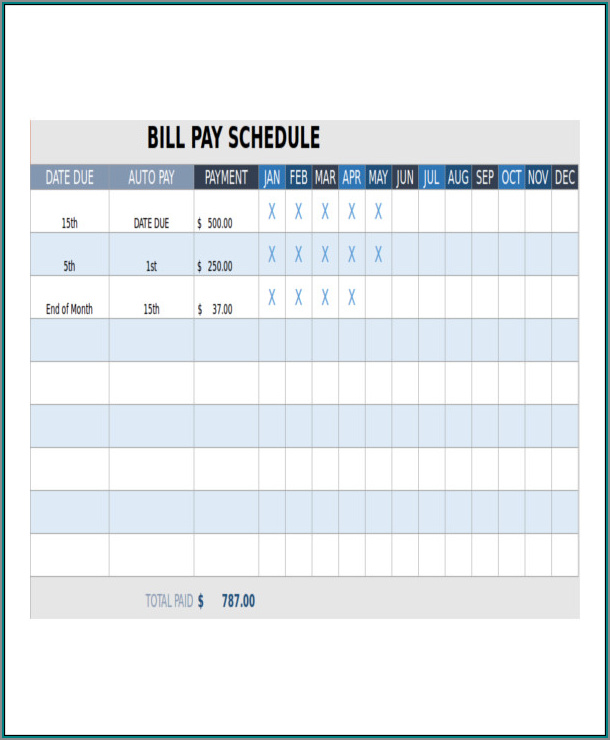

Next, go through each bill and note down the due dates and the amounts that need to be paid. This information will be crucial in setting up your bill pay schedule.

3. Choose a Bill Paying Method

Decide on the method you will use to pay your bills. You can choose to pay manually by writing checks or using online bill payment platforms. Online bill payment is often more convenient and can help automate the process.

4. Set Up Reminders

Whether you choose to pay manually or use online bill payment, setting up reminders is essential to ensure you don’t miss any due dates. You can use calendar apps, reminder apps, or even set up automatic reminders through your online banking platform.

5. Create Your Bill Pay Schedule

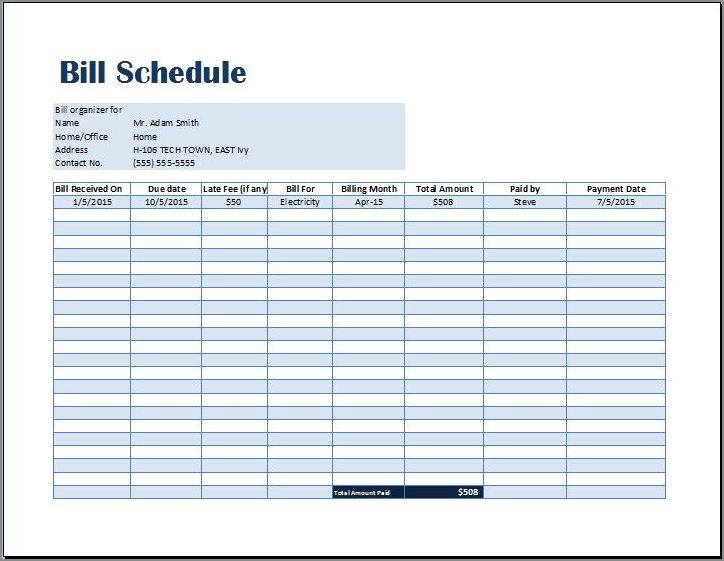

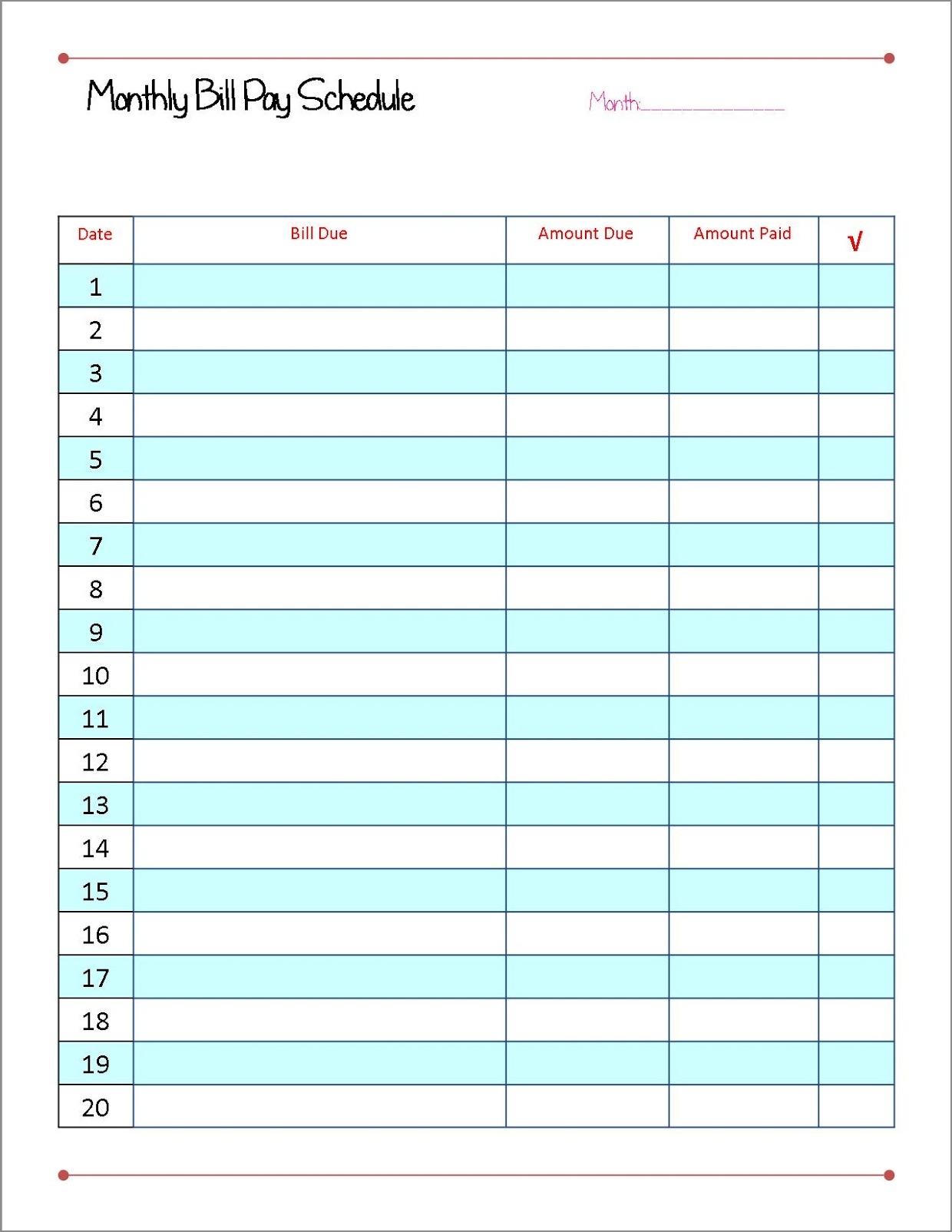

Using a spreadsheet or a bill pay tracking tool, create a schedule that includes all your bills, their due dates, and the amounts to be paid. You can also add columns to track whether you have made the payment and the payment method used.

6. Review and Adjust Regularly

Regularly review your bill pay schedule to ensure that it is up to date. Make adjustments as needed, especially if there are any changes in due dates or amounts. This will help you maintain an accurate and effective bill-pay schedule.

Tips for Managing Your Bill Pay Schedule

Here are some additional tips to help you effectively manage your bill pay schedule:

- Automate where possible: Whenever possible, set up automatic payments through your bank or bill payment platform to avoid missing due dates.

- Keep track of payment confirmations: Save payment confirmations or receipts as proof of payment in case any disputes or issues arise.

- Set aside time for bill payment: Dedicate a specific time each month to review and pay your bills. This will help you stay organized and ensure that you don’t forget any payments.

- Monitor your bank account: Regularly check your bank account to ensure that all your bill payments have been processed correctly.

- Communicate with creditors: If you are unable to make a payment on time, contact your creditors to discuss alternative payment arrangements. It is always better to communicate proactively rather than face late payment penalties.

- Update your schedule: Whenever there are changes in your bills or due dates, make sure to update your bill pay schedule to reflect the new information.

Conclusion

Creating a bill pay schedule is an effective way to stay organized and ensure that all your bills are paid on time. By following the steps outlined in this guide and implementing the tips provided, you can take control of your finances and reduce the stress associated with managing multiple bills. Remember to review and adjust your bill pay schedule regularly to keep it accurate and up to date.

Bill Pay Schedule Template – Download